One of the world's largest cryptocurrency exchanges, the famous, or infamous FTX Trading Ltd (FTX) filed for bankruptcy in 2022. Shortly thereafter, U.S. regulators, in particular the U.S. Securities and Exchange Commission (SEC) as well as the Commodity Futures Trading Commission (CFTC) brought to light their investigations of FTX's relationship with its sister entity Alameda Research, the FTX US platform, and its crypto-lending activities, liquidity issues, and mishandled customer funds.

A month after FTX filed for bankruptcy, the SEC released new guidance on December 8, 2022, requiring companies that issue securities to disclose to investors their exposure and risk to the cryptocurrency market. Under the new guidance, companies will have to include crypto asset holdings as well as their risk exposure to the FTX bankruptcy and other market developments in their public filings.

The Securities and Exchange Commission (SEC) charged Samuel Bankman-Fried with orchestrating a scheme to defraud equity investors in FTX Trading Ltd. (FTX), the crypto trading platform of which he was the CEO and Co-founder. Investigations as to other securities law violations and into other entities and persons relating to the alleged misconduct are ongoing. According to the SEC's complaint, since at least May 2019, FTX, based in The Bahamas, raised more than $1.8 billion from equity investors, including approximately $1.1 billion from approximately 90 U.S.- based investors.

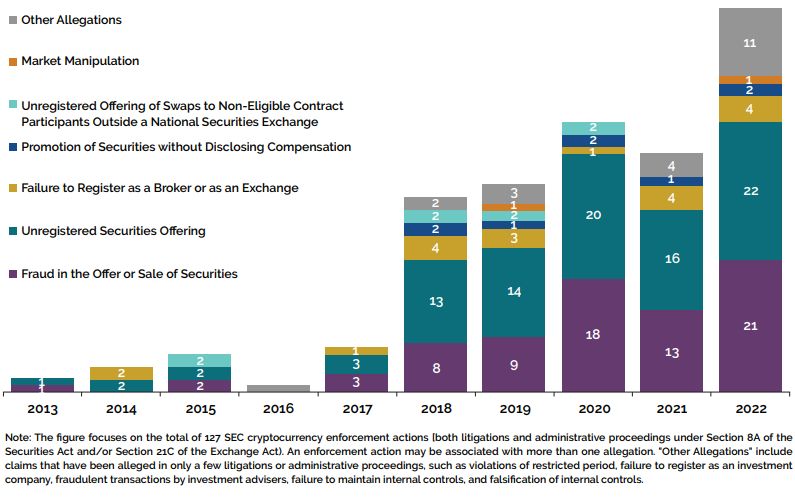

The SEC continues to prioritize its cryptocurrency enforcement. In 2022, the SEC administration reported a total of 30 cryptocurrency-related enforcement actions, up 50% from 2021. To put this in context, there have only been 127 total cryptocurrency-related enforcement actions since 2013. The most frequent allegations in cryptocurrency-related enforcement actions remained fraud and unregistered securities offerings as seen below.

The current SEC Chair, Gary Gensler provided insight into its administration's outlook stating, "There's no reason to treat the crypto market differently just because different technology is used. We should be technology-neutral. . . . We already have robust ways to protect investors trading on platforms. And we have robust ways to protect investors when entrepreneurs want to raise money from the public. We ought to apply these same protections in the crypto markets. Let's not risk undermining 90 years of securities laws and create some regulatory arbitrage or loopholes.".

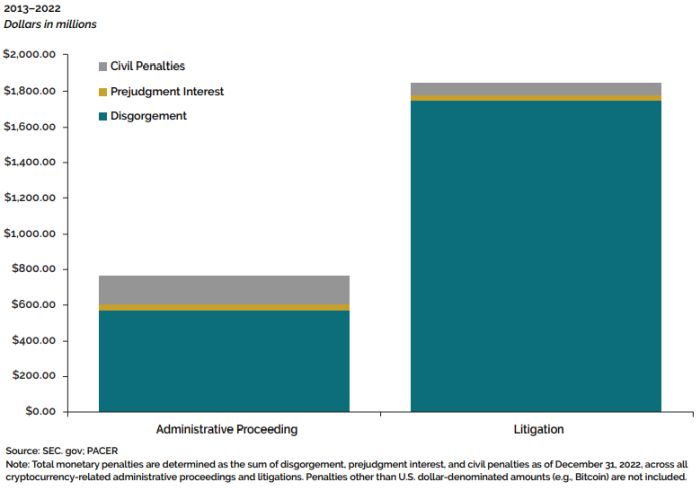

Since 2013, monetary penalties against digital-asset market participants amounted to approximately $2.61 billion. Totaling $242 million in 2022 alone. Please find the total monetary penalties in SEC cryptocurrency enforcement actions below.

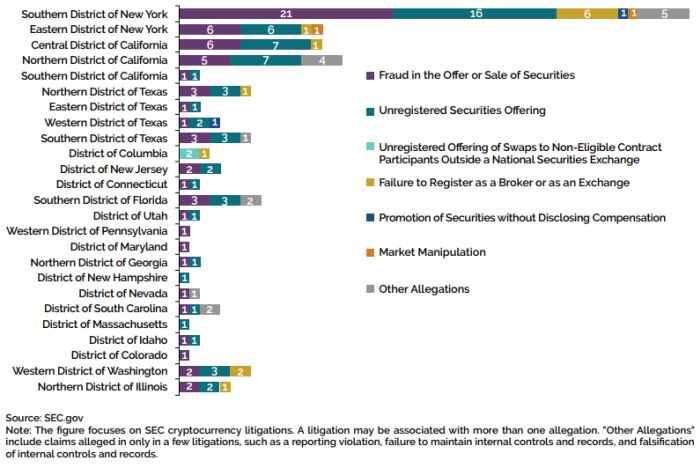

Although most litigations occur in New York, there has been increased cryptocurrency enforcement actions in other federal courts brought on by the SEC. Below you can see the types of allegations in SEC cryptocurrency litigations by court venue.

The year 2022 was a rollercoaster year for the crypto industry, from the downfall of the FTX empire to its effect on other entities in the crypto ecosystem. Many prominent institutional trading firms, venture funds, and market makers were also adversely impacted by loss of trust in the industry, centralized exchanges, and the liquidity crunch. Moving forward, Federal regulators, including the SEC, and state regulators continue to walk a fine line between maintaining regulatory compliance and controlling illegal activity and cybercrime while still encouraging the development of a growing virtual currency and potentially lucrative digital assets industry.

Our team can assist organizations with the ever-changing Federal and State regulatory environments. With its large team of longtime licensing officers and former Federal and State regulators, We have extensive experience in licensing money transmission, cryptocurrency, prepaid access, currency exchange, lending, and gaming. We also provide Anti-Money Laundering/Combating the Financing of Terrorism (AML/CFT), fraud prevention, integrated regulatory compliance, financial crimes prevention and enterprise risk management services, and regulatory compliance services to the Fintech industry.

REFERENCES

SEC-Cryptocurrency-Enforcement-2022-Update

chrome-extension://efaidnbmnnnibpcajpcglclefindmkaj/https://www.cornerstone.com/wp-content/uploads/2023/01/SEC-Cryptocurrency-Enforcement-2022-Update.pdf

https://www.sec.gov/litigation/litreleases/2023/lr25616.htm

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.