The time – and opportunity – to plan for major tax changes is upon us.

Without Congressional action, a variety of tax credits, exemptions and reduced tax rates are scheduled to expire at the end of this year. Election year politics make it difficult if not impossible to determine whether Congress will act to extend any of these provisions, so businesses and individuals should use the time remaining in 2012 to understand how these changes will affect them and, if appropriate, take action before the end of this year.

What's at Stake?

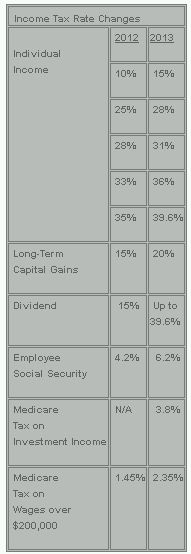

As illustrated by the chart to the right, there is a lot at stake. Knowing what changes are on the horizon and when they will take effect can help put you in greater control of your tax position. As a starting point, the list below outlines some of the more significant tax changes that are scheduled to become effective January 1, 2013:

Business Income Tax Changes

- End of accelerated depreciation on certain business property

- Expiration of research and experimentation tax credit

- Reduction of the limit on expensing certain business purchases from $500,000 to $125,000

- Increase in rates for the accumulated earnings tax and the personal holding company tax

- Contraction of employer-provided educational assistance to include graduate education

- Elimination of the tax deduction for employers who receive

Medicare Part D retiree drug subsidy

payments

Individual Income Tax Changes

- Termination of the election to accelerate AMT credits in lieu of additional first-year depreciation

- Return of the phase-out of itemized deductions and personal exemptions for higher income taxpayers

- Limitation to $2,500 per year on the amount of contributions to a flexible spending account for medical expenses

- Expiration of the exclusion from income of discharge of

indebtedness

on a principal residence - Increase to the threshold for the itemized deduction for unreimbursed medical expenses from 7.5% of adjusted gross income to 10% of adjusted gross income

Estate Tax Changes

- Top estate tax rate increases to 55% from 35%

- Exemption amount for estate taxes decreases from $5,120,000 (adjusted for 2012) to $1,000,000

- Surviving spouses will not be able to use a deceased spouse's unused exclusion amount

- Reinstatement of the qualified family-owned business deduction

- Modifications to generation-skipping transfer tax rules regarding deemed allocations of exemption to certain transfers in trust, severing of trusts, valuation and relief for late elections

This update is for information purposes only and should not be construed as legal advice on any specific facts or circumstances. Under the rules of the Supreme Judicial Court of Massachusetts, this material may be considered as advertising.