On May 31, 2024, the Quebec Court of Appeal ("QCCA") unanimously dismissed the Agence du Revenu du Québec ("ARQ") appeal in ARQ v. Kone Inc.1 The QCCA confirmed that a cross-border financing arrangement effected by way of a repurchase (or "repo") transaction was not a sham and was not subject to the Quebec general anti-avoidance rule ("GAAR"). For prior discussion, see our previous publication on the lower court's decision in this case, here.

The decision sets an important precedent for the Canadian tax treatment of repo transactions, which are under increasing scrutiny by Canadian tax authorities. The QCCA held that:

- While the economic result of a repo transaction may resemble that of a loan, the legal relationship it establishes is that of a sale, and, in Canada, legal form governs over economic substance.

- Cross-border repos are a common financing instrument. Parliament must have been aware of them and did not (until recently) pass legislation to eliminate the tax benefits associated with the transactions. In this context, it would be inappropriate for the court to apply the GAAR to these transactions when Parliament had decided not to address them.

The decision is helpful to other taxpayers who engaged in cross-border repos and are now subject to potential reassessments by the ARQ and the Canada Revenue Agency (the "CRA").

Background

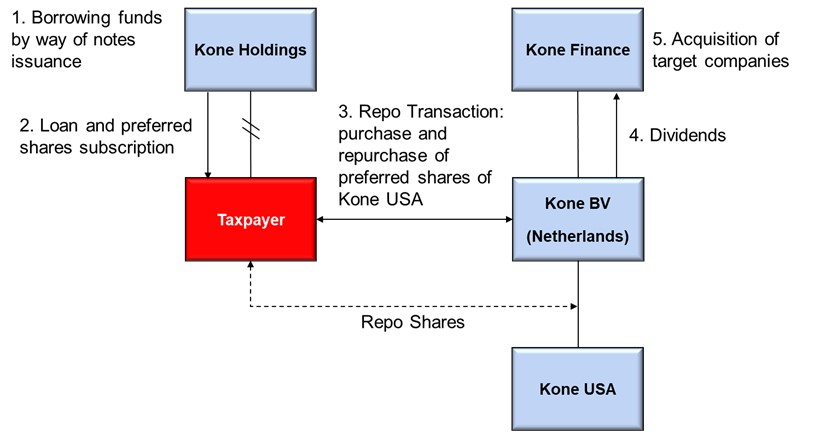

Kone Inc. (the "Taxpayer") is a Canadian corporation that is part of an international group ("Kone Group") headed by Kone Corp., a Finnish corporation. In 2001 the Kone Group required funding to finance acquisitions in Europe. The Taxpayer's indirect Canadian parent, Kone Holdings, borrowed funds from third parties in Europe by issuing notes. The borrowed funds were then used to make an interest-bearing loan to, and to acquire preferred shares of, the Taxpayer (via the Taxpayer's direct parent). The Taxpayer then purchased various classes of cumulative dividend preferred shares of a US-resident Kone Group member ("Kone USA") from a Dutch affiliate ("Kone BV"). At the same time, the Taxpayer and Kone BV entered into a repurchase agreement, under which Kone BV agreed to repurchase the Kone USA preferred shares (the "Repo Shares") at a future date at the same price, together with all accrued and unpaid and undeclared dividends. The purchase price for the Repo Shares received by Kone BV was ultimately used by the Kone Group to finance the acquisitions.

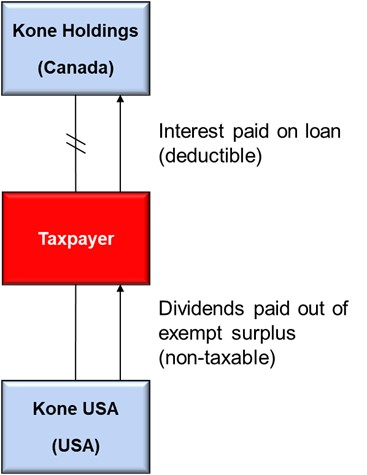

The repurchase agreement closed pursuant to its terms and the Repo Shares were sold back to Kone BV. The Taxpayer received dividends on the Repo Shares, which were fully deductible on the basis that they were paid out of Kone USA's exempt surplus in respect of the Taxpayer. At the same time, the Taxpayer deducted interest paid on its intercompany debt (and Kone Holdings ultimately deducted interest payable to the third party noteholders).

As a result, the Taxpayer had non-capital losses in 2002 through 2004 available to be carried back (to 1999 and 2000) and forward (to 2005 and 2006).

Under the "substance over form" doctrine in US federal income tax law, the repo transaction was viewed as a loan made by the Taxpayer to Kone BV, secured by the Repo Shares.

The ARQ reassessed the Taxpayer for its taxation years 1999, 2000 and 2002 to 2006, taking issue with the Taxpayer's arrangement that permitted the creation of the losses, attributable to the fact that the Taxpayer's return on the Repo Shares benefitted from the favourable exempt surplus regime and were thus not taxable in Canada.2

The ARQ claimed, as a principal argument, that the repo transaction was a loan disguised as a purchase and sale of the Repo Shares and was therefore a sham. In the alternative, the ARQ argued that the GAAR applied to deny the tax benefit obtained.

The Court of Québec allowed the Taxpayer's appeal and dismissed both ARQ's positions.3 The Court concluded that the ARQ failed to prove that the Taxpayer intended to deceive the tax authorities, which is required to establish the existence of a sham.4 With respect to the GAAR, the Court found that the repo transaction did not defeat the underlying rationale of the Quebec equivalent of section 17 of the Income Tax Act (Canada) ("the Act").5

QCCA Decision

The QCCA upheld the Court of Québec decision. With respect to the sham argument, the QCCA affirmed that "the parties acted in accordance with the rights and obligations established by the documents".6 The fact that US tax law considers the economic substance of the repo transaction and treats it as a secured loan does not mean that it is a "sham" to treat the transaction as a sale for Canadian tax purposes in accordance with its legal form. In Canada, legal form governs, and the legal form of the transaction is that of a purchase and sale of shares.7

With respect to the GAAR, the QCCA concluded that there was no abuse of the object, spirit and purpose of the Quebec equivalent of section 17 of the Act. Even if Parliament intended that the provision extended to all financing transactions, and was not simply limited to loans or other amounts owing, the repo did not defeat the purpose of that provision as it provided for a reasonable form of return in the form of dividends.8

The QCCA acknowledged that the transaction results in mismatch that allowed the Taxpayer to generate tax losses by deducting both the dividends received out of exempt surplus and the interest paid on the loan. Nevertheless, the QCCA held that this is permitted by the legislation and its underlying policies, and does not result "from any improper action by the Taxpayer".9

Finally, the QCCA concluded that the Taxpayer was entitled to choose the financing structure that provided the most favourable tax outcome, and that doing so does not trigger the application of the GAAR. It held that repo transactions are widely known and used financing instruments on the international market. It is incumbent on the legislator to provide clear rules governing the tax treatment of these instruments. In absence of those specific rules, it would be inappropriate for the QCCA to apply the GAAR to impute interest on the Taxpayer, which would risk unpredictable consequences as to the tax treatment of repos.10

Finally, the QCCA noted, helpfully, that it is not the courts' role to rewrite tax statutes to legislate where Parliament has decided not to. In this respect, the Kone decision echoes Justice Iacobucci's remark in the Supreme Court of Canada's landmark decision in Canderel Ltd. v. Canada: "The law of income tax is sufficiently complicated without unhelpful judicial incursions into the realm of lawmaking."11

Takeaways

The Kone decision is an important precedent confirming that cross-border repos are not shams, are not subject to the GAAR, and cannot be recharacterized according to their economic substance. The case provides a strong argument that courts should respect the legal substance of these transactions. This decision will serve as a helpful precedent for taxpayers who have engaged in these transactions. There is currently a case before the Tax Court of Canada dealing with a CRA challenge of a more traditional cross-border repo, and other similar cases are under review at the audit stage. While the basis of these reassessments may differ, they all rest on the basic argument that the legal form of the taxpayer's transactions should not be respected. The Kone decision will provide taxpayers with a strong argument that there is nothing inappropriate about these transactions and their legal form should be respected.

Footnotes

1 2024 QCCA 678 ("Kone QCCA").

2 Kone QCCA, para. 35.

3Kone inc. v. Agence du revenu du Québec, 2022 QCCQ 9892 ("Kone CQ").

4 Kone CQ, paras. 101 and 102.

5 Kone CQ, para. 199. Generally speaking, section 17 of the Act imputes interest income to a Canadian corporation which makes non-interest bearing (or low interest) loans to non-residents. If the Taxpayer had simply made a non-interest bearing (or low interest) loan to Kone BV, section 17 (or the transfer pricing rules) would have applied to require an interest income inclusion.

6 Kone QCCA, para. 23.

7 Kone CQ, para. 132.

8 Kone, QCCA, para. 34.

9 Kone QCCA, para. 35.

10 Kone QCCA, para. 38.

11 1998 CanLII 846 (SCC), [1998] 1 SCR 147, para. 41.

To view the original article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.