AIM: SWEET 16 AND STILL GOING STRONG

By Marcus Stuttard

Quoted business catches up with Marcus Stuttard, head of AIM at the LSE, to find out how the growth market is faring and its plans for the future.

Often dubbed the 'junior market', it would appear that 16 years after its launch AIM has truly come of age. Through three years of global economic turmoil, AIM has demonstrated its resilience not just as an IPO market, but as a mature growth market where companies can continue to come and access finance. In 2009, around £5.6bn was raised on AIM through new admissions and fundraisings, rising to £7bn in 2010. This year, AIM has raised £3.6bn to date, proving it can hold its own despite the tough market conditions.

Strength to strength

Marcus Stuttard, head of AIM, says: "A public listing has put many AIM companies in a far stronger position than their unlisted peers in these difficult times. This demonstrates the benefits of a public quote versus other forms of finance, particularly when you look back to 2008/09 when market conditions were exceptionally tough. It was difficult for many unlisted companies to access finance then. But those on AIM were able to tap into the deep pool of institutional capital and adviser capability available. Add to this the spin-off benefits of good profile, visibility and credibility and, for many companies, an AIM listing has been the right decision."

There continues to be a strong pipeline of companies looking to access AIM, largely because it's one of the few growth markets representing such a broad range of sectors (40) and jurisdictions (90+). "So far this year, there have been 62 new AIM admissions of which 16 have been international. And the pipeline is growing," says Marcus. "AIM remains diverse and is not looking to prescribe the types of companies that should come to the market. But it recognises that at different points in the economic cycle, certain companies will appeal more than others. For example, the extractive industries sector is currently looking attractive to investors because of strong commodity prices."

Role of equity finance

Marcus sees equity finance playing an increasingly important role, especially in the technology and innovation sectors where accessing growth finance at an early stage is crucial. He says: "If companies can't access equity then there's the risk they'll have to sell early and miss out on fulfilling their potential. Across key markets in Europe, equity investment is under-utilised." In fact, recent figures published by the European Central Bank show that equity investment is among the least used sources of finance by SMEs in Europe, just missing out on the bottom slot to debt securities.

"The European venture capital community is in need of more active, dynamic, growth markets to exit their investments, which provides a real opportunity for AIM," says Marcus. But, for investors and companies to want to continue coming to AIM, investors need to feel that the market remains well regulated – although not to the extent that companies find the admission process unduly onerous. There is also the question of whether the introduction of the Standard Listing regime on the Main Market, with its lower eligibility criteria and fewer continuing obligations than AIM, could pose a threat to the junior market.

Regulation v flexibility

According to Marcus, the balance between regulation and flexibility on AIM is a key focus for his team. "The package of regulatory changes that we introduced in 2007 set us up well for current market conditions," he says. "No further changes are in the pipeline, although these issues are always under review. It's important for companies to have access to growth capital, but investors must also have confidence in the regulatory model. The levels of fundraising that we've seen in these tough economic times suggest we've got the balance right."

In the case of the Standard Listing regime, Marcus says it offers additional choice for companies but it isn't being actively promoted as such. "The platform has appealed to companies that might not be appropriate for a Premium Listing on the Main Market or AIM and would benefit from a more flexible regime, for example, real estate companies or acquisition vehicles. But it's not for everyone. Many investors are asking companies to explain their reasons for wanting a Standard Listing," says Marcus. "If the answer is simply the lighter-touch regulatory regime then investors just aren't interested. They want satisfactory reasons for companies taking this route." With this in mind, it seems unlikely that a Standard Listing will be enough to lure away existing AIM-listed issuers or new market entrants in large numbers – but only time will tell.

Looking ahead

Going forward, Marcus says: "There's still a need to widen our investor base and this has been a theme in the lobbying and public policy debate that we've been involved in. AIM has representatives on the European Commission's SME Finance Forum and other European lobby groups. It has been actively involved in negotiations on a number of UK and European directives that have been reviewed or are up for review."

In fact, Marcus says the recent changes to the UK rules on venture capital trusts (VCTs) and the enterprise investment scheme (EIS) were pushed for by AIM. They are also involved in dialogue on MiFID and welcome a framework that attracts a broader range of SME investors via the growth markets. "Policymakers in the UK and across Europe understand the importance of SME growth and the need to access meaningful amounts of capital. This means lightening the burden on SMEs and proportionate disclosure so that AIM and other growth markets can play an increasingly important role.

"Through the AIM community, we have contributed £21bn to GDP, £2bn to UK tax revenues and 570,000 employees. The future of the market depends on maintaining this strong and diverse community, and ensuring that AIM remains competitive compared to other markets around the world."

BOXING CLEVER

By Matt Watts

Matt Watts looks at the latest proposals for the patent box regime and considers whether they will help encourage businesses to stay in the UK.

The patent box regime will provide for a lower rate of corporation tax for profits derived from qualifying patents from April 2013. It has been hailed by the Government as one of the measures that could once again help the UK compete as a jurisdiction of choice for international business. Yet many of our European neighbours have already implemented similar regimes, so we are essentially playing catch up. If the regime is to achieve its stated goal and persuade businesses to remain in the UK – or even to move here, it needs to be competitive and practical.

Reduced corporation tax

Under the current proposals, qualifying profits will be subject to a reduced rate of corporation tax at 10%, to be phased in gradually from 2013 to 2017. While this is substantially less than the main rate of corporation tax (currently 26%, but decreasing to 23% by April 2014), it falls short when compared to other patent box regimes against which we are competing. For example, the Netherlands at 5% and Luxembourg at 5.76% provide much lower rates. Indeed, the Netherlands reduced its rate from 10% to 5% to increase competitiveness. So, unless the UK reduces its rate, it may struggle to achieve its intended goal of being a top location of choice for innovative industries.

Complex calculations

Calculating which profits will qualify for the reduced rate also needs further consideration. Under the current proposals the rules are complex and there is a risk that, practically speaking, the regime will only be available to the largest companies that can justify the additional compliance costs associated with the calculations due to the scale of their operations.

If the regime is to act as a stimulus for the UK economy, then surely its appeal needs to be widened to companies outside of the FTSE100? Again, the regime in the Netherlands provides a compelling comparison, as the lower rate is applicable to all profit derived from an asset if 30% or more of the income derived is attributable to the patent.

Don't miss the boat

There can be no quibbling with the aims and rationale for the Government introducing the patent box regime and, if implemented correctly, it could make a significant contribution to the UK economy. However, the Government needs to make bold decisions now to ensure this goal is achieved, including whether to extend the regime to other forms of intangible assets other than patents, making it practical to access for more companies and lowering the rate of corporation tax or introducing a small companies' rate.

While this may be difficult to justify in these times of austerity, it is hard to see how the trend of companies relocating their intangible assets offshore – Virgin Enterprise (which has rights to the Virgin brand) being a recent high-profile example – will otherwise be reversed.

INDIA: OPPORTUNITIES FOR GROWTH

By Sonny Lulla

Sonny Lulla of Infrastructure India plc discusses the company's experiences investing in infrastructure businesses in India.

In March 2011, Guggenheim Global Infrastructure Company (GGIC) sold its two Indian infrastructure investments to Infrastructure India plc (IIP) in return for share consideration. The co-founders of GGIC were appointed to IIP's board, while an affiliate was appointed manager.

Rationale for the deal

The rationale for the transaction was relatively straightforward: a lack of diversified, well-managed, UK-listed, actively traded equities were preventing public market investors from accessing India's burgeoning infrastructure industry. IIP was originally envisioned as one such company, but unfavourable market conditions meant it needed a catalyst to help get it there. The addition of the GGIC-owned businesses, coupled with the strength of IIP's investment pipeline in India, provided just that.

Investment opportunities

Since March, IIP has made an offer for and acquired Indian Energy Limited (IEL), an AIM listed developer and operator of wind energy projects in India. It has increased the size of IIP's investment in the Shree Maheshwar 400 megawatt hydropower project at accretive returns to IIP shareholders and it has also consolidated full ownership of Vikram Logistic & Maritime Services (VLMS) into IIP. IIP now has investments in three strong projects in India and additional outright ownership of two scalable businesses in attractive sub-sectors of infrastructure, namely renewables (IEL) and transportation and logistics (VLMS).

Investment approach

Investing in infrastructure businesses should be approached as much from the vantage point of developer as investor, as there is significant value to be created in disciplined project development. One of the challenges faced by investors in India is finding reasonably priced transactions with reliable project partners. Outright ownership of IEL and VLMS means IIP can deploy significant capital into businesses that it controls (and whose management the company appoints) to develop projects and earn attractive returns for investors at the base cost of the asset, not at a large premium. VLMS's recently announced acquisition of Freightstar is one example of this strategy at work.

IIP is also positioned to invest opportunistically (and disinvest) smaller stakes in other infrastructure businesses that meet its investment criteria. Those criteria focus us on basic, hard-asset, project-financeable businesses which we understand. In our view, IIP's businesses have a sustainable advantage (and corresponding returns) coming from regulation, concession, location, monopoly position and contract.

Given the work IIP has done to date, the company seems well positioned to raise and deploy additional capital, giving it the scale it needs to achieve what we intended back in March.

EU PROSPECTUS DIRECTIVE

By Gary Thorpe

Gary Thorpe of Clyde & Co outlines the potential changes to the EU Prospectus Directive.

The EU Prospectus Directive (2003/71/ EC) requires companies seeking admission to an EU-regulated market or making a public offer in an EU member state to publish a prospectus approved by the competent authority in the relevant member state. In the UK, this is the UK Listing Authority (UKLA), although it is set to become the Financial Conduct Authority. A prospectus must contain information as set out by the Prospectus Rules and enable investors to make an informed assessment of the company and its securities.

Admission document

AIM is not an EU-regulated market, so companies seeking admission need to publish an admission document not a prospectus – unless they are making a public offer, which most tend not to do. The contents of an admission document are governed by the AIM Rules (in reality, an abbreviation of the Prospectus Rules) and are not UKLA approved. In general, issuing a prospectus to raise capital is more costly than issuing an admission document and UKLA approval lengthens the timetable.

Exemptions

For companies seeking admission to AIM, there are exemptions from the prospectus regime. These include:

- offers to qualified investors

- private placings to less than 150 people (not qualified investors)

- offers raising less than €5m.

Exemptions are not available for subsequent pre-emptive offers to shareholders, for example, rights issues and open offers, raising more than €5m.

Prospective changes

The EU Prospectus Directive has had little practical effect on companies on the Official List, but on AIM almost all admissions and subsequent fundraisings have been private placings and retail investors rarely participate. However, change is coming. The EU has amended directive (2010/73/ EC) as part of its review of the EU Prospectus Directive. The amended directive will be implemented in the UK by July 2012. It outlines a framework for a proportionate (or reduced) disclosure regime for prospectuses for rights issues, small market capitalisation companies (three-year average of less than €100m) and SMEs. The European Securities and Markets Authority provided final technical advice to the EU Commission on these proposals in October 2011.

So far, indications suggest that a proportionate disclosure regime will be introduced for rights issues for quoted companies on the Official List and AIM. Competent authority approval will remain. It is hoped that open offers will also fully benefit. A similar regime will be permitted for small market capitalisation companies and SMEs on EU-regulated markets but not for an IPO.

A proportionate disclosure regime would be permitted for companies on admission to AIM, even where there is a public offer. This would allow AIM companies to reach a wider category of investors on admission and later, although they would need to bear the cost of issuing a reduced disclosure prospectus and would require competent authority approval.

Looking ahead

There is little to suggest that the prospectus regime has prevented smaller quoted companies from raising capital in any major way. The principal effect has been the dilution of retail investors. Despite this, placings are still an effective way of raising capital. It will be interesting to see how market practice develops once these reforms are implemented.

GLOBAL MARKETS IN TURMOIL

By Philip Lawlor

Following a tough third quarter for world markets and escalating problems in the eurozone, Philip Lawlor looks at where we go from here.

World markets were volatile in the third quarter of 2011, as they struggled to contend with two powerful and simultaneous headwinds.

Structural headwinds

The first was a rapid decline in economic momentum in both the US and Europe. Confirmation of this came when the International Monetary Fund (IMF) reduced its growth estimates for advanced economies from 2.2% to 1.6% for 2011 and from 2.6% to 1.9% for 2012.

The rapid decline in US, UK and German bond yields to 60-year lows is also a powerful indicator that developed economies are recalibrating to a much lower nominal gross domestic product (GDP) growth trajectory (the 'New Normal').

The second major headwind, which has increasingly preoccupied the markets, is the marked escalation in the eurozone debt crisis. The shift in focus to Italian solvency, combined with an inadequate political and leadership response to the eurozone crisis, has raised legitimate concerns over the future of the euro.

The systemic risks posed by the potential decline of the euro are global in nature and have contributed to the 'risk-off' positioning of markets and increased tension in the interbank market.

The eurozone remains extremely vulnerable to further pulses of tension as growth slows in 2012 and sovereign solvency risks increase correspondingly. The New Normal lower nominal growth trajectory continues to exert pressure on solvency arithmetic, but also imposes significant operating leverage risk to earnings growth forecasts.

UK economy

The IMF and the Organisation for Economic Co-operation and Development have reduced their 2012 growth estimates from 2.3% to 1.6%. This has raised further questions over the need to stimulate the economy.

Despite an energy-led surge in the Consumer Prices Index and the Retail Price Index to 5.2% and 5.6% respectively, the Monetary Policy Committee (MPC) voted unanimously to kick-start a second round of quantitative easing (QE) in October. The MPC justified this by referring to the underlying weakness of the UK economy and the vulnerability of the banking system to potential eurozone bond defaults and bail-outs.

The parlous state of the UK economy was emphasised by GDP data that showed that the decline in output in 2008/09 was the deepest contraction since the 1930s. Three and a half years after the recession, the UK economy is still 4% below prior peak levels.

What next?

With a weak labour market, real disposable income is likely to remain negative for several more months and this supports Mervyn King's view that inflationary expectations are not rising and domestically generated inflation is 'almost zero'. Although at some stage in 2012 disposable income will be boosted by declines in inflation, the MPC is likely to expand the scale of QE in 2012 to address the weakness in underlying demand.

The agenda is now shifting towards whether QE should be used in a more holistic way. For instance, Adam Posen on the MPC has warned of the need to counter "policy defeatism" and to use QE to provide credit to SMEs directly, circumventing the banking sector.

UK MARKET COMMENTARY -TURBULENT TIMES FOR CAPITAL MARKETS

By Azhic Basirov

The third quarter of 2011 was one of the most challenging in the recent history of financial markets due to underlying volatility and a substantial decline in market value.

AIM

A total of 33 new companies were admitted to AIM in the third quarter of 2011. This was an improvement on the 24 new issues in the previous quarter and a slight increase on the 31 new companies that listed in the same period last year.

New money raised on AIM in the third quarter of this year totalled £271m, with £414m of further money raised. These figures are lower than in both the previous quarter and the equivalent period last year, reflecting stalling investor confidence.

Despite this turbulence, the number of companies listed on AIM rose for the first time since the fourth quarter of 2007 to 1,156. However, there was a decrease in the aggregate market capitalisation of these companies, with the average market capitalisation falling to £55.1m at the end of September from £65.6m at the end of June. This decline in average value is also reflected in the AIM All-Share Index, which fell 18% in the third quarter of 2011, with an 11% drop in August.

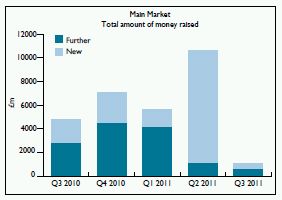

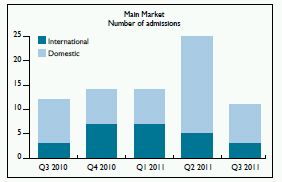

The Main Market

It has also been a difficult quarter for the Main Market, where the number of new admissions fell from 25 in the relatively successful preceding quarter to 11. This was slightly down on the 12 new admissions in the third quarter of 2010. The level of funds raised from new issues was £474m, a substantial decline on both the previous quarter and the same period last year, when new money raised totalled £9.6bn and £2.0bn respectively. All of the £474m was raised in July, with no money raised through new issues on the Main Market in August and September.

In the third quarter, £585m of funds were raised through further issues on the Main Market, compared with £1.1bn in the previous quarter and £2.8bn in the equivalent period last year. Unlike AIM, the total number of companies listed on the Main Market fell to 1,402, down 11 on the previous quarter and 27 on the third quarter of 2010.

The FTSE All-Share Index fell 14% in the third quarter of 2011, with a 10% drop in August.

Similarly the FTSE 100 Index decreased 14% in the third quarter of 2011, with a 9% fall in August.

What's next?

Overall, optimism in the IPO market has been low since the end of the second quarter. This is reflected in the lower levels of money raised and the number of new listings on both AIM and the Main Market in the third quarter.

The post-IPO share price performance of newly listed companies has been poor on balance. This, combined with macroeconomic issues, has meant investors are reluctant to invest in new opportunities until more stable market conditions return.

Anecdotal evidence and current data suggest that the final quarter of 2011 will show little improvement; October was the third consecutive month this year when the Main Market didn't raise any money from new issues, with AIM raising just £0.8m.

Despite recent agreements in the eurozone, there is still substantial progress to be made before a detailed solution emerges and investor confidence is restored. Yet even with this challenging outlook, a significant level of investor cash has been built up. It would be reasonable to expect this money to start flowing into the financial markets once the eurozone is stable and confidence in the global economic outlook returns.

SMES 'WLTM' PRIVATE INVESTORS

By Peter Webb

Peter Webb of Webb Capital asks if retail bond issues could create the perfect partnership between SMEs and private investors?

I pity the ordinary folk who work hard for a living and whose financial future has been put in jeopardy by the greed and madness of recent years. What must they be thinking seeing recent reports of another rogue trader losing his employer's billions? Clearly, Warren Buffet was right when he said that the big banks had little clue of the risks their traders were undertaking when chasing profit.

Capital woes

The capital needed for SMEs to function is getting scarcer, as traditional lenders feel the pinch. The UK Government's cries for more lending to SMEs are hollow compared to the impact of edicts to bolster capital ratios. Never mind, there will be another Government initiative soon – in fact, it has already arrived, namely the Government bond purchase scheme. No doubt the funding crisis will have resolved itself long before the bumbling bureaucrats get to first draft.

Bridging the liquidity gap

There is an answer to the liquidity problem if only the powers that be would open their eyes to the obvious and stop regulating the private individual out of the opportunity.

Tired of poor returns on savings and shaky equity markets the private investor has nowhere to go for yield or profit. Meanwhile, whether it's asset finance, leasing, invoice discounting, factoring or other means of finance, for SMEs there is a huge liquidity gap emerging as traditional lenders are forced to shrink their loan books.

Power to the people

The answer to the capital shortage lies with the people with the cash – and some smart companies and advisers are tapping into the private investor's appetite for something different.

Long of cash, short of investment opportunities and excluded from the mainstream, private investors are voting with their cheque books. Retail bond issues for King of Shaves, Hotel Chocolat and the much larger Places for People are a step in the right direction. However, these small shoots are just a pre-cursor for what might occur in the future.

It won't be too long before the market sees the potential of financing business opportunities through high-yielding bonds owned by the private investor. For this to happen, we would need to see more innovation from the City and a greater effort to embrace the private investor as we endeavour to overcome the challenges ahead.

LSE promotes Order Book for Retail Bonds

The London Stock Exchange has recently completed a series of roadshows promoting the launch of its Order Book for Retail Bonds. This has been initiated in response to strong demand from private client brokers for greater access to retail bonds and a wider range of retail size corporate bonds to be made available. The minimum issue size at the moment is £25m, but this could reduce in future if the initiative is successful.

SPOTLIGHT SOUTH-WEST

By Nick Reeve

The South-West has seen a number of its home-grown companies go public. Nick Reeve looks at some of the big success stories.

In recent years, several companies formed in the South-West of England have been listed on the LSE's Main Market and AIM. A notable example was financial services firm Hargreaves Lansdown, which was started by Stephen Lansdown and Peter Hargreaves in the early 1980s. It was floated on the Main Market in 2007 and is now a FTSE100 company worth around £3bn.

More recently, Devizes-based Rockhopper Exploration, which listed on AIM in 2005, has achieved a high public profile related to its licences to explore for oil in the North Falklands Basin. Despite well-publicised concerns about security in the region, it has achieved a market capitalisation of over £500m.

Closer to our hearts at Smith & Williamson is the tremendous success of our long-term Bristol-based client, Albemarle & Bond. The firm was admitted to AIM in 1995 at an opening price of 11p and has recently been trading at close to £4, with a market capitalisation well over £200m.

Nomad to AIM companies

The Bristol office of Smith & Williamson has acted as Nomad to many companies since the launch of AIM in 1995, and we continue to offer the service today. In fact, we are one of only two Nomads in Bristol.

Like most AIM companies over the past three years or so, our clients have had to deal with difficult trading conditions, but most have survived the recession – and some are now beginning to thrive. A good example is cosmetics firm Swallowfield, one of the biggest employers in Wellington, Somerset. International expansion for the company is underway and, despite a rocky couple of years, the future is now bright.

A brighter future?

At Smith & Williamson, we look forward to a recovery in the markets so that IPO activity can continue. AIM was formed to provide a public market for small trading companies with high-growth potential. But risk-averse investors have largely shunned such companies since the credit crunch.

We believe that particularly following the improvements next year to the EIS and VCT regimes (which will enable many more potential AIM companies to benefit from tax breaks for investors), opportunities to take advantage of the many benefits that can flow from a public listing will improve significantly.

The values attached to businesses when they 'go public' are likely to be much lower than they would have been before the credit crunch. But the benefits of a public listing are for the long term and the value attached to an IPO should not be the only consideration when making such an important decision.

New equity funding rules

From 6 April 2012, the annual limit on the aggregate of VCT and EIS funding for qualifying businesses will rise from £2m to £10m. This will give individuals the chance to invest alongside VCTs and other investors in much larger fundraisings through the EIS, while still offering significant tax breaks.

As well as an increase in the annual investment limit, the number of full-time employees in a qualifying business will rise from 50 to 250. Moreover, investors will be able to invest in businesses with maximum gross assets before investment of £15m, up from the current level of £7m.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.