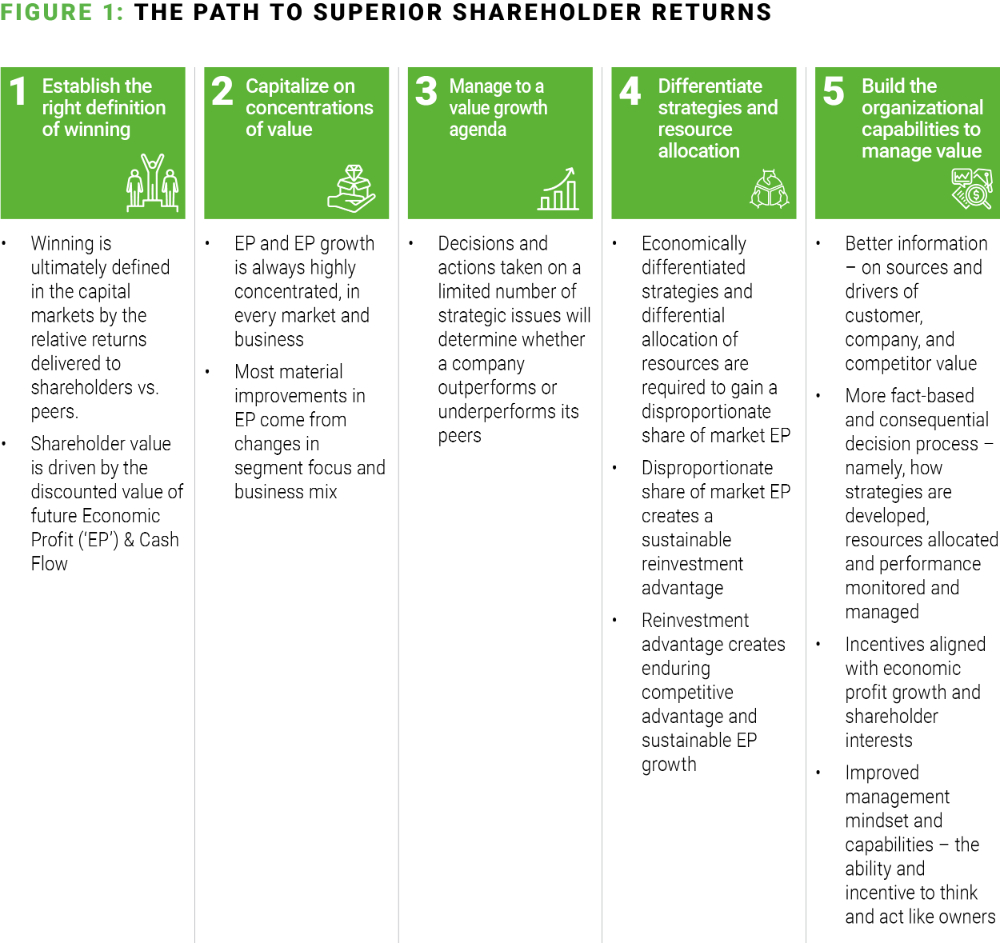

In this series, we discuss how an approach known as "managing for value" can help grocers develop a powerful reinvestment advantage. We'll cover five key steps in the process: aligning on a single measure of success; identifying internal and external concentrations of value; establishing management's key priorities; creating differentiated strategies and resource allocation; and building a culture of ownership.

All management teams aspire to deliver superior value to their customers, their employees, and their shareholders, but few have a single governing objective that enables them to do so. Fewer still understand the financial performance required to achieve superior returns, much less keep a clear agenda of the short list of activities essential to achieve that result.

Setting top quartile shareholder returns as the sole governing objective allows companies to focus energy toward one goal, removing distractions that inhibit making the right decisions. Winning in the capital markets requires first delivering superior value to customers and inherently builds value for employees by funding the opportunities for further growth.

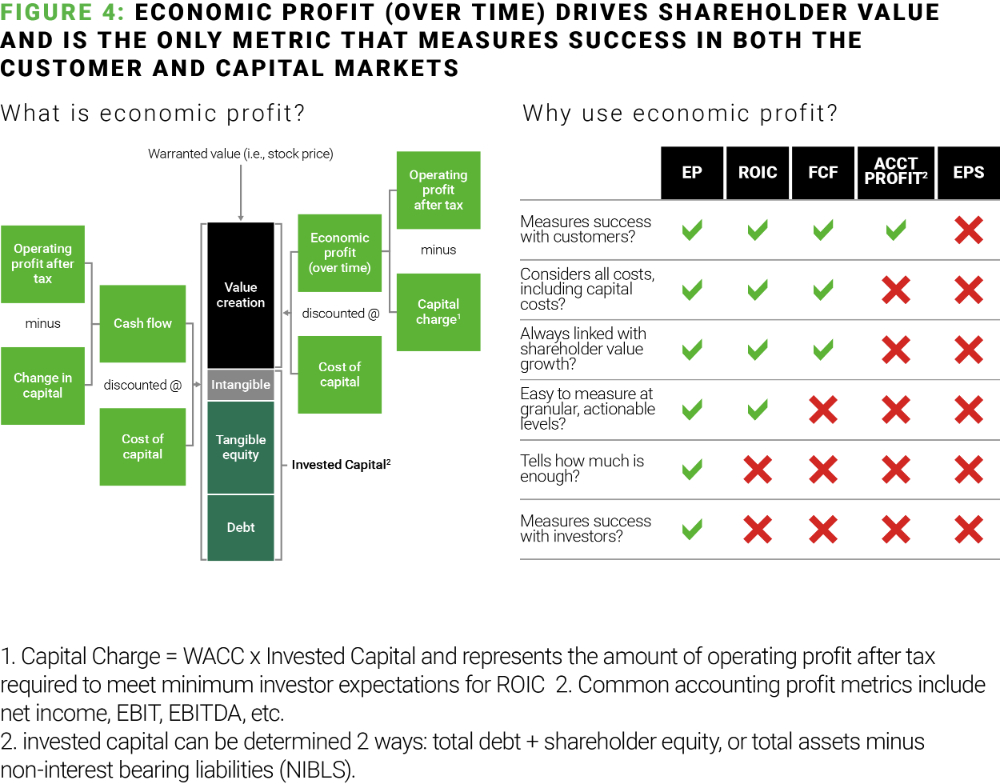

Even among companies that do prioritize delivering superior value for shareholders, management teams often have differing views on what drives this value. We have found the most consistent driver of shareholder value is relatively straightforward, albeit difficult to achieve: maximizing long-term economic profit growth.

Increasing economic profit growth faster than competitors creates a reinvestment advantage, which can be used to improve infrastructure, strengthen talent, and fund a host of initiatives that further differentiation. For grocers, this may mean reformatting stores, training employees, investing in technology, or making other improvements to customer experience. These actions create a "flywheel effect," wherein investments continue driving increased competitive advantage and additional profit growth – which ultimately benefits all stakeholders (customers, employees, communities, shareholders, etc.).

In this series, Managing for Value, we will introduce a new way of managing your grocery business to maximize value for your customers, your employees, and your shareholders. We will start with 5 guiding principles and how to apply them within the grocery business.

In our experience, these principles have driven successful companies across industries to deliver shareholder value in excess of 50% above their peers, creating a virtuous cycle and enabling them to reinvest heavily in their people and customers.

1. Establish the right definition of winning

Managing for value means making business decisions with the objective of maximizing returns for shareholders or owners, which is critical to providing benefits for all other stakeholders. Transforming an organization to manage for value first requires leadership agreeing on this common goal and how to measure success, as well as embedding this philosophy deep into the organization. This objective applies to both public and private companies, as we will expand upon in the next section.

2. Capitalize on concentrations of value

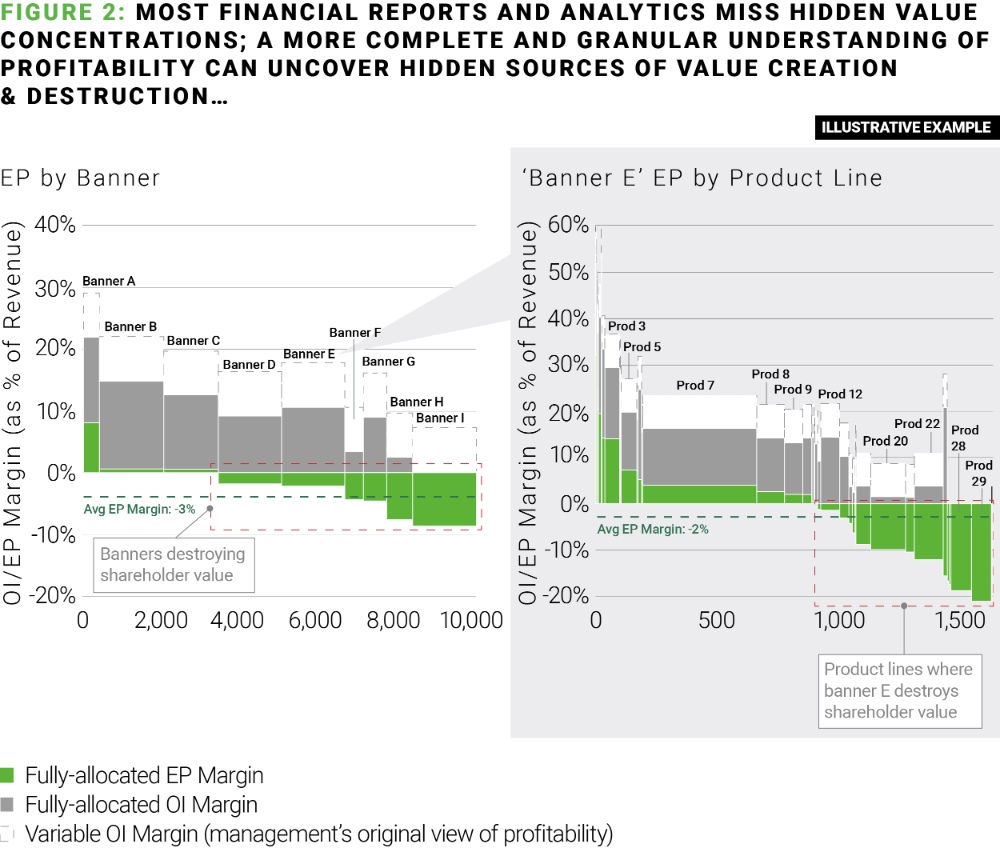

Within any company, value is highly concentrated; across industries, we typically see that roughly one-third of activities generate the majority of profits, while ~40% are value neutral and the remainder actually destroy value (i.e., are economically unprofitable). This generally holds true across entire markets as well. Knowing where and why these concentrations exist allows management to focus efforts on growing the highest value areas, while minimizing losses elsewhere.

For grocers, value is concentrated by customer, product, category/department, store, etc. — and for larger chains, by banner or geography. It is not atypical to see 20% of shelf space generating 80% of economic profit, and it is critical for management to know which products these are, who buys them, and why.

3. Manage to a value growth agenda

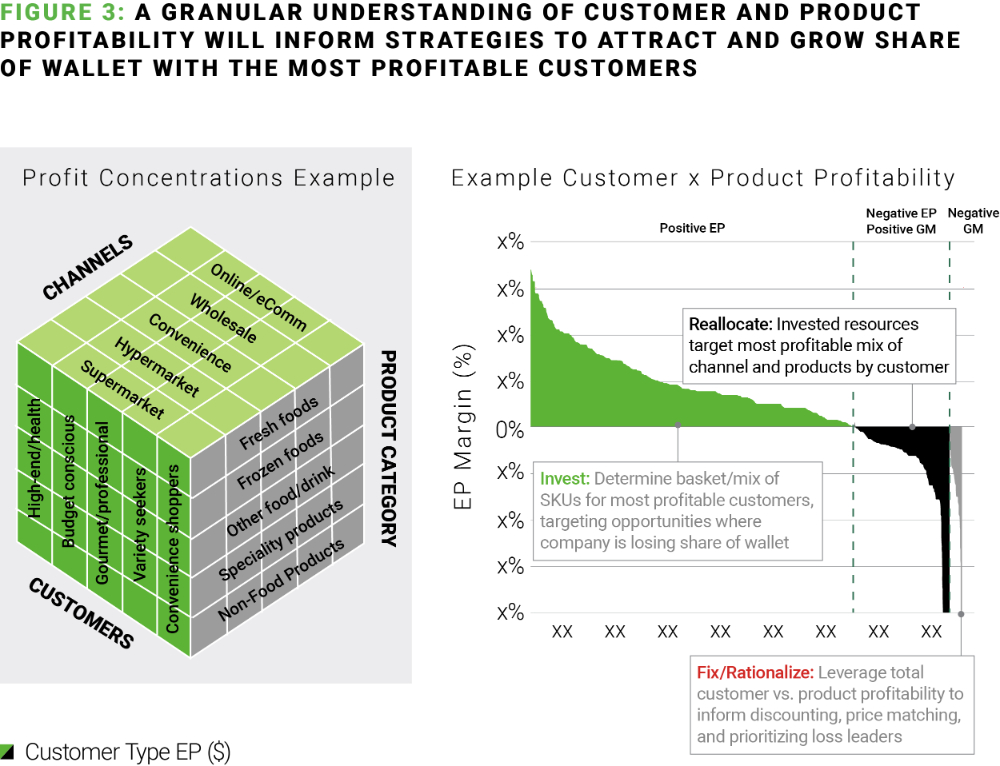

Armed with the knowledge of where value is concentrated, management teams must pursue a short-list of initiatives that offer the greatest potential for value creation. At any given time, an organization will have dozens (or many more) of "important" initiatives underway. Often these projects require significant bandwidth, conflict with one another, and do not deliver expected returns in aggregate. Prioritizing the top 3-5 initiatives based upon value growth potential minimizes distractions for CEOs and their leadership teams while significantly improving the odds of achieving desired results.

For example, a sample agenda for a grocer with profit concentrated in wealthier customers who value high quality products, new/seasonal assortment, and in-store experience might look like: sourcing new local products from small vendors; adding high-end private label products with rotating assortment in frozen/snacks; and individualized marketing/experiences (e.g., cooking classes) that link loyalty, digital, and in-store experience.

4. Differentiate strategies and resource allocation

Achieving a meaningful growth agenda requires doing things differently than the competition. Many companies fall into the trap of chasing "best practice," or improving line items/components of the business in isolation, rather than pursuing integrated strategic change.

For example, matching the assortment of a successful competitor may drive a small boost in sales but is unlikely to convert enough new customers to dramatically impact the top or bottom lines. On the other hand, designing promotions to drive traffic towards the most profitable products (perhaps by discounting price-elastic items frequently purchased in the same basket) has the potential to simultaneously increase sales and margins through mix improvement. Similarly, shifting resources (time, capital, etc.) toward these strategies – and away from unprofitable areas of the business – will greatly accelerate value growth.

5. Build the organizational capabilities to manage value

To execute these strategies optimally, every level of the company must be enabled and encouraged to think like owners. Across an entire organization, hundreds of decisions are made each day — many of which senior management are not involved in. Ensuring that employees have the information, tools, structure and incentives necessary to independently make value-maximizing decisions is critical to sustaining superior returns over time.

Going deeper: Establishing the right definition of winning

In order to get the entire company "rowing in the same direction," a grocer must first define what winning looks like. Establishing a singular definition provides management teams with a consistent basis for prioritizing initiatives, helping to minimize competing objectives and provide a unified message to employees. For public entities, there is one clear definition: maximizing shareholder value — measured by Total Shareholder Returns (appreciation in share price, plus dividends) — as this is the fiduciary responsibility of executives.

While some companies may instead use financial engineering to capture temporary boosts in their share price, metrics like EPS are surprisingly disconnected from long-term total shareholder returns. The most consistent measure of shareholder value is growth in Economic Profit (EP) — earnings, less a charge for the capital employed to generate those earnings — which is much easier to manage a business to in real-time (and also relevant to private grocers).

While not every grocer has shareholders, in practice, private companies can similarly measure value as returns to owners or investors. But why should non-owners adopt this definition? Simply put, maximizing "shareholder" value in any company inherently maximizes value to customers and employees.

To win in the capital markets, a company must first win in the customer marketplace. Said another way: to maximize EP, a grocer must capture a greater share of the market profit pool by serving customers better than the competition. Gaining loyal — and profitable — customers requires these consumers perceiving greater benefits for the price than they can find elsewhere, and when a company achieves this, they create value for said customers.

At the same time, maximizing EP growth over time enables companies to build a reinvestment advantage, which means they have more money to reinvest in their management agenda (i.e., to continue better serving customers), their employees, and their communities.

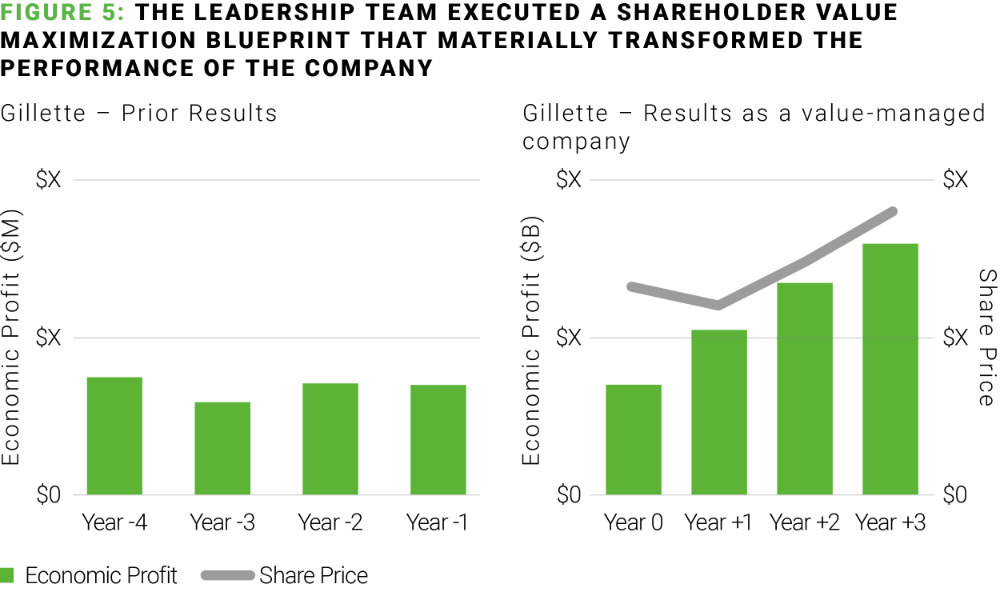

Adopting this mindset has led companies across many different industries to achieve superior results, as evidenced by one of our former clients, Gillette. The company had experienced four years of flat revenues, a 40% decrease in shareholder value, and consistently missed earnings targets to investors. New management realized that a focus on short-term tactics to improve near-term results (e.g., boost quarterly EPS) was failing to generate desired results.

Looking at the business through the lens of economic profit revealed that one business unit generated 80% of the company's value, while several other segments were actually destroying value. This was driven by a consumer advantage – where certain products were able to grow market share at premium prices (while competitors failed to gain share, even when lowering price). However, investments in different areas of the business were consuming these profits and burdening the company with unproductive capital.

Management adopted shareholder returns as their guiding objective, and in doing so built an agenda to grow the value of their core business – entailing several new product launches and strengthening the mutual economics of customer relationships, among others.

Investments were reallocated to deliver even more value to consumers across their preferred product lines, geographies, and methods of interaction (e.g., shifting from advertising to sampling). The organization was aligned to better reward employees for creating value, which created the foundation for sustained growth.

As a result, both EP and share price roughly doubled over the next 4 years, fueling further innovation and sharing increased benefits across stakeholders.

Grocers can achieve similar transformation when they embrace the managing for value approach. For more on this topic, stay tuned for the next piece in this series, coming next month.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.