Germany's climate law has set out the framework to achieve net zero emissions by 2045, with an agenda of phasing out coal and ensuring that 80% of all electricity supply comes from renewable energy sources by 2030 and 100% by 2035. Integral to these goals is the ongoing Energiewende, a comprehensive energy transition that will require significant planning and strategy from businesses.

To understand the impact of energy-related issues on German corporates and their valuations at this crucial juncture, Alvarez & Marsal has analyzed data from the 91 firms listed in the benchmark DAX 40 and MDAX stock indexes between 2017 and 2023, as well as the projections for 2024-2027.

In this article, we will look into the effect of energy-related issues on the valuations of Germany's large and mid-sized listed companies.

FULL METHODOLOGY OF ANALYSIS

We analyzed pricing levels, proxied by the trading multiple metric EV/EBITDA, of all German listed firms within the DAX-40 and MDAX indexes over the period 2017 to 2027. The sample includes 91 firms with a total of 1,001 observations.

In the historical period 2017-2023, actual earnings and stock price data was used, whereas figures for the years 2024-2027 are based on stock price data as of year-end 2023 and projected consensus earnings estimates for the years 2024-2027.

Keeping in mind that pricing levels of firms are influenced by their exposure to energy-related factors, we grouped firms into two clusters to explore pricing dynamics: "energy-sensitive" and "not energy-sensitive".

Here, energy-sensitive firms are defined as firms whose performance and operations are significantly affected by fluctuations in energy prices, policies, or technological advancements in the energy sector.

In the energy-sensitive cluster, we categorized firms into "well placed" and "not well placed". In order to establish a sufficient level of objectivity to our scoring approach, we researched company information and publicly available information:

The highest score was given to firms having their own energy supply

The second highest score was given to firms actively engaged in energy transition efforts

The lowest score was attributed to the degree of commitment to energy efficiency and sustainability in production and product offerings.

ENERGY SENSITIVITY AND VALUATION DYNAMICS

Energy-sensitive companies span across various sectors, including automotive, transportation, manufacturing and utilities. Fluctuations in energy prices, driven by geopolitical tensions, supply-demand dynamics, and advancements in renewable energy technologies, directly impact the profitability and growth prospects of these firms.

Moreover, government policies and regulations play a pivotal role in shaping the operating environment for energysensitive companies. Subsidies, tax incentives and carbon pricing mechanisms can significantly impact the cost structure and competitiveness of companies reliant on fossil fuels.

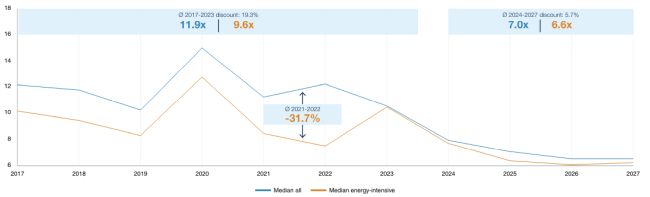

ENERGY-SENSITIVE FIRMS TRADE AT A DISCOUNT

As shown in figure 1, energy-sensitive firms traded at a discount of 19.3% on average, compared with the overall sample in our analysis, within the historical period 2017 to 2023. The spread widened in 2021 and 2022 to an average discount of about 31.7%, at a time when supply chain disruptions caused by Covid-19 lockdowns and the war in Ukraine stoked uncertainty among investors, increasing the risk premia for energy-exposed stocks. In the forecast period 2024 to 2027, the observed discount appears to be less prominent.

In a nutshell, energy-sensitive firms were exposed to higher energy costs which erode profit margins and diminish investor confidence, leading to lower valuation multiples than non-energy-sensitive firms.

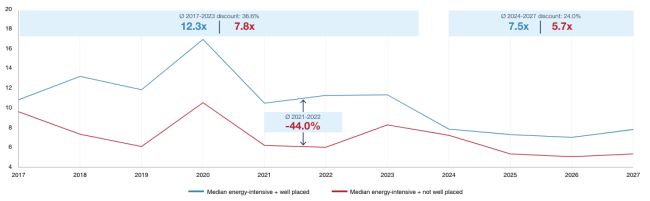

ENERGY-SENSITIVE FIRMS THAT MANAGE ENERGY RISKS EFFECTIVELY MAY COMMAND A PRICE PREMIUM

As shown in figure 2, within the cluster of energy-sensitive firms, those "not well-placed" faced an even more significant discount of 34% on average to their well-placed peers. This discount in trading pricing levels is also evident in the forecasting period with about 24.0% in the 2024-2027 period, compared to an average discount of about 36.6% in the historical period 2017-2023.

The "well-placed" firms even trade with a premium of 5.0% compared to the median of all analyzed companies in the period 2017-2027 (median of 10.6x vs. 10.1x). Investor confidence seems to be even more pronounced in the forecasting period 2024-2027, with a premium of about 7.0% (median of 7.5x vs. 7.0x) for well-placed energy-sensitive companies in the period 2024-2027.

This shows that energy-sensitive firms that effectively manage energy risks through their own energy supplies, efficiency measures or renewable energy adoption may command premium valuations, reflecting their resilience to energy market volatility.

THE PATH AHEAD

The valuation of energy-sensitive companies is subject to an interplay of factors, from economic, environmental and regulatory changes to investor sentiment. As the global energy landscape undergoes rapid transformation towards cleaner and more sustainable alternatives, companies that adapt to these changes and embrace energy transition opportunities are likely to enhance their long-term competitiveness and valuation prospects.

With Europe's biggest economy at the forefront of the endeavor to move to a low-carbon future, German businesses have a key role to play in shaping the transition.

By integrating energy risk management, sustainability initiatives and ESG considerations into their strategic agendas, companies can navigate market uncertainties and create value for stakeholders. By contrast, companies perceived as laggards in addressing environmental risks may face valuation discounts and reputational damage.

HOW A&M CAN HELP

All energy-sensitive companies face similar challenges:

- Ensuring energy supply at competitive costs – a huge challenge, especially in Germany

- Transforming the value chain to reduce CO2 emissions, with the aim of achieving carbon-neutral production.

- Being aware of the valuation impact of energy-related measures and proactively influencing market perceptions.

We observe that nearly every company has already established dedicated teams to address energy supply and value chain transformation, but concrete measures often still lag behind.

From our experience, building complete internal competencies is neither fast enough nor effective enough. Rather, it is about leveraging the existing ecosystem and bringing together relevant stakeholders. For instance, industrial companies can collaborate with energy producers, banks and financing institutions, specific startups, or private equity funds to tackle joint energy generation projects. This approach enables projects to be implemented more quickly and ensures profitability for each partner.

Originally Published 20 June 2024

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.