Background

Pillar Two is an international tax reform initiative that aims to ensure that large multinational groups pay a minimum effective tax rate of 15% on all their profits, on a country-by-country basis.

This is to be achieved by countries implementing top-up tax rules – known as the GloBE Rules – under which they will charge parent companies in large multinational enterprise (MNE) groups a top-up tax in respect of the profits of any low-taxed foreign subsidiaries they have. Many participating countries, including the UK, Luxembourg, and most EU Member States, have implemented the GloBE Rules for accounting periods beginning on or after 31 December 2023.

Groups that are in scope of the GloBE Rules will face new, potentially onerous, reporting requirements, as well as potential new tax liabilities if they have low-taxed profits.

The policy intention behind Pillar Two is to prevent profit-shifting by large trading groups. However, there is no general exclusion for investment funds, so whether a fund is in scope of Pillar Two must be determined by applying the general GloBE scoping rules. As we explain below, we expect that most investment funds will be out of scope, but there may be exceptions.

Who is in scope of Pillar Two?

Pillar Two applies to large MNE groups. For this purpose:

- a group is defined as the collection of entities that are included in a parent entity's GAAP-compliant consolidated financial statements (or that would be if the parent was required to prepare such accounts);

- a group is multinational if it has entities located in more than one jurisdiction; and

- a group is large if it has consolidated revenues of at least €750m per annum in two of the previous four accounting periods.

Under the Pillar Two rules, whether entities are included in the same accounting consolidation determines whether they are connected, and whether their financial results are aggregated for the purposes of testing the revenue threshold and calculating top-up taxes.

For a fund the ideal outcome is likely to be that it neither consolidates its investments nor is consolidated by its investors. In that case it will not be part of a large MNE group, and not therefore be in scope of Pillar Two.

Fund level issues

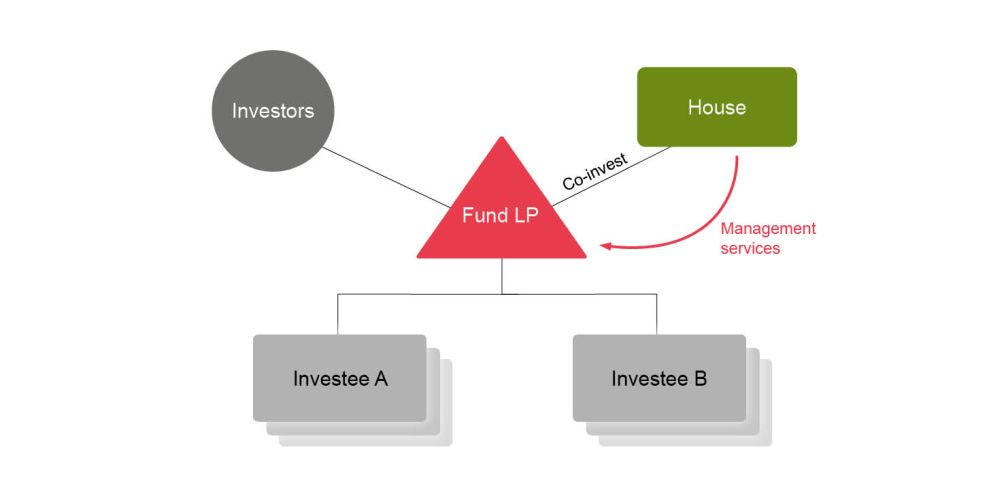

Consider a typical private equity fund structure such as that depicted above.

The basic accounting rule under IFRS is that a parent entity must consolidate a subsidiary if it controls that subsidiary and is exposed to variable economic returns from it. However, investment entities are excepted from the requirement to consolidate their investments. We expect that most private equity funds (and many institutional investors) will fall within this investment entity accounting exception, and on that basis will not consolidate (and be grouped with) their investee entities.

Where that is the case, the fund will be regarded for Pillar Two purposes as a standalone entity, and not therefore part of an MNE group. We expect most funds will be out of scope on this basis.

If a fund does consolidate one or more entities located in another jurisdiction and is therefore an MNE group, it will be in scope of Pillar Two if it meets the revenue threshold. The fund entity itself might nevertheless be excluded from the Pillar Two top-up tax under special rules that apply to investment funds. However, the fund's consolidated subsidiaries would potentially be subject to top-up tax – and for the purposes of the calculations their financial results would be aggregated. We expect this will be most relevant to private equity funds that own operating businesses.

Investor level issues

Even if a fund does not consolidate its investments, it may still be pulled into scope of Pillar Two because of its connection to one of the fund's investors. That could happen if:

- the fund (and by extension, its investments) is consolidated by one of the fund's investors and they collectively constitute a large MNE group; or

- an investor that has at least a 50% interest in the fund is in scope of Pillar Two, and accounts for the fund using the equity method of accounting (in which case the fund will be treated as an in-scope joint venture of the investor group).

We expect that most institutional investors, such as pension schemes and sovereign wealth funds, will themselves be treated as investment entities for accounting purposes. Such investors would therefore account for their interests in the funds they invest in as fair value investments, and not consolidate them or apply the equity method.

Even where a fund investor is not able to benefit from the investment entity accounting exception, it would still only be required to consolidate a fund over which it has control. We would not generally expect this to be the case because control will lie with the fund manager (although this is an accounting question that will depend on each fund and investor's facts).

However, we are aware of a small number of funds that are consolidated by an investor. The cases we have seen include instances where a fund manager that has control also has a significant co-investment in the fund, with the result that the fund manager would be required to consolidate the fund that it manages.

If an in-scope investor consolidates a fund then the analysis set out under fund level issues above would not apply. Instead, the fund would be part of an in-scope group because it is consolidated by the investor, even if the fund benefits from the investment entity accounting exception and does not consolidate any subsidiaries itself.

What are we seeing in practice?

While we expect it will be uncommon for investment funds to be in scope of Pillar Two, the consequences of unexpectedly falling in scope are significant. Even where, as will often be the case, there is no top-up tax to be paid, the reporting obligations may be onerous and fall on entities that are not set up to easily fulfil them.

Increasingly we are seeing investors in new funds seeking to include Pillar Two-specific wording in their subscription letters. The drafting we have seen has not addressed the potential issues exhaustively, but rather has sought to:

- establish a mutual obligation of the fund and the investor to act in a way that minimises the risk of consolidation; and

- set out a basic framework for dealing with the eventuality that the fund is in scope (for example, creating an obligation to share relevant information).

We have also seen managers carrying out diligence exercises to obtain a level of assurance that their existing funds are not caught by Pillar Two.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.