The new economic reality of slow growth, high inflation, rising interest rates, depressed private consumption and impacts from geopolitical tensions has created the conditions for an uptick in corporate distress in 2023.

In January 2022, rating agency S&P Global said it expects credit defaults to more than double in Europe this year to near pandemic levels, citing challenges related to the energy crisis, soaring input costs and higher interest expense burdens. Fitch Ratings has also forecast an increase in corporate defaults in 2023 and 2024.

Further clues on future restructuring activity may emerge in the coming months as companies with December financial year-ends get their annual accounts ready

Auditors will be looking at both cash flow forecasts and access to finance, which is becoming more difficult to secure, to assess the ability of companies to keep trading for at least the next 12 months. As part of this assessment, it is expected that firms that have hitherto showed resilience may begin to buckle, potentially triggering more going concern warnings and turnaround conversations.

Many consumer-facing companies, for example, are struggling with higher operating costs, fast-changing consumer habits and a cost-of-living crisis that is squeezing household budgets. Consumers across Europe are gloomy, with confidence indexes in various countries near record lows. In the UK, retail sales unexpectedly fell over the Christmas period, the latest blow to retailers that were already bracing for a decline in profits this year.

In other sectors, such as automotive and manufacturing, pressures including escalating energy prices and the semiconductor crisis are increasingly weighing on companies' profitability.

A&M analysis shows deteriorating trend in balance sheets

In fact, corporate financial health across Europe and the Middle East has been deteriorating for some time, as evidenced by Alvarez & Marsal (A&M)'s Distress Alert1 (ADA), which assesses financial performance and balance sheet robustness of over 4,4002 companies in more than 30 countries.

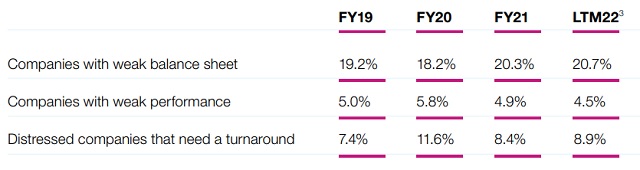

Our most recent analysis shows that the number of companies considered to be in distress – a combination of both weak balance sheet and weak performance – has increased consistently since 2019. Last year, they accounted for 8.9% of total businesses, compared to 8.4% in 2021 and 7.4% in 2019, before the pandemic. The percentage of businesses with weak balance sheets has also expanded to 20.7% of total in 2022, from 20.3% in 2021.

A&M Distress Alert

The consumer (excl. fashion and food & beverage)4 , healthcare and manufacturing sectors have seen the biggest increases in the level of distress in 2022 versus the previous year, of 72%, 47% and 39%, respectively. In contrast, the proportion of travel, hospitality and leisure businesses in distress has declined in the period, likely reflecting the strong sales rebound last year on the back of pent-up tourism demand.

This weakening trend has not yet materialised into a wave of corporate bankruptcies, mostly due to generous Covid support measures that were in place in most countries throughout 2021 and in certain countries also into 2022, as well as ample liquidity available in the market. However, this year and beyond, troubled companies will no longer have that reassurance.

Looming debt maturities and refinancing risks

Amid balance sheet worries, looming debt maturities are also underpinning predictions of increased levels of corporate/financial distress.

According to Bloomberg data5 , there's around €103 billion of sub-investment grade debt maturing in EMEA this year, rising to €155 billion in 2024. Because regulation requires directors to show that companies have sufficient liquidity for at least 12 months from the point of accounts signature, both 2023 and 2024 maturities will feature highly on auditors' radars this first quarter.

One point of concern is that companies may struggle to meet these obligations given the expected decline in earnings and tighter (re-)financing conditions that have made debt more expensive. Loan pricing for euro-denominated single B-rated institutional loans, for example, has climbed to levels not seen since the eurozone debt crisis6 . The recent rise in amend and extend transactions shows just how challenging refinancing has become to some borrowers in today's market.

However, even for those companies that can, prolonging payment dates is not a definitive solution. Given persistent changes in consumer behaviour since the pandemic, restructuring as a continuous process becomes a top priority for management teams if they want to preserve a competitive position in the market and enhance the company's longevity. Therefore, we anticipate that more companies will embark on strategic re-alignment and operational restructuring programs to maximise profitability and increase their refinancing prospects.

Meanwhile, for some companies the option to extend maturities simply will not exist if lenders are unwilling to be exposed to excessive leverage with uncertain refinancing prospects. For this group, we expect that much more severe restructuring measures or comprehensive programs will be needed, with shareholders being forced to contemplate their medium to long-term investment rationale and associated financial commitment. At the same time, directors will have to consider their duties to all their stakeholders, whilst lenders will need to prepare themselves for any scenario.

How Can A&M Help?

A&M has the most comprehensive suite of services to help companies and their stakeholders through challenging times. Our Financial Restructuring, Debt Advisory and Turnaround specialists bring decades of experience of working on the world's largest and most complex transactions and gaining consensus amongst multifaceted stakeholder groups to deliver outstanding outcomes against difficult backdrops.

These core restructuring services are all supported by a comprehensive suite of complementary skills to address every single aspect of the most complex transactions from within one team, including deep strategic, operational and financial expertise, valuations and tax advice together with cutting-edge contingency planning support to ensure we can get a transaction done in any circumstances.

A&M. Leadership. Action. ResultsSM

Leading companies, financial institutions and public entities turn to Alvarez & Marsal (A&M) to solve their operational, financial and regulatory challenges and provide turnaround management solutions that work.

Companies around the globe are facing unprecedented operational and financial challenges due to ever more complex global markets and the rapid disruption across industries. A&M is uniquely positioned to help your business confront challenges and provide you with solutions that bring long-term value.

As your trusted partner, we will provide clarity and deliver results from beginning to end – driving critical change that will optimise performance, maximise value and mitigate risks. Our team brings significant industry experience covering a variety of different sectors including consumer products, energy, financial services, healthcare, industrials, life sciences, media, natural resources, pharmaceuticals and technology.

Footnotes

1 The index analyses 18 KPIs to create two sub-scores: the performance score, based on the company's own income statement as well as related KPIs measured against its industry peers; and the robustness score, based on detailed balance sheet data. The scores are applied on a scale from zero (heavily impacted) to 10 (very solid situation). It covers private and public companies with revenues of more than €20 million.

2 LTM2022 analysis covers 4,421 companies. FY2021, FY2020 and FY2019 analyses cover 11,528 companies.

3 LTM22 is defined as the 12-month period before the latest published half year, or quarterly financials reported in 2022

4 Consumer (excl. fashion and food & beverage) includes hypermarkets and super centers, specialty stores, electronics stores, home and furnishing stores among others.

5 https://www.bloomberg.com/news/articles/2023-01-04/european-debt-defaults-seen-surging-in-echo-of-covid-turmoil

6 https://pitchbook.com/news/articles/amid-distress-european-leveraged-loan-high-yield-defaults-remain-low

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.