INTRODUCTION

Few states have deregulated basic telephone service. The underlying rationale seems to be the concern that subsets of the population—e.g., people subscribing only to plain old telephone service (POTS), or those in more rural areas—have no real competitive options and thus would face significantly higher rates. In this paper, I examine whether this concern is justified. Historically, POTS consumers purchased either basic service alone or they assembled "synthetic packages" of basic service, toll services, and ancillary services like call waiting from phone company a la carte offerings. More recently, customers have been switching from these services to packaged services from incumbent local exchange carriers (ILECs), competitive local exchange carriers (CLECs) or mobile wireless service providers, or more inclusive packages such as a cable company "triple-play" bundles. This ongoing migration from basic service or synthetic packages to packaged services shows that packages substitute for a la carte services.

Packaged services provided by cable companies, wireless companies, and CLECs regulate prices for ILEC customers, including basic service customers, in four ways. First, they compete directly for customers purchasing ILEC packages. Second, packages are available at rates close to those paid by synthetic-package customers; thus, current synthetic package customers could easily become packaged service customers. Third, competitive packages compete for those basic service customers "at the margin," i.e., those who may now buy only basic service but that would switch to a competitive package of some type if the ILEC were to raise basic rates above competitive levels. Fourth, competitive packages provide indirect protection for customers who only purchase basic service because an increase in the basic rate would also affect customers who purchase synthetic bundles—of basic service, toll, and optional services—and the prospect of losing these more lucrative customers to competitors deters ILECs from raising basic rates. Customers living in more isolated rural areas are also protected by competition because it turns out that competitive alternatives are already widely available, and customers who may not have competitive options today are protected because communications services are marketed to broad areas.

My conclusions are based on data for the nation as a whole, and on more detailed analyses done for a number of states. To determine if the conclusions apply in a particular situation, the analysis needs to be applied to data for the company and jurisdiction at issue.

ANALYSIS

Evidence of switching shows that consumers have viable competitive substitutes

FCC data show that ILECs lost over 37 million access lines between June 2000 and June 2006, as cable telephone triple play options, CLECs offering packages, and wireless services, which bundle local with toll and vertical features, have grown dramatically in the US. The fact that total LEC (ILEC + CLEC) lines fell by 26.2 million lines over the same time period shows that the majority of the lost ILEC lines were captured by facilities-based "intermodal" competition from cable telephone, broadband services, VoIP services, and mobile wireless providers.

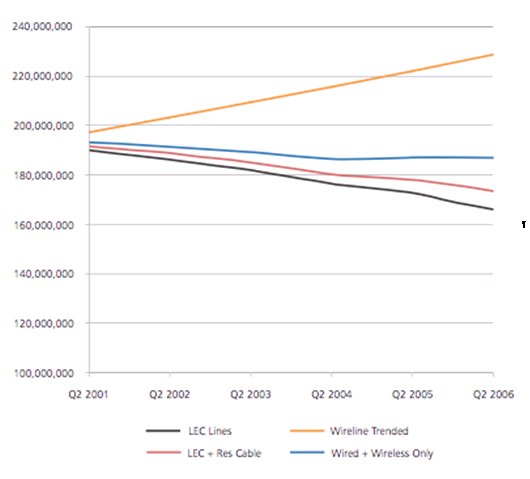

Figure 1 below shows how wireline access lines have declined as intermodal competition has grown over the last five years for which the data were available. The lowest line shows LEC (ILEC + CLEC) switched access lines, excluding residential cable telephone lines. The next line up adds cable telephone lines to LEC lines, and the one above that adds in the number of households that have only wireless phone service. The upper-most line shows the expected number of LEC lines estimated based on historical average growth rates experienced during the 1980s and 1990s.2 The difference between the lowest and highest line represents losses by LECs to other modes of competition. The difference between the lowest line and the next line up shows losses to cable telephone; the difference between the next line above and the one including cable telephone lines shows the number of households that have completely cut the cord; and the difference between upper most line and the one below it represents additional losses to wireless, secondary cable telephone lines, VoIP over broadband, and broadband lines for Internet access. In June 2006, at historical trend rates we would have expected to see about 228 million switched wireline access lines but for losses of at least 7.5 million lines to cable telephone services, at least 13.3 million to wireless, and as many as 42.9 million to broadband for VoIP and/or Internet access lines.3 Thus, losses compared to lines expected at historical growth rates absent intermodal competition—i.e., historical growth applied to mid-2000 line counts to estimate 2006 lines—totalled about 63.8 million lines.4

This pattern depicted in Figure 1 provides strong evidence that intermodal substitution has been taking place and, thus, competition or the potential for competition regulates prices for the vast majority of customers.

Figure 1: Intermodal Competition Has Reduced the Number of LEC Switched Access Lines5

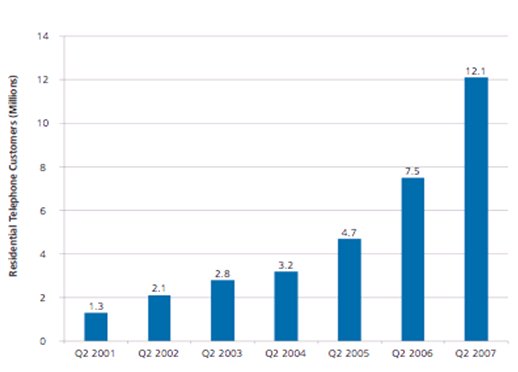

The dramatic growth in the use of competitive bundled services is even more evident from the following charts depicting cable company residential telephone customer growth and the growth of wireless only households.

Figure 2: Growth of Residential Cable Telephone Customers6

Figure 3: Growth of Wireless Only Households7

Competitive networks are widely available

The competition is widespread as well as intense; facilities-based alternatives are available to the vast majority of households in the US. First, I estimate that cable telephone service is already available to at least 75% of households in the US.8 Moreover, the effect of cable telephone competition is much wider. Innovation has driven down the costs of cable telephone services and facilitated cable entry and expansion into voice telephony; thus, once cable networks have been upgraded to provide broadband services—as they have been for over 90% of households in the US9—VoIP can be quickly deployed at low incremental costs to provide cable telephone services. Indeed, one analyst concluded that:

... Cable operators can offer voice and data services over a pre-existing video infrastructure. As a result, the incremental cost of each service is extremely low. Cable operators can therefore offer consumers a very attractive bundled "triple play" price, while still earning compelling ... margins and returns on investment.10

Another analyst found that by year end 2005: "[T]he estimated cost for a premise powered VoIP-based cable telephony solution is approximately $280 per subscriber." This compares with $600 to activate circuit switched cable telephone service in 2000.11

Thus, competition or the potential for competition from cable telephone and VoIP over broadband constrains LEC prices for over 90% of households in the US. A substantial number of the remaining households can avail themselves of wireless. According to FCC data, at least one form of digital mobile wireless service is available in counties in which 99% of the US population resides; and "...98 percent of the total U.S. population [live] in counties where three or more different operators compete ... in some parts of those counties, while nearly 94 percent of the U.S. population continues to live in counties with four or more mobile telephone operators competing..."12

As explained below, competition from cable telephone, mobile wireless, and VoIP over broadband regulates prices not only for bundled services but for basic services.

Regulators have recognized the desirability of deregulating packaged services

Regulators have recognized that the evidence of competitive trends and the availability of competitive alternatives show that customers who purchase packages have competitively priced options available from other suppliers and, thus, some have deregulated "non-basic services." For example, the New York Public Service Commission (NYPSC)13 found that:

...Cell phones and high-speed internet services ... enable flexibility and diverse services such as e-mail ... and VoIP services that [compete] with traditional telephone services. Businesses often combine voice and data communications onto a single (IP-based) platform and residential customers increasingly have that same capability. Every month tens of thousands of customers in New York switch from their [ILECs] to intermodal competitors .... (p. 4)

... Alternative facilities-based platforms and viable substitute services are available in the market sufficient to constrain most residential prices such that we can and should rely more heavily on market forces to set prices. (p. 42)

The record ... establishes that [the two large ILECs] have sufficient competitive constraints territory-wide to constrain non-basic residential prices. (p. 68)

Thus, the NYPSC deregulated "non-basic" services; however, it required these services to be offered at a single price throughout a carrier's territory, and retained price cap regulation for basic residential services for the two largest ILECs.14

The California Public Utilities Commission15 recently found that: "Competition in the voice communications market allows us to rely on the market to assure the reasonable pricing of any bundle of services that does not include a service subsidized by LifeLine." (p. 269) Thus, it decided to: "... grant carriers broad pricing freedoms concerning almost all telecommunications services, new telecommunications products, bundles of services, promotion[s], and contracts." (p. 2) However, it found that:

... continued pricing regulation is warranted in a few specific circumstances .... when a service receives a social program subsidy, such as ... (LifeLine) residential service and basic residential service in areas receiving California High Cost Fund-B ... subsidies. Thus, we cap the price of basic residential service until 1 January 2009 in order to address the statutorily-mandated link between the LifeLine rate and basic residential service rates. (p. 2)16

Competition regulates basic telephone service rates

Although at least some state commissions have found that competition regulates rates for package services, even these policy makers have retained price caps for basic rates (at least as a transitional mechanism), and most states are more reluctant to deregulate basic services. They appear to have two concerns about basic service prices: (1) competition will not effectively regulate basic prices because direct substitutes may not be available at prices close to current levels; and (2) the competitive price level—which no one can specify prior to letting market forces work—could be much higher than current prices.

These apprehensions are not justified. To understand why, it is helpful to identify three types of customers: (1) "package customers," who purchase packages that may include at least vertical features and/or toll service, and possibly larger bundles that include video and broadband services; (2) "synthetic package customers," who purchase basic services, vertical features, and toll services (from either their local carrier or a long distance carrier) on an a la carte basis; and (3) "basic only" customers who currently purchase only basic local services. Note that the prices paid for basic service are the same for both synthetic package customers and basic only customers, but the former customers spend more for wireline services because they also buy additional services. Having identified these customer groups, we can explore how each is protected by competition.

Package offerings regulate basic service rates

First, package customers are protected by competition from

cable telephone and wireless service packages at rates

comparable to those offered by ILECs for their packages.

Indeed, as discussed below, the charges for current cable video

customers and wireless mobile customers for replacing wireline

voice service are lower than packages offered by the ILECs. In

addition, broadband protects package customers because: (1) the

widespread presence of the cable modem platform means that

cable companies can offer triple play packages within a year to

millions more customers; and (2) the presence of cable and DSL

platforms allows use of over the top VoIP by the millions of US

households that already have broadband access or could get it

soon. In addition, wireless providers offer competitively

priced packages to customers including those outside of areas

with cable

voice services.

Second, the same options that constrain package prices also constrain prices for customers who currently purchase synthetic bundles because packages are available at rates close to the expenditures made by many synthetic package customers; thus, basic service customers that purchase other voice services from their local and/or toll carriers, and likely purchase other communications services—such as video, broadband, or mobile wireless—from other carriers are protected by competition.

Third, competition for synthetic packages also regulates prices for the basic-only customers because an increase in basic service prices also raises the price of synthetic packages. Therefore, charging excessive prices for basic service could erode ILEC revenues from the more lucrative services—e.g., usage and vertical features—purchased by synthetic package customers. More specifically:

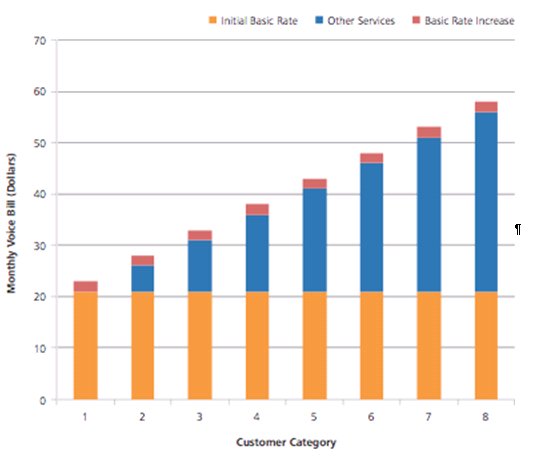

- Raising rates for basic service customers affects charges not just for basic-only customers who spend about $21 per line per month,17 but for synthetic package customers who may spend $30 to $50 (or more) per month for telephone service.18

- Thus, since ILECs cannot discriminate against basic-only customers, these customers are protected because the ILEC risks losing much more revenues and profits than for the minority of customers who purchase only basic services.

- The following chart illustrates the dilemma faced by ILECs. It shows that a hypothetical $2 per line per month basic rate increase affects not just "category 1" customers who spend $21 per line per month for basic service alone, but those in categories 2 through 8 who are assumed to be spending $26 to $56 per month per line for their synthetic package of local service, toll service, and features as well. Since the increase in basic rates affects all of these customer categories, a basic service rate increase carries with it the prospect that the ILEC could lose a substantial number of the more lucrative customers who have many competitive alternatives available. Thus, the ILEC could lose substantial revenues and profits.

Figure 4: An Increase in Basic Rates Affects Prices for Synthetic Packages

Fourth, as demonstrated in the next section below, low-cost options regulate prices for today's basic-only customers. These customers fall into several categories:

- Customers with wireless service—could simply drop their wireline phone without incurring any charges, or augment current wireless plans with larger usage of family share plans at low incremental charges.

- Customers who don't already have wireless—could switch to low-priced wireless mobile options available at prices comparable to current basic prices. They range from $10 for low-use plans to $30 per month for plans with usage levels that exceed average local usage levels, and typically include valuable features such as caller ID, call waiting, and voice mail. These compare with the $21 current monthly charges paid for basic alone—i.e., with no features or toll charges.

- Customers with video and broadband—could move to a cable triple play for low incremental charges.

- Current broadband customers could purchase VoIP on top of broadband for low incremental charges.

Fifth, subscription levels for these technologies are high and growth has been rapid.

- About 60% of US households had broadband access by October 2007.19

- Over 70% of US households have at least one wireless phone.20

Moreover, ILECs cannot identify which of their basic-only customers already purchase communications services from competitors and so cannot identify which customers could replace basic service at low incremental charges. Therefore, competition for synthetic-bundles regulates prices even for those customers not subscribing to other services but who could demand them if they find the package desirable relative to a higher priced basic service.

Existing low-priced options compete with ILEC basic services

The data show that even customers that purchase only basic services have low-priced competitive options available today. For example, wireless plans are available at prices from $10 (with no calling allowance) to about $30 per month with 300 anytime minutes and unlimited off peak calling. To confirm that such plans are economical for basic-only consumers, it is necessary to consider their usage patterns. Using the limited available data, I estimate that the average local usage for all residential customers during the wireless daytime minutes calling period—during which usage counts against "anytime" wireless minutes—is about 284 minutes per line per month.21 However, basic only customers—i.e., those that don't use any optional services or toll calls—likely make fewer than the average number of calls. Assuming their calling volumes are at least 10% lower than the average, I conclude that these customers use about 255 or fewer daytime minutes per month.

These data imply that basic only wireline customers can

switch to low-priced intermodal options.

This can be seen by considering two types of basic only

wireline customers: (1) those that purchase no other voice,

data, or video services—likely to be an extremely

small percentage of the population—and (2) those that

already buy wireless, video, or other communications services

but not as part of a bundle. Customers in the first category

have the following viable wireless alternatives available:

|

Provider/Plan |

Monthly Price |

Included Anytime Minutes |

Price Per Additional Minute |

Long Distance Included? |

Additional Features |

|

Consumer/Cellular Anywhere .25 |

$10.00 |

0 |

$0.25 |

Yes |

voice mail, caller ID, call forwarding, call waiting, 3-way calling, detailed billing, text messaging for $0.10/message |

|

T-Mobile/Prepaid 30 |

$10.00 |

30 |

Yes |

voice mail, caller ID, call waiting, 3-way calling, text messaging for $0.10/message, free e-mail address |

|

|

Consumer Cellular/Anywhere 100 |

$20.00 |

100 |

$0.25 |

Yes |

voice mail, caller ID, call forwarding, call waiting, 3-way calling, detailed billing, text messaging for $0.10/message |

|

T-Mobile/Prepaid 130 |

$25.00 |

130 |

Yes |

voice mail, caller ID, call waiting, 3-way calling, text message, free e-mail address |

|

|

T-Mobile/Basic Plus |

$29.99 |

300 |

$0.40 |

Yes |

unlimited weekends, call waiting, caller ID, conference calling |

|

Sprint/Basic Plan |

$29.99 |

200 |

$0.45 |

Yes |

unlimited nights and weekends (starting at 9pm, call waiting, caller ID, conference calling |

|

Consumer Cellular/Anywhere 400 |

$30.00 |

400 |

$0.25 |

Yes |

voice mail, caller ID, call forwarding, call waiting, 3-way calling, detailed billing, text messaging for $0.10/message |

Source: Company websites, accessed in mid 2007.

Even the $30 options are viable alternatives to the current basic only (priced today at about $21 per line, including the SLC) because they include toll calling and the valuable vertical features tabulated above. The least expensive options offer wireless services, and provide viable substitutes for the wireline services currently purchased by basic only customers with low usage levels.

ILEC basic only customers who already subscribe to wireless can either drop wireline service if their existing wireless plan includes enough minutes to replace their wired usage, or upgrade to plans with more usage and/or additional phones. As shown in the following table, the added charges for upgrading are comparable to the $21 basic service charge described above. The range of values is estimated based for several types of customers. I estimate that the customer's cost of replacing basic-only wireline service by augmenting wireless service is between $10 and $29.99. The cost of replacing wireline service is between $9.99 and $20.00 for individuals with wireless service who replace their existing wireline service by purchasing a wireless plan with additional minutes. The cost of replacing wireline service is about $30 for families who replace their wireline service by upgrading from a single-phone wireless plan to a multi-phone wireless plan with additional usage. Families with family wireless plans who need to purchase additional minutes and add a phone to their service need to pay between $19.99 and $29.99 to replace their wireline service. The cost of replacing wireline service is less expensive for families already on a family share plan who simply increase their usage to replace wireline usage—about $10 to $20. Over all of these types of consumers, the costs range from $10 to about $40, and the least cost options for the various upgrades range from about $10 to $30 per month. A substantial number of wireline customers may already have large enough wireless plans to drop their wireline service without incurring even these charges, because a large percentage of customers already use their wireless phone as their primary phone.

|

Consumer Category |

Incremental Service Charge Range |

Monthly Charge for Additional Phone |

Total Added Charges |

|

Purchase Additional Minutes on Individual Wireless Service |

$9.99-$20.00 |

NA |

$9.99-$20.00 |

|

Upgrade from Individual to Family Wireless Service and Purchase Additional Minutes |

$20.00-$30.00 |

$0.00-$9.99 |

$29.99-$30.00 |

|

Purchase Additional Minutes on Family Wireless Service and Additional Phone |

$10.00-$20.00 |

$9.99 |

$19.99-$29.99 |

|

Purchase Additional Minutes on Family Wireless Service |

$10.00-$20.00 |

NA |

$10.00-$20.00 |

|

Overall Summary |

$9.99-$39.99 |

$0.00-$9.99 |

$10.00-$39.99 |

|

Summary of Least-Cost Options |

$9.99-$20.00 |

$0.00-$9.99 |

$9.99-$29.99 |

Source: Company websites, accessed first half of 2007./

ILEC basic only customers with broadband and/or video can also drop their basic service and switch to VoIP or a triple play package for low incremental charges. For example:

- VoIP adds about $14 for 500 minute plans to about $20 - $25 per month for unlimited local and toll service to the cost of an existing broadband connection.22 Besides large or unlimited calling packages, VoIP offers numerous calling features.

- Using recent data for Comcast and Cox, I estimate the incremental charge23 for voice service as part of a triple play ranges from about $4.00 to about $7.00 per line per month during the initial one-year promotional period and from about $10 to $31 per line per month in subsequent years, depending on the carrier and how long the service is maintained. For example, averaging these charges over three years implies that they come to about $10.80 to about $27.60 for a primary voice line, depending on the carrier. The average price range is somewhat less over a period of two years and higher over four years. The following table shows these data:

|

Comcast |

Cox |

|

|

First Year |

$3.95 |

$6.57 |

|

Later Years |

$39.36 |

$12.90 |

|

Years in Service |

Average Price Per Month |

|

|

1 |

$3.95 |

$6.57 |

|

2 |

$21.66 |

$9.74 |

|

3 |

$27.56 |

$10.79 |

|

4 |

$30.51 |

$11.32 |

Source: Company websites, accessed in mid 2007.

The options described above regulate prices for basic services for the vast majority of customers, including those who currently subscribe only to basic wireline service with no other features or toll services. In considering data on the distribution of customers who purchase basic only services, packages, or synthetic packages, companies and policy makers should keep in mind that customers who appear to be buying only basic service from an ILEC today may have been purchasing packages or synthetic packages from the ILEC before they switched to VoIP over broadband or to wireless service for use as their primary phone service—i.e., they may include customers using POTS lines for "backup."

Competition regulates rates for customers in less densely populated areas

Regulators may also be concerned about the perceived lack of competition in more rural, less densely populated areas of their states. Although the availability of competitive options may be somewhat lower in such areas, the national data imply that competition from intermodal options is extremely widespread. Thus, as shown above, facilities-based options are available to the vast majority of customers—mobile wireless service is available in counties that account for over 99% of the US population, and cable broadband facilities are available to 90% of US households.

Even if ILECs could identify areas in which some customers would not have the option (or desire) to switch to substitutes, they would likely find it impractical to try to discriminate against customers in such areas. Competitors typically market their services across wide geographic areas—wireless companies offer their services at least across MSAs, if not on a national basis at the same prices. Similarly, cable companies market their services for the same prices across wide areas. And, given the economics of mass market advertising as well as the need to meet this competition, ILECs would find it impractical to market their services at different prices in different parts of an MSA or market area for example.

NOTES

1 Dr. Ware is a Vice President at NERA. This paper was derived in part from earlier work done in collaboration with Dr. William E. Taylor for use in testimony by Dr. Taylor on behalf of Verizon Virginia.

2 FCC, Trends in Telephone Service, "U.S. Wireline Telephone Lines," Table 7.1, February 2007.

3 An unknown but potentially large percentage of the 42.9 million lines may be business cable telephone lines or wireless business lines, or residential secondary cable telephone or wireless "lines." This is because the data I use in Figure 1 is for residential cable telephone subscribers (as opposed to lines) and the number of households with only wireless service.

4 As stated above, the absolute losses, ignoring expected growth were also sizeable: actual LEC lines declined by about 26.2 million lines or about 14% from mid-2000 to mid-2006.

5 Data on LEC lines are from FCC Local Competition Reports; data on wireless-only households are from Stephen z. Blumberg, and Julian V. Luke, Division of Health Interview Statistics, National Center for Health Statistics, "Wireless Substitution: Early Release of Estimates Based on Data From the National Health Interview Survey, July – December 2006; data on cable telephone subscribers are from the National Cable Television Association. See Figure 2 of this paper.

6 National Cable Television Association, "Residential Telephony Customers: 2001-2006," http://www.ncta.com/ContentView.aspx?contentId=61; and Industry Statistics, Residential Cable Telephony Subscribers, June 2007, http://www.ncta.com/ContentView.aspx?contentId=54.

7 Derived from data from Census Bureau, and S. J. Blumberg, J. V. Luke, National Center for Health Statistics data cited above.

8The Yankee Group forecast that VoIP-based cable telephone service would be available to about 75% of households in areas served by cable companies by year end 2006. (See Kate Griffin, "Consumer Technologies & Services Director, the VoIP Evolution Continues: Forecasting Broadband VoIP and Cable Telephony," August 2006, p. 1.) The cable companies' efforts to extend voice services rapidly imply that more than 75% of households already have cable telephone service available. This estimate is reasonable because the FCC reports data showing that 99% of occupied housing units were passed by cable television systems at the end of 2004. (See FCC, Annual Assessment of the Status of Competition in the Market for the Delivery of Video Programming, Twelfth Annual Report, Released 3 March 2006, at paragraph 30. http://fjallfoss.fcc.gov/edocs_public/attachmatch/FCC-06-11A1.pdf, (accessed 12 October 2007).

9 The NCTA reported that cable broadband availability had reached 119.1 million housing units in 2006. The Census Bureau reported that there are approximately 125.8 million housing units in the US as of June 2006. This translates to 94.7%.

10 C. Moffet, et al., Cable and Satellite: ~40% of Cable VoIP Customers "New" to Broadband, Bernstein Research, 6 July 2006, p. 2.

11 M. Paxton, Cable Telephony Service: VoIP Drives Subscriber Growth, In-Stat, December 2005, p. 28.

12 See FCC, Annual Report and Analysis of Competitive Market Conditions With Respect to Commercial Mobile Services, Eleventh Report, Released 29 September 2006, at paragraphs 116 and 214.

13 New York Pubic Utilities Commission, CASE 05-C-0616 – Proceeding on Motion of the Commission to Examine Issues Related to the Transition to Intermodal Competition in the Provision of Telecommunications Services. Statement of Policy on Further Steps Toward Competition in the Intermodal Telecommunications Market and Order Allowing Rate Filings, (Issued and Effective 11 April 2006).

14 That is, the NYPSC stated (at p. 68) that: "If carriers want to implement flexibility on a more disaggregated basis (i.e., upstate/downstate), they must first demonstrate that competition within the more disaggregated areas is sufficient to constrain prices in the aggregate."

15 California Public Utilities Commission, Order Instituting Rulemaking on the Commission's Own Motion to Assess and Revise the Regulation of Telecommunications Utilities, Rulemaking 05-04-005 (Filed 7 April 2005), Decision 06-08-030, 24 August 2006.

16 In its findings, the Commission determined that: "[It] should eliminate all retail price regulations for all business services and, except as expressly ordered otherwise in this decision, all residential services... There is no public interest in maintaining outmoded tariffing procedures that require review of cost data and delay service provision to customers and this practice should end....All tariffs should go into effect on a one-day filing, but any tariffs that impose price increases or service restrictions should require a thirty-day advance notice to all affected customers." (See "findings of law," 33, 34 and 35.)

17 According to the FCC's latest data, the average residential charge for flat rate service came to $25.27 per month, including $5.98 for Federal and State Subscriber Line charges, and $4.26 for taxes, E911, and "other charges," in the 95 urban areas included in the FCC data. (Subtracting $4.26 from $25.27 yields $21.01. I omit taxes and other charges to allow comparisons with published rates for intermodal alternatives.) See Pedro A. Almoguera, Reference Book of Rates, Price Indices, and Household Expenditures for Telephone Service, FCC Industry Analysis & Technology Division, Wireline Competition Bureau, 2007, at iv, and Table 1.1. http://fjallfoss.fcc.gov/edocs_public/attachmatch/DOC-276876A1.pdf.

18 TNS data imply that the average expenditure by wireline telephone subscribers is about $49 per month, including $37 per month for local service and $12 per month for long distance services. (According to data from a 22 June 2006 TNS news release, wired local service customers spend an average of $37.11 per month; and long distance subscribers spend about $13.38 per month, and about 90% of households with wired service subscribe to long distance service. http://www.tnstelecoms.com/press-6-22-06.html, accessed 15 November 2007.) Unfortunately, their published data do not distinguish between spending by customers with and without bundles. However, about 40% of wireline customers purchase packages, about 20% buy only local basic service, and about 40% buy synthetic bundles. So assuming that package customers spend about $50 to $70 per month for wired service implies that the average spending by synthetic bundle customers comes to about $34 to $54 per month.

19 Olga Kharif, "Wal-Mart's Latest Sale: Broadband," Business Week, 8 October 2007 citing ABI Research. These data are generally consistent with FCC data showing about 50.3 million broadband residential lines in mid-2006 and growth of about 30 percent from the prior (June 2005) figure. Such growth implies that there were about 65 million residential broadband lines by mid-2007 in the US, which represents about 59% of occupied housing units.

20 According to the Center for Disease Control data, only about 29.6% of landline households did not have a wireless phone in 2006. See Stephen J. Blumberg, and Julian V. Luke, Division of Health Interview Statistics, National Center for Health Statistics, "Wireless Substitution: Early Release of Estimates Based on Data From the National Health Interview Survey, July – December 2006," Table 1.

21 The most recent FCC data (for 2001) on minutes of local usage show 56 dial equipment minutes (DEMs) per line per day. (See FCC Trends In Telephone Service, August, 2003, Table 10.2.) Since two DEMs equals one conversation minute, this implies about 28 conversation minutes per line per day in 2001. Since calling volumes (local calls per ILEC line as reported by the FCC) have been declining by about 6.7% per year since 2001, I estimate that conversation minutes fell to about 18.4 per day or 553 per month in 2007. (See FCC Trends in Telephone Service, February 2007, Tables 7.1 and 10.2) And since about 57% of calls are made during wireless daytime billing periods, the number of billed wireless minutes would be about 317; however, the DEM data include business usage, and business usage has historically been greater than residential. Reducing the average usage by 10% to adjust for this factor implies residential "daytime" local usage averages about 284 minutes per month.

22 Estimated from company websites in first quarter of 2007.

23 This is the charge added when a customer adds voice service to his video and broadband service bundle or synthetic bundle. The charges for Cox are based on its lowest cost local voice service. Comcast voice service includes a more comprehensive bundle of features and usage.

About NERA

NERA Economic Consulting is an international firm of

economists who understand how markets work. We provide economic

analysis and advice to corporations, governments, law firms,

regulatory agencies, trade associations, and international

agencies. Our global team of more than 600 professionals

operates in over 20 offices across North and South America,

Europe, and

Asia Pacific.

NERA provides practical economic advice related to highly complex business and legal issues arising from competition, regulation, public policy, strategy, finance, and litigation. Our more than 45 years of experience creating strategies, studies, reports, expert testimony, and policy recommendations reflects our specialization in industrial and financial economics. Because of our commitment to deliver unbiased findings, we are widely recognized for our independence. Our clients come to us expecting integrity and the unvarnished truth.

NERA Economic Consulting ( www.nera.com), founded in 1961 as National Economic Research Associates, is a unit of the Oliver Wyman Group, an MMC company.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.