HMRC has issued new guidelines relating to the VAT treatment of fees charged by football agents for negotiating the transfer of a football player to a new club or new terms at the player's existing club.

This article explains the reason for the guidelines and how the new policy should be implemented.

What is the reason for the new guidelines?

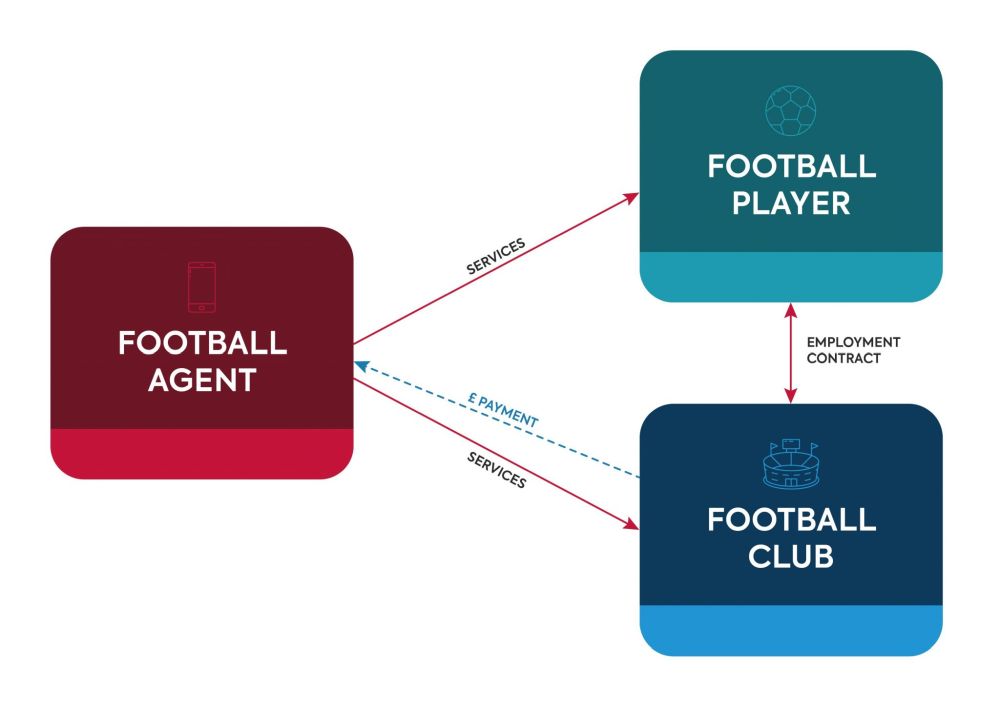

When engaging in contract negotiations, the role of a football agent is usually to negotiate the best possible terms for the player they represent. However, during these negotiations it's sometimes the case that the agent will also perform certain services for the club. Where all parties agree to such an arrangement, this is known as 'dual representation' (see diagram).

Where a dual representation contract is in place, the club will usually pay the agent on behalf of the player for the services they have received, as well as for the services received by the club. The total amount paid to the agent will be subject to a VAT charge at 20%. The club will generally be entitled to recover the VAT incurred on the services it has received, but VAT will not be recoverable on the services performed by the agent for the player.

HMRC are concerned that when agents bill their fees, the split applied between player and club services may not accurately represent the distribution of the agent's services between the two parties. Since VAT is likely to be recoverable by the club on the services they receive, there's a clear incentive to shift the value of the fee in favour of these club services, and to reduce the value of the services that were received by the player.

HMRC have issued new guidelines to address this matter, which they believe is currently resulting in lost VAT revenue as well as implications regarding the liability to income tax and National Insurance. The guidelines are intended to provide clarity regarding how the fee should be split between player and club services.

What are the new guidelines?

In the new guidelines, HMRC clarify that the split of agent fees between player and club services must represent the commercial reality of the services provided. It's not acceptable to apply a 50/50 split as the default position.

HMRC take the view that where an agent has an existing relationship with a player, working in that player's interest to place them with (or keep them at) their preferred club, and secure the player the best employment terms, the largest part of the agent's services will be provided to the player. Where services are also received by the club, it will be necessary to retain the necessary evidence to support this.

Where a genuine dual representation arrangement exists, the parties involved are required to retain a comprehensive audit trail and documentation to demonstrate the true contractual and commercial nature of their relationships. This is likely to include evidence such as:

- the player-agent representation agreement

- the club's request for the agent to provide the club with services

- the agent's agreement to enter into a dual representation contract

- the player's agreement to enter into an employment contract with the club

- the potential buying club's initial approach to the player and the player's agent

It's expected that the agent should issue separate invoices to the player and the club. In each case, these invoices should include a detailed description of the services provided to each.

What steps need to be taken?

HMRC expect that football clubs and agents will use the new guidelines to assist them in ensuring that they apply the correct split in agent fees.

Football agents are expected to correct any errors identified following the new guidelines for both the current and past years.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.