This article discusses 04 investment structures commonly used in Vietnam to grant investors majority control and entitlement to the principal share of profits generated by the target company, while maintaining the target company's classification as a local entity under Vietnamese legislation. They are:

- Multi-Tiered Corporate Structure

- Local Majority-Equity Holder Arrangement

- Special Class of Shares

- Variable Interest Entity (VIE) Structure

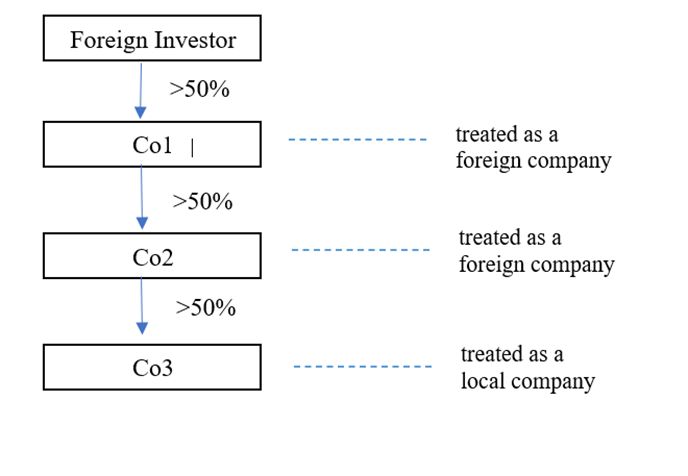

1. Structure 1: Multi-Tiered Corporate Structure

According to the Law on Investment, a company (Co1) with more than 50% foreign ownership and its subsidiaries (Co2) are treated as foreign entities. Companies outside these parameters are treated as domestic entities under Vietnamese law. Many legal experts believe that a subsidiary of Co2 (Co3) does not fall under this foreign classification, and thus, Co3 would be treated as a domestic entity.

However, this interpretation remains legally ambiguous as there has been no explicit confirmation from the relevant authorities. While no objections have been raised by the authorities so far, the possibility of a conservative interpretation cannot be entirely ruled out. Such an interpretation might argue that if Co3 is majority-owned by Co2, which is a foreign entity, then Co3 should also be subject to the regulations applicable to foreign companies.

To mitigate the risks of a conservative interpretation, some companies create additional subsidiary layers to enhance legal safety. This might involve establishing a subsidiary of Co3 (Co4) or even a further subsidiary of Co4 (Co5).

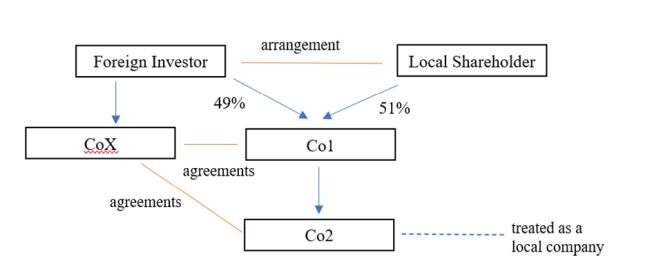

2. Structure 2: Local Majority-Equity Holder Arrangement

Under the Law on Investment, legal experts generally agree that if foreign equity holders own less than 50% of Co1, its subsidiaries (Co2) will be treated as domestic entities under Vietnamese law.

Building on this interpretation, an investment structure can be created where a Foreign Investor partners with a Local Majority-Equity Holder. In this arrangement, the Local Equity Holder holds a 51% stake in Co1, while the Foreign Investor retains the contractual right to manage Co1 and has options to repurchase shares.

Additionally, the Foreign Investor might establish a wholly-owned entity involved in activities not restricted by Vietnam's foreign ownership laws, such as management consultancy or advisory services (CoX). This entity can then enter into agreements with Co1 and Co2 (e.g., service contracts, loan agreements) to channel profits from these companies.

While this arrangement is not uncommon in Vietnam, it exists in a legal gray area due to the lack of explicit approval or guidance from regulatory authorities. The authorities may view it as a nominee arrangement, which has faced governmental scrutiny. Although current laws do not explicitly prohibit nominee structures, there is a possibility that the legal or regulatory environment could become more restrictive.

To further mitigate risks, companies often create additional subsidiary layers, similar to Structure 1, to enhance legal safety.

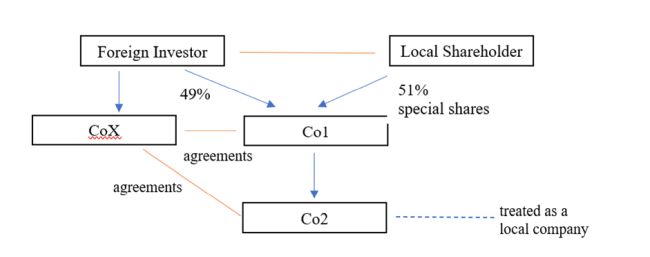

3. Structure 3: Special Class of Shares

This structure also involves the Foreign Investor acquiring a 49% stake in Co1, while a Local Shareholder holds a 51% interest. The key difference here is that the Local Shareholder holds a special class of shares that do not confer voting rights or entitlement to dividends. This allows the Foreign Investor to retain full control over Co1 and receive all dividends, despite holding a minority stake.

Similar to the second structure, the Foreign Investor and Local Shareholder can enter into agreements that grant the Foreign Investor rights to purchase shares or direct the Local Shareholder to transfer shares to another shareholder. Additionally, CoX may be established to divert profits from Co1 and Co2, maximizing the financial benefits for the Foreign Investor.

This approach is possible due to the specific language of the Law on Investment, which assesses corporate ownership based on the 50% charter capital threshold, including all share classes, without considering the distribution of voting or dividend rights. However, it is crucial to consider the potential for future regulatory changes or a shift towards a more conservative interpretation by legal authorities, which could impact the viability of this structure.

As with the previous structures, some companies create additional subsidiary layers for added legal safety.

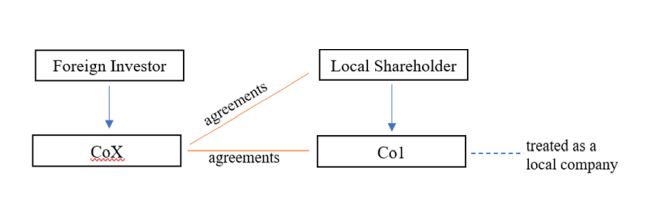

4. Structure 4: Variable Interest Entity (VIE) Structure

The Variable Interest Entity (VIE) structure, widely used by Chinese corporations to attract overseas investment, can also be applicable in the Vietnamese market for short-term strategic endeavors. This structure allows the Foreign Investor to gain a controlling interest and profit entitlement from Co1 without holding direct equity.

In a VIE structure, control is achieved through a series of contracts between CoX (wholly or predominantly owned by the Foreign Investor), the Local Shareholder, and Co1. Key VIE contracts typically include, but are not limited to, Proxy Agreements, Exclusive Call Option Agreements, and Equity Pledge Agreements. Through these agreements, the Foreign Investor, via CoX, can exercise control over Co1 without direct ownership.

Additionally, Loan Agreements and Service Agreements are used to enable the Foreign Investor, through CoX, to derive profits from Co1. These contracts ensure that the Foreign Investor benefits financially from Co1 while maintaining compliance with local ownership regulations.

The VIE structure can be a viable option for foreign investors seeking control and profit entitlement without direct equity ownership. However, it's important to be aware of the potential legal and regulatory risks associated with this approach, as changes in the regulatory environment could impact the effectiveness of the VIE structure.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.