Will there or won't there be a recession? What's the long-term economic outlook? How high can inflation go? How do I better forecast my liquidity? These questions have been on the minds of most CEOs, CFOs, and financial controllers in the past 12-18 months, as organizations look to them to steer the business to a better place.

It's no wonder, then, that for the last two years, according to the AlixPartners Disruption Index, more than 70% of CEOs have been worried about losing their jobs.

One factor at the root of this issue is that companies are unable to quickly analyze external influences such as inflation and map the extent to which it will affect their profitability and liquidity. While the consequences of these impacts are usually well understood, in terms of the effects on cashflow, for example, the remedies are typically "rule-of-thumb" or top-down adjustments when building financial budgets. When all you have is a hammer, everything looks like a nail. However, there is a better way...

Before outlining how to address the issue, let's look at why these issues occur.

In our experience, the most common cause is a lack of connectivity between systems and data sources, which means companies are generally unable to effectively answer the following questions:

- What factor(s) are causing the most severe impact(s) on our profitability and liquidity?

- How can I get answers in real-time and spend less time analyzing and finding root causes and more time actioning solutions?

- Which customers/ products are contributing positively vs. negatively to our profitability and liquidity?

This disconnection not only limits visibility but also leaves the business relying on lagging indicators, which means any change of course is often too late to be effective and may compound a problem.

With disconnected, old data, CFOs and CEOs are only able to make informed guesses or experienced-based plays in response to a shift in fortunes. Sometimes these work, sometimes they don't. Accurately modelling different actions and their outcomes would greatly enhance executive decision-making and confidence in a positive outcome.

So, how can businesses address these challenges?

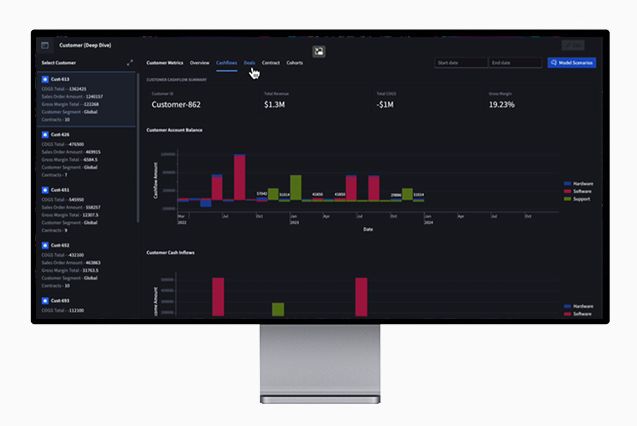

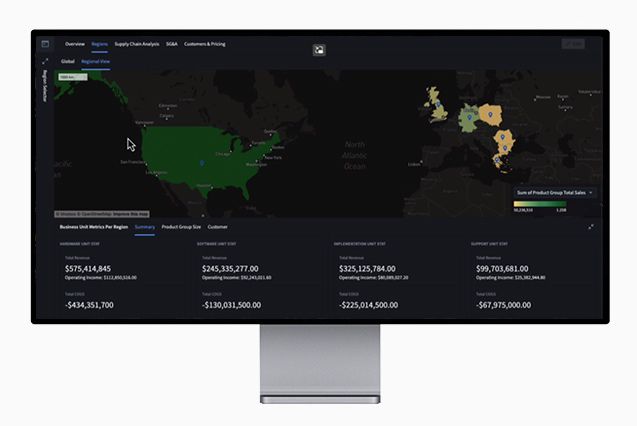

Through a combination of deep industry expertise and leading-edge technology, our partnership with Palantir has enabled us to develop a practitioner-centric application – the Liquidity Control Tower – that tackles the issues head-on.

Liquidity Control Tower gives executives real-time data to inform better decision making

It gives CFOs and CEOs the power to model changes in financial health and liquidity based on select internal and external factors by giving them a side-by-side, real-time view of both Profit & Loss and cashflow by rapidly aggregating data from as many source systems as necessary (both internal and external)

It also enables executives to 'push' potential decisions and actions back into the source data systems. This affords them the ability to understand the impact of various decisions. This accelerates their ability to analyze the situation. It also drives time-sensitive tangible actions and improvements faster and enables visibility of the impact across changing market conditions.

Executives can model scenarios to drive tangible actions and improvements faster

What was once a lag data set whereby the consequences of an action could take some time to materialize, businesses now have the chance to 'test' their response and proceed with far greater degrees of certainty. This is what we call "digital real-time decisions".

Navigating disruption is an exercise in agility, pace, and well-informed decision-making. Expertise and experience are critical. Enhancing these with up-to-the-minute and on-the-money data brings clarity and a greater certainty of outcome. Managing this size of disruption in any other way could have existential results.

Executives who are steering a post-pandemic business through such challenging times want the highest levels of confidence in the course that they set and, in using the Liquidity Control Tower, they can move beyond the "rule of thumb" and drive their organization forward with increased granularity, accuracy, and certainty.

Additional contributions from Joy Didier Scapel at Palantir

Navigating disruption is an exercise in agility, pace, and well-informed decision-making. Expertise and experience are critical. Enhancing these with up-to-the-minute and on-the-money data brings clarity and a greater certainty of outcome. Managing this size of disruption in any other way could have existential results.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.