Economic and financial concerns are causing organizations to revisit – and revise – their approach to their salary budget strategies.

Economies are in a constant state of change, and their trends and dynamics shape pay strategies around the world. This makes comprehensive salary budget insights vital for executives and HR and compensation professionals. In fact, the latest WTW 2024 Global Salary Budget Planning Report reveals movements in salary budgets that are driving trends in talent management priorities as well as the emergence of AI in compensation processes.

Salary budget projections

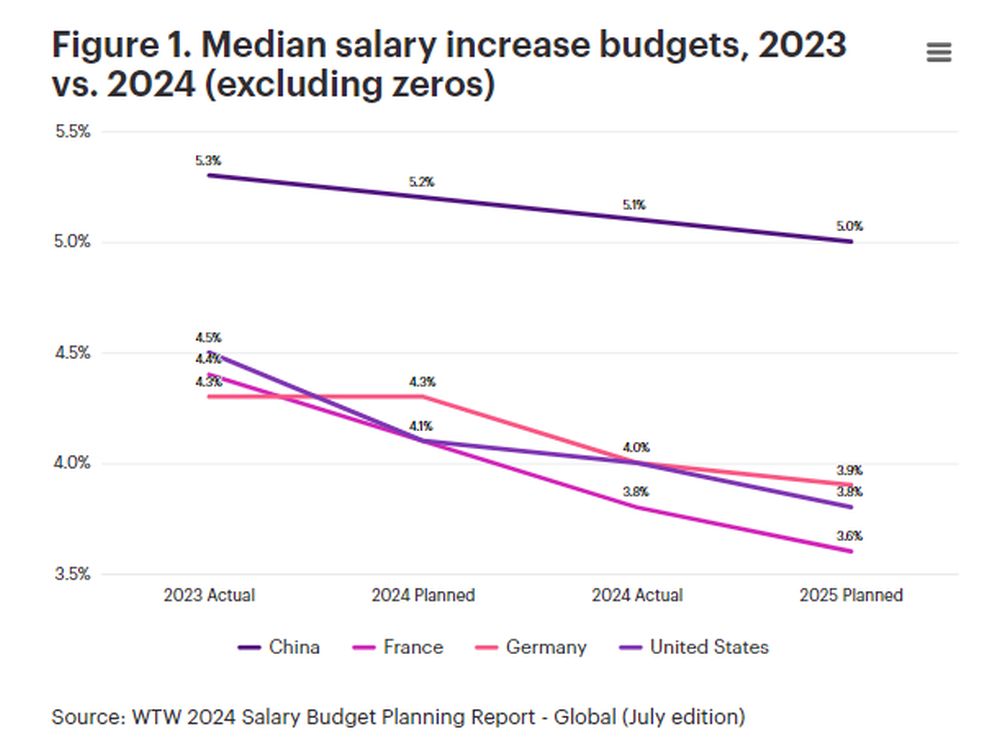

The first six months of 2024 witnessed a notable decline in salary budgets in various locations around the world. The magnitude of the reduction varies, and it never exceeds a fully percentage point. In most locations, including the United States, this dip has been less than half a percentage point.

On the other end of the spectrum, countries such as Brazil and the United Kingdom have seen the most significant declines. Regardless, these movements in salary budgets confirm a global downward trajectory that began in 2023. Additionally, these reductions provide enough data to establish a trend as respondents project into 2025.

The days of aggressive 4.5% budget growth in 2022 and early 2023 have shifted back down to the low 4%s and even the high 3%s in Western countries like the United States, France and Germany. In these locations, actual budgets last year came in lower than planned, and they expect even less in 2025. Even in Asia, where China has had much more aggressive budgets, survey respondents are planning to reduce growth by a full percentage point off actual going into 2025 (Figure 1).

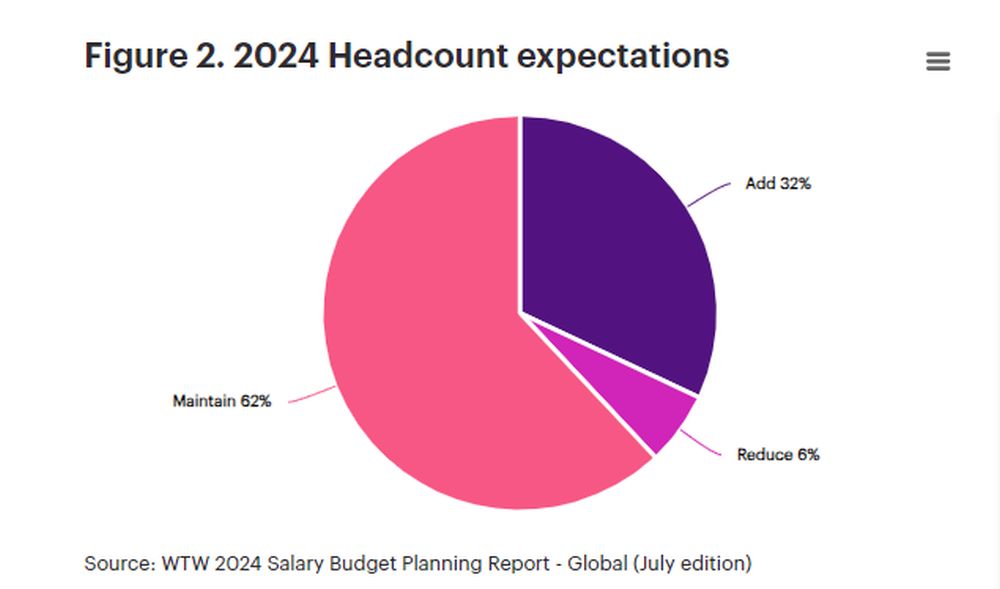

Were these reductions in salary budgets fueled by a knee-jerk reaction to missed goals? Or do they serve as indicators of rightsizing and other changes in strategic thinking? Strategic reductions in headcount could alleviate unexpected and reactionary pressure from missed goals. But if budgets remain low, does that hint that an organization is rightsized and has no plans to staff back up in the coming year?

The data certainly indicates that most companies aren't planning to hire. When asked, "Do you expect to add, reduce or maintain your headcount in the coming year?", the answer overwhelmingly was "maintain" (Figure 2).

Indications are that organizations appear to have rightsized their workforce as well as their salary budgets – we see this in stable headcounts and salary budgets. Does this change indicate a shift in a growth mindset? Let's consider additional data from the report that reveals other influences that organizations are thinking about.

Shifting priorities are affecting salary budgets

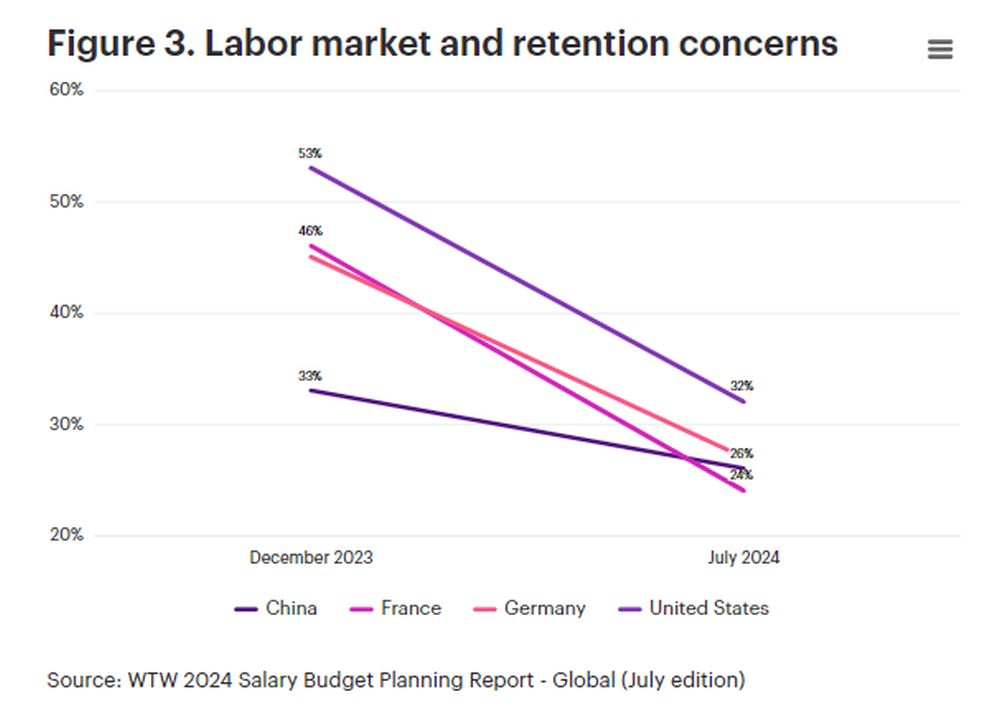

Since December 2023, organizations have made some interesting shifts in their strategic plans based on changing priorities. For example, concerns among U.S. organizations about a tighter labor market and retention challenges have dropped 21 percentage points in just the past six months!

The sense that the labor market is loosening is not limited to the United States. China, France and Germany all experienced a similar drop (Figure 3). While labor market and employee retention are still important, they have dropped to fourth place for each country reflected in the figure.

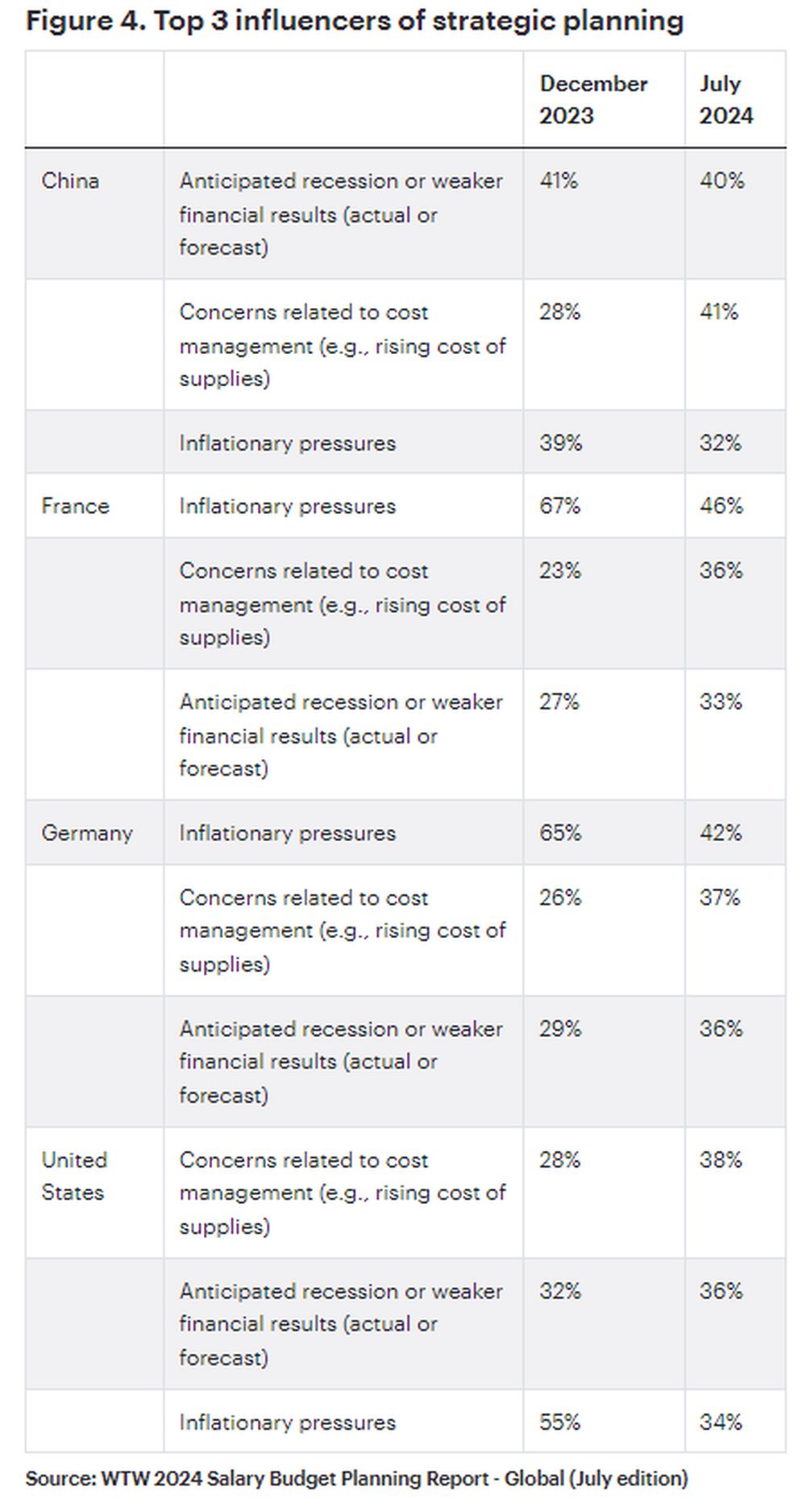

The ranking of the top three areas of concern varies from location to location (Figure 4). Interestingly, while the order may shift, these influences are the same for China, France, Germany and the United States – again, with labor market and employee retention standing at fourth place in each country.

Inflation

Inflation as a top-three concern is unsurprising. However, the significant drop in concerns about inflation is a surprise. Even in Germany and France, where inflation ranks as the No. 1 influencer, it is down by more than 20 percentage points. The United States is seeing a similar drop; however, the top three influencers are nearly equal at a three-way split. As inflationary concerns drop, two other strategic contenders are on the rise.

Cost management

In China, France and Germany, cost management moved from the 20s to the high 38s, and higher to 40% in China. A similar jump didn't just happen in the United States – it became the No. 1 influencer, just edging out the anticipation of recession or weak financial results.

Anticipating a recession or weak financials

Hinting at concerns about stormy financial seas for the foreseeable future, recession or weak financials remained the No. 1 concern in China at an unchanging 41% since the start of the year. In France, Germany and the United States, its influence grew 5 to 7 percentage points.

Concerns about achieving results and recessions nearly always turn attention to cost management, given how closely related they are. Is this combination of low confidence in the future and a focus on cost management the one-two punch that unseated talent acquisition and retention concerns?

Regardless the reasons, the data clearly show that talent management priorities are shifting. Companies around the world are focusing on cost management with an eye toward inflationary impact and potentially weaker financials.

With tight budgets and increasing cost-management pressures, companies are turning to comprehensive compensation reviews to optimize their pay structures and ensure alignment with strategic business goals. Nearly 40% of respondents to the salary budget planning survey indicated they are conducting full compensation reviews for some or all employee groups (Figure 5).

Regionally, these numbers support the overall global analysis. The No. 1 action taken in China, France, Germany and the United States was a compensation review of some kind, either full or targeted. Planned actions show little variation, with either additional compensation reviews or, as is the case in France, aggressive salary range adjustments.

These in-depth compensation reviews, followed by thoughtful range adjustments, allow organizations to identify and close pay gaps, ensure competitive positioning within the market and enhance transparency and fairness in their compensation practices. By leveraging detailed pay data and analytics, companies can make informed decisions that support more cost-focused organizational objectives while keeping a critical eye on employee satisfaction.

Getting back to basics, but with AI

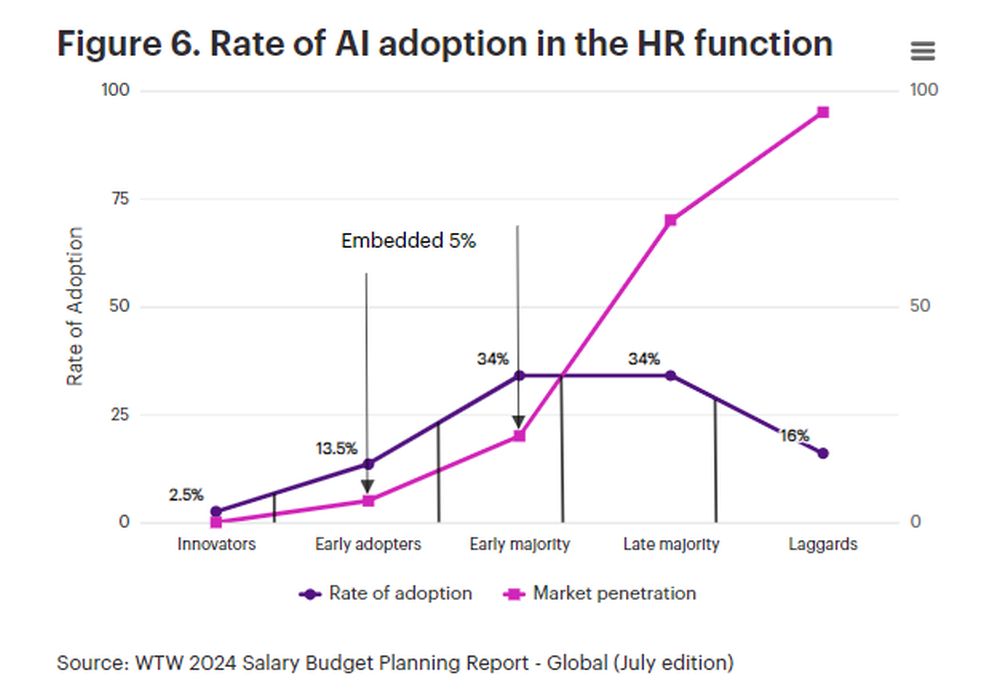

Though employee compensation reviews are nothing new, more organizations are looking to new tools to help with accuracy and effort. Specifically, they are looking to AI.

Given the growing prevalence of AI in so many aspects of the workplace, this July edition of the salary budget planning survey probed on the use of AI. We were curious whether we would see significant adoption, whether AI use had moved past relatively low adoption among innovators toward the early-adopter level of technology acceptance.

About 10% of respondents globally have started or implemented AI-related technologies, marking a clear move into the early adopter curve for AI in HR practices (Figure 6).

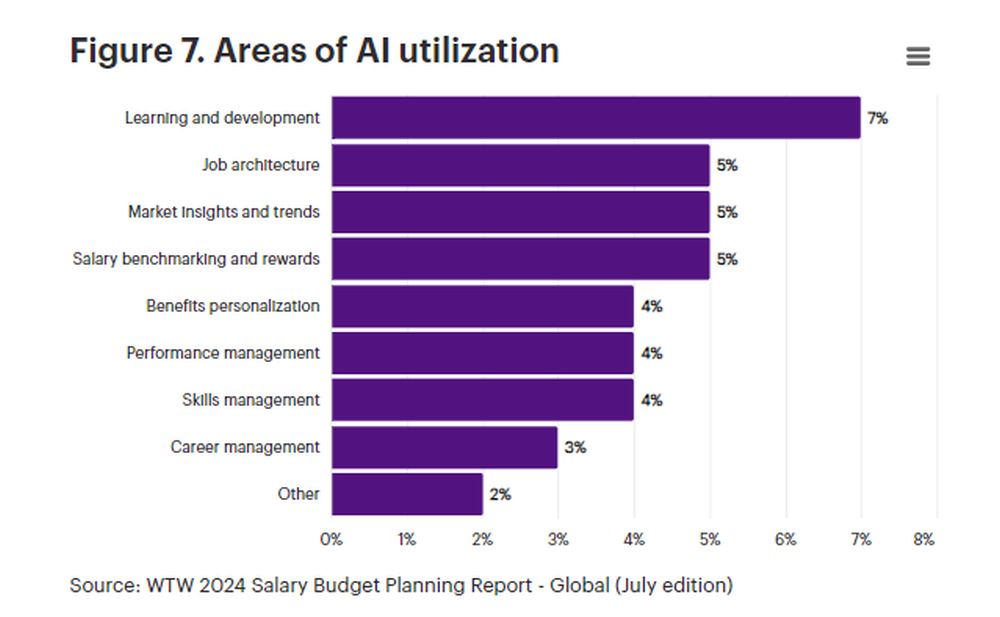

Respondents indicated a leading area where AI use is focused is salary benchmarking and rewards (Figure 7). This is not a surprise, given the aggressive compensation reviews reported by respondents.

Given the areas in which AI utilization is up, it appears companies are using this technology to streamline compensation processes, enhance decision-making accuracy and ensure the effective targeting of the right employees for salary adjustments and rewards.

Adjusting and preparing for ongoing change

This year's slowdown in salary budgets is, perhaps, both a correction from higher spending in the past couple of years as well as the result in notable shifts in priorities. Organizations are more focused on cost management, inflation and uncertain financial times – all of which are competing directly with the need to attract and retain the right talent at the right price.

Compensation and HR professionals must leverage trusted and up-to-date data to effectively manage these changing priorities while at the same time balancing cost efficiency and value. The insights that data delivers are crucial for ensuring competitive and fair compensation practices that support organizational objectives and employee satisfaction – even as organizations tighten their budgetary belts.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.