The growth in partnerships between banks and Fintech companies through Banking as a Service (BaaS) models presents significant opportunities for innovation across the financial services sector. However, these collaborations also introduce complex challenges, particularly in relation to financial crime compliance. This article explores the considerations and strategies essential for both banks and Fintechs to navigate the regulatory landscape effectively, mitigate financial crime risks, and develop successful long-term relationships.

While banks have long been under the purview of stringent regulatory frameworks designed to prevent financial crimes, Fintechs face a more varied regulatory landscape. Depending on their services and operational jurisdictions, Fintechs may encounter different regulatory expectations. However, when partnering with banks via a BaaS model, Fintechs are required to meet the same exacting standards of compliance, reflecting the bank's regulatory obligations and risk appetite.

Ultimately, navigating the complexities of financial crime compliance in BaaS models requires a collaborative approach, with both banks and Fintechs working together to balance growth and innovation with clearly defined compliance measures, thereby ensuring the success of their partnership and the future of financial services innovation.

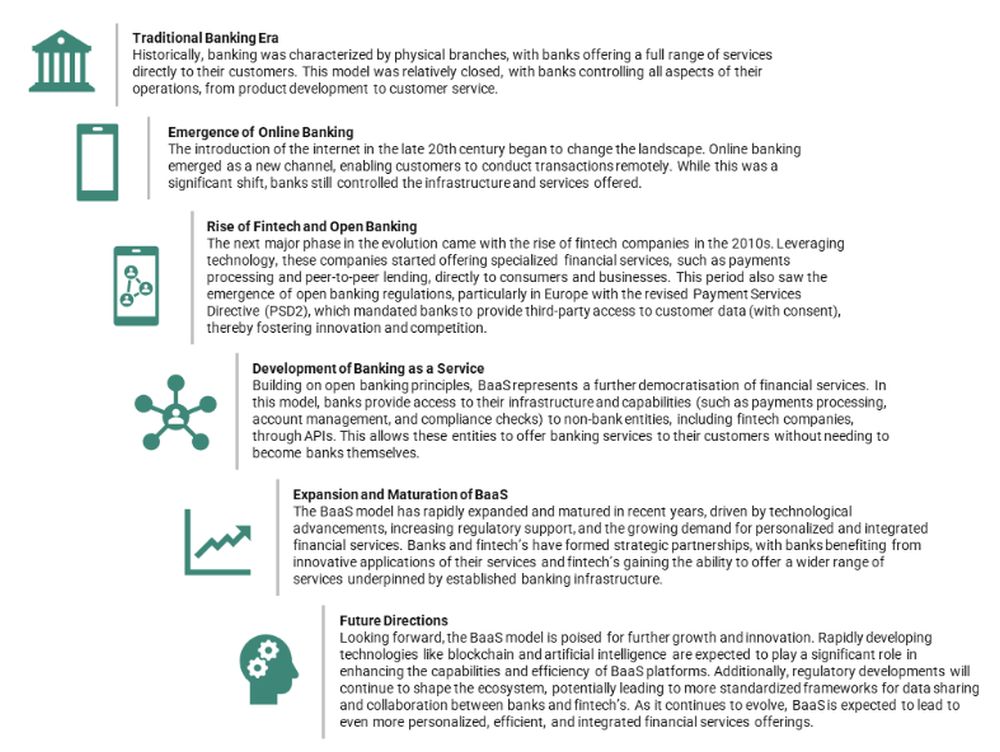

The evolution of Banking as a Service (BaaS)

A Bank's Perspective: Addressing Risks in BaaS Models

For banks, offering BaaS to Fintech companies involves a significant shift in risk management paradigms. The primary concern is the inherent risk of facilitating financial crimes, including money laundering, terrorist financing, and fraud, through their platforms. Banks are traditionally subject to rigorous regulatory standards and have established sophisticated compliance frameworks to detect and prevent financial crimes. When establishing BaaS partnerships with Fintechs, banks are one step removed from the end customer and as a result extend these risks and responsibilities to their Fintech partners, necessitating a reassessment of their risk management strategies.

The Key Risk Considerations for Banks:

- Due Diligence: Banks must conduct thorough due diligence on Fintech partners to understand their business models, customer base, and inherent risks. This includes evaluating the Fintech's own compliance capabilities and the robustness of its controls against financial crimes.

- Regulatory Compliance: Banks remain accountable to regulatory bodies for any services offered through their platforms, including those by Fintech partners. Ensuring that Fintechs comply with applicable financial crime regulations is paramount to avoid penalties and reputational damage.

- Monitoring and Reporting: Continuous monitoring of transactions and activities conducted through BaaS platforms is crucial. Banks must ensure that mechanisms are in place to identify suspicious activities and report them as required by law.

- Technology and Data Security: Banks must assess the effectiveness and scalability of the technologies of Fintech partners, ensuring they meet the standards required to monitor and detect financial crime.

A Fintech's Perspective: Managing Bank Expectations and Regulatory Challenges

Fintech companies leveraging BaaS models benefit from accessing the banking ecosystem without the need for a banking license or the infrastructure traditionally required to offer financial services. However, this arrangement also requires Fintechs to align with the compliance standards and expectations of their banking partners which often exceed their own set of regulatory requirements.

The Strategies for Fintechs:

- Understanding Regulatory Landscapes: FinTechs must have a comprehensive understanding of the regulatory expectations for both banks and Fintechs. This includes staying abreast of changes in financial crime regulations, and ensuring their services are designed to comply with these requirements.

- Building Robust Compliance Frameworks: Implementing strong internal controls and compliance frameworks is essential for Fintechs to manage financial crime risks effectively. This not only meets the expectations of banking partners but also builds trust with regulators and customers.

- Collaboration and Communication: Fostering open lines of communication with banking partners about compliance matters is crucial. Regularly sharing information on compliance efforts, audit findings, and risk assessments can help manage expectations and ensure alignment on compliance standards.

- Investing in Technology: Critical for early-stage Fintechs is identifying the point where increased volumes and/or complexity necessitates a move away from end user defined applications (spreadsheets/databases) / internally developed tools and adoption of more industry-standard technology. Leveraging advanced technologies such as artificial intelligence and machine learning for monitoring transactions and identifying suspicious activities can enhance compliance efforts and demonstrate a commitment to preventing financial crimes.

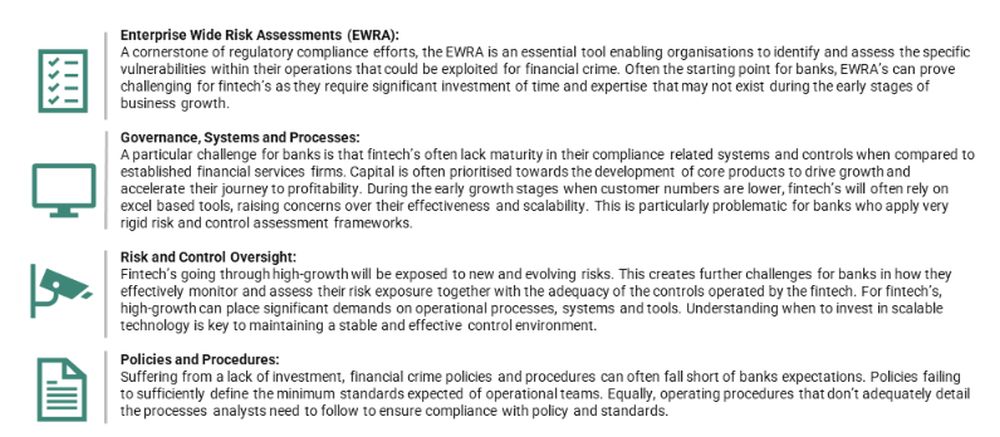

What Are the Typical Challenges for Fintechs in Meeting Their Banking Partner's Expectations?

Regardless of their growth stage, Fintechs must define a roadmap for how they will develop and scale their financial crime systems, processes, and controls to manage the evolving risks. Critically they must understand the trigger points, be that volumes or complexity, which demands more sophisticated and scalable systems to ensure they continue to meet regulatory requirements and expectations of their banking partners. This can prove challenging for Fintechs who are often under pressure from investors with capital investment directed towards driving revenue rather than compliance-related activity. Fintechs must ensure investors and the executive board understand the financial crime development roadmap and the implications of not providing the necessary capital investment.

Common examples of financial crime programme-related challenges for banks and Fintechs establishing a BaaS partnership:

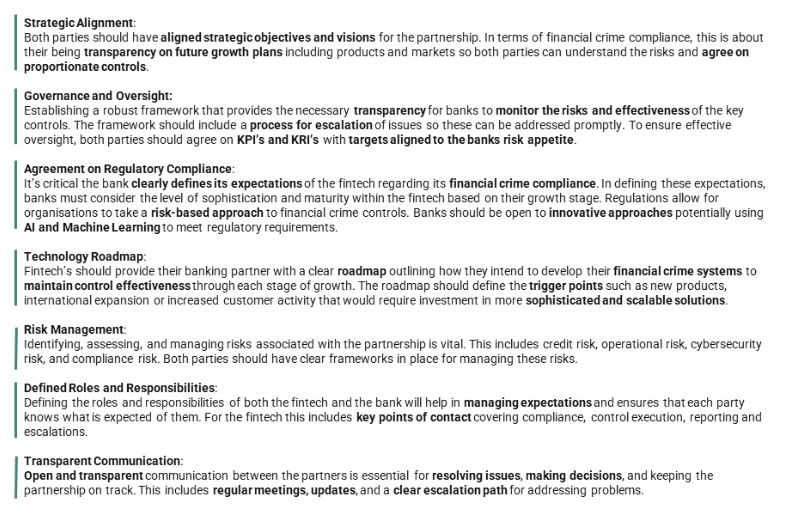

So, What Are the Key Success Factors for Establishing a Trusted BaaS Partnership?

Establishing a trusted and effective Banking as a Service (BaaS) partnership between a bank and a Fintech involves several key success factors that are critical for the success and sustainability of the partnership. Here are some of these factors:

In Conclusion

The collaboration between banks and Fintechs in offering BaaS requires a balance between innovation and compliance. Both parties must navigate the complexities of financial crime compliance, ensuring they meet regulatory expectations while fostering an environment conducive to business growth and financial innovation. By addressing these challenges collaboratively, banks and Fintechs can unlock the full potential of BaaS, driving forward the future of financial services.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.