The banking sector has long been the cornerstone of the global economy. From retail banking to syndicated loans, financial institutions provide a variety of services to individual customers and businesses. With the increasing technology and financial innovation, banks are positioned to deliver their services on a global scale and emerge as one of the driving forces of the world's economy.

Due to its critical position in the global economy, banking is one of the most regulated and supervised of economic sectors. Even in less developed countries, banks are subject to extensive regulations and a complex system of on-site and off-site supervision. The regulatory framework not only shapes the functioning of the financial system but also influences its resilience to crises, thereby impacting the stability of the broader economy1.

In Turkey, the banking sector operates under the Banking Act2, which was enacted in 2005 and has since undergone numerous amendments to address the sector's evolving needs. The Banking Regulation and Supervision Agency ("BRSA") serves as the key regulatory authority for the sector in Turkey. The BRSA is responsible for establishment of confidence and stability in financial markets, the sound operation of the credit system, the development of the financial sector and the protection of the rights and interests of depositors3.

The Banking Act, which establishes the core framework for banking operations in Turkey, undergoes continuous amendments to keep pace with evolving demands. Developments such as internet and mobile banking, which have significantly reduced reliance on physical branches, are now deeply embedded in our daily lives, reflecting the broader impact of digital technologies on the banking sector. As these technologies continue to permeate various aspects of life, concepts like digital banking, electronic banking, and electronic money have become integral to modern financial discourse

In recent years, the concept of "Neobanks," or digital-only banks, has gained significant traction. These digital-first institutions aim to minimize operational costs by eliminating the need for physical branches, thereby fostering a more competitive environment and offering customers enhanced financial benefits.

The Regulation on the Operating Principles of Digital Banks and Banking as a Service Model ("Regulation")4 has paved the way for banks in Turkey to operate exclusively through digital channels, without the need for physical branches. This Regulation also sets forth the operational principles for these branchless banks, along with the principles for service model banking.

Digital Banking

Digital banks are credit institutions that offer banking services through electronic distribution channels instead of physical branches.

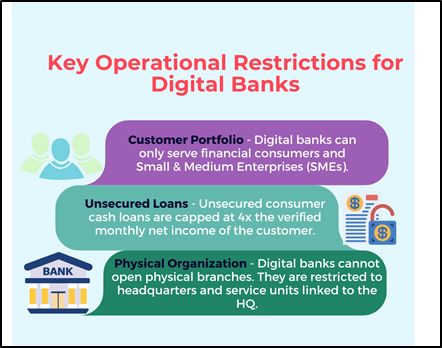

The Regulation brings a set of operational restriction for digital banks:

- Customer portfolio: The clientele of digital banks is limited to financial consumers and small and medium-sized enterprises ("SMEs")

- Unsecured loans: The total amount of unsecured consumer cash loans that can be granted to any customer cannot exceed four times the relevant customers' verified monthly average net income.If the customer's monthly average net income cannot be determined, the loan amount cannot exceed ten thousand Turkish Liras.

- Physical organization: Digital banks cannot organize other than the headquarters and service units affiliated with the HQ. They cannot launch physical branches or use their headquarters as physical branches. They also cannot provide physical custody services to their customers. However, there are exceptions to these physical restrictions. For instance, digital banks are required to establish at least one physical office to handle customer complaints. Additionally, they may offer services through their own ATM networks or the ATM networks of other banks.

Establishment Requirements

The Regulation outlines specific requirements for establishing a digital bank. Notably, the minimum paid-in capital requirement is set at TRY 1 billion. This requirement is set at TRY 2.5 billion for traditional banks.

Pursuant to the Regulation, if digital banks increase their minimum paid-in capital to TRY 2.5 billion, the restrictions may be lifted by the BRSA's decision upon the application of the banks. Beyond fulfilling the substantial capital requirements, aspiring digital banks must also present a comprehensive business plan as part of their BRSA application.

Having fulfilled these requirements, digital banks must focus on customer acquisition to commence operations. Establishing a digital bank requires creatina a 5-year pricing plan, including a competitive analysis of the service to be offered to the target audience and a sustainable business structure.

Operationally, digital banks must also develop a comprehensive information systems strategy, prepare process documentation, and meet specific qualifications for their executives.

The BRSA may impose additional requirements, if the applicant's controlling shareholders are legal entities providing technology, e-commerce, or telecommunication services, including mandates that these entities be residents of Turkey and sign an information exchange agreement with the Risk Center to share their risk data regarding the indebtedness and financial power of the persons residing in Turkey.

Lastly, the establishment and operation license requirements applicable to traditional banks are also applicable to digital banks.

Service Continuity Commitment

mandates that digital banks publish their committed service continuity percentage on the homepage of their websites. This continuity percentage must be no less than 99.8% for online and mobile banking channels.

Service Model Banking (BaaS)

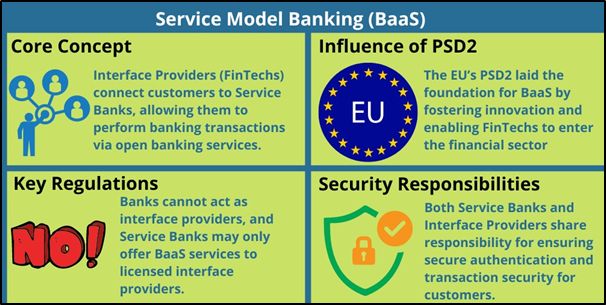

The Regulation also establishes the principles governing service model banking. In this banking model, interface providers, such as FinTechs, offer an interface that connects customers directly with the systems of service banks via open banking services, enabling them to perform banking transactions through the service bank. Banks offering BaaS services are classified as service banks.

We believe that the EU's Payment Services Directive 2 (PSD2) significantly influenced the incorporation of BaaS into the Regulation. PSD2 was designed to facilitate the entry and growth of third-party companies, such as FinTechs, within the payment services sector, allowing them to develop innovative applications. PSD2 has effectively laid the groundwork for these entities to drive innovation, with the BaaS model playing a pivotal role in this transformation.

The Regulations stipulates that banks cannot be interface providers and service banks can only provide BaaS services to interface providers within the framework of their operating licenses. Interface providers are regulated to serve as a bridge between customers and banks.

Indeed, interface providers are regulated as support organizations that assist service banks in delivering services to the banks' customers, rather than directly serving their own customers. However, both interface providers and service banks are jointly responsible for ensuring authentication and transaction security in the services provided to customers.

Status of the Traditional Banks

Traditional banks that are already established and hold an operating license may also transition to digital banking or offer digital banking services. In such cases, they are not required to submit a separate application to the BRSA. That said, these banks must shut down their existing branches under a plan that needs to be approved by the BRSA.

Conclusion

Turkey's banking sector is not only keeping pace with global technological advancements but is also emerging as a leader in certain areas of payment solutions. For instance, a Turkish bank was the first in the world to implement the "pre-validation" solution, allowing payments to be verified between the sender and recipient banks before being transferred. As digital banking continues to evolve, Turkey is poised to become a significant player in the global financial landscape, driven by robust regulations and a forward-thinking approach to technological integration.

The evolution of digital banking in Turkey reflects a broader trend towards increased innovation, efficiency, and customer-centric services in the financial sector. With the rise of digital banks and BaaS model, Turkey's financial ecosystem is set to become more competitive, inclusive, and responsive to the needs of modern consumers.

Footnotes

1. IMF Working Paper, Regulatory Capture in Banking, Daniel C. Hardy

2. Banking Act Numbered 5411

3. https://www.bddk.org.tr/KurumHakkinda/Detay/28

4. The Regulation was published in the Official Gazette on 29 December 2021 and entered into force on 1 January 2022.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.