Michael Bacina, Steven Pettigrove, Jake Huang, Luke Higgins and Luke Misthos of the Piper Alderman Blockchain Group bring you the latest legal, regulatory and project updates in Blockchain and Digital Law.

Appeal in yield product case may lead to regulatory clarity

This week, Web3 Ventures Pty Ltd (trading as Block Earner) filed a cross-appeal to the Federal Court decisions which found Block Earner previously offered a unlicensed financial product but absolved it from civil penalties.

Block Earner's cross-appeal appears prompted as a result of the Australian Securities and Investments Commission (ASIC)'s recent appeal to the Federal Court's decision relieving Block Earner of a penalty for not holding an Australian Financial Services Licence while offering their Earner product. This escalation of court actions marks the latest round of dispute over whether a yield bearing "Earner" product (a yield generating product) offered by Block Earner was a regulated financial product and if so, whether Block Earner should bear civil liabilities for providing such product.

A brief summary of the history of judicial decisions and the parties' appeals is set out below.

Round 1

ASIC alleged that between March and November 2022, Block Earner had offered two products that were financial products.

The first product was "Access", through which customers could send funds through to Aave and Compound, prominent DeFi lending protocols which compensate lenders for depositing cryptocurrency. The second product was "Earner" , which paid users interest on crypto and was framed as a loan. Block Earner promptly removed the Earner product in response to ASIC's concerns, but was sued nonetheless.

In the primary judgement delivered on 9 February 2024, Jackman J of the Federal Court of Australia found that Access was not a financial product, but Earner satisfies the definition of a managed investment scheme and an investment facility, hence a financial product.

ASIC got a partial win in round 1.

Round 2

Despite finding Block Earner offered a financial product, in the penalty hearing on 4 June 2024 Jackman J relieved Block Eaner from civil penalties arising from offering the unlicensed financial product, finding that it had acted honestly and fairly in the circumstance.

His Honour found that Block Earner had not been "careless or imprudent" to any degree as it made a genuine attempt to comply with the requirements of the Corporations Act, despite ASIC's contentions to the contrary.

His Honour also accepted that Block Earner's active participation in policy discussions with key industry participants and regulators concerning crypto-asset products supported a finding that Block Earner had sought to conduct its business in a lawful manner.

The Court noted that Block Earner had formed an "unchallenged view", after obtaining legal advice from a law firm, that there was no identified risk that the Earner product would breach any laws or regulations, despite ASIC's contention that there was no evidence that legal advice prepared for Block Earner was actually relied upon by it or specifically drafted in relation to its Earner product.

In particular, His Honour accepted a complaint by Block Earner that a media release published by ASIC the same day as the judgment, titled "Court finds Block Earner crypto product needs financial services licence", was unfair and misleading for reasons including that Block Earner did not "need" an AFSL as at 9 February 2024 as the Earner product had been withdrawn. ASIC has since changed the title of the media release to use the past tense.

Finally, his Honour ordered the parties to bear their own costs up to the date of the decision in February. ASIC was ordered to pay Block Earner's costs after 9 February (including for the penalty hearing).

Block Earner has recouped grounds in round 2 and ASIC has suffered great loss by not being able to get any penalty or recover its litigation costs.

Round 3

On 17 June 2024, ASIC lodged an appeal outlining three grounds, which contests both the factual findings and legal analyses of Jackman J's 4 June 2024 decision relieving Block Earner from a penalty. ASIC is seeking to overturn nearly all of Justice Jackman's penalty decision, other than the order that the parties bear their own costs for the main proceedings, meaning ASIC has accepted that they cannot recover any costs they incurred in suing Block Earner.

ASIC is still pressing for the Full Federal Court to impose "a pecuniary penalty in the amount of $350,000 or such other amount the Court sees fit". This was the amount originally sought by ASIC and rejected by Justice Jackson.

It was not entirely surprising that Block Earner dealt back the cross-appeal to guard itself against ASIC's offensive moves. Block Eaner is arguing that the Eaner product is not a financial product at all and ASIC should bears Block Eaner's costs.

The outcome for round 3 will be closely watched.

Conclusion

ASIC's appeal has caused concern in the Australian crypto-community as it signals an aggressive regulation by enforcement approach in the absence of clear guidance or a pathway to compliance.

Beneath the legal matters arising from this appeal lies a far more important macro issue, that regulation, sought by the industry for years, is finally starting to be formed, and a regulation by enforcement remains a very inefficient means to make rules, as has been seen in the USA, and often court decisions can raise more questions than they answer.

In a regulatory environment that has been judicially recognised as unclear and "tangled mess", the question of how precious public funds are spent and what outcomes are being achieved from that spending is an important question that needs to be considered.

Setting clear rules of the road and a viable and affordable pathway for licensing for crypto-asset products, to the extent it is required to manage real risks (principally custody), would appear an outcome more consistent with fair rule of law, better reached by consultation and rule/law-making by parliament.

Federal Court declares PayPal fee error clause unfair

The Federal Court has declared a term in PayPal Australia Limited's (PayPal) standard form contracts with small businesses to be unfair. This decision affects small businesses that opened PayPal Business Accounts between 21 September 2021 and 7 November 2023.

The term would have permitted PayPal to retain fees it had erroneously charged unless the small business notified PayPal of the error within 60 days of the fee appearing on its account statement. The term appeared in PayPal's Combined Financial Services Guide and Product Disclosure Statement and its User Agreement, one of several documents that form the contract between PayPal and its Australian business account holders.

His Honour also found that PayPal was not aware of any instance where it has caused a consumer to suffer loss or damage by relying on the fee error term and ASIC's investigation did not uncover any instance of PayPal having done so.

According to an ASIC media release, the court found this term to be unfair, highlighting that small businesses were not in a position to manage the risk of incorrect overcharging.

Deputy Chair Sarah Court delivered a warning relating to unfair contract terms.

Today's decision serves as a reminder to all businesses that unfair contract terms contained within standard form contracts with small businesses will not be tolerated

Justice Moshinsky, the judge presiding over the matter, delivered oral reasons shortly after the hearing and noted that the 60-day notification period was unreasonable. His written reasons are expected to follow in due course.

The declarations impact over 600,000 small businesses with PayPal Business Accounts. PayPal agreed that the term was unfair and removed it from its contracts on 8 November 2023. The court declared the term void from the start of the contracts and restrained PayPal from applying or enforcing it.

PayPal has been ordered to pay ASIC's litigation costs, despite having cooperated with ASIC during the investigation and in resolving the proceedings.

Given PayPal's cooperation and the absence of consumer harm or any monetary penalty, ASIC decision to pursue the case to Court is curious in circumstances particularly where PayPal has already removed the term from its standard agreements. However, this decision is perhaps a forewarning of ASIC's intentions to pursue further unfair contract term actions in the near future given the recent changes to the unfair contract terms regime.

Despite the conduct period being before the introduction of the new unfair contract term penalties on 9 November 2023, the decision underscores a renewed emphasis on protecting consumers and small businesses from onerous and one sided terms in standard form contracts. Had ASIC initiated the proceeding on or after 9 November 2023, PayPal would have been subject to new monetary penalties under the unfair contract terms regime. The amended regime covers a broader range of consumer and small business contracts, includes additional examples of potentially unfair terms, and imposes new civil penalties for parties imposing or relying on those terms. You can read more about the changes here. The decision is a timely reminder to all businesses that have not already done so to review their standard form contracts in light of the changes to the unfair contract terms regime and stricter penalties now in force.

MiCA's stablecoin regime: what can Australia learn?

On 30 June 2024, the European Union's Markets in Crypto-Assets Regulation (MiCA) officially brought its stablecoin regime into effect across the EU. This milestone legislation, which aims to regulate the crypto-asset market with a focus on stablecoins, sets an important global precedent. Circle, the issuer of USDC, will be the first stablecoin issuer to obtain full approval under the regime.

For Australia, a country steadily growing its footprint in the digital assets space, there are valuable lessons to be drawn from MiCA's framework and its implications for stablecoin regulation.

1. The Significance of Stablecoins in the Crypto Market

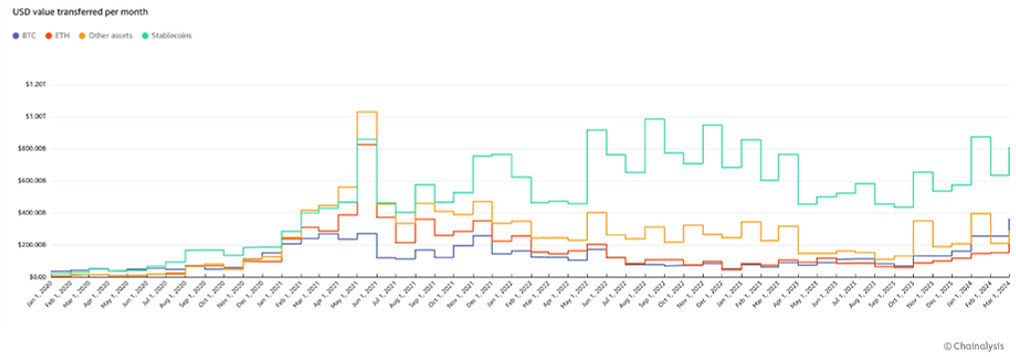

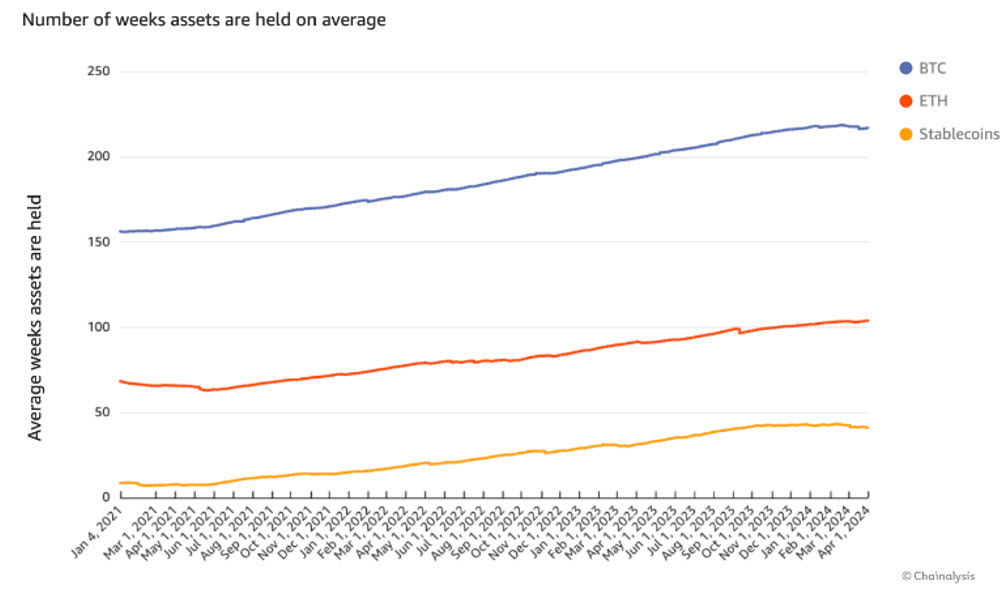

The dominance of stablecoins within the crypto-asset market has been closely watched. In 2023 alone, a stablecoins accounted for 60% of the USD$10 trillion transaction volume on-chain. This is primarily driven by retail users, with 91% of daily transfers being under USD $10,000. Interestingly, stablecoins are now being held for longer durations, averaging 40 weeks, indicating user confidence in them as a store of value and a strategic holding asset, especially during market downturns.

Figure 1: USD value transferred on-chain

per month

Figure 1: USD value transferred on-chain

per month

Stablecoins are touted as the "future" of money, and data indicates that stablecoins are used the most for everyday transactions and often have a short holding time.

Figure 2: Average holding period

(measured in weeks)

Figure 2: Average holding period

(measured in weeks)

2. MiCA's Stablecoin Regime

MiCA's categorises three main types of crypto-assets:

- Asset-Referenced Tokens (ARTs): these tokens maintain a "stable" value by referencing assets such as gold, crypto-assets, or a basket of currencies.

- E-Money Tokens (EMTs): these tokens maintain stable value by referencing a sovereign currency.

- Other Tokens: includes major cryptocurrencies like BTC and ETH, with their specific regulatory obligations commencing on 30 December 2024.

Issuers of both ARTs and EMTs under MiCA must adhere to stringent regulatory requirements, including the submission of a detailed whitepaper to regulators. This whitepaper must cover the issuer's information, token specifics, reserve asset management, operational mechanics, and associated risks, ensuring transparency and accountability.

It is worth noting that MiCA excludes from its scope of operation tokens that are already subject to other regulatory frameworks, such as tokenised financial assets (such as tokenised shares, bonds, or derivatives).

3. EMTs vs. ARTs: Key Differences

The distinction between EMTs and ARTs is fundamental, explained by Chainalysis as follows

- E-Money Tokens (EMTs)

- Issuable only by authorized e-money institutions and credit institutions.

- Holders have a direct claim for redemption at par value at any time.

- Considered funds, usable as a means of payment, and subject to the E-money Directive 2 (EMD 2) and Payment Services Directive 2 (PSD 2).

- Asset-Referenced Tokens (ARTs)

- Regarded solely as a means of exchange, not payment.

- Holders can redeem tokens for fiat equivalent to the market value of the referenced assets.

- Issuers must provide public disclosures about reserve assets and undergo mandatory audits every six months.

4. Reporting and Issuance Restrictions

MiCA imposes detailed reporting requirements on ARTs and non-EU currency denominated EMTs, especially for issuers with global issuance values exceeding EUR 100 million. These requirements include comprehensive details on underlying assets, transaction volumes, and holder demographics. Additionally, MiCA sets strict issuance restrictions to prevent excessive market dominance and ensure financial stability.

However, despite its thorough framework, the Chainalysis report highlights several challenges that the MiCA regime will face:

- National implementation laws: first, the MiCA requires national laws to define its own implementation and enforcement details. As of the date of writing, approximately half of the EU member states have passed necessary laws and regulations.

- Practical implementation: second, there is uncertainty regarding how MiCA's provisions will be interpreted and applied by firms and regulators across the EU, particularly concerning non-MiCA authorised stablecoins post-30 June 2024.

- Dual classification of EMTs: finally, EMTs are classified as both e-money and crypto-assets, creating potential regulatory confusion for "Crypto Asset Service Providers" in the EU (CASPs).

5. Lessons for Australia

As Australia continues to develop its regulatory approach to crypto-assets, EU's MiCA regime offers several insights and positions of precedent:

- Comprehensive regulatory framework: MiCA's detailed approach to regulating stablecoins highlights the importance of a comprehensive framework which addresses the technological aspects of stablecoin issuance, redemption, reserve management, and transaction transparency so as to reach technology neutral outcomes.

- Transparency and accountability: the requirement for detailed whitepapers and regular reporting ensures that issuers are transparent and accountable, a practice that could enhance trust within the Australian market if adopted here.

- To-the-point definitions: not wanting to follow confused footsteps, MiCA's challenges regarding the classification of EMTs and ARTs highlights the necessity for clear and unambiguous definitions within any regulatory framework to avoid confusion and ensure compliance. Regulators should consider any overlap that may be created when legislating crypto-asset specific laws in Australia, with the creation of bespoke laws enabling the technology being preferable.

- Australia should be agile and adaptive: the evolving nature of the blockchain ecosystem demands an agile and adaptive regulatory approach that can provide clarity on emerging issues. The ongoing refinements to the application of the MiCA regime by the European Banking Authority and the European Securities and Markets Authority are maintenance which will need in our upcoming legislation.

6. Conclusion

MiCA's stablecoin regime sets a global benchmark for crypt-asset regulation. For Australia, the adoption of a similar comprehensive and transparent regulatory framework could foster innovation, enhance consumer protection, and ensure the stability of the financial system.

With the MiCA regime as a guiding star (albeit non-perfect), Australia has the opportunity to learn from MiCA's implementation, addressing its challenges and building a robust regulatory environment that supports sustainable growth and innovation in the crypto market.

Mirror, mirror on the wall: is copy trading compliant with the law?

Copy trading is becoming an increasingly popular trading strategy, allowing investors to replicate the strategies of other potentially more experienced traders and investors. This practice can be an appealing entry point for novices, as it provides an opportunity to learn from more experienced investors and potentially achieve similar returns (or alternatively, is a convenient way to get exposure to a broader range of investments).

In recent years, ASIC has specifically listed copy trading as one of its priorities for supervision (see ASIC's priorities for 2022, 2023, and 2024). Accordingly, it is essential for platforms, copy trading strategists and investors to understand how copy trading may be regulated under Australian financial services laws to ensure compliance and protect one's investments.

What is copy trading?

There is no formal definition of copy trading under Australian law. Copy trading is a form of trading whereby an investor (i.e. a copier) automatically replicates the trades of a chosen trader (often referred to as a "signal provider"). This replication can include various financial instruments such as stocks, forex, commodities, derivatives, or crypto-assets.

On a platform that offers copy trading, investors are able to view the well-performing traders that can be copied much like traders could view the well-performing assets on that particular platform. By mirroring the trades of a successful trader, the copier hopes to achieve comparable investment returns without having to actively manage their portfolio.

The platform will typically provide the underlying technology infrastructure to enable copy trading and may earn trading fees or commissions. The trading strategist sets the trading strategy and may earn referral fees or commissions depending on the number of people who opt to copy their strategy.

Regulation of Copy Trading in Australia

In Australia, financial services are primarily regulated by the Australian Securities and Investments Commission (ASIC). The regulatory framework that applies to copy trading will depend on a range of matters, including the applicable terms and conditions, technology implementation, the fee model, the nature of the financial products involved, and social or gamification features. A variety of different models are evident in the market. It is important to note that both the platform provider and the strategist may be carrying on a financial services business and should obtain advice on their obligations under Australian laws.

Australian financial services licensing

If a platform offers copy trading services, it may be required to hold an Australian Financial Services Licence (AFSL) with appropriate authorisations. This licence is mandatory for persons providing financial advice or dealing in financial products. Platforms facilitating copy trading must ensure they comply with the conditions of their AFSL, including the obligation to act efficiently, honestly, and fairly, among others.

Depending on the facts and circumstances, the copy trading strategist may also be carrying on a financial services business by providing financial product advice or potentially dealing in or arranging a financial service, among others.

Financial Advice

Financial advice in Australia is defined in section 766B of the Corporations Act 2001 (Cth) as a recommendation or statement of opinion intended to influence a person's decision in relation to a financial product. Depending on how the product is operating, both the platform and the individual traders offering their strategies for copying may need to comply with the requirements for the provision of financial advice, including being appropriately licensed (i.e., holding an AFSL that covers the provision of financial advice) and ensuring that advice is suitable for the investors.

Dealing in a financial product

Dealing in a financial product occurs when a person (as principal or agent) issues a financial product, applies for or acquires a financial product, varies a financial product, or disposes of a financial product. The definition of dealing in a financial product also includes the concept of "arranging", which is interpreted broadly and as a general rule, the more active an intermediary is in facilitating a certain transaction between a consumer and a financial product issuer, the more likely their activity would be "arranging" the dealing of a financial product. Both the platform and the trading strategist could be seen as intermediaries in offering copy trading strategies depending on the facts and circumstances.

Managed investment schemes

Copy trading arrangements might also be considered a financial product in the form of an interest in a managed investment scheme. In essence, a managed investment scheme involves the pooling of funds from multiple investors to acquire interests in assets managed by a responsible entity. Retail managed investment schemes are required to be registered and comply with a variety other compliance obligations under the Corporations Act.

Financial investment

The general financial product definition also includes any arrangement where money is paid or invested into a product/offering for the purposes of gaining a financial return, where the investor has no day-to-day control over the money paid or invested. Copy trading strategies could fall under the purview of this definition depending on how the particular platform and strategy is operated.

Managed discretionary accounts (MDA)

Although not a defined category of financial product under the Corporations Act, a copy trading strategy could also fall under the definition of MDA services. The provision of MDA services is governed by the Corporations Act, ASIC Regulatory Guide 179: Managed discretionary accounts (RG 179), and ASIC Corporations (Managed Discretionary Account Services) Instrument 2016/968.

MDA services involve a "client" making contributions that are managed at the discretion of the MDA provider. The provider manages these assets to generate financial returns or other benefits for the client, with agreed limitations. In RG 179, ASIC acknowledges that a wide variety of arrangements can constitute a MDA and that MDAs generally fall within the definition of a managed investment scheme and a facility for making a financial investment.

Disclosure and transparency

Generally speaking, ASIC places a strong emphasis on disclosure and transparency for financial services businesses. Platforms that are offering copy trading strategies should provide clear, accurate, and up-to-date information to their users at all times. This includes details about the risks involved and the costs associated with any copy trading service.

This is also important so as not to breach the misleading or deceptive conduct laws. It is crucial for investors to receive sufficient information to make informed decisions about whether to participate in a copy trading arrangement.

Conclusion

Copy trading offers an intriguing opportunity for both novice and experienced investors to gain exposure to a variety of trading strategies in a potentially low cost way. The growth in copy trading follows broader market trends impacted by the dominance of social media and gamification. However, the regulatory landscape in Australia is complex and requires careful navigation. Platforms and traders must ensure their particular arrangement operates in compliance with Australian financial services laws to protect themselves and investors. Given the complexity of the law in relation to this area, platforms and traders are encouraged to take a look in the mirror and seek professional advice before jumping into the social trading phenomenon.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.