Introduction

Treasurer Jim Chalmers handed down the Albanese Government's third budget on 14 May 2024. The Federal Budget measures were not entirely unexpected, with key initiatives focused on easing cost-of-living and inflation pressures and investing in the "Future Made in Australia" policy and renewable energy investment.

There is very little in relation to tax reform announced in the Federal Budget. While this may not come as surprise given that the Government is considering heading to the polls early, economists, commentators and the business community have widely identified tax reform as being important to boost Australia's economic potential and to ensure that Australia can support its aging population and changing business dynamic.

The Federal Budget includes the (already legislated) personal tax cuts (applying from 1 July 2024), extension of the $20,000 instant asset write-off for small businesses and a potentially significant broadening of the foreign resident capital gains tax rules. Funding to the ATO will continue to increase, with a renewed focus on fraud prevention and the establishment of a new Counter Fraud Strategy taskforce.

Outlined below are the key tax measures from this year's Federal Budget.

KEY TAX MEASURES FROM THE FEDERAL BUDGET 2024 - 2025

Businesses

$6.7 billion production tax incentive for the production of renewable hydrogen

- The Future Made in Australia package establishes time-limited incentives to invest in new industries. The Hydrogen Production Tax Incentive will make Australia's pipeline of hydrogen projects commercial sooner, at an estimated cost of $6.7 billion over the decade. This Federal Budget also expands the Hydrogen Headstart program by $1.3 billion, supporting early movers to invest in the industry's development.

$7 billion production tax incentive for the processing and refining of critical minerals

- These complement incentives that build economic resilience, including the 10 per cent production tax incentive for the processing and refining of critical minerals, and investments in clean energy technology supply chains.

Extension to the instant asset write-off measures for small businesses

- The Federal Budget extends the $20,000 instant asset write-off for small businesses by 12 months until 30 June 2025 . Where a business has "aggregated annual turnover" of less than $10 million, the business will be able to continue to immediately deduct the full cost of eligible assets costing less than $20,000 that are first used or installed ready for use by 30 June 2025.

- The provisions apply on an asset-by-asset basis therefore enabling small businesses to deduct multiple assets simultaneously. Simplified depreciation measures (such as the small business simplified depreciation pool) should continue to apply to assets not eligible under the instant asset write-off provisions.

- On a related note, the previously enacted provisions preventing small businesses from applying the simplified depreciation regime for five years (where the business has chosen to cease to apply the simplified rules) will continue to be suspended until 30 June 2025.

- This measure is estimated to decrease receipts by $290.0 million over the 5 years from 2023–24 but continue the trend in Government measures to stimulate current economic growth while being broadly revenue neutral over the longer term (i.e. by merely bringing forward a taxpayer's future depreciation deductions).

International

Strengthening the foreign resident capital gains tax (CGT) regime

The most significant corporate tax measure announced as part of the Federal Budget relates to a "strengthening" of the foreign resident CGT regime. The Federal Budget papers include three key changes proposed to apply to CGT events happening on or after 1 July 2025 to:

Clarify and broaden the types of assets on which foreign residents are subject to CGT

- The proposed change appears to expand the definition of "taxable Australian property" (TAP) to include direct/indirect interests in assets with a "close economic connection to Australian land" which may not be captured under the current law. This is likely to expand Australian CGT exposure for foreign residents, including in respect of energy assets (particularly networks and renewables), data storage assets, mobile towers and other assets closely associated with land.

- This builds on the ATO's activity in challenging non-TAP claims made by foreign residents in the courts, and appears to target significant tangible assets that are not "fixtures" to land, and therefore not TAP under the current law. Although the details of the proposal are not yet known, Australia's double tax treaties should still override the domestic regime where inconsistent.

Amend the current point-in-time principal asset test to a 365-day testing period

- This integrity measure requires the "principal asset test" to be passed over a 365-day testing period (i.e. testing whether the membership interests are/were "land rich" in the previous 365 days, rather than just at time of disposal). The aim of this measure appears to be to prevent the disposal or acquisition of underlying assets prior to a transaction in order to impact whether the "principal asset test" is passed.

Introduce a new notification requirement

- This new measure requires foreign residents disposing of membership interests exceeding $20 million in value to notify the ATO prior to executing their transaction, regardless of whether or not the membership interests are TAP or not.

- This measure is intended to improve ATO oversight and compliance with the foreign resident CGT withholding rules, and may open the door for the ATO to disagree with self-assessments made by foreign residents regarding their TAP assessment.

These "strengthening" of the foreign resident CGT regime measures are estimated to increase receipts by $600.0 million and increase payments by $8.0 million over the 5 years from 2023–24.

The Government will consult on the implementation of these measures and we look forward to receiving further information and participating in consultation.

Continued focus on intangibles, royalty withholding tax and payments relating to intangibles held in low- or no-tax jurisdictions

The Federal Budget has continued the focus on intangibles, with two separate announcements:

New penalty regime for mischaracterised or undervalued royalty payments

- In a new measure, the Government intends to impose a penalty where royalty payments which would otherwise be subject to royalty withholding tax (RWHT) are mischaracterised or undervalued. The penalty will apply from 1 July 2026 to taxpayers part of a group with more than $1 billion in global turnover.

- This new measure bolsters the ATO's continued focus on intangibles, including the recent release of Practical Compliance Guideline PCG 2024/1 relating to the migration of intangibles, the updated draft Taxation Ruling TR 2024/D1 relating to royalties in respect of software and intellectual property rights, and the ATO's concerns in respect of "embedded royalties" in PepsiCo, Inc v Commissioner of Taxation [2023] FCA 1490.

- The proposed new penalty regime could potentially bridge the gap by subjecting large groups to additional penalties for underpaid RWHT. Currently, where both RWHT and diverted profits tax apply, RWHT takes precedence, causing the ATO to lose out on penalties under the diverted profits tax regime (which imposes a 40% penalty).

- Taxpayers should review their existing and proposed arrangements in light of the Government's proposed new penalty regime and existing ATO guidance, noting that additional guidance may be provided prior to the introduction of the penalty regime on 1 July 2026.

Previously announced measure for intangibles held in low- or no-tax jurisdictions discontinued

- The separate measure previously announced in the 2022–23 October Federal Budget, which sought to deny deductions for payments relating to intangibles held in low- or no-tax jurisdictions will be discontinued, as the integrity issues will now be addressed through the OECD Pillar 2 framework to be implemented in Australia.

- The previously announced measure sought to deny an income tax deduction in Australia in respect of a payment made by an Australian entity to an associate (the recipient) linked to the exploitation of an intangible asset resulting in the recipient deriving income in a lower corporate tax jurisdiction.

- Broadly, the proposed OECD Pillar 2 framework introduces a Global Minimum Tax and Domestic Minimum Tax for large multinational enterprise group entities. The measure seeks to ensure that multinational enterprises pay a global minimum 15% tax rate on income derived in jurisdictions where they operate. In March, Treasury released exposure draft legislation to implement key aspects of the OECD Pillar 2 framework.

Individuals

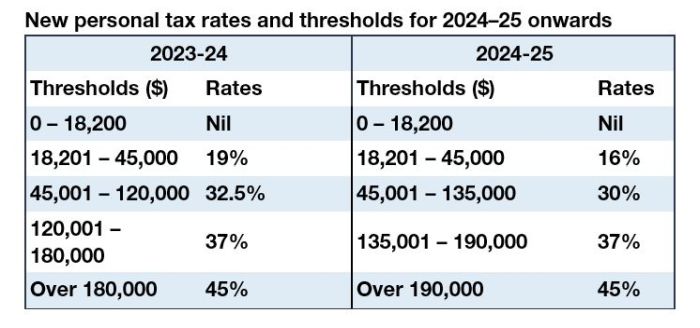

Reannouncing already-legislated cuts to personal income tax rates

- As expected the Federal Budget has reiterated the Government's changes to the (already legislated) personal income tax rates. The Federal Budget papers state the cuts will "provide cost-of-living relief, return bracket creep, support women and boost labour supply".

- The already legislated measures apply from 1 July 2024 and are estimated to decrease income tax revenues by $1.3 billion over the 5 years from 2023–24.

- While providing some support for all income earners, these

measures do very little to address the pressing structural issue of

"bracket creep", a factor driving the estimated increased

$8 billion of personal income tax collections in 2024-25 and $26

billion over the forward estimates period.

- A taxpayer with taxable income of $190,000 will pay $4,529 less income tax in the year ending 30 June 2025 as compared to the 2024 income year.

- The Federal Budget also announces an amendment to the tax law to give the ATO discretion to not use a taxpayer's refund to offset old tax debts, where the old tax debt was put on hold prior to 1 January 2017. This discretion will apply to individuals, small businesses and not-for-profits, and will maintain the ATO's current administrative approach. This measure seeks to address negative publicity regarding the ATO's recent controversial approach to debt collection with respect to historic debts.

Other Tax Measures

ATO Funding

Funding to the ATO for the Tax Avoidance Taskforce, the Shadow Economy Taskforce and the Personal Income Tax Compliance program have all been continued. A new Counter Fraud Strategy will be implemented in the wake of increased fraudulent activity. More details are provided below.

Tax Avoidance Taskforce: Funding will continue to the Tax Avoidance Taskforce for 2 years from 1 July 2026, extending the program until 1 July 2028 with a commitment of an additional $1.16 billion in funding.

- The focus of the Tax Avoidance Taskforce is the optimisation of the tax performance of large corporate groups and multinationals to ensure they pay the right amount of tax.

- Recently the ATO has increased its focus on medium and emerging publicly listed businesses and multinationals as well increasing scrutiny on private groups and high wealth individuals.

- The measure is estimated to increase receipts by $2.4 billion over the 5 years from 2023–24.

Shadow Economy Compliance Program: Funding for the ATO Shadow Economy Compliance Program will be extended for an additional two years until 30 June 2028.

- The Shadow Economy Compliance Program, established in 2017, investigates unreported and dishonest economic activities outside the tax and regulatory systems (e.g. demanding or paying for work in cash to avoid reporting obligations, under-reporting income earnt, engaging in sham contracting and the underpayment of wages).

- This extension will allocate an additional $610.2 million in funding, projecting to result in an increase in receipts of $1.9 billion.

Personal Income Tax Compliance Program: The ATO's Personal Income Tax Compliance Program will be extended for one further year, up to 30 June 2028.

- The ATO's Personal Income Tax Compliance Program is designed to prevent and correct areas of personal tax non-compliance including the overclaiming of deductions and the incorrect reporting of income, as well as to detect emerging risks to the tax system.

- It is expected that the extension of the program will result in an increase in tax receipts of $180.3 million.

Counter Fraud Strategy: In a new initiative, $187.4 million is being provided to better protect taxpayer data and revenue against fraudulent attacks on the tax and superannuation systems. $83.5 million will go towards the establishment of a new taskforce to recover lost revenue and intervene when attempts to obtain fraudulent refunds are made.

- Funding will also go towards upgrading the ATO's information and communications technologies and increase their fraud prevention capabilities to equip the ATO to manage increasing risk, prevent revenue loss, and support victims of fraud and cyber-crime.

- The ATO will also have extended time to notify a taxpayer if it intends to retain a business activity statement (BAS) refund for further investigation (from 14 days to 30 days to align with time limits for non-BAS refunds).

- While the measures are not intended to affect legitimate refunds, there is a likelihood that refunds from new enterprises may be further delayed (especially during peak processing periods).

- This measure is estimated to increase receipts by $302.2 million over the 5 years from 2023–24.

Originally Published 14 May 2024

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.