Back leverage is a mechanic whereby a debt fund lender borrows money from a third-party to finance its loan to a borrower. It is increasingly employed by commercial real estate (CRE) lenders as they advance funds to borrowers for the purchase of real estate assets.

In particular, back leverage structures afford investors the means to invest in the real estate markets whilst maintaining a level of diversity within their portfolio. The recent CREFC conference on back leverage, price discovery and distress introduced key forms of back leverage financing employed by CRE lenders. Two of the most utilised, in our experience, are loan-on-loan and repurchase agreement (repo) structures.

What do each of these structures look like?

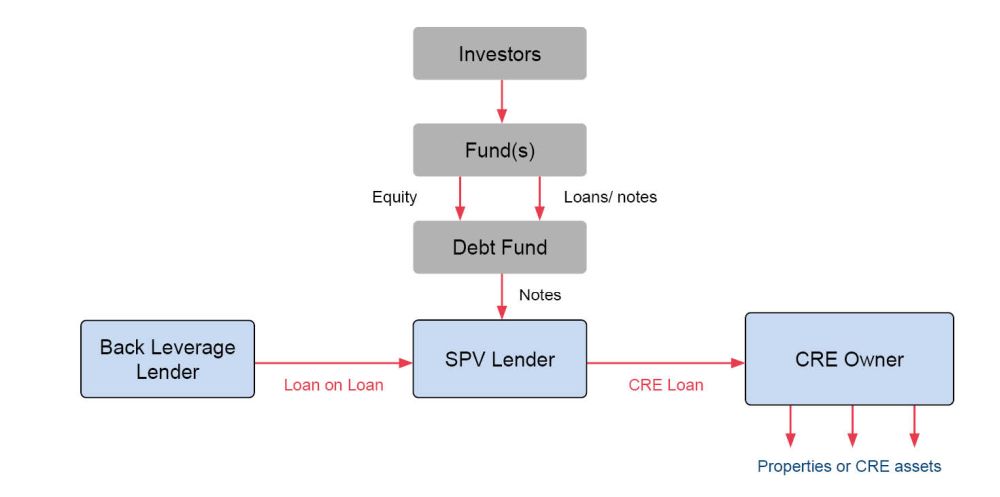

Loan-on-loan structure: The loan-on-loan structure is centred around an underlying loan. Typically, a debt fund lender seeking additional financing establishes a special purpose vehicle to act as the lender of record (SPV Lender) and make a loan (CRE Loan) to an underlying borrower (Borrower) for the purpose of acquiring or developing an asset or portfolio of assets. A second loan (Loan on Loan) is advanced to the SPV Lender by a back leverage provider (Back Leverage Lender). This is typically a more traditional finance provider, such as a bank, who may not want direct exposure to the underlying assets or who is seeking better capital treatment than lending directly to the asset owning entity.

Cash flows of interest and principal flow upwards from the CRE Loan and are used to make payments on the Loan on Loan, with the financial covenants under both loan facilities focussed on the payments and performance of the CRE Loan.

The terms of the CRE Loan permit the SPV Lender to deal with matters relating to the underlying asset(s), such as the enforcement of security or assessing the eligibility of new assets to add into the portfolio of secured assets within the structure. The security for the Loan on Loan includes all-asset security from the SPV Lender in favour of the Back Leverage Lender, which will encompass security over the rights of the SPV Lender under all security that they themselves were granted under the CRE Loan, including any legal mortgages.

Diagram 1 – Loan on Loan Structure

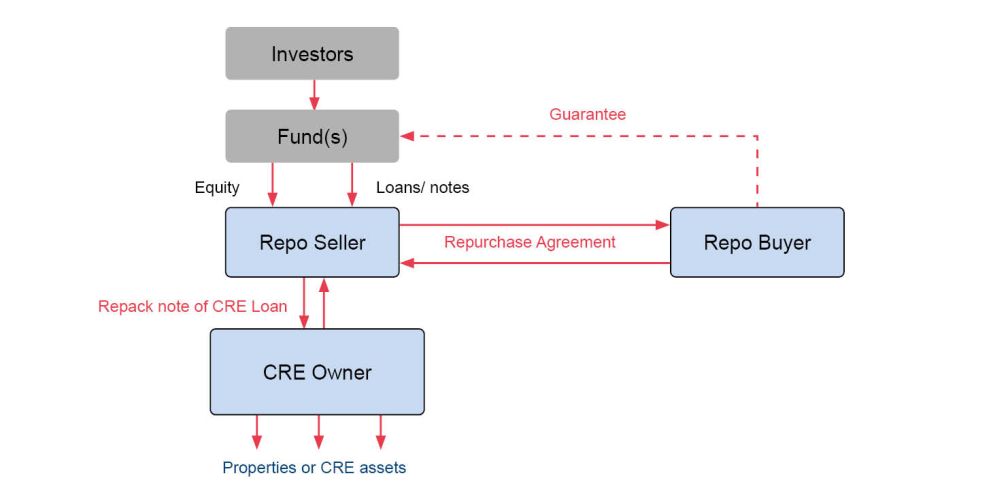

Repo structure: The repo structure is centred around a repurchase agreement (Repurchase Agreement) – a form of borrowing whereby a borrower sells securities to an investor and subsequently buys them back from that investor at a pre-agreed time at an agreed price, which may include a premium - with the back leverage provider, being the repo buyer (Repo Buyer), and the debt fund lender seeking additional financing, being the repo seller (Repo Seller).

The repo structure uses either the Global Master Repurchase Agreement 2000 or 2011 (GMRA), which is English law governed, or the New York law governed Master Repurchase Agreement (MRA). In both cases, Annex I and the trade confirmations (in the case of the GMRA) or the full document (in the case of the MRA) will typically be bespoke in order to track the three-to-five-year terms of the underlying CRE Loans, rather than the shorter-term financing where the repo structure might usually be used.

CRE Loans may be traded either into the repo structure or repacked as a pure 'pass-thru' note. Once repacked, notes are issued at a discount to the value of the CRE Loan, which effectively means the advance rate on the CRE Loan is less than 100%. Specific terms relating to the repack notes, such as that discount, the repurchase date and financial covenants are contained in the trade confirmations, which makes a repo structure ideal for obtaining back leverage on a significant pool of assets which may be added to over the life of the transaction. In contrast to the loan-on-loan structure where the addition of assets to the secured pool may require additional security, adding a new asset under the repo structure is as simple as filling in a new confirmation and (if using an MRA) entering into supplemental 'back up' security.

On the topic of security, under the GMRA, there is an immediate sale - by way of true sale of legal and beneficial title to the repacked notes - to the Repo Buyer, and therefore the Repo Buyer becomes lender of record able to use the notes to the fullest extent permitted by the GMRA. This is in contrast to both the position under the MRA and the loan-on-loan structure, where each of the Repo Seller and the SPV Lender respectively, remain lender of record. As such if using the New York law governed MRA structure, additional pledges are needed (and safe harbour opinions requested and given by counsel acting on such transactions) to mitigate the recharacterisation risk – i.e., the risk that the transaction is seen as a secured loan rather than a repurchase transaction and affects the capital treatment and perfection requirements. Choice of the law of the repo (GMRA or MRA) will depend on transacting parties' familiarity and, to some extent, the governing law of the jurisdiction in which underlying assets are located.

Under a repo structure, the cash flows from the underlying CRE Loan (or the repack note of the CRE Loan) are paid on a quarterly basis through the repo structure as price differential, which may be split between the Repo Buyer and the Repo Seller. The CRE Loans are also subject to marked to market provisions. The Repo Buyer may call additional margin from the Repo Seller to the extent the value of the CRE loans change during the life of the loan, though valuation of such loans is typically challenging and hotly negotiated in practice.

Diagram 2 - Repo Structure

So why choose one structure over another?

While considerations such as the underlying assets (including location, jurisdiction and income production) are taken into account, key concerns of both Repo Sellers and Repo Buyers include:

- Capital and risk treatment: A repo structure may be complemented by issuing tranched notes using the price differential as the pool of assets on which the performance of the notes is based, which allows the structure to benefit from securitisation capital treatment. The interposition of the Repo Seller also allows the Repo Buyer to provide funding without direct exposure to the pool of underlying assets. The exposure is to the Repo Seller, which is often a more favourable choice in terms of the Repo Buyer's risk appetite and existing financing relationships.

- Control and security over underlying assets: The ability to control the use of the underlying asset is more straightforward on a repo structure than on a loan-on-loan structure. As mentioned above, under the GMRA the Repo Buyer is lender of record due to the true sale feature of the GMRA, bound only to deliver 'equivalent securities' at the end of the life of the transaction. A Back Leverage Lender might exert control through the financial covenants and the all-asset security granted to it by the SPV Lender. Under an MRA, the Repo Buyer will also have wide ranging powers to deal with the asset akin to under a GMRA, with the recharacterisation risk covered by pledge agreements which allow the Repo Buyer to exert control in enforcement scenarios.

- Cost and complexity of documentation: In terms of documentation, a loan-on-loan structure is typically simpler to document and execute and more similar to existing financing arrangements for smaller and mid-size fund managers. For repo structures the complexity of bespoke Repurchase Agreements - altered to allow for the longer-term loan life repurchase date rather than the seven-to-fourteen-day turnaround normal in such transactions - combined with the opportunity to seek improved capital treatment, largely reserve the structure for larger funds and regulated financial institutions.

Back leverage is a hot topic, and with more alternative lenders entering the CRE market it is likely that the role of back leverage will become more important and along with it we expect to see the number, and complexity, of different types of structures increase.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.