Resurgence of Covid Ship Backups and Soaring Costs

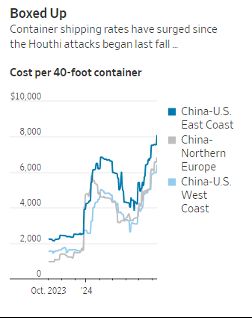

Ship backups that plagued seaports during the Covid pandemic are resurfacing due to vessel diversions triggered by Houthi rebel attacks in the Red Sea. These attacks have effectively closed the Suez Canal, causing congestion and soaring costs at the start of the peak shipping season. Flotillas of containerships and bulk carriers are now growing off the coasts of Singapore, Malaysia, South Korea, and China, while European ports struggle to manage container piles. The disruptions extend voyage times, throw ships off schedule, and strand sea containers, complicating logistics for retail and manufactured goods. Importers and exporters are particularly concerned that the backups could worsen as demand picks up, potentially driving freight rates close to pandemic levels.

The average worldwide cost of shipping a 40-foot container has tripled compared to June last year, reaching $4,119, the highest rate since September 2022. Retailers and manufacturers are worried about potential strikes at U.S. East Coast and Gulf Coast ports, further exacerbating supply-chain challenges. The disruptions are forcing some importers to use costly airfreight and leading to significant delays and higher costs for companies like British retailer DFS Furniture. The diversions around Africa have also knocked ships off schedule, causing cancellations and further congestion in global ports. This has led to skyrocketing container leasing prices and increased shipping costs, significantly impacting the earnings of importing companies.

Investors in the shipping industry are observing a unique trend where profits of liner companies appear to be inversely correlated with the ongoing conflict in Gaza. Following the UN's ceasefire resolution on June 10th, major shipping firms such as Maersk, Hapag-Lloyd, and ONE experienced declines in their share prices, reflecting market concerns over potential disruptions to Red Sea transits and subsequent impacts on earnings. Analysts from Clarksons Securities noted significant losses in liner equities, highlighting a 5% drop just last week and a cumulative 9% decline since recent developments.(Source: https://www.wsj.com)

Dunavant Solution: Dunavantensures optimized routing and scheduling, minimizing delays and cost escalations for importers and exporters dealing with fluctuating freight rates and logistical challenges. If you have any questions, please reach out to your customer service representative.

Associations Urge White House to Intervene in Dockworker Negotiations

Dozens of US industry associations have appealed to the White House to intervene in stalled negotiations between East and Gulf coast dockworkers and port operators, emphasizing that a strike would further strain the already fragile global supply chains. Contract talks between the International Longshoremen's Association and the US Maritime Alliance broke down earlier this month, with the current agreement set to expire on September 30. The letter, signed by more than 150 groups including the US Chamber of Commerce, the National Association of Manufacturers, and the National Retail Federation, urges the administration to ensure the resumption of contract negotiations to avoid disruptions to port operations and cargo flow.

Global maritime trade is already experiencing significant challenges due to Houthi attacks on ships in the Red Sea, forcing container carriers to take longer routes around southern Africa, thereby increasing lead times and freight rates. The letter stresses that additional disruptions from a potential strike would be detrimental to the supply chain, companies, and employees reliant on the movement of goods through East and Gulf Coast ports. The mere threat of a port walkout has already caused shippers to seek alternative routes, as evidenced by the diversion of cargo from West Coast ports during prolonged contract negotiations that concluded with a six-year deal in September. The letter notes a shift back to West Coast gateways, which now have a long-term contract, particularly as the peak shipping season approaches. (Source: https://www.bloomberg.com)

Dunavant Solution: Dunavant is monitoring the situation closely and will relay any information we have.

Container Shipping Lines Expand India Trade Routes Amid Growing Demand and Strategic Enhancements

Major container shipping lines are intensifying their focus on India's trade routes in response to growing demand and expanding market opportunities in Asia. CMA CGM has spearheaded this effort with several service enhancements, including the launch of BIGEX 2, a new route connecting Bangladesh's Chittagong Port to key Gulf markets via Jebel Ali, Djibouti, Aden/Berbera, Colombo, Mangalore, Nhava Sheva, and Mundra. This move aims to bolster connectivity and support economic growth across these regions, reflecting CMA CGM's confidence in meeting customer needs amid evolving trade dynamics.

Additionally, CMA CGM has updated its flagship Indamex service, enhancing connections between West India and the US East Coast with new calls at Savannah and Charleston starting August 15th. This adjustment is expected to streamline logistics and improve transit times, reinforcing CMA CGM's commitment to optimizing trade links between India and major global markets. Meanwhile, other industry leaders like Hapag-Lloyd and Maersk have also expanded their networks between India and Europe, further enhancing accessibility for Indian exporters and improving transit times, particularly beneficial for sectors like lifestyle and retail. Despite these positive developments, challenges persist with congestion at Asian ports affecting trade flows, underscoring the ongoing complexities in global shipping operations.

Dunavant Solution: Dunavant Global Logistics can facilitate seamless integration into these expanded India trade routes by offering tailored supply chain solutions that optimize efficiency and mitigate challenges such as port congestion and fluctuating transit times. Reach out for a quote.

Fuel Surcharge Benchmark Rises

For the first time since March, the benchmark price for fuel surcharges has risen for two consecutive weeks, with the Department of Energy/Energy Information Administration reporting a price of $3.769 per gallon, up by 3.4 cents. Despite the lack of obvious reasons for this increase, as demand remains low and supply is stable, energy economist Philip Verleger suggests market manipulation might be behind the rise in Brent crude prices. Verleger highlights the significant buying activities of trading companies Gunvor and Trafigura, which have acquired large quantities of crude grades influencing the dated Brent assessment, resulting in an over 11% price increase from June 7 to the recent Friday.

Verleger points to past instances of market manipulation, such as Trafigura's recent $55 million fine for manipulating another SPGCI assessment, and similar heavy buying of West Texas Intermediate crude influencing Brent prices. He argues that these trading activities exploit the vulnerable pricing system of global crude oil, which has faced criticism but little reform. Interestingly, refined diesel products have also seen price increases, with the ULSD price relative to Brent rising since June 7. This suggests that efforts to drive up crude prices have not left refined products unaffected, contrary to typical market behavior. (Source: https://www.freightwaves.com)

Federal Regulators Approve 25% Increase in UCR Fees for Motor Carriers

Federal regulators have approved a significant 25% increase in fees collected by states from motor carriers, brokers, and leasing companies under the Unified Carrier Registration (UCR) Plan for the 2025 registration year. The fee adjustments, announced by the Federal Motor Carrier Safety Administration, range from an additional $9 to $9,000 per year depending on the size of the carrier's fleet. This marks a notable shift following two years of fee reductions, averaging a 37.3% decrease, and nearly a decade of unchanged collections from 2010 to 2017. The FMCSA defended the fee increase as necessary for maintaining the UCR Plan's operational obligations, emphasizing that it aligns with statutory requirements and supports state highway safety programs, enforcement efforts, and administrative costs associated with the UCR.

The UCR program, involving 41 participating states, collects fees used at state discretion, primarily for truck safety initiatives and program administration. Despite objections raised during the comment period, FMCSA concluded that the fee adjustment was warranted based on the UCR Plan's fiscal stability and adherence to budgetary constraints in recent years. The total funding entitlement for states under the UCR program for 2025 is set at approximately $108 million, with allocations varying from $7.5 million for Michigan to $372,007 for North Carolina, underscoring the program's integral role in state-level transportation funding and safety enhancements. (Source: https://www.freightwaves.com)

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.