Norway, much like the rest of the world, witnessed a very uncertain M&A and IPO market in 2022 after record levels of activity in 2020 and 2021. Some of this could be seen as a normalization and a return to pre-pandemic activity levels and toward historical averages, and there still is high activity in several sectors. Macro factors and geopolitics are changing rapidly and into new territories, and this will continue to affect the markets in 2023. Many transactions remain in progress, so with the right conditions, we could see some large transactions in both M&A and capital markets during the year.

About this report

In addition to insight provided by our M&A and capital markets' experts, this report is largely based on transaction data from Mergermarket. The Mergermarket database generally includes mergers and acquisitions where there is a transfer in ownership of an economic interest in an ongoing business concern, the deal value exceeds USD 5 million and the stake acquired is greater than or equal to 30% of the entire share capital.

All charts and figures are based on Mergermarket and Oslo Børs data.

Unless otherwise indicated, we define Norwegian deals as transactions where the target company is a Norwegian entity.

Key take-aways

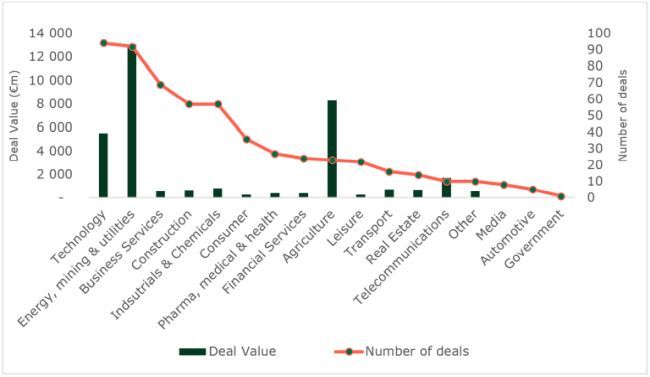

- The sectors with the largest representation in Norwegian deals in 2022 were Technology (94), followed by Energy (92) and Business Services (69), with the highest deal values being in Energy (€13.1bn), Aquaculture and fisheries (€8.3bn) and Technology (€5.5bn).

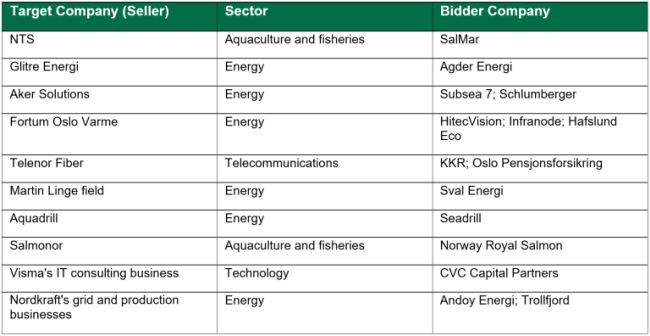

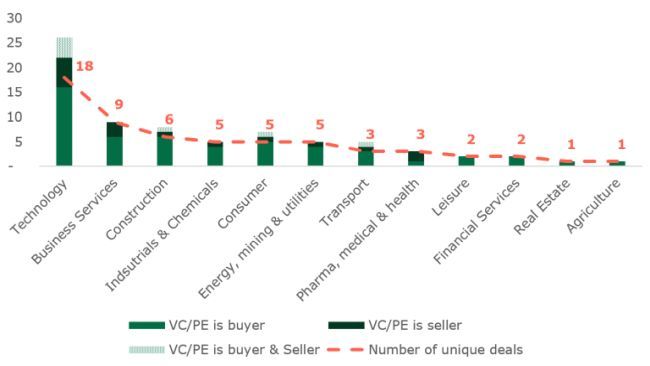

- Private equity continues to account for a large proportion of deal activity in Norway, including a significant percentage of the largest deals. Of the top 10 largest deals in 2022, three of them involve a private equity buyer and/or seller.

- The largest overseas investor nations have a familiar look, with Sweden (83), the US (46) and the UK (25) taking the top three spots, with the US ranked number one by deal value by some distance (€9.57bn).

- There continues to be a prominent-looking pipeline for Norway's ESG, energy and infrastructure sectors.

- The recently introduced special tax on salmon farming is likely to affect investments within the seafood sector.

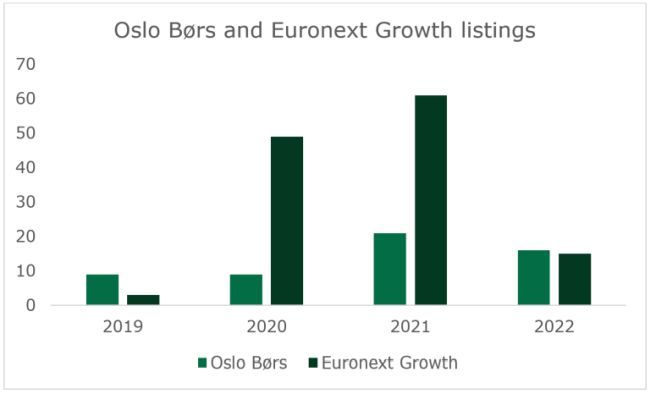

- Initial public offerings completed on Oslo Børs have decreased significantly with only two IPOs completed in 2022 compared to 8 initial public offerings in 2021. Euronext Growth listings have dropped off on a more dramatic level, with 15 listings in 2022 compared with the record high 61 in 2021.

- Capital raises in connection with listings on Oslo Børs or on Euronext Growth were carried out by 14 companies which largely reflect the established sectors in Norway, with oil & gas services dominating the list of most capital raised, while shipping, pharmaceuticals and energy being the most active.

- Pipeline for IPOs is promising for 2023, in particular the second quarter when market conditions are expected to pick up, and several of the IPO projects that have previously been put on hold are expected to re-initiate their plans to IPO in Oslo.

Deal activity remains high in spite of market volatility

Norway, much like the rest of the world, has witnessed a very uncertain M&A market in 2022 and seen a dramatic fall in M&A deal activity in 2022 when compared with 2021, although this could be seen as a normalization and a return to pre-pandemic activity levels (eg 2019 and early 2020) and toward historical averages, and there still is high activity in several sectors. Macro factors and geopolitics are changing rapidly and into new territories, and this does of course also affect the M&A market. Interest rates continue to increase – in Norway, most recently up to 2.75 per cent on 15 December – and inflation remains high. Buyers across the spectrum have also become more wary of surging energy prices and decreasing consumer spending power, and the companies this affects.

There are plenty of projects in the pipeline and plenty of cash in the hands of private equity and large corporates but banks are more cautious and the fundraising environment is facing additional headwinds. There are now added hurdles that make deals less attractive and people are more cautious, which has led to more postponements, taking additional time to consider options and a greater focus on preparation, planning and project management.

The most active sectors were Technology, Energy, Aquaculture and fisheries and shipping, a familiar list to those with knowledge of Norway's core historical sectors. Energy has long been a dominant sector in Norway, but the last 12 months has seen an increased focus on energy, and an increase in deals in a resurgent oil and gas sector, as well as ancillary services such as drilling.

Figure 1: Top 10 deals with Norwegian targets in 2022 by deal value

The most active and highest grossing sectors maintain a familiar feel with Technology (94), followed by Energy (92) and Business Services (69) rounding out the top three and the highest deal values being in Energy (€13.1bn), Aquaculture and fisheries (€8.3bn) and Technology (€5.5bn). Whilst the size of technology deals has decreased, with no technology deals featuring amongst the largest by deal value in 2022, demand for the best technology assets continues, both for consolidation and for business transformation purposes. The most notable surge was in the aquaculture sector, a particularly Norway-centric sector, which is referred to above.

Figure 2: Norway 2022 deal count and value by sector

Cross-border deal activity in Norway has increased further, with 81% of all deals involving a Norwegian target having a cross-border element. In the sectors with significant activity we have seen 90% of Business services, 88% of Technology and 77% of Energy deals by value respectively being cross-border, whilst of the sectors with significant deal activity, the sectors with lower cross-border representation were Transport (50%) and Real estate (65%). In terms of acquisition of Norwegian targets by foreign owners by deal number, we have seen a slight dropoff from 2021, from 50% to 45%% in 2022. For overseas investment into Norway, the 'big three', Sweden, the US and the UK retain their positions in the top three, reflecting their position as Norway's strongest long-term trading partners with Norway. The US ranked number one by deal value by some distance with deals totalling €9.57bn).

Figure 3: 2022 Top 5 sectors and inbound investment countries by deal number and value

Private equity has increased its footprint in Norway even further, recording the highest number of deals to date, with 94 PE deals involving a Norwegian target in 2022, worth €9.5bn in total. Six of the top 20 M&A deals by value involved a PE buyer or seller. This includes the acquisition by a consortium of HitecVision, Infranode and Hafslund Eco of a 50% stake in Fortum Oslo Varme and Visma's c. €800m sale of its IT consulting business to CVC Capital Partners.

Figure 4: Private equity/VC deal count by sector, based on any party being PE/VC and Norwegian target/buyer/seller

In addition, private equity firms with a need to put dry powder to work, have been increasingly engaging in smaller, minority and growth investments that are generally less risky and do not require access to credit markets and focusing on strengthening portfolio companies through add-on acquisitions or other strategies. This trend is expected to continue, along with corporate carve-outs, which could lead to more sponsored spin-offs. The sectors that are succeeding in the current market environment are creating attractive capital-raising or exit opportunities for businesses and investment opportunities for PE funds looking to deploy their excess dry powder.

While debt financing will remain a challenge, we expect to see a recovery in private M&A activity in 2023. Recalibration of valuation expectations and significant investment power among private equity firms are likely to drive the volume of transactions.

Sverre Sandvik, Wiersholm

We have started to see the re-emergence of public-to-private (P2P) transactions as a trend in 2022, with several major deals announced. Listed companies with upcoming financing needs and falling share prices in the current market in Norway has seen an increase in takeover activity. In Q2 we also saw the first takeover of a Euronext Growth-listed company. High growth, low revenue public companies and depressed valuations in the tech sector could see this activity continue to grow. There remains a strong level of interest and activity in P2P deals to date, albeit at a fairly sedate pace compared with more buoyant times.

As a result of lower share trading prices and lower liquidity in the shares, 2022 was a year with high take-private activity in Oslo and some of the largest deals in Norway involved public companies. The much anticipated takeovers of companies on Euronext Growth Oslo started, but we have also seen some of the larger P2Ps on Oslo Børs. There have also been a lot of earlier stage take private dialogues and processes which never reached the market, several of which were initiated by the board of directors of the companies. The combination of companies wanting to explore structured processes, a low Norwegian krone and investor dry powder, mean we will likely see more take-private processes in 2023, on Oslo Børs and Euronext Growth.

Anne Lise E. Gryte, Wiersholm

As access to debt financing has become more limited, we have seen more creativity when it comes to both settlement mechanics and deal structures in general. We have also seen that the sales processes are designed to cater for the processes taking more time and potentially also that they are not successful. Further, to explore new business opportunities, especially within the area of green transition, we have seen an increased interest in creating joint ventures and partnerships between strategics and between strategics and companies held by private equity funds. Such partnerships may be beneficial as they increase the financing available without necessarily increasing the funds invested by each party and they make it possible to combine and leverage the combined capabilities of the joint venture partners.

Looking ahead, there is a need for a recalibration of expectations on the sell side, with a reset in valuations likely to be a significant driver of M&A activity in 2023. To some extent, there is a 'waiting game' where some are waiting for one or two deals to successfully close, thereby confirming a new pricing point. The new year is likely to see valuations marked down thereby setting the tone for the year.

Although there is significant equity available to invest by private equity funds, we have experienced a somewhat reduced access to debt financing combined with the price for such funding having increased. This has again resulted in fewer transactions and a general reduction in the price of the targets. Strategic players with a strong balance sheet will in any case have the possibility to take a long-term view on an acquisition and may therefore be well placed to do more deals. And if availability improves, and macro factors and geopolitical factors stabilise, we see a great potential for significant M&A activity in general, especially in highly attractive sectors.

The macroeconomic situation affected Norwegian VC and PE funds negatively during 2022, with decreasing company valuations and a slower market for transactions. However, throughout, Norwegian active owner funds have appeared optimistic. We still have many funds with significant dry powder, and at the beginning of a new year there are signs that investment activity is increasing once again. Many fund managers expect a positive or neutral state of their business in 2023, seeing opportunities arising even in a difficult year.

Ellen Amalie Vold, NVCA

As we have seen, some sectors will be more affected than others, with the need to target companies – both venture and startups and more established larger companies alike – with an ESG focus and a focus on tackling the climate crisis and sustainability being high on the investor agenda. Investors will also be prioritising businesses which are able to absorb or counter the effects of inflation and rising costs (such as materials, labour and transportation), for example through price increases, as this will have a significant impact on growth potential going forward.

We also expect an increase in the number of deals in the seafood sector. This sector draws more and more attention internationally, and we see a stronger interest from both PE and infrastructure funds for investment opportunities in the aquaculture value chain. It will also be interesting to see how the recently introduced 40% special tax on salmon farming will effect investments in the seafood sector, including if this will increase the number of investments in seafood business not currently covered by the special tax, such as land based salmon farming. Although in force from 1 January 2023, the details of the special tax on salmon farming are yet to be determined by the government, and the final outcome of this will influence any effect the special tax will have for investments and fundraising in the seafood sector.

Equity capital markets subdued after records highs of 2020 and 2021

Going back at least 12 months, there has been a much discussed and highly anticipated pipeline of companies looking to list in Norway, with many companies pushing back their planned listings from 2021, this pattern repeating across all of 2022, which market conditions significant worsening during the year. Throughout 2022, continued volatility in the market and the knock-on effects have caused a significant number of postponements.

Norway's IPO deal numbers for 2022 represented a return to normality of sorts, and more expected activity levels based on historic numbers. There were 16 listings on Oslo Børs, compared to 21 across 2021, and 15 listings on the Euronext Growth market, aimed at small and mid-sized companies, which hit their peak in 2021 with 61. This represents the first time since 2019 that listings on the main board have exceeded those on the secondary market. A nuance to that, is that there were 14 companies that listed on Euronext Growth in 2020-2021, which transferred their listing to Oslo Børs in 2022. Generally, no capital is raised in connection with these uplistings, and they are thus not subject to market volatility.

Offerings totaling approximately NOK 13bn were completed in 2022, compared to approx.. NOK 38bn in 2021. The most notable listing in 2022 was the NOK 8.9bn main board IPO of Norwegian oil & gas company Vår Energi, the second largest IPO in Europe last year. The remaining NOK 4bn was raised in offerings spread across the remaining 13 companies completing IPOs or offerings in connection with new listings. Interestingly, NOK 4bn of these funds were raised by companies within shipping (Gram Car Carriers ASA) and oil and offshore services companies (Shelf Drilling, Noram Drilling and Dolphin Drilling), which supports the trend of investor appetite being focused around the more traditional sectors.

2022 started off with a lot of optimism. We were prepared for another busy year, with larger and complex IPOs and listings planned. There was a strong line-up of larger IPOs being planned for later in the year, but as 2022 arrived, most deals were pushed due to geopolitical and economic factors. Deal optimism resulted in 33 IPOs and listings arriving in waves throughout 2022, with three drilling companies listing in October and six IPOs and uplistings completing in December. However, we did not see the larger and more complex IPOs launching in 2022. Wiersholm maintained its position as the leading capital markets firm with 13 IPOs and listings in Norway in 2022.

Anne Lise E. Gryte, Wiersholm

Last year saw a shift away from "growth" stories after the heated activity from 2020 and 2021, with greater focus on companies that show sustainable profits and free cash flows, in sectors such as energy. The capital markets in Norway continue to see high activity from oil and gas and ancillary businesses, with drilling companies in particular being highly active within capital raisings and new listings in 2022. We have seen an increase in emergency capital raises and rights issues, with larger discounts reflecting the difficulty in raising funds at or close to market value. New investors are difficult to attract and existing investors may struggle with lower valuation as a result of lower share prices on the stock exchange.

2020 and 2021 were two extraordinary years with very high listing activity at Oslo Børs. In a historical perspective, 2022 ended up being a more normal year despite uncertainty and geopolitical instability influencing the capital markets.

Øivind Amundsen, Oslo Børs

When compared with global markets, the Oslo Børs main index remained resilient in 2022, with only a 1 per cent fall in value from the start of the year. This resilience was heavily reliant on the particularly strong performance of both the oil and gas and shipping sectors, core traditional sectors in Norway. Beyond these performers, the fall in value of companies on the main board was generally in line with similar falls around the world. Accordingly, a greater level of acquisitions were expected in 2022 than materialized, likely down to the uncertain market conditions.

We have observed a significant increase in uplistings from Euronext Growth to Oslo Børs, this progression representing a core aim of the Growth Market. 14 of the 16 listings on the main board in 2022 were transfers from the secondary market, and since 2020, there have been 32 such transfers. Many growth companies are committing to doing so within a year of their IPO, and are adopting this approach in order to expedite short-term access to capital and then, after a period of growth, secure larger investors more focused on companies on the main list. The fact that a majority of the companies that have uplisted have a market cap above NOK 2 billion (€200m) reflects this strategy. This is noteworthy as an uplisting is not necessarily dependent on or reflective of the market because no capital is normally raised, and it is more a question of fulfilling listing requirements. Accordingly, IPOs (not uplistings) and new Euronext Growth listings are a better measure of market activity and prosperity.

There has been a decrease in the trading volume on Euronext Growth Oslo since the peak in 2020, as the largest and most liquid companies have transferred to the Main Market to secure larger investors more focused on companies on the main list.

Øivind Amundsen, Oslo Børs

With the Russian invasion in Ukraine and the subsequent energy crisis, the sector breakdown of listings in 2022 largely reflects a return to the more traditional and predominant established sectors in Norway, with technology (eight transactions), shipping (three) and oil & gas and oil & gas services (three) being the most active. Notably, of the technology sector listings, a number operate in clean technology and health technology, which continues a strong recent trend in Norway.

It should be noted that, in general, processes have been delayed rather than cancelled, and that it is not only market conditions responsible for the pushbacks, but also strategic measures, such as planning and executing further pre-IPO acquisitions, preparing carve-outs, or doing further preparation of the company. The general consensus is that the equity capital markets in Norway are going through a quieter period, which is to be expected with the global market volatility and uncertainty.

Figure 5: Euronext Growth and OSE listings 2019 to 2022

In recognition of the need to meet sustainable investment goals, in May 2022, Euronext launched the OBX ESG index. The index identifies the 40 blue-chip companies that demonstrate the best Environmental, Social and Governance (ESG) practices in Norway, to meet the demand for investable ESG alternatives in the Norwegian market. Euronext now have five ESG indices across its markets, and recently launched the CAC SBT 1.5* Index investing solely in companies within the SBF 120 Index that have emissions reduction targets approved to be in line with the 1.5°C goal of the Paris Agreement. The launch of this index is a further strong signal of the transition towards responsible investment.

Looking out to 2023, whilst the market remains very uncertain at this point, continued postponements should result in a healthy pipeline for 2023, with a preference for main market Oslo Børs listings, large carve-out IPOs and transfers on to the main market from Euronext Growth. If everything that is currently in planning progresses into listing processes, the market will be very busy and we should expect to see a number of the large deals happen. However, predictions remains extremely challenging.

As listings slowed because of the market conditions in 2022, the trading volumes have continues increasing. We saw record numbers of trading in 2020 and 2021 as volatile markets sparks more trading activity. In 2022 we saw an increase of nearly 14 percent in the trading volume compared to 2021.

Øivind Amundsen, Oslo Børs

2022 ended up much on the same note as it started, with a lot of optimism and a promising pipeline for 2023. As we enter the second month of 2023, this positive trend has been further strengthened, and the perception is that the stars will be aligned for large IPOs in 2023, in particular pre or post-summer.

Anne Lise E. Gryte, Wiersholm

An important year for merger control in Norway

2022 has seen a steady flow of merger activity. Among the notable transactions from a Norwegian-linked perspective are the approval by the European Commission of the merger between the mobile payment companies MobilePay and Vipps, and the salmon producer SalMar's acquisition of NTS conditional on commitments where NTS undertook to divest one of its subsidiaries, active in the market for the production of Icelandic farmed salmon.

Cases where a decision of the NCA has been overturned

The DNB/Sbanken saga came to an end in March 2022. The Norwegian Competition Authority (the "NCA") had blocked the merger due to alleged adverse effects on the market for distribution of mutual funds to consumers. DNB appealed the NCA's decision to the CAT, who reversed the NCA decision – allowing the transaction to go through. The CAT criticized the NCA for not sufficiently appreciating the competitive pressure from remaining competitors in the market. Indeed, the CAT held that the remaining market players could replace the competitive pressure from Sbanken.

Following the Supreme Court hearing in January 2023 judgement is now pending in the Schibsted/Nettbil-case. The hearing took place following the Court of Appeal's decision to overturn the former CAT (and original NCA decision) to block the merger. The outcome of this case could be central in determining the future strategy of the NCA in merger cases, namely their approach to the fact finding exercise and the breadth of evidence to be considered, since a key matter at issue in this appeal was the reliance on internal documents over economic analysis.

In addition the case can have wide reaching implications for the treatment and risk assessment of so-called "gap cases" where the target does not have turnover and thresholds are not met, nor is the company dominant.The outcome is also interesting from a separation of powers perspective, of how willing (or not) the courts are to intervene and review decisions of the competent authorities going forward.

Approval decisions – subject to conditions

The NCA has issued three approval decisions subject to conditions.

The first concerned Royal Unibrew's acquisition of Hansa Borg. Here the NCA was concerned that the transaction would impede effective competition in the market for cider and flavoured alcoholic beverages as it would entail a reduction from three to two large providers of the products in the market. Hence it is not surprising that the NCA demanded commitments. The case ended with Unibrew offering to terminate certain distribution contracts.

The Nortura/Steinsland case, a relatively novel one, concerned a vertical merger, where the NCA was concerned that Nortura's acquisition of Steinsland (one of two producers in Norway of day-old hatching chickens) would foreclose Nortura's competitors in the downstream egg market. The case was resolved by the parties accepting behavioural commitments, requiring them to source eggs and sell day-old hatching chickens on non-discriminatory conditions.

The Royal Unibrew case is quite traditional from a merger control perspective, whereas the Nortura/Steinsland is a rare example of the NCA investigating a vertical merger. The case seemed to raise issues since Steinsland and Nortura had significant market shares in their respective markets. The case also shows that behavioural commitments still are relevant in vertical cases.

The NCA also cleared the acquisition by Bewi of Jackon Holding, subject to conditions,. The parties both produce and sell insulation and packaging products made of cell plastics (mainly expanded polystyrene and extruded polystyrene). The NCA concluded the merger would significantly hinder effective competition in the market for EPS fishing boxes in Troms and Finnmark. To meet these concerns, remedial measures to divest Jackon's fish box factory in Alta, as well as Jackon's stocks in the fish box factory Kasseriet in Gratangen, were implemented.

Finally, the NCA continues to use its competence to impose reporting obligations for transactions below the threshold values, and in 2022 imposed reporting obligations on two transactions Axess Logistics AS – Auto Transport Service AS (eventually dismissed) and Skion Water International GmbH – Enwa AS.

It remains to be seen whether both the overturn of the NCA's decision in Schibsted/Nettbil and the CAT's decision to reverse the NCA's decision to block the DNB/S Banken merger earlier in 2022 will lead to a paradigm shift in the NCA's approach in regards to merger control. The much awaited Supreme Court judgement in Schibsted/Nettbil may address that question.

Infrastructure M&A on the rise

In Norway, infrastructure M&A has seen a particular surge in popularity in the last 12 months, and a number of infrastructure deals represent some of the largest M&A deals in Norway in 2022, including a joint venture of Hafslund Eco, Infranode, and HitecVision acquiring Fortum Oslo Varme, Norway's largest district heating provider,the sale by Telenor of a 30% stake in its Norwegian broadband fibre business to a consortium including KKR and Oslo Pensjonforsikring and the sale of the shares in Sola Bredbånd to Infranode.

The joint venture behind the Fortum Oslo Varme-deal included a clear carbon capture target, which will be crucial for the City of Oslo to achieve its ambitious climate goals of reducing emissions by 95 per cent by 2030. The latter deal is reflective of a recent trend in Europe of divesting stakes in telecoms tower assets in order to ensure capital efficiency in a region where such sales are comparatively relatively unexplored.

New momentum behind wind, both onshore and offshore

There has been significant recent activity in offshore wind, with the size and complexity of future projects necessitating international companies forming consortia, a significant number of which we are assisting. There have been a number of delays to the issuing of licences for new offshore wind projects. The developmental area Sørlige Nordsjø II (bottom fixed) has been split in several phases, where the plan is to award acreage for the first phase around mid-2023. The development area at Utsira Nord (floating) will be split into three areas, with all three areas being allocated late 2023, but the recipients will likely need to compete for subsidies in a later competition. The government has stated publically that they intent to open additional areas for development in the future, but they will likely not process this procedure until the Sørlige Nordsjø II and Utsira Nord areas have been allocated.

With onshore wind, two things happening to promote new projects and inevitable investment opportunities: a clarification of the rules and an increased understanding that new power production is an urgent necessity in Norway. New regulation for the onshore wind concession regime has combined with a shift in the political landscape, meaning there is now a concerted focus on how to ramp up activity in this area again as soon as possible. 2022 saw significant activity in the second hand M&A market in wind production and we expect that greenfield developments and investments will become more relevant once the government starts to process onshore concessions again. Additionally, there are currently several companies trying to develop solar power in Norway, and concessions have already been granted to some early stage companies. We foresee quite high activity in this sector during the coming years.

A trend that gathered pace in 2022 saw industrial power producers engage in new types of energy uses and infrastructure, with joint ventures between these industrial producers and capital owners being a means of access to investment capital and risk reduction. Recent deals include the aforementioned joint venture acquisition of Fortum Oslo Varme,HitecVision and Nordkraft's joint investment in the small-scale hydropower company Cadre, Ringeriks-Kraft AS' (Kople AS) partial sale of the EV Infrastructure business to Cube Infrastructure and the sale of the remaining 30% of Recharge AS from Fortum to Infracapital. We also foresee additional activities within this sector in the coming year. Such is the level of interest and investment in this area, the Norwegian Competition Authority in 2022 imposed disclosure requirements for any transaction within the electric vehicle charging infrastructure sector.

Money continues to flow into green energy technology companies, including clean battery production, electric vehicle charging infrastructure, industrial energy recycling and battery storage. Reflecting the continue strong interest in such companies notwithstanding market conditions, Euronext Growth-listed Kyoto Group AS, a thermal battery storage company, in late 2022 received an additional capital injection.

More ESG legislation and a greater focus on security

Corporate Sustainability Reporting Directive (CSRD)

An upcoming legislation from the EU is the Corporate Sustainability Reporting Directive (CSRD), which represents both an amendment to and an extension of the existing Non-Financial Reporting Directive (NFRD). The CSRD is a new directive obliging all large companies and all companies listed on regulated markets (except listed micro-enterprises) to report on their climate and environmental impact, and requires the audit (assurance) of reported information. According to the European Commission, the reporting standards will be consistent with the ambition of the European Green Deal and with Europe's existing legal framework, the Sustainable Finance Disclosure Regulation and the Taxonomy Regulation. The Council gave its final approval to the CSRD in November.

National Security Act

As a result of the ongoing war in Ukraine, there has been an increased awareness in Norway concerning security threats. Due to the surge in hybrid warfare, the private sector must prioritise security work in order to reduce risk for companies, society and, in particular, the valuable assets that private companies control. The National Security Act aims to prevent, detect and counter activities threatening national sovereignty and security and several new companies have been made subject to the Act. There have been proposed amendments to expand the remit of the Act, but it is uncertain when the legislative process will move forward. The digitalisation of Norwegian society represents security challenges and risks. In 2022, there has been an increase in the number of attempts to compromise Norwegian businesses. Three sectors in particular have been exposed to various types of cyber attacks: technology companies, research and development and public administration bodies.

Tax developments

Increased taxation of profit from natural resources

On September 28 the government presented a proposition for new rules on taxation of profit from natural resources ("resource rent-taxation"). They proposed a resource rent taxation on fish farming and onshore wind power, as well as an increase in the resource rent-taxation on hydropower and an extraordinary tax on wind and hydropower. The proposal is largely due to assumed extraordinary income in these industries and the government's desire to distribute profits from natural resources more effectively.

Exit taxation

On 29 November 2022 the Government presented new rules on exit taxation. When a taxpayer ceases to be considered a resident for tax purposes in Norway they become liable to taxation on shares as though the shares were realized ("Exit tax"). The payment of such tax liability can however be postponed. Previously, the liability to pay exit-tax would become nulled after 5 years. The 5-year rule is now revoked, and therefore the liability to pay Exit tax will now only be nulled if the taxpayer becomes resident in Norway for tax purposes again.

Working group has reviewed the Norwegian tax system

Previously, the government nominated a working group (the "Tax Committee") to review the tax system. On December 19 the Tax Committee presented its report to the Minister of Finance. This report recommends a series of changes to the Norwegian tax system. Note however, that these proposed changes have not been legislated yet, and are at this stage merely recommendations. Whether these proposed changes will be legislated or not in the future, is uncertain. Some of the propositions are as follows:

Participation exemption method

Shareholders who are limited liability companies (and certain similar entities) resident in Norway for tax purposes ("Norwegian Corporate Shareholders") are largely exempt from tax on dividends distributed from the Company, pursuant to the Norwegian participation exemption method (Nw. fritaksmetoden). However, unless the Norwegian Corporate Shareholder holds more than 90% of the shares and the voting rights of the company, 3% of the dividend income distributed to the Norwegian Corporate Shareholder is taxable as ordinary income at a rate of 22%, resulting in an effective tax rate of 0.66% (22% x 3%), the "three percent rule".

Liquidation gain subject to withholding tax

Currently, liquidation of a company is treated as a realisation. As a result, payments from the liquidation of a company are taxed as capital gains, and not as dividends. For foreign shareholders, this classification has created an opportunity for tax planning and adjustments, as foreign shareholders are generally only subject to Norwegian WHT on dividends, and not on capital gains.

The committee believes it is unfortunate that foreign shareholders have the opportunity to avoid Norwegian withholding tax on dividends through adaptations to these rules. The committee therefore proposes that these payments on liquidation are treated as dividends instead of gains.

Withholding tax on interest and royalty payments

From 1 July 2021, Norway introduced withholding tax on interest payments. A Norwegian debtor is liable to withhold 15% tax on gross interest payments to the extent the creditor is both (i) a related party to the issuer and (ii) tax resident in a low-tax jurisdiction. A "related party" is a company or other legal entity which controls, is controlled by, or is under common control with, the issuer. "Control" means the direct or indirect ownership of 50 % or more of the issued share capital or voting rights. Further, a "low-tax jurisdiction" is a jurisdiction in which the effective taxation of the overall profit of the company is less than two thirds of the effective taxation such company would have been subject to if it had been resident in Norway. A recipient and beneficial owner of interest payments affected by the withholding tax may however be protected by a tax treaty, typically reducing the tax rate on interest payments.

The withholding tax rules also apply to royalty payments. This includes royalty payments related to use of right to use intellectual property and payments related to use of the right to use ships, rigs and other vessels, airplanes etc.

The committee believes that the scope of withholding taxes should be expanded. The committee recommends that the scope of withholding taxes on interest, royalty and rental payments for certain physical assets be extended so that they are no longer limited to payments to low-tax countries. Furthermore, the committee recommends that the current exception rule for payments to companies that are genuinely established and conduct genuine economic activity within the EEA be repealed, and replaced by a net taxation method that ensures that companies subject to withholding tax within the EEA are given the right to deduct costs associated with the income subject to withholding tax.

Tonnage tax scheme for shipping companies

Companies within the tonnage-tax scheme for shipping companies are exempt from taxation of more precisely defined shipping income, and must instead pay a tonnage tax (in addition to tax on net financial income). The purpose of the shipping tax scheme is to prevent the relocation of Norwegian shipping companies.

Repayment of paid-in capital

The committee believes that there is a need to consider changes to the rules on taxation of repayment of paid-in capital. The main problem with the current rules is, in the committee's view, that the tax position is linked to paid-in share capital and the premium on the individual share, regardless of the change of ownership and the buyer's input value of the share.

The proposed solution involves changes in existing tax positions. Due to the connection between repayment of paid-in capital and the shares' input value, the outlined proposals will initially involve a shift in the time of taxation. The committee states that a closer assessment must be made as to whether this indicates that transitional rules should be provided.

VAT

The majority of the committee proposes that the current VAT rules that give exemption and reduced rates to certain industries or consumers be repealed, and introduce a general rate of 25% VAT that applies in all circumstances.

Outlook for 2023

Looking ahead, the new year is likely to see valuations marked down thereby setting the tone for the year. The same deal drivers exist as those 12 months ago, with good opportunities remaining, and a possible catch-up effect from 2020 and 2021 which could see significant M&A activity, especially in highly attractive sectors and particularly if macro factors and geopolitical factors stabilise. Corporates are looking beyond the current climate to focus on long-term strategy and growth, which is supported by access to capital. For private equity, the picture remains unchanged in terms of significant dry powder in the Nordics and further afield. The emergence of a recessionary climate will provide acquirers with strong balance sheets or capital to deploy with even more opportunities for deal-making.

In the capital markets, whilst the market remains very uncertain at this point, continued postponements should result in a healthy pipeline for 2023, with a preference for main market Oslo Børs listings, large carve-out IPOs and transfers on to the main market from Euronext Growth. If everything that is currently in planning progresses into listing processes, the market will be very busy and we should expect to see a number of the large deals happen.

Originally published 3 February 2023

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

We operate a free-to-view policy, asking only that you register in order to read all of our content. Please login or register to view the rest of this article.