Sarah Collison looks back at this record-breaking year in the risk transfer market. At the time of writing, the final bulk annuity volumes for 2023 are not yet known, but our market intel suggests that the record of c£45bn in 2019 is likely to be broken, with an expected total of c£50bn.

The picture is even more pronounced when you consider that yields have been rising over the last couple of years meaning that recent deal volumes would be significantly higher when converted to "old money". Allowing for these changing market conditions the total expected volume would be double the previous record!

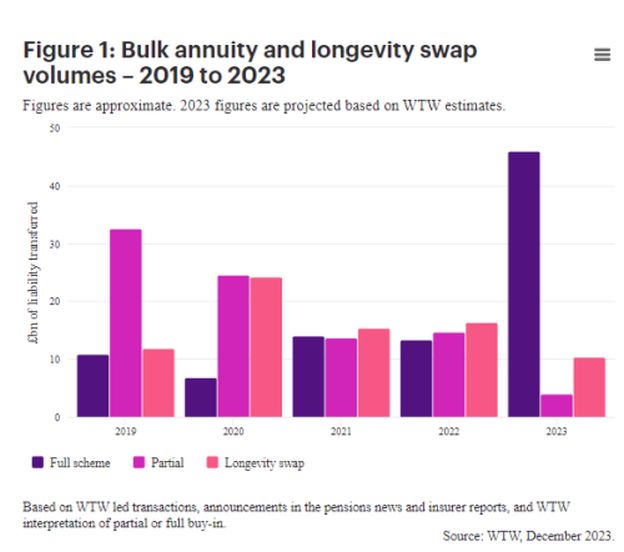

As shown above in figure 1, the market has noticeably changed this year with a significant shift from pensioner buy-ins as a means of de-risking, to full scheme transactions, as more schemes are finding themselves better funded thanks to increased gilt yields and attractive insurer pricing. For many schemes, buyout remains the target end goal and this has been brought closer than previously anticipated. Others have been focussing on run off, possibly in conjunction with a partial buy-in or longevity swap to reduce demographic risk. And for those schemes for which those aren't feasible options, the alternative of entering into a superfund agreement has now become a realistic possibility, with the first deal with Clara-Pensions ("Clara") having completed in November, paving the way for schemes in a similar boat to follow suit.

High demand has led to some insurers having to prioritise their resources, with some deals attracting fewer bidding insurers than we'd have typically seen in previous years as market demand increases, although pricing remained competitive for well-prepared schemes.

Despite the busy market we are proud to report that we have been able to secure a bulk annuity for every case that wanted to transact in 2023, with deals ranging in size from £2m to £2,700m. Later in this report, Greg Robertson shares some insights from the insurers about their triage processes and the implications for helping schemes maximise market engagement.

2023 highlights from the de-risking market:

- February saw the completion of the UK's largest ever bulk annuity transaction for RSA (read more below).

- Canada Life completed its first ever deferred member buy-in, with a £58m deal covering around 300 deferreds and 270 pensioners.

- M&G re-entered the bulk annuity market, announcing two transactions in September of £286m for the Northern Bank Pension Scheme (led by WTW), followed by a £331m for one of its own schemes.

- The UK's first ever pensions superfund transfer was announced in November. The transaction with Clara was led by WTW as both the transactions advisor and Scheme Actuary to the Trustees of the Sears Retail Pension Scheme. Later in this report Suzanne Vaughan shares more about this landmark transaction and what it means for the future of this emerging superfund market.

- Four longevity swap deals were completed, namely a £5bn transaction for the BT Pension Scheme and a c£1.6bn swap for YCB Pension Scheme both led by WTW, a £1.7bn deal for the Nationwide Pension Fund and a £2bn deal for the MMC UK Pension Fund. The MMC transaction was another example of a longevity swap covering non-pensioner members, which is becoming increasingly common.

Case study: RSA

The UK's largest ever pension scheme buy-in took place in February 2023, covering £6.5 billion of liabilities for RSA's pension schemes, once again raised the bar for the bulk annuity market.

As adviser to the Trustee of the Royal Insurance Group Pension Scheme, WTW was involved in all elements of the process, from initial feasibility through to execution.

The size and complexity meant this was a highly bespoke transaction and the number of parties involved introduced some logistical challenges. As well as the key stakeholders — the two trustee boards, the company and the insurer — the transaction involved three transaction advisers, two scheme actuaries and four legal advisers! Undoubtedly, strong collaborative working contributed towards the great outcome for the client.

Establishing clear Trustee objectives at the outset and negotiating key terms with the insurer, and Company, as part of the selection process meant that many of the Trustee's commercial priorities were locked down prior to execution, so all parties could focus on 'getting the job done'.

Reflecting on our predictions for 2023

In last year's report, Tom Ashworth, a Director in our Transactions team, made a number of predictions for 2023. Let's take a look at how 'on the money' these were.

01

Full scheme buy-ins to dominate a busy market (by number of deals)

As shown in figure 1, this was definitely the case. The huge jump up in full scheme buy-ins relative to partial buy-ins was mainly thanks to improved funding levels. The market for pensioner buy-ins is still alive, forming a key part of the de-risking toolkit for the right scheme, albeit with liquidity in schemes more limited post LDI crisis, that pool of schemes is smaller now than in previous years. The volume of longevity swaps was lower than its peak in 2020, but as Rhys and Matt discuss in their article: What happened in the longevity swap market in 2023? it remains a valuable de-risking tool.

02

Schemes to accelerate transaction readiness

- Tom predicted that asset and data readiness would come under sharper focus in 2023.

- Many schemes have reached their buyout target significantly ahead of plan and as a consequence find themselves with illiquid assets that they had intended to hold for a longer period. Whilst options to ensure that illiquids are not a barrier to transact do exist (and, as Gemma Millington discusses in her article: Do pension scheme illiquid investments present an insoluble issue? later in this report, 2023 has seen much innovation from insurers in this space), many schemes have been considering their options, and taking action, well in advance of any possible transaction.

- Agreeing a data journey plan with the administrator and strategic adviser has been key to balancing the timing of approaching the market to maximise engagement and pricing opportunities.

- Other areas of transaction readiness include considering the governance structure, understanding the legal powers within the Trust Deed and Rules, and establishing certainty over the benefits to be insured.

03

Evolving insurer offerings

As insurers newer to non-pensioner transactions have looked to enhance their credentials and the more established providers look to push boundaries in order to stand out from the crowd, there has been an acceleration in the market's pace of innovation in relation to some of the "extras" that come into focus with a full scheme buy-in, such as:

- Most insurers are now able to provide a wider selection of investment vehicles for members' Additional Voluntary Contribution pots

- Enhanced residual risk propositions

- Improved member interface tools, and

- Further standardisation of processes, both as part of the quote process itself but also as part of their ongoing interactions with schemes' administrators post transaction.

04

A steady flow of deals, with unexpected opportunities for flexible schemes

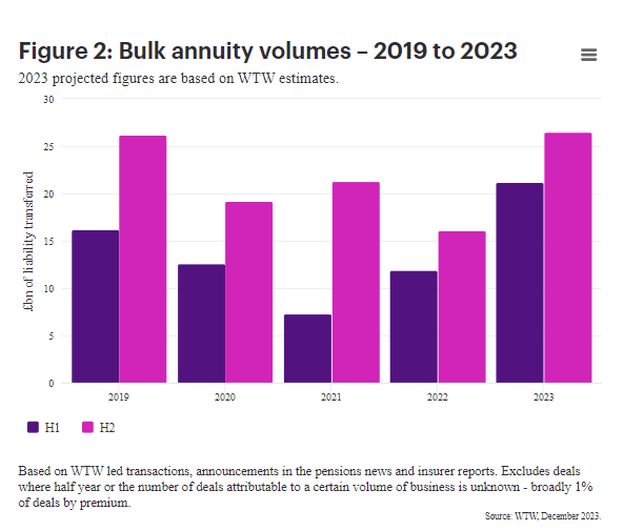

Tom predicted a much more even spread of deals across 2023 than in previous years where H2 has traditionally been a lot busier than H1.

- Figure 2 shows that H1 2023 was the busiest first half of the year on record, with £21bn of business written. The second half of the year is also expected to finish strong as shown below.

And finally for something we didn't predict

In July, the Chancellor, Jeremy Hunt MP, announced wide ranging reforms to the UK pensions regime, known as the Mansion House Reforms, and these proposals were formalised in the Government's Autumn Statement. Part of the rationale of these reforms is to increase pension scheme investment in productive finance, but other 'wins' include an expectation of improved governance and, where appropriate, accelerated scheme consolidation.

These reforms – in particular the potential for sponsors to benefit more from surplus generated within schemes – have understandably caused some pension scheme sponsors and trustees to pause and reconsider their preferred endgame. The considerations for each scheme will vary – based on funding levels, scheme size and maturity, legal powers and covenant outlook. It's likely most will reach the conclusion that buyout is still the best endgame home for their members but some may choose to run-on for a period, perhaps with a longevity swap, which could be helpful in easing the demand pressure in the bulk annuity market.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.