The Taskforce on Nature-related Financial Disclosures has released ten new guidance documents to assist companies in applying the TNFD recommendations. In addition, the Taskforce published June 30 adoption statistics.

Formally launched in mid-2021, the TNFD describes itself as a market-led, science-based and government-supported global initiative whose recommendations and guidance provide organizations with a risk management and disclosure framework to act on evolving nature-related dependencies, impacts, risks and opportunities. The recommendations and guidance are intended to provide decision-useful information to capital providers and other stakeholders.

The TNFD disclosure recommendations are structured around four pillars, consistent with the approach of the International Sustainability Standards Board (which incorporates the recommendations of the Task Force on Climate-related Financial Disclosures). Those four pillars are Governance, Strategy, Risk & Impact Management and Metrics & Targets.

The TNFD framework also is aligned with the goals and targets of the Kunming-Montreal Global Biodiversity Framework. For information on the GBF's four 2050 goals and 23 2030 targets, see here.

Adoption Stats

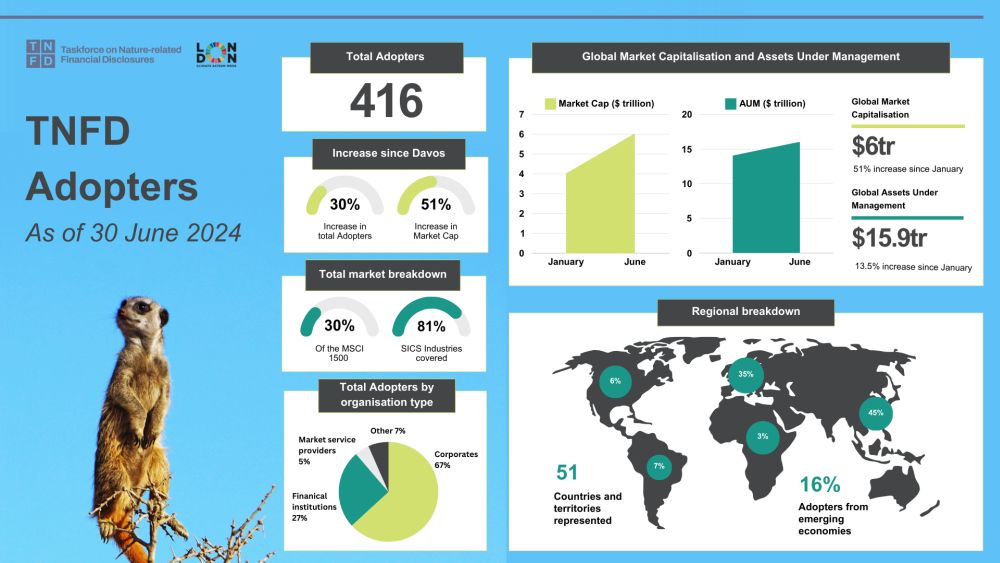

According to the TNFD, since January, total adoption has increased by 30%, to now include more than 250 corporates and more than 110 financial institutions. These organizations have committed to disclosing material nature-related issues to investors and other stakeholders based on the TNFD recommendations.

Thus far, most of the uptake has been in Europe and Asia, which represent 35% and 45% of the total adopters, respectively. Only 6% of the adopters come from North America. Seventeen adopters are U.S.-based (ten corporates, three financial services institutions, three market service providers and one academic-scientific adopter).

The adoption graphic put out by the TNFD last week is below. A sortable list of adopters is available here.

Additional Guidance

The sector-related guidance published by the TNFD last week covers nine sectors. The guidance includes, among other things, recommended sector-specific metrics.

Version 1.0 sector guidance covering the following "real economy" sectors was published. This guidance previously was published in draft for public consultation and feedback.

- Aquaculture

- Biotechnology and Pharmaceuticals

- Chemicals

- Electric Utilities and Power Generators

- Food and Agriculture

- Forestry and Paper

- Metals and Mining

- Oil and Gas

Version 2.0 guidance also was published for financial institutions. The Version 1.0 guidance was published last September. The financial institutions guidance includes guidance and recommended metrics for banks, re/insurance companies, asset managers and asset owners and development finance institutions.

Lastly, sector-agnostic value chain guidance also was released (Version 1.0). The value chain guidance provides additional support to organizations on identifying and assessing dependencies, impacts, risks and opportunities in their upstream and downstream value chains. This includes when it is appropriate to seek full traceability and where the use of secondary data is an acceptable alternative to the direct measurement of dependencies and impacts.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.