Indian State Governments offer varied incentives under their respective state industrial development corporation policies to promote the set-up of new manufacturing units in the state. Such incentives are in the form of capital subsidies, interest subsidies, subsidized electricity tariffs, and more. The purpose of such incentive schemes is to attract investments thereby enabling infrastructure development, generating employment, developing focus sectors, and largely facilitating the overall economic development of the state.

To enable the availability of a quick summary of such general incentives offered by various Indian states, Nexdigm is releasing a series of documents focusing on providing a brief overview of such incentives offered by respective State Governments in India. This document covers information about incentives offered by Gujarat under the 'Aatmanirbhar Gujarat Schemes 2022 for Assistance to Industries'.

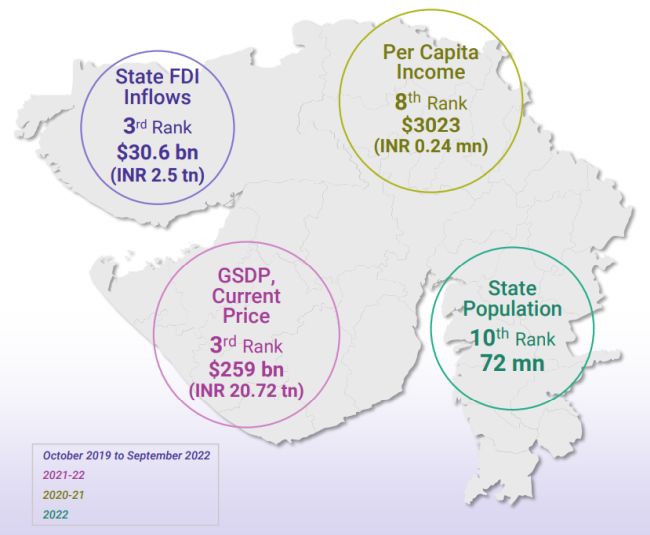

Key Statistics | GUJARAT

Policy Overview

To facilitate the vision of Aatmanirbhar Bharat, the Gujarat State Government released 'Aatmanirbhar Gujarat Schemes 2022 for Assistance to Industries', which is valid from 5 October 2022 to 4 October 2027 for all industries (with an additional five years for Mega Industries).

The policy aims to attract investment of ~USD 150 billion (~INR 12.5 trillion) by encouraging entrepreneurs to innovate and generate employment for ~1.5 million people in Gujarat by enhancing manufacturing opportunities.

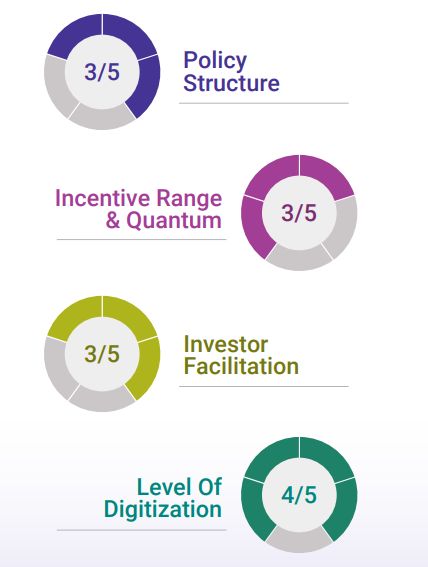

Nexdigm Ratings and Observations

- 10 sectors (along with 23 sub-sectors) have been recognized as thrust manufacturing sectors in the policy. Sectors such as Gems & Jewelry and Textiles & Apparel have historically been areas of strength for Gujarat due to the easy availability of raw materials, associated manpower, state-of-the-art equipment, etc. Furthermore, the list also includes emerging sectors such as Mobility, Green Energy, Sustainability, etc. which are in line with global trends and are considered the future of manufacturing.

- State Goods and Services Tax (SGST) reimbursement is one of the major incentives in the scheme. Companies with a target market or supply chain of customers within Gujarat may be able to take the most advantage of the SGST reimbursement incentives.

Policy Highlights

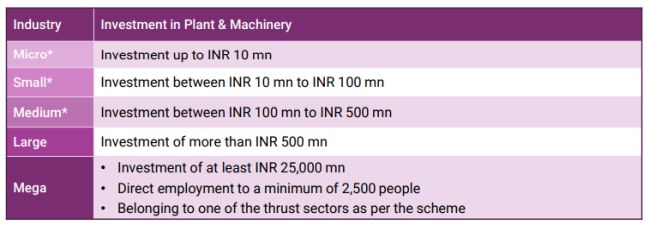

Industry Classification

*Micro, Small & Medium Enterprises (MSME) must have also obtained acknowledgment/registration, as the case may be, from the appropriate authority

Region Classification

Regions in Gujarat, for the purpose of the scheme, are classified under different categories based on the development stage of such regions. This promotes investments with relatively higher incentives in developing or moderately developed regions for the balanced growth of Gujarat. The classification is tabulated briefly below:

Thrust Sectors

Every state encourages select sectors based on its competitive strength and advantage such as geographical location, available resources, raw material availability, existing manufacturing practices, and growth potential. Such sectors are known as thrust sectors and are accorded additional benefits in the incentive scheme. Sectors identified under this policy are mentioned below:

- Green Energy Ecosystem

- Capital Equipment

- Textiles & Apparel

- Agro-processing

- Mobility

- Metals & Minerals

- Healthcare

- Sustainability

- Gems & Jewelry

- Chemicals (Only for Mega Industries)

To view the full article, click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

We operate a free-to-view policy, asking only that you register in order to read all of our content. Please login or register to view the rest of this article.