Private Placement Life Insurance (PPLI) is very much a misunderstood product even though its applications are vast and tremendously useful. Indeed, in any estate planning discussion with a high-net-worth individual its mention is virtually mandatory. PPLI is a product specifically developed for the investing and insurance needs of the high high-net-worth individual. While most traditional retail insurance products focus on death benefit protection with somewhat limited regard to cash value accumulation, PPLI provides a major focus on the accumulation of the cash value, but still provides a meaningful death benefit in compliance with the tax regulations of Internal Revenue Code Section 7702.

The Investment Benefit

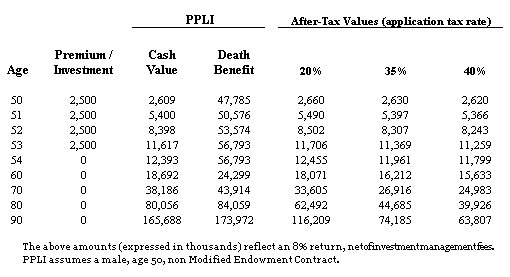

While there are multiple benefits to PPLI, one of the primary attractions is the tax advantages afforded life insurance. All too often investment advisors to high-net-worth clients provide investment return information net of investment management fees, but without regard to the effect of taxes. However, any investment return must be monitored on a tax-adjusted basis. At its simplest level, and structured properly in conformity with Code Section 7702, the PPLI premium amounts invested in life insurance accrete free of federal income tax during the life of the insured and the death benefit passes to the beneficiary free of any federal income tax. A very favorable investment structure develops when coupled with underlying investments that are actively managed investments which would typically generate ordinary income (e.g., hedge funds, commodity funds, high-yield taxable bonds). The growth of the underlying assets free of any federal income tax turns an otherwise 8% after-tax return into a 12.3% return (or a 10% return into 15.4% return) assuming a 35% tax bracket.

There is little argument that the tax regime in the United States is going to change and most probably will result in an increase in the capital gains and ordinary income tax rates at both the federal and state level. The chart below compares the accretion within PPLI as compared to different tax rates:

The Living Benefit

In each scenario presented above, the PPLI clearly generates the highest account value over the investment horizon on a tax adjusted basis. During the life of the insured, the policy owner has access to the cash value without being subjected to income tax either through withdrawals of basis (i.e., cumulative premiums paid) or policy loans (provided the policy does not lapse prior to the death of the insured). This is another tremendous benefit of PPLI as it provides for another tax-adjusted savings vehicle without the limitations of a 401(k) or Individual Retirement Accounts. However, as compared to a 401(k) or IRA, there is unrestricted access to the cash value of the policy, typically up to 90% of the accumulated cash value. This amount may be borrowed tax free, with net borrowing costs ranging from 0.25% to 1.0%. From a planning perspective, the living benefits can be used to fund lifestyle needs or capital expenditures.

The Death Benefit

The death benefit is sometimes overlooked in the PPLI context, but is actually an incredibly important part of the planning process. The death benefit can be used for a multitude of planning applications ranging from an estate tax mitigation tool to philanthropic gifting or to a tool as complex as the pay off of a note in a split-dollar arrangement.

While the estate tax landscape remains in flux, it is unquestioned that some form of estate tax will emerge over the next year. Beneficiaries will certainly enjoy the liquidity created by the PPLI death benefit to help pay estate taxes and thus limit other liquidations of an investment portfolio or a family business.

The death benefit may also be used to create a family legacy. The beneficiary of the death benefit could be a charity, church, school or a family foundation, or still yet, used to create a private family foundation for future generations.

One rather advanced, but highly effective, planning technique is the use of a split-dollar premium payment arrangement. Split-dollar planning is a flexible framework that facilitates transferring wealth to future generations in a transfer-tax-efficient manner. For example, a senior generation can pass assets in a leveraged manner to the next generation with minimal transfer-tax liability by creating an irrevocable life insurance trust and by funding the insurance purchase through an alternative premium-paying arrangement, such as an intrafamily loan structured as a split-dollar arrangement under the applicable tax regulations. When a client's net worth suggests the need for removing substantial assets from the estate tax base, PPLI, a traditional irrevocable life insurance trust, and an intrafamily split-dollar loan can be a very effective combination.

Domestic And International Asset Protection

In addition to the wide array of tax benefits inherent to PPLI, the existence of life insurance in an estate can also serve as a powerful asset protection tool. Prudent and wise planning requires wealthy individuals to create structures that prevent a complete loss of their estate due to a frivolous claim (although careful attention must be paid to the applicable fraudulent conveyance rules). While a detailed discussion is outside the scope of this article, policy ownership in jurisdictions outside of the United States can further strengthen the asset protection of the life insurance ownership structure; in addition, certain jurisdictions statutorily protect the life insurance policy itself. It is important to know that there are significant differences in pricing between domestic and international insurers, the primary difference being the application of state premium tax which is assessed against each premium and ranges from 1.5% to 4%.

Conclusion

PPLI, at its foundation, is most often used as a simple, tax-efficient investment vehicle. However, by adding varying layers of complexity and employing competent counsel and advisers, PPLI should be a part of every high-net-worth individual's estate plan.

Provided the policy remains in force, the benefit of tax-free accretion of investment earnings, coupled with tax-free access to the policy assets, and a tax-free death benefit, presents an unparalleled planning tool that simply cannot be ignored by estate planners and wealth advisors to the high-net-worth community.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.