Consumer Sentiment Uptick

In May, US consumer confidence rose unexpectedly for the first time in four months, driven by less negative views on business conditions and the labor market. The Conference Board's sentiment gauge increased to 102 from 97.5 in April, surpassing all estimates in a Bloomberg economist survey. The index of present conditions improved for the first time since January, and the measure of expectations saw its largest jump since July. Despite this uptick, the overall confidence trend has been downward due to persistent inflation, record household debt, and a softening job market. Additionally, the Federal Reserve's maintenance of high interest rates has contributed to voter pessimism about the economy as the November election approaches. The report highlighted growing consumer concerns about a potential recession, with expectations rising for the second consecutive month. (Source: Bloomberg)

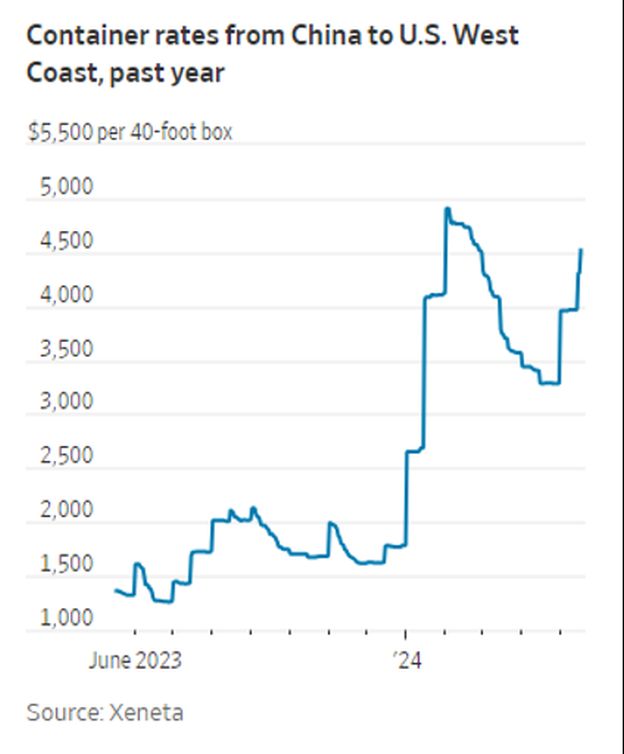

Container Crunch Send Rates Soaring

The recent diversions of container ships from the Red Sea, a direct result of attacks by Iran-backed Houthi rebels, have had a significant impact on global shipping. This shift in shipping routes has seen most large container ships bypass the Suez Canal, opting for the longer route around the Cape of Good Hope, which adds up to two and a half weeks to their journey. The approach of the peak summer shipping season, coupled with this change, has led to a 30% surge in shipping costs. Smaller importers like Dennis Tsakiris, who rely on goods from Europe, are particularly affected, facing extended shipping times and higher expenses. However, large importers like Amazon and Walmart remain relatively insulated due to pre-negotiated, long-term contracts.

The diversion has intensified the capacity crunch, with shipping lines increasing container capacities to cope with the longer routes. This has increased shipping costs across major routes, with spot rates spiking significantly. The ongoing geopolitical tensions, coupled with trade disruptions and bad weather in Asia, have exacerbated the situation. As a result, logistics managers are pushing to move freight earlier to avoid further delays, particularly with the holiday season approaching. This early frontloading is further straining an already tight shipping capacity, leading to warnings of potential cost hikes and supply chain disruptions reminiscent of the COVID-19 pandemic's peak. (Source: Wall Street Journal)

Dunavant Solution: If you have questions or concerns regarding your maritime shipments, Dunavant's Global Team is continually monitoring the situation and can offer alternatives and recommendations. Contact us.

Eagle Pass: Fastest Growing Border Crossing

The Port of Eagle Pass has experienced the most rapid trade growth among U.S.-Mexico border crossings and is the fastest-growing major port across the nation's 450 airports, seaports, and border crossings. From January to March 2024, the port recorded over $11.37 billion in trade, marking a 22% year-over-year increase. This surge is driven primarily by imports of commercial vehicles, passenger vehicles, and beer, alongside significant exports of auto parts, gasoline, and soybeans. Recent rail developments have significantly impacted the port's growth, including the merger of Canadian Pacific and Kansas City Southern and Union Pacific's alignment with Ferromex, enhancing connectivity, and boosting trade flow through Eagle Pass.

The strategic importance of the Port of Eagle Pass is underscored by its infrastructure, including a vital rail and vehicle bridge linking it to Piedras Negras, Mexico. With the introduction of the Falcon Premium Intermodal Service and potential future expansions like the proposed Puerto Verde Global Trade Bridge, the port is poised to increase its capacity further. Industry experts emphasize the importance of focusing on the port's existing strengths and the benefits of rail investments. These developments ensure that Eagle Pass will continue to play a critical role in U.S.-Mexico trade, supported by robust infrastructure and strategic partnerships. (Source: FreightWaves)

Dunavant Solution: Our cross-border team provides end-to-end support, including customs brokerage, transportation management, warehousing, and distribution services, ensuring smooth and timely movement of goods across the border. Contact Johnny Araiza to learn more.

Canadian Rail Strike Unlikely in Next 2 Months

Canadian Pacific Kansas City (CPKC) announced that a regulatory decision on whether Canada's two major railroads must continue transporting certain goods during a labor disruption could take up to two months, potentially delaying a strike until summer. The Teamsters Canada union had planned a strike for May 22 at both CPKC and Canadian National Railway, which could significantly impact North American supply chains. CPKC plans to resume collective-bargaining talks with Teamsters Canada, but the union declined the company's offer for binding arbitration. Canadian National presented a revised offer, removing proposed pay and scheduling changes. The union did not respond to requests for comment and noted the unpredictability of the Canadian Industrial Relations Board's decision timeline.

Labor Minister Seamus O'Regan requested the industrial relations board to determine if railroads must transport essential goods during strikes, with submissions due by May 21. This request has created uncertainty about the timing of any work stoppage. The board stated it would expedite the decision process, as strikes or lockouts cannot begin until the decision is made—concerns from propane producers, who rely on rail transport, partly motivated O'Regan's request. The Canadian Propane Association emphasized the critical need for propane delivery to various sectors. Teamsters Canada is negotiating three agreements with CPKC and Canadian National, contesting the companies' attempts to remove key safety provisions, though the railroads assert they are not compromising safety.

Dunavant Solution: Dunavant's Global Team is continually monitoring the situation and can offer alternatives and recommendations if that need arises. Contact us.

Hurricane Season is Upon Us

This year's hurricane season is expected to be particularly active, with forecasts predicting between 20 and 25 named storms, of which 8 to 12 may develop into hurricanes. Texas, which experienced a below-average risk last year, is anticipated to face significant threats. Despite these predictions, Texas ports are maintaining their usual state of readiness. Port officials emphasize the importance of constant preparedness, with detailed plans and coordination with the U.S. Coast Guard and local emergency services to manage severe weather. The recent history of storms, including the devastating impact of Hurricane Harvey in 2017, underscores the critical need for these preparedness measures.

The increased severity of this year's storms is attributed to La Niña conditions, which reduce high-altitude winds that usually inhibit storm formation, combined with exceptionally warm sea surface temperatures. These conditions create an environment conducive to more and stronger storms. Port officials in Texas, such as those from Corpus Christi and Houston, have adapted their emergency response strategies, learning from past hurricanes to enhance their resilience and response capabilities. (Source: FreightWaves)

Dunavant Solution: Our operations in Texas are fully equipped with robust contingency plans and state-of-the-art infrastructure to navigate through hurricane season seamlessly. This ensures the safety and timely delivery of our customers' shipments with unparalleled reliability and efficiency.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

We operate a free-to-view policy, asking only that you register in order to read all of our content. Please login or register to view the rest of this article.