- with readers working within the Utilities industries

- within Criminal Law topic(s)

Key takeaways

- Changes to the beneficial ownership regime took effect on 31 July 2024 and enforcement relating to the new requirements is suspended until early 2025.

- Many entities that previously had few or no obligations will have to take steps to comply.

- Industry members are to suspend filing under the previous framework until notified to recommence filing under the new framework.

Table of Contents

What is the beneficial ownership regime?

What is changing?

Which entities are in scope?

What action do entities need to take?

What is the timing?

What type of entity can a CIMA registered private fund or a CIMA

registered mutual fund appoint as Contact Person?

What is the role of the Contact Person?

What is a Registrable Beneficial Owner?

Who is a Beneficial Owner?

What is a Relevant Legal Entity?

Is further guidance available?

What obligations apply to Legal Persons which benefit from an

alternative route to compliance have?

What obligations apply to Legal Persons which do not benefit from

an alternative route to compliance?

What obligations do Corporate Service Providers have?

Is the beneficial ownership information public?

Who can access beneficial ownership information?

Which other countries can request beneficial ownership information

under the BOTA?

Are Legal Persons required to implement any special reporting

software?

Are Legal Persons or others liable for any penalties?

Is anything changing for CSPs?

Next steps

What is the beneficial ownership regime?

To comply with international standards and commitments to combat money laundering, tax evasion and terrorist financing, the Cayman Islands implemented a beneficial ownership reporting regime ("BORR") in 2017 which required each in-scope entity to instruct its corporate service provider ("CSP") to establish and maintain a register of information required under the BOTA ("Register") and file it with the Registrar of Companies or Registrar of Partnerships, as applicable (together the "Registrar"). The Registrar maintains a search platform that enables specified persons to access information on Registers.

What is changing?

Following industry consultation, the Beneficial Ownership Transparency Act (the "BOTA") was gazetted on 15 December 2023, updating the BORR in line with evolving international standards, and commenced on 31 July 2024. The BOTA expands the scope of the BORR, meaning that many entities which previously had few or no obligations will have to take steps to comply.

Which entities are in scope?

Cayman Islands companies, limited liability companies, limited liability partnerships, foundation companies and, for the first time, exempted limited partnerships and limited partnerships (together "Legal Persons") are in scope of the BOTA. Trusts and registered foreign companies (for example, US general partners of Cayman Islands partnerships) continue to be out of scope.

What action do entities need to take?

Many Legal Persons that were previously out of scope or exempt will now need to identify their registrable beneficial owners ("RBOs") and provide details of such RBOs to their CSP. Entities that were previously out of scope of exempt include, for example, Cayman Islands general partners, carry vehicles, debt issuance vehicles, special purpose vehicles, blockers, trading subsidiaries, entities registered under the Securities Investment Business Act or Virtual Assets (Services Providers) Act and others.

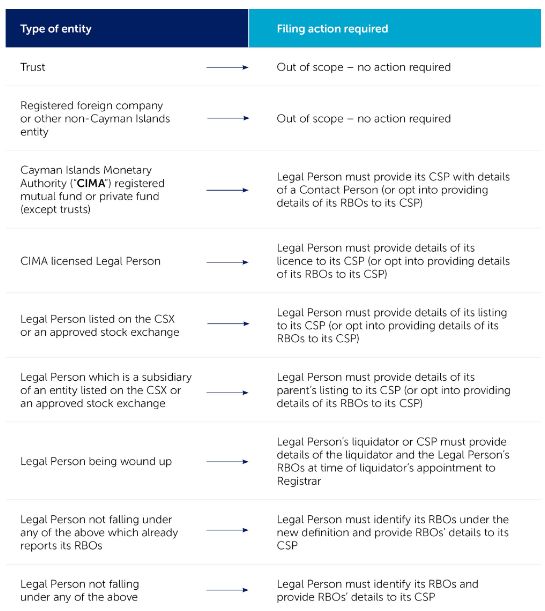

Legal Persons which are registered with the Cayman Islands Monetary Authority ("CIMA") as mutual funds or private funds may provide their CSP with details of a Contact Person (see below) rather than their RBOs. Legal Persons licensed under a "regulatory law" or listed on the Cayman Islands Stock Exchange ("CSX") or an approved stock exchange or which are a subsidiary (as defined in the BOTA) of an entity listed on such an exchange may provide their CSP with details of their licensed or listed status rather than their RBOs. Alternatively, such Legal Persons may opt in to providing details of their RBOs. A brief summary is below.

For further considerations arising from the BOTA for entities previously out of scope or exempt, please see our January 2024 advisory.

What is the timing?

The BOTA came into force on 31 July 2024 subject to a grace period for enforcement relating to the new requirements which will be suspended until early next year. Industry members are to suspend filing beneficial ownership information under the previous framework until the Ministry notifies them to recommence filing under the new framework. Beneficial Ownership Transparency Regulations have been issued and Guidance on Complying with Beneficial Ownership Obligations is available via the Cayman Islands Registry website.

What type of entity can a CIMA registered private fund or a CIMA registered mutual fund appoint as Contact Person?

Only an entity licensed by or registered with CIMA for providing beneficial ownership information (typically a CSP) or a fund administrator that holds a Mutual Fund Administrators Licence under the Mutual Funds Act is eligible to be appointed as Contact Person. Walkers Professional Services is able to act as Contact Person subject to agreement. Please get in touch with one of the contacts listed below or your usual Walkers contact if you wish to discuss.

What is the role of the Contact Person?

The Contact Person is a liaison who facilitates communication between the Legal Person and the competent authority. The Contact Person is not required to maintain a beneficial ownership register or beneficial ownership information for the Legal Person to which it is appointed but must have access to such information in order to be able to provide the competent authority with any requested beneficial ownership information within 24 hours of a request being made or such other time as the competent authority may reasonably stipulate.

What is a Registrable Beneficial Owner?

A RBO in relation to a Legal Person means an individual Beneficial Owner or a Reportable Legal Entity ("RLE").

Who is a Beneficial Owner?

A "Beneficial Owner" means an individual who:

(a) ultimately owns or controls, whether through direct or indirect ownership or control, 25% or more of the shares, voting rights or partnership interests in the Legal Person;

(b) otherwise exercises ultimate effective control (in other words, through a chain of ownership or other than direct control) over the management of the Legal Person; or

(c) is identified as exercising control of the Legal Person through other means.

Together, conditions (a) to (c) are referred to as the "Specified Conditions".

However, an individual that operates solely in the capacity of a "Professional Advisor" (including a lawyer, an accountant or a financial advisor who provides advice or direction in a professional capacity) or a "Professional Manager" (including a liquidator, a receiver or a restructuring officer who exercises a statutory function) are deemed to not meet the Specified Conditions.

Governments, government departments, international organisations whose members include two or more countries or governments and public authorities are all deemed to be individuals.

Where no individual meets any of the Specified Conditions but the trustees of a trust meet one of these Specified Conditions in relation to the Legal Person, the trustees of the trust are the Beneficial Owners of the Legal Person if they have ultimate effective control over the activities of the trust other than solely in the capacity of a Professional Advisor or a Professional Manager.

Where there is no individual who meets the definition of a Beneficial Owner on any of the above grounds, the Legal Person's Senior Managing Official shall be identified instead. A Senior Managing Official includes a director or a chief executive officer of the Legal Person. Unlike an individual Beneficial Owner, a Senior Managing Official may be a Professional Advisor or a Professional Manager. Legal Persons may have multiple directors but only one will be the Senior Managing Official, who is generally the one who exercises more authority (such as a managing or executive director or chairman).

What is a Relevant Legal Entity?

A RLE means another Legal Person that if it were an individual would be a Beneficial Owner of the first Legal Person. An RLE through which any individual Beneficial Owner or another RLE indirectly holds a Relevant Interest in the first Legal Person is an RBO.

It is not necessary for a Legal Person to report individual Beneficial Owners of such RLE, since the RLE will have its own reporting obligations under the BORR through which such individual Beneficial Owners are identified to the Registrar.

Is further guidance available?

Yes – please register here for our decision steps and FAQs to help you determine whether your entity is required to identify its RBOs and, if so, to identify its RBOs.

What obligations apply to Legal Persons which benefit from an alternative route to compliance?

Provide written confirmation: CSPs of Legal Persons which benefit from an alternative route to compliance are required to provide written confirmation to the competent authority as follows:

- for CIMA registered investment funds, the CSP must provide the contact details of a Contact Person;

- for Legal Persons licensed under a Cayman Islands regulatory law, the CSP must provide the regulatory law under which the Legal Person is licensed;

- for Legal Persons listed on the Cayman Islands Stock Exchange or an approved stock exchange and their subsidiaries, the CSP must provide the name and jurisdiction of the stock exchange; and

- for Legal Persons which are subsidiaries of an entity listed on the CSX or an approved stock exchange, the CSP must provide details of its parent's listing.

Keep information up to date: Where a Legal Person that benefits from an alternative route to compliance becomes aware that any information in the written confirmation has ceased to be true, it must, within 30 days, provide its CSP with an amended written confirmation correcting the erroneous information and providing any additional information required, and instruct its CSP to file the amended confirmation with the competent authority.

What obligations apply to Legal Persons which do not benefit from an alternative route to compliance?

Establish and maintain a beneficial ownership register: A Legal Person that does not benefit from an alternative route to compliance is required to establish and maintain a Register which lists its RBOs. The Register must be kept at the Legal Person's registered office as provided by its CSP. As part of this process, Legal Persons must identify all RBOs.

Serve notice on RBOs and others where necessary: A Legal Person that does not benefit from an alternative route to compliance must serve notice in writing on the RBOs it has identified (and on any person that it knows or has reasonable cause to believe is a RBO). The notice will require the RBO, within 30 days of receiving it, to confirm whether or not it is a RBO and, if it is, to confirm or correct the information in the notice. There is also a legal duty on a RBO to supply the relevant information.

The Legal Person does not have to give notice if it knows that the individual or entity is not a RBO or if it has already received all the required particulars in relation to that RBO. Further, the RBO does not have to supply information if it is legally privileged or if it would contravene applicable law.

Provide required particulars of RBOs: The BORR prescribes specific information that must be recorded on the Register. For individuals, this includes their name, address, date of birth, nationality (and an indication of any additional nationalities), details from their unexpired and valid passport, driver's licence or other government issued identification document, the nature in which the individual owns or exercises control of the Legal Person, and the date on which the individual became (or ceased to be) a RBO. For RLEs, this includes their name, address of registered or principal office, legal form, governing law, the nature of the RLE's ownership or its exercise of control of the Legal Person, register in which they are entered and registration number (if applicable) and the date on which the RLE became (or ceased to be) a RBO.

If the Legal Person is in the process of taking reasonable steps to find out if there is anyone who is a RBO, or the required particulars of a RBO are yet to be confirmed, the Register may state "Pending". If the Register states "Pending" for three or more calendar months, this will constitute prima facie evidence of a breach of the BOTA.

Keep information up to date: If a Legal Person becomes aware of a relevant change with respect to a RBO, it must provide a notice to the RBO, as soon as reasonably practicable (and no later than 30 days after it learns of the change or had reasonable cause to believe that the change had occurred), requesting confirmation of the change and, following such confirmation, request its CSP update the Register accordingly. For this purpose, a "relevant change" will occur if the RBO ceases to be a RBO or there is a change in its particulars. The Legal Person must also update its CSP if the RBO is deceased and has ceased to be a RBO.

What obligations do Corporate Service Providers have?

A Legal Person must engage a CSP for the purposes of complying with the BORR. Where a CSP is engaged, there are certain direct obligations imposed on the CSP itself. These include a direct obligation to, as applicable:

- establish and maintain a Register on behalf of the Legal Person if it does not benefit from an alternative route to compliance;

- develop a process and take reasonable measures to verify beneficial ownership data;

- give notice to a Legal Person if it considers that the entity has failed to comply with certain obligations without reasonable excuse, including to keep its Register up to date, or if it has made a statement that is false or misleading;

- issue a restrictions notice to the Legal Person as a means of compelling the Legal Person to obtain the required particulars of its RBOs and send a copy of the notice to the Registrar within 14 days of issuing it;

- deposit beneficial ownership information (or indicate that there has been no change in the information deposited) with the competent authority not less than once a month;

- respond to any request for additional information from the Registrar within the specified time period; and

- retain records for a period of at least five years from the date a person ceases to be a RBO.

Is the beneficial ownership information public?

In October 2019, the Cayman Islands made a commitment to have a public register of beneficial ownership information by December 2023. The BOTA provides that beneficial ownership information can only be made available to the public if and when regulations have been proposed by Cabinet and affirmed by a future resolution of Parliament. Therefore, such information will not become publicly available unless and until such resolution of Parliament. It is envisaged that there will be some limited access for persons with "legitimate interests" in due course subject to various safeguards.

Who can access beneficial ownership information?

A centralised electronic platform ("Platform") has been established by the competent authority on which Registers are maintained. It continues to be the case that the Platform can be accessed by the competent authority on its own behalf or at the request of certain Cayman Islands authorities (namely the Royal Cayman Islands Police Service, the Financial Reporting Authority, CIMA, the Anti-Corruption Commission, the Tax Information Authority, the Maritime Authority of the Cayman Islands, the Civil Aviation Authority of the Cayman Islands, the Registrar of Lands or an entity undertaking procurement in accordance with the Procurement Act and any other body which is assigned responsibility under the Proceeds of Crime Act for monitoring compliance with money laundering regulations).

In addition, under BOTA the Platform can be accessed for a fee by Cayman Islands licensed financial institutions and designated non-financial business and professions (such as law firms) ("Regulated Bodies"), with a view to facilitating the customer onboarding and ongoing due diligence.

Which other countries can request beneficial ownership information under the BOTA?

The United Kingdom has entered into an agreement with the Government of the Cayman Islands for the sharing of beneficial ownership information. Pursuant to that agreement, the United Kingdom can request that the Royal Cayman Islands Police Service make a formal request for the competent authority to execute a search of the Platform, with the beneficial ownership information being shared with the United Kingdom law enforcement official.

Other countries continue to be able to request information pursuant to other laws, agreements, or legal arrangements (for example through production orders under the Tax Information Authority Act and the Monetary Authority Act), which were already in place before the BORR. The BOTA does not widen the scope of information that can already be requested pursuant to such arrangements.

Are Legal Persons required to implement any special reporting software?

No. Legal Persons can provide information to their CSP in whatever form is required by their CSP, which may include an online portal or via legal counsel.

Are Legal Persons or others liable for any penalties?

Yes. It continues to be the case that Legal Persons are subject to penalties. Potential offences include failure to establish or maintain a beneficial ownership register; failure to comply with or make a false statement in response to notices (including failure to comply with a restrictions notice or knowingly or recklessly making a statement that is false); and failure to provide information (including RBOs failing to supply relevant information or knowingly or recklessly making a statement that is false). Penalties for offences range from fines of CI$5,000 to CI$100,000 and imprisonment and the court has power to order a Legal Person to be struck off for persistent offending.

The Registrar can also impose additional administrative fines for non-compliance with various aspects of the BORR. Administrative fines are CI$5,000 for each breach, with an additional fine of CI$1,000 imposed for every month that the breach continues, until the total amount due is CI$25,000. Where an administrative fine remains unpaid for 90 days, the Registrar may strike the relevant Legal Person off the register, resulting in the entity being dissolved. Administrative fines issued to a CSP for failing to deposit beneficial ownership information may be reduced by 25% if information is deposited within a specified time period.

Is anything changing for Corporate Services Providers?

Yes. CSPs are accustomed to maintaining beneficial ownership information for Legal Entities and filing such information with the Registrar as the BORR has been in place since 2017.

However, in response to the dynamic landscape of regulatory requirements and international standards, significant technological updates with respect to the reporting of beneficial ownership information has been undertaken by the Cayman Islands.

Next steps

Walkers can assist with all aspects of compliance with the BORR applicable in the Cayman Islands and will be discussing with our clients and others who require assistance.

Please register here for our decision steps and FAQs to help you determine whether your entity is required to identify its RBOs and, if so, to identify its RBOs.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.