In this Edition

- How the Ontario Securities Commission (OSC) is improving access to capital for early-stage businesses

- New policies for foreign investments in the gaming, VR and digital media sector, workplace policies across Canadian jurisdictions, the 2024 federal budget, and other need-to-know topics

- Artificial Intelligence (AI) investment deals are trending; Bank of Canada cuts interest rates

Market Insights

OSC Introduces Initiatives to Support Capital Raising for Early-Stage Businesses in Ontario — As part of its mandate to foster capital formation and competitive capital markets, the OSC has recently introduced certain time-limited initiatives to improve access to capital for early-stage businesses in Ontario. These initiatives include creating new dealer registration exemptions for early-stage businesses and not-for-profit angel investor groups and extending the self-certified investor prospectus exemption pilot program. The OSC is implementing these initiatives through its TestLab program, which it uses to evaluate capital market innovations and new approaches to regulation in Ontario's capital markets. Read more in our new Blakes Bulletin: OSC Introduces Initiatives to Support Capital Raising for Early-Stage Businesses in Ontario.

Legal Update

Founders and investors may find the following insights from our Blakes colleagues helpful and instructive:

- Interactive Technology — On March 1, 2024, the Canadian government issued two policies that will be consequential for foreign investment in the Canadian gaming, virtual reality and digital media sectors, indicating that such investments will be subject to increased scrutiny. Read more about these policies in our Blakes Bulletin: This Is Not a Simulation: Canada Releases New Policies for Foreign Investments in Interactive Digital Media.

- Digital Services Tax Act — Canada's long-anticipated Digital Services Tax Act was introduced into Parliament on November 30, 2023 as part of Bill C-59. Read our Blakes Bulletin: The Mechanics of Canada's New Digital Services Tax to learn more about how affected taxpayers should compute their 3% DST liability as we inch towards an implementation date.

- Workplace Policies — While the updating of workplace policies is often on an organization's to-do list, regular review of such policies frequently gets pushed aside for other more pressing tasks. Depending on the jurisdiction in which your organization operates, multiple workplace policies are mandated by legislation. Read more in our Blakes Bulletin: Keeping Current on Mandatory Workplace Policies Across Canada.

- 2024 Federal Budget — On April 16, 2024, the Government of Canada released its 2024 budget. We've summarized key aspects that may impact your business in our Blakes Bulletin: Your Guide to the 2024 Federal Budget.

- Cybersecurity — On May 13, 2024, the Government of Ontario introduced Bill 194, the Strengthening Cyber Security and Building Trust in the Public Sector Act, 2024, which, if passed, will significantly reform the Freedom of Information and Protection of Privacy Act (FIPPA). FIPPA governs how the Ontario government and prescribed public sector entities collect, use and disclose personal information, and sets out a general right of access to government records. To learn more, read our Blakes Bulletin: New Ontario Bill 194 to Reform FIPPA and Introduce Mandatory Privacy Breach Reporting.

Deal Monitor

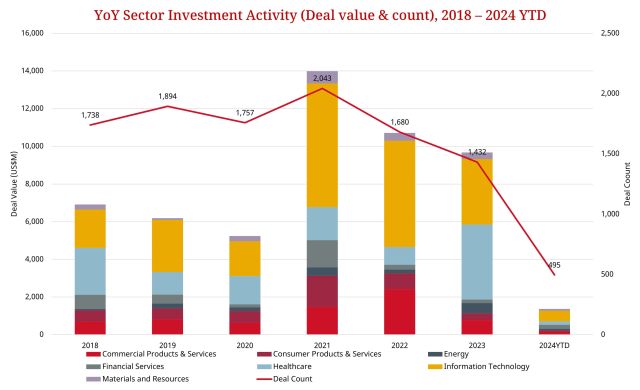

Data sourced from PitchBook.

- IT investments continue to be the most active industry, making up nearly half of the top 20 deals in 2024 YTD based on value, with a primary focus on SaaS and Artificial Intelligence (AI), the latter of which has been a trending topic in the space. Financial Services investments are on the rise, already surpassing its 2023 year-end total in deal value and count.

- Among the largest transactions was Ontario-based QuadroCore's strategic partnership with Sustainable Development Technology Canada, including US$66-million funding to manufacture their mass spectrometer offering high-performance tools with rapid throughput, cost-effective process and modular design, enabling security, healthcare, and other industries to accurately quantify analyte of interest.

- Other large SaaS and AI transactions in 2024 include Brim Financial's US$63-million Series C led by Export Development Canada, Reactiv's US$59-million funding from Unbound Capital, Thentia Cloud's US$53-million Series B1 led by Spring Mountain Capital, BDC Capital and First Ascent Ventures, and Dcbel's US$52-million grant funding from California Energy Commission.

- While 2024 to date has remained relatively slow, we may see a spike in deals as we approach the end of Q2. The Healthcare industry has been slow to start 2024, but if past trends continue, we should see it jump to one of the leading industries by year's end.

- With the Bank of Canada cutting key interest rates to 4.75% (the bank's first rate cut since March 2020), businesses should hopefully start to see an increase in investment activity and a turn in the venture and growth equity market.

For permission to reprint articles, please contact the Blakes Marketing Department.

© 2020 Blake, Cassels & Graydon LLP.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.