Effective June 25, 2024, the 2024 federal budget is proposing to increase the capital gains inclusion rate for individuals to two-thirds on the portion of gains earned in the year in excess of a $250,000 threshold, below which gains will remain taxed at the current one-half inclusion rate.

In Ontario, assuming an individual is in the top tax bracket of 53.53%, the effective tax rate for capital gains realized on or after June 25, 2024 will be as follows:

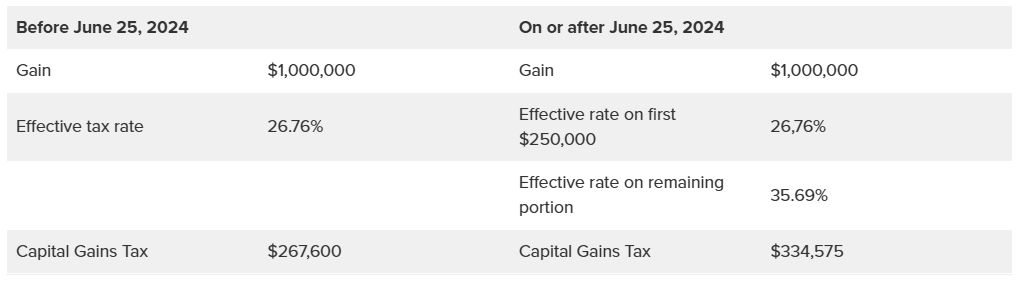

The next table illustrates the difference between an individual in Ontario realizing a $1M gain before June 25, 2024 and after:

Therefore, a $1M gain realized after the new inclusion rate comes into effect will trigger additional tax of $66,975 for an individual in Ontario. Once an individual's $250,000 exemption has been used up for a year, each additional $1M in capital gains in that year will result in almost $90,000 in additional tax being paid (as compared to the current regime).

Planning Opportunity for vacation properties

We are receiving a number of calls from clients inquiring as to whether they should pre-emptively sell or gift their cottage properties to their children (or to third parties).

The following should be considered when making this decision:

- Joint ownership: If the property is jointly owned with a spouse, each spouse should be able to access their own $250,000 portion of gain taxed at the lower rate. Depending on the accrued gain, this may be sufficient to ensure that the gain is mostly, if not entirely, taxed at the one-half inclusion rate.

- Capital gains reserve: If the purchase price is paid over time (as opposed to the entire price being paid at the time of sale), tax for a given year will generally only be paid on the portion of the purchase price that is actually received in that year (to a maximum of five years from the date of sale and subject to certain rules beyond the scope of this article). As such, tax payable on a current sale (including, for example, a sale to one's children for a promissory note) should be able to be spread out over the next five years, which could assist with cash-flow issues. Because the government has not yet released legislation implementing these changes to the capital gains regime, however, it is currently unclear (a) whether, if a sale was originally undertaken prior to June 25, 2024, the gains in subsequent years will be taxable at the 50% inclusion rate (i.e. the rate in effect at the time of sale) or whether they will be taxable at the new 66 2/3% inclusion rate (i.e. the rate in effect at the time the proceeds are received in the future), and (b) if subsequent gains are taxable at the 66 2/3% inclusion rate, whether the vendor will be able to take advantage of a new $250K exemption each year. As mentioned, draft legislation on the new capital gains rules has not yet been released by the Ministry of Finance but is expected on or before June 21, 2024.

- Opportunity cost of crystalizing gains before June 25, 2024: In the example above, triggering a $1M gain now will require coming up with $267,000 in order to save $66,975 down the road. At an average rate of return of 5%, it will take roughly nine years to generate $66,975 after tax (meaning that, if the cottage otherwise would not have been sold for nine years, it may actually cost more to trigger the gains now, even if the gains are taxed at a lower rate). The higher the rate of return, of course, the shorter the break-even point. This should be discussed further with your financial advisor.

- Control of the property: a non-tax consideration to think about is the loss of control over the property when gifting or selling to children. Considerations include the property being encumbered by a creditor of the child or it becoming tied up in the context of divorce proceedings. These issues are beyond the scope of this article but should nonetheless be considered.

- Future of the Capital Gains Tax Regime: At this point, while most advisors think that these changes will be implemented as proposed, there is certainly still a chance that the government will decide to back down in the face of potentially-higher-than-expected opposition. Even if the changes are implemented it is also possible that a future government (possibly a Conservative government) may repeal the changes and revert back to the current 50% inclusion rate for all gains. In either of these cases, triggering gains now will almost certainly result in more tax being paid, as opposed to doing nothing.

Takeaways

It may or may not make sense to crystallize gains prior to June 25, 2024, and the above considerations need to be looked at. Generally, if the plan is to sell or gift the cottage property within a short time horizon, it may make sense to do so prior to June 25, 2024. If not, it may make sense to hold on to it.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

We operate a free-to-view policy, asking only that you register in order to read all of our content. Please login or register to view the rest of this article.