Internal Revenue Code § 83 governs the taxation of property (e.g., stock, restricted stock units, or stock options) transferred in connection with the performance of services. Generally, the property is included in the recipient's gross income (valued at fair market value minus any amounts paid for the property) when it is transferable or no longer subject to a "substantial risk of forfeiture." In the case of stock subject to vesting requirements, the stock will be included in gross income at the vesting date rather than at the grant date.

The code also gives taxpayers a powerful tool under part (b), which is unsurprisingly known as an "83(b) election."

What is an 83(b) election?

An 83(b) election allows employees or company founders to accelerate the tax on the subject property based on its fair market value as of the grant date (which, in the case of a start-up, is likely to be lower) rather than the vesting date (when the value of the property is likely to be higher).

What is the benefit of an 83(b) election?

The benefit of making an 83(b) election is that it allows taxpayers to treat the appreciation of restricted stock as long-term capital gains rather than ordinary income for taxation purposes.

Let's consider a step-by-step example of how the 83(b) election works:

1. Issuance of Restricted Stock.

Four friends—fed up with the rigors of code-jockeying for someone else's profit—quit their day jobs and decide to start a boutique programming business—Code Thumpers. They hope to hit it big and know they must attract top talent. To lure away a friend of theirs, Michelle, from her current gig, they offer her a small salary and 10,000 shares of their company (vesting over four years, 25% on each anniversary) to work at Code Thumpers.

2. Election Period.

Michelle accepts the offer to join Code Thumpers on September 1, 2024, and is excited to potentially make it big in Silicon Valley. The stock has a fair market value of $1.00 per share on September 1, 2024. Michelle has 30 days from the grant date (until October 1, 2024) to file an 83(b) election with the IRS.

3. Filing the Election.

Michelle submits a letter to the IRS on September 30, 2024, indicating she wants to be taxed on the stock she received as compensation at the grant date rather than the vesting date.

4. Taxation at Grant.

For the tax year 2024, Michelle pays ordinary income tax based on the fair market value of the stock she received from Code Thumpers. She realizes ordinary income of $10,000 and must pay tax based on her applicable bracket.

5. Future Gains.

Code Thumpers is massively successful. On September 1, 2025, the fair market value of Code Thumpers stock is $20 per share. Michelle's first 2,500 shares vest, and she decides to sell them immediately for a tidy $50,000. Her basis in those shares is $2,500. Because she made an 83(b) election and already paid ordinary income tax on that amount, Michelle pays long-term capital gain tax on the gain she realized upon selling the shares ($47,500).

What would have happened in the above example if Michelle had not made (or missed the deadline for) an 83(b) election?

Assuming all the other facts and circumstances remained the same:

- When Michelle joins Code Thumpers on September 1, 2024, she wouldn't realize any income on the granted shares

- When Michelle's first batch of 2,500 shares vests on September 1, 2025, she realizes ordinary income of $50,000, whether she decides to sell them or not

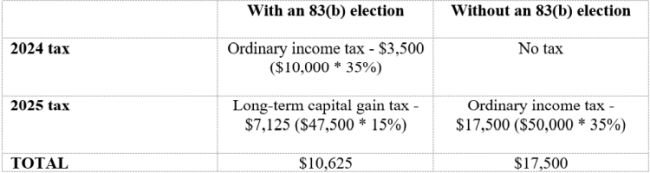

The final math:

Let's assume Michelle has a combined federal and state income tax rate of 35% and falls under the 15% long-term capital gain tax bracket.

If Code Thumpers continues to perform well through 2028 and Michelle's shares vest at even higher values than in 2025, the difference in tax is even more stark.

What are the risks of an 83(b) election?

- Risk of Forfeiture. If the stock fails to vest (e.g., if the vesting is based on performance metrics the company or the employee doesn't meet) or the employee leaves the company, the 83(b) election tax paid is non-refundable.

- Cash Flow. Paying taxes at the grant date can be challenging for individuals without liquidity to cover the immediate tax burden.

- Valuation. Determining the proper fair market value of the stock is critical. Underestimation can lead to adjustments and penalties from the IRS, while overestimation causes an unnecessary upfront tax burden to the individual.

Conclusion

For business owners and their employees, the 83(b) election offers a strategic tax planning tool that can help minimize tax liabilities on stock compensation. The decision to make an 83(b) election should be informed by carefully considering the potential risks and benefits, the company's growth prospects, and the individual's financial situation.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.