The Ministry of Financial Services and Commerce in the Cayman Islands announced today that awaited changes to the beneficial ownership reporting regime (BORR) have come into effect on 31 July 2024. "These are the most significant changes to the beneficial ownership reporting regime since it was introduced in the Cayman Islands in 2017," notes Lucy Frew, partner in the Regulatory & Risk Advisory group at Walkers. "Many entities that previously had few or no obligations will have to take steps to comply."

What is changing?

strong>The Beneficial Ownership Transparency Act, 2023 (BOTA) updates the BORR in line with evolving international standards and expands the scope of the BORR. Cayman Islands companies, limited liability companies, limited liability partnerships, foundation companies and, for the first time, exempted limited partnerships and limited partnerships (togetherLegal Persons) are in scope of the BOTA. Trusts and registered foreign companies continue to be out of scope.

Many Legal Persons that were previously out of scope or exempt will now need to identify their registrable beneficial owners (RBOs) and provide details of such RBOs to their corporate services provider (CSP). Entities that were previously out of scope or exempt include, for example, Cayman Islands general partners, carry vehicles, debt issuance vehicles, special purpose vehicles, blockers, trading subsidiaries, entities registered under the Securities Investment Business Act or Virtual Assets (Services Providers) Act and others.

Are there alternatives?

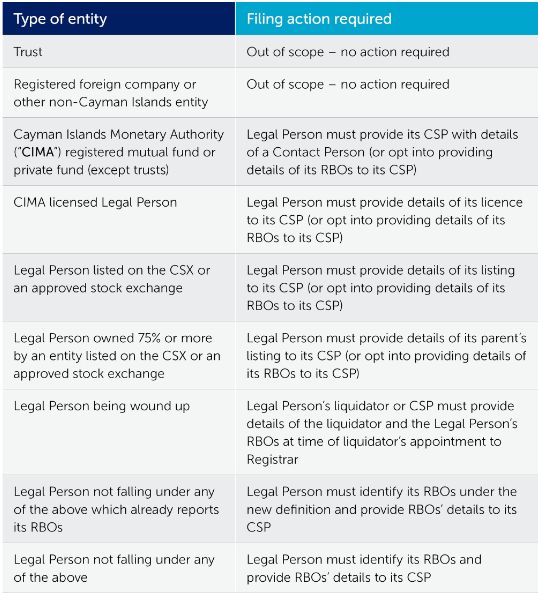

Legal Persons which are registered as mutual funds or private funds may provide their CSP with details of a Contact Person (see below) rather than their RBOs. Legal Persons licensed under a "regulatory law" or listed on the Cayman Islands Stock Exchange or an approved stock exchange or which are a subsidiary of an entity listed on such an exchange may provide their CSP with details of their licensed or listed status rather than their RBOs. Alternatively, such Legal Persons may opt in to providing details of their RBOs.

What does my Cayman entity have to do?

A brief summary of initial actions is below.

Who can be appointed as Contact Person?

Only an entity licensed by or registered with CIMA for providing beneficial ownership information (typically a CSP) or a fund administrator that holds a Mutual Fund Administrators Licence under the Mutual Funds Act is eligible to be appointed as Contact Person. Walkers Professional Services is able to act as Contact Person subject to agreement. Please get in touch with one of the contacts listed below or your usual Walkers contact if you wish to discuss.

What is the timing?

The BOTA came into force on 31 July 2024 but enforcement relating to the new requirements in the framework will be suspended until early next year. Industry members are to suspend filing beneficial ownership information under the previous framework until the Ministry notifies them to recommence filing under the new framework. Beneficial Ownership Transparency Regulations have been issued and Guidance on Complying with Beneficial Ownership Obligations is being made available.

What is the BORR?

To comply with international standards and commitments to combat money laundering, tax evasion and terrorist financing, the Cayman Islands implemented a BORR in 2017 which requires each in-scope entity to instruct its CSP to establish and maintain a register of beneficial ownership information and file it with the Registrar of Companies. The Registrar maintains a search platform that enables specified Cayman Islands enforcement agencies and, on request, the United Kingdom, to access information on beneficial ownership registers.

Is further guidance available?

Yes – please register here to receive our detailed advisory on what the changes mean. Please also register here to receive our decision steps and FAQs to help make it easy for you to determine whether your entity is required to identify its RBOs and, if so, how to do so.

Our extensive beneficial ownership reporting regime compliance experience means we are always on hand to help. Please get in touch with one of the contacts listed below or your usual Walkers contact if you wish to discuss.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.