EDITOR'S COMMENT

By Anthony Spicer

Welcome to the spring 2011 edition of the restructuring & recovery quarterly bulletin.

In this edition Steve Butt, fresh from his travels to INSOL Singapore, considers the general atmosphere of the South East Asian market and how our friends at Nexia TS can offer support in this region.

At a time when the UK has recorded the highest number of fraud cases since records began, one of the sharpest increases has been in the area of employee fraud; David Alexander explores how risks can be reduced.

From our Bristol office Paul Wood examines the issues being faced by company directors, while Mark Garnett discusses how focusing on developing markets could be a route for economic recovery.

Finally Toby Holt takes a closer look at whether the advice being given by many insolvency practitioners regarding entering into an IVA is actually the best advice.

As always, we hope you will find our articles interesting and informative and we welcome your feedback.

DIRECTORS IN THE 'TWILIGHT ZONE'

By Paul Wood

Unsure what the next problems will be, or how their companies will survive them, directors are taking risks that perhaps they should not be taking.

Many directors feel as though they are in a commercial battlefield. They are being battered from all sides and can only see the position generally worsening as austerity measures implemented by the Government start to bite. We examine some of the issues that companies will have to contend with now and in the near future.

Unusual economic conditions

HMRC

HMRC statistics show that up to December 2010 395,400 time to pay (TTP) arrangements had been granted involving tax totalling £6.83bn. This exceptional amount of support from the Government over the last two years has helped companies survive. However, times are changing and we are seeing evidence of HMRC hardening their stance to companies renegotiating TTP plans and the leniency shown previously is starting to disappear.

Interest rates

Interest rates have been at an all time low of 0.5% for two years. Losses that some companies would be making had they still been at pre-recession levels are therefore being masked. The majority of economists believe that interest rates will rise this year and by the middle of next year be somewhere near 2% in order to curb inflationary pressures. This increase will cause companies that cannot afford the repayments to either further cut costs (which have already been dramatically slashed) or face defaulting on their loans.

Banks' position

Banks have had no option but to be supportive of businesses during the recession because their security, primarily on property, was dramatically affected when the property market collapsed at the beginning of 2008. Many banks are allowing businesses to pay only the interest they owe and freezing capital repayments to help companies survive. As interest rates increase this may become impossible for many companies and it will then be down to the banks to decide whether to change strategy and perhaps consider enforcement.

Challenges for directors

UK corporates are clearly going through a challenging period. Many companies are just about surviving day-to-day, with their balance sheets exhausted and all means of finance having been utilised. Many have survived one of the longest and deepest recessions in living memory by implementing stringent controls on costs, making redundancies and holding back on capital investment. These companies cannot reduce their cost base further and are unlikely to be able to deal with the pressures coming, especially if they all come at the same time.

Directors need to be very careful that, as these pressures start to mount, they avoid trading while insolvent and they take advice at an early stage if they become aware that any of these discussed (or other) issues will adversely affect their businesses. Early discussions with banks, HMRC and other major stakeholders are vital to the survival of a company that is experiencing financial difficulty.

FRIENDS IN THE RIGHT PLACES - NEXIA TS CAN ASSIST OUR CLIENTS IN SOUTH EAST ASIA

By Steve Butt

Following a recent visit to Smith & Williamson's associated business in South East Asia, Steve Butt considers the current market and how we can assist clients with a need for local advice in this region.

In the global market, it is generally the case that small and medium-sized enterprises as well as larger businesses will have international aspects to their receivables, payables, debt financing and/or equity. Increasingly, these international aspects will involve China and the emerging economies of South East Asia.

Global effects of the financial crisis

While the implications of the global financial crisis (GFC) will continue to be felt for some time to come in the USA, Eurozone and UK (the Developed West), in the newly emerging and emerged industrial powers of China, India and Brazil and the emerging markets of South East Asia (principally Indonesia, Singapore, Malaysia, Thailand and the Philippines), the GFC appears already to have been confined to the past.

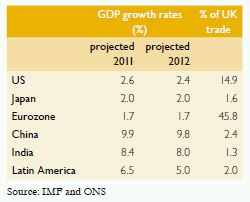

As can be seen in the accompanying table, global economic growth continues to principally be driven by these nations, the majority of which, save for India, have national debt/gross domestic product ratios which are the envy of the Developed West, aided no doubt, by having no need to financially support the banking, insurance and other structurally important industries.

Double digit GDP growth and strengthening exchange rates against the currencies of the Developed West bring their own economic challenges however. Consequently China and a number of the South East Asian nations are actively seeking to suppress growth so as to ward off the effects of inflation and maintain their competitive positions.

South East Asian market

While the general economic indicators in the South East Asian nations are in the main positive, understanding the extent of business and lender confidence in these markets and the current and anticipated extent of business failures and the need for advisory support for distressed businesses is significantly more challenging.

Statistical information on the trends in the volume and geographical and sector spread of formal insolvency processes in a number of the South East Asian nations are not published. Given that the major banks view and deal with risk and distressed lending issues on an Asian-wide basis, in the absence of official statistics the best indicative information on the state of the market (albeit far from perfect) can be obtained from discussing the position with bank risk teams.

My own research in this market has indicated that the volumes of impaired assets in lenders' books is proportionately much smaller than those of the Developed West as is the likelihood of the banks taking precipitive action. The impact on the respective rights and enforcement actions available to banks in each of the jurisdictions in South East Asia will of course be a factor. Unsurprisingly, the transactional corporate finance market and availability of investment capital and debt is in a far healthier state.

None of this takes into consideration the macro and micro-economic implications of the earthquake and tsunami in Japan. At the time of writing, this disaster had resulted in significant loss of life, widespread destruction of property and agricultural and industrial infrastructure, as well as potentially leading to the most significant nuclear accident since Chernobyl. All of this has, unsurprisingly, resulted in significant turmoil and uncertainty in the global financial markets.

However, while the economic indicators across the region are generally positive, as in any market-driven economy, a number of the key drivers that lead to businesses suffering financial distress are present (counterparty/receivables risk, inadequate management and poor risk and financial controls). Consequently, there is a firm need for distressed businesses and their stakeholders to seek the involvement from advisers working in the relevant jurisdictions on recovery, risk management and work-out strategies.

Smith & Williamson are able to service the needs of our clients in South East Asia in conjunction with our associated business, Nexia TS.

GUNS POINTING IN THE WRONG DIRECTION? DEVELOPING MARKETS ARE THE ONES TO AIM FOR

By Mark Garnett

Mark Garnett discusses the need to focus attention away from traditional export markets as a strategy for economic recovery.

Two years ago, investors were questioning the viability of the Anglo-Saxon capitalist system. With the absence of a feasible alternative, the leaders of the G20 nations agreed a series of inflationary measures, the total worth of which was about $4 trillion. With the global economy worth about $50 trillion, it would have been surprising if the global economy had not responded.

The growth in the emerging markets rose strongly, and the developed world was pulled out of a recession, with varying degrees of success. Any country selling goods and services to the Asian and emerging market economies have recovered strongly, while those countries orientated towards the developed world have continued to struggle. Indeed the US has struggled so much that they have embarked on a second round of quantitative easing, known as QE2, as well as extending a number of fiscal policies over the next two years with a combined worth of $1.4 trillion. Despite all of this, one in five Americans is dependent upon its Government to feed them.

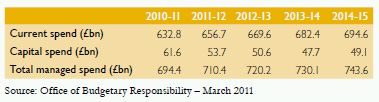

In the UK, the Government is embarking on an austerity programme, the full impact of which has yet to be felt. While our Government states that the impact is significant, they are only reducing the real value of the expenditure. As the table below shows, in absolute terms total expenditure is rising.

The financial position of the UK will only improve if the UK economy grows over the life of this Parliament. The projected rates of growth in GDP are 2.1% per annum in 2011-12 rising to 2.8% per annum in 2013-14.

The main driver behind the projected growth is our ability to sell more goods and services into a global economy, which is set to expand over the coming years. In theory it is a very good idea, but in reality it is more challenging. Ideally we should be selling goods and services to the developing world, but we are still orientated towards the developed world, where economic growth rates are more modest. The table below identifies some of the economic zones to whom we export.

Like the naval defences in Singapore, where the guns were pointing in the wrong direction and therefore unable to fire during World War 2, our existing markets are not primed in the right direction for growth. We export more to Ireland than to the whole of China, India and Brazil combined.

Strategies of the past are creating a challenging environment. There is increasing evidence that while the inflationary policies of two years ago helped the majority of businesses, we are entering a period where the difference between the winners and the losers is increasing.

This is all taking place against a background where banks are applying restrictive lending policies. Effectively they are happy to lend to those businesses who do not need debt, and will turn away companies who do. The banks have more than enough cash to lend; they do not have enough equity on the balance sheets.

There is no easy exit route for the UK economy, but there will be a huge number of businesses who will take advantage of the current climate. Back the winners and turn round the losers!

CAN YOU STOP EMPLOYEE FRAUD?

By David Alexander

In 2010, losses due to fraud were estimated at 5% of the world's gross domestic product.*

One of the lessons to be learnt from the recession is that few, if any, companies can ignore the threat of employee fraud. This is not only because the incidence of fraud is increasing, but also when it does occur shareholders, bankers and other investors want to know what precautions the company directors had taken to prevent or limit the damage. Ignorance of fraud is no defence. The ostrich mentality of 'it won't happen to me' is no longer acceptable. Fraud is now recognised as a business risk to be managed in the same way as any other business or financial risk.

So what practical steps can be taken to reduce the threat of employee fraud? When fraud happens, how can we mitigate the loss and bolster the confidence of the investors that the directors are still in control?

The guiding principals for an effective fraud risk strategy are prevention, detection and investigation. The strategy must address all three principals in equal measure. In an ideal business world, prevention controls would be strong enough to stop all fraud, but this would also grind the company into the ground under the bureaucratic burden. Also, past experience has taught us that if a fraudster is sufficiently motivated and can justify his action, fraud will happen despite the tightest controls. We therefore need the other principles – to be able to detect fraud as it is happening and then investigate it once detected – or as is more likely, for someone to blow the whistle.

These three principles should be linked in a virtual circle where lessons learnt from investigations are used to improve controls, where weaknesses in controls identified during prevention activities lead to selected detection procedures, which in turn instigate investigations.

Don't think fraud won't happen to you; rather than waiting for the inevitable review your anti-fraud procedures now. Here are a few elements every business can easily incorporate into their control environment.

- Fraud risk assessment – understand the fraud risks that you face.

- Pre-employment screening – ensure that all staff are appropriately screened before you employ them or before you promote them into a more sensitive role.

- Whistleblowing procedure – ensure employees know how to report suspicions of fraud.

- Senior management accountability – make sure responsibilities for fraud prevention are understood.

- Audit of employee compliance with policies and procedures – test controls, don't just assume they are effective.

- Tone at the top – consider senior management's attitude to employee fraud and how they communicate this attitude to their employees.

- Corporate culture – encourage the corporate culture to support the business' attitude to fraud.

- Fraud awareness training – train staff to understand what fraud looks like and the damage it can do to the business.

- Code of conduct – clearly communicate codes of conduct with employees.

- Disciplinary procedure – explain clearly to staff the consequences of committing fraud.

- Reporting fraud to the authorities – make your company's attitude to reporting fraud clear.

- Career counselling – consider how you manage the careers of your staff.

- Employee complaints – develop a communication system for employee complaints, this is by far the most likely avenue of discovering fraud.

- Employee participation in own performance goals – allow staff to feel they have some control over how their performance is appraised.

- Avoid excessive rewards and punishments – discourage excessive rewards and punishments for performance within your business – especially difficult in the finance sector – as these can be strong drivers for fraudulent behaviour.

*Per the Association of Certified Fraud Examiners.

NO LONGER 'BUSINESS AS USUAL' - IMPLICATIONS FOR BUSINESSES OF THE UK BRIBERY ACT

By David Alexander

Companies need to take swift action to ensure adequate procedures to prevent and detect bribery.

For many years the US has led the way in investigating corruption through the Foreign and Corrupt Practices Act. The UK has been comparatively slow to update its legislation, however with the introduction of the Bribery Act (the Act) this is about to change.

The Act introduces a new offence if companies fail to prevent bribery by employees, agents or persons connected to their business. The only defence available will be if the company can demonstrate it has, and maintains, adequate procedures to prevent and detect bribery.

Unless a business is a household name, it is tempting to think that the chances of being prosecuted are slim at best and that therefore you can conduct 'business as usual'. This is a high risk strategy. The SFO's policy on self reporting increases the chance that bribery will be reported and should a successful prosecution ensue there is a nasty sting in the tail in the shape of the Proceeds of Crime Act not to mention the Money Laundering Regulations.

Most people would associate the Proceeds of Crime Act with depriving convicted drug dealers of their ill-gotten gains. However it is equally applicable to businesses convicted under the Bribery Act. Conviction for paying a £100,000 bribe to win a £1m contract could result in a confiscation order to the gross value of the contract, and that's on top of any fines imposed as a result of the conviction.

Companies need to act now to ensure they have adequate systems and controls in place if they are going to both prevent bribery by employees and agents and defend themselves against the new corporate offence of failing to prevent bribery.

ARE DEBTORS BEING DISADVANTAGED BY IVAS?

By Toby Holt

Toby Holt argues that, as the legislation stands today, for most debtors bankruptcy is a better solution than the individual voluntary arrangement.

There have been a surprisingly large number of individual voluntary arrangements (IVAs) approved over the last few years.

Surprising in the sense that often the debtor will have to make contributions from his/her salary for a five-year period, and if a property is owned, will have to revalue it in month 54 of the arrangement and still inject sufficient funds to pay creditors for any equity that may have accrued in that period.

Surprising too when one realises that bankruptcy only lasts for one year and that income payment agreements only run for a maximum of three years. The trustee must also realise any equity within three years of the bankruptcy order.

Is the stigma of bankruptcy so bad considering over 64,000 people went bankrupt in the year to 31 September 2010?

The bankruptcy system was originally set up as a place of sanctuary where debtors could go to deal with their debts as there was no practical alternative. I would argue, as the legislation stands today, that for most debtors bankruptcy remains the most suitable regime.

Are these debtors involved in an industry where they are unable to work if made bankrupt? This is unlikely. The statistics from the department for business, innovation and skills show that the vast majority of IVAs are entered into by non-professionals who would be able to continue to work if a bankruptcy order was made against them. So are they getting the best advice from the larger providers of IVAs? Possibly not.

Having recently assisted debtors in putting together proposals in more complex IVAs (one debtor worked overseas and the other had three trading businesses) it also appears that creditors may have started to overstep the mark in their expectations of debtors.

In one instance the debtor chose to take out an insurance policy which ensured that all the debts of his IVA would be paid in the event of his death during the period of the arrangement. Surely a most sensible approach, and one which he had taken as he did not want to risk leaving his partner with the prospect of selling their jointly-owned property should his worst fears be realised.

A well known organisation, which acts for a number of credit card companies and charges them for the privilege, initially refused to allow the debtor to pay for this policy. Are creditors now able to dictate how and what a debtor spends his money on?

I can understand the argument that the creditor may well want more to be offered by way of a dividend – but surely they cannot dictate in which way the debtor spends the residue? Fortunately, after much discussion a deal was eventually struck which allowed the debtor to take out the desired insurance policy.

The alternative in this instance was bankruptcy, which would have resulted in a far lower dividend being received by the creditors. Not only was the debtor being told what he could and could not spend his income on but the creditors' representative was prepared to risk his client receiving a far lower dividend than in the IVA.

It is clear to me that the choice of insolvency practitioner when asking for advice is paramount to both debtors and creditors alike.

|

Case study My firm was contacted by a land owner, who happened to sit on the board of a clearing bank. His gamekeeper had got into trouble financially and had no way of making contributions from his low wages. He lived on the estate in a house that came with the job. As a gesture of goodwill to the debtor's creditors, the employer was prepared to offer creditors £25,000 as a one-off payment through an IVA. The proposal meant that creditors would receive payment of 20p in the £1 within one month of the approval of the arrangement. Because the dividend offered was below certain credit card companies' thresholds, their representatives rejected the proposals, and the offer of the money was withdrawn. The debtor subsequently went bankrupt and the creditors received nothing. Whose interests were the representatives serving? |

Nominees' fees

Many so called 'debt factories' have their nominees' fees limited by creditors. These factories are set up to knock out simple proposals and often do not even meet the debtor, therefore keeping costs low.

But what of proposals that are a little more complicated, predicated on a trading business where cash flow forecasts are needed, or where the debtors' affairs do not easily fulfil the one size fits all methodology, where the debtor will need to meet with his nominee several times?

Is the debtor going to be penalised because the insolvency practitioner who could put together a more complicated proposal is going to shy away from taking the instruction for fear that he will lose money if his fees are capped? Are the creditors who force nominees to repay their fees that have been paid upfront back into the arrangement not just limiting the options for a debtor? Surely if a debtor wants to use certain trusted advisers and has been told of the fee structure in advance then that is a matter for them not the creditors? Should the creditors have the right to limit the choice of a debtor to only using cheaper firms, who may not be giving the best advice?

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.