As the evolving environment of investment in Egypt, there will be arising need to law amendment to face the new imposed issues in the investing changing circumstances that we would like to summarize as follows:

A- CAPITAL GAINS TAX:

Executive Instruction Number 34 of 2024:

The decree helps boots the compliance procedures and the applicable laws and regulations.

Key Highlights

Capital Gains Tax:

Deduct the paid capital gains tax on treasury bills from Corporate Tax Payable and natural persons and that in accordance to the indicated amounts of the unit revenue of treasury bonds and bills, and to the entity executing the transaction (prior establishment the unit revenue of treasury bonds and bills).

And all that, in according to the ministerial decree No.428 of 2021, which included main provisions as following:

- Imposed capital gains tax at the rate of 22.5% on treasury bills (including in tax pool as an ordinary income)

- Permission to the entity executing the transaction that withheld 20% at source.

If you look at the provisions of clause 1 and 2 from paragraph 2 that is the issue where double taxation can arise.

The Tax Treatment of Revenues on Treasury Bills

1- Issuance Date Before 20-2-2019:

Deduct the tax calculated-on revenues of treasury bills from Corporate Tax Payable and natural persons and that is limited to the due tax.

2- Issuance Date 20-2-2019 Onwards:

The revenues of treasury bills are treated as separate tax pool.

B- PAYROLL TAX:

Articles 8 and 13, Item 1 From Law 91 Of 2005

Regarding Law No. 91 of 2005 and its amendments concerning income categories, specifically Articles 8 and 13, item 1.

A Brief Overview of Article 8 is as Follows:

This article is used to determine the tax rates applicable to individuals' income, whether natural persons or legal entities.

There have been several amendments to this article since the issuance of this law, starting with the amendment of new brackets and the addition of new percentages.

This article has been amended 10 times so far, with significant amendments made in 2023. In that year, this article was amended twice under Law No. 30 of 2023, which was published in the Official Gazette on June 15, 2023.

This law came into effect starting from the tax period of June, where the exempt bracket was increased from 15,000 to 21,000, the 2.5% bracket was abolished, and the personal exemption was increased from 9,000 to 15,000.

Furthermore, another amendment was made to the article under Law No. 175 of 2023, increasing the exempt bracket from 21,000 to 30,000 on October 30, 2023, to be effective from the beginning of the tax period in November 2023.

Additionally, at the beginning of the year 2024, another amendment was made to this article under Law No. 7 of 2024, introducing new updates:

- Increasing the tax exemption limit to 40,000 pounds annually by an increase of 10,000 pounds from the previous limit.

- Raising the annual personal exemption limit for funders to 20,000 pounds instead of 15,000 pounds.

- For salaries: the new rules will come into effect from the beginning of next March.

- For commercial activities, professions, and real estate revenues: the new rules will apply from the tax period ending after the law is published.

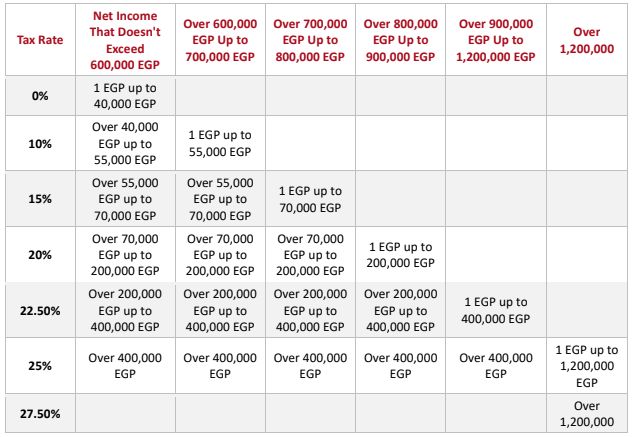

Below Is a Presentation of The New Tax Brackets

On the other hand, the Egyptian Tax Authority is working on resolving disputes with taxpayers and always seeks to simplify transactions. Previously, Law No. 30 of 2023 was issued, containing Article 3 aimed at simplifying transactions and settling disputes.

If you were audited before 2023 and are still negotiating with the internal committee at the Tax Authority, you can benefit from the provisions of Article 3 of Law No. 30 of 2023 and take advantage of the simplified processing outlined in the article. This means that if your business revenues are less than 250,000 pounds, you only need to pay a tax of 1,000 pounds.

If your business revenues range between 250,000 pounds and 500,000 pounds, you only need to pay 2,500 pounds as tax. If your business revenues range between 500,000 pounds and 1 million pounds, you only need to pay 5,000 pounds as tax.

C-TRANSFER PRICING:

According to Article (12) of Law 206 of 2020, in the case of transactions with related parties, whether inside Egypt, abroad, or in a free zone, totaling 8 million EGP or more, the company is required to submit a local file and a master file to the Egyptian Tax Authority at the time specified by the Unified Tax Procedures Law 206 of 2020.

However, In February,2024 the minister of finance issued ministerial decree that raised the total amount of transactions from 8M to 15M EGP.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.