- in European Union

- in European Union

- within Family and Matrimonial, Insurance and Law Practice Management topic(s)

The Cyprus Tax Department announced an amendment to the tax treatment of health care plan premiums, effective May 30, 2024. This affects premiums paid by individuals for their own coverage and by employers for their employees, detailing deductions under Articles 9(1)(β) and 14(5) of the Cyprus Income Tax Law No. 118(I)/2002.

Key Provisions of the Cyprus Income Tax Law No. 118(I)/2002:

- According to Article 9(1)(β), the usual annual contributions paid by an employer to a fund under Article 14 will be deducted from each person's taxable income.

- According to Article 14(5), the tax department will grant a discount equal to the annual amount of the individual's paid premiums.

Health Care Plan Tax Deduction Guidelines:

For health care plans offered by insurance companies or employers' funds, the tax deduction will be granted as follows:

- Deduction from the taxable income of the employer for the annual contributions paid to such a scheme, up to the amount of 1% of the emoluments of employees who are members of the scheme.

- Deduction from the taxable income of the employee/self-employee, for the annual contributions paid to such a scheme with a restriction of up to the amount of 1.5% of the income subject to income tax of the individual.

- Deduction from the taxable income of the employer for the annual contributions paid to such a scheme.

- Deduction from the taxable income of the individual (employed / self-employed) for the annual contributions paid to such a scheme with a restriction of up to the amount of 2% of the income subject to income tax of the individual.

Additional information:

- The deduction for both the employer and the individual relates to all contributions paid to all schemes in which these persons participate.

- The deduction concerns contributions to cover health care and dependent persons, i.e., spouse and dependent children included in the scheme.

Income on which the deduction for a person is calculated:

An individual can receive a tax deduction for insurance premiums up to 1.5% or 2% (depending on the tax year) of their income from the following sources:

- For self-employed persons: profit from business activities after deducting allowable expenses and gross rent.

- Income from salaries, including overtime, allowances, and bonuses (excluding Ex Gratia payments and other non-taxable benefits).

- Any other income subject to income tax.

Equal contribution of employer and employee to a plan:

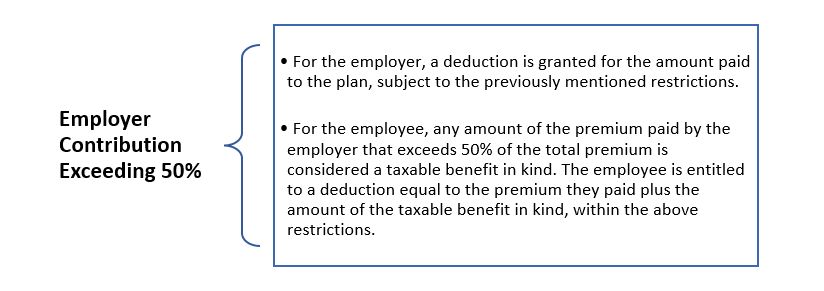

If the employer and employee each contribute the same amount (in other words, 50%) to cover the employee's health plan, both can claim a deduction for the amount they have paid, subject to the previously mentioned restrictions.

Unilateral employer's contribution to a plan:

To sum up, the recent amendment to the tax treatment of health care plan premiums by the Cyprus Tax Department affects both individuals and employers and provides clear guidelines for deductions and discounts, ensuring equitable treatment and compliance for health care plans offered by insurance companies or employers' funds.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.