The U.S. Securities and Exchange Commission (SEC) recently unanimously voted to issue proposed rules under Title III of the JOBS Act related to crowdfunding. Crowdfunding is a general term for internet-based fundraising characterized by decentralized groups of donors/investors individually committing relatively minor amounts of capital to small businesses, social projects, artistic performances, etc. Popular sites such as Kickstarter and IndieGoGo already provide a crowdfunding platform for the solicitation of donations, while sites like Fundrise, CircleUp and AngelList offer securities using existing securities registration exemptions such as Regulation A and Regulation D. However, under current federal securities laws and regulations, participation in crowdfunding offerings under Regulation D cannot be extended to non-accredited investors, and the use of Regulation A involves an onerous disclosure and review process at both the state and federal levels. The JOBS Act and the recently released proposed rules provide an outline for a regulatory regime that narrowly permits certain issuers, investors and intermediaries to participate in investment-based crowdfunding while attempting to limit the occurrence of fraud.

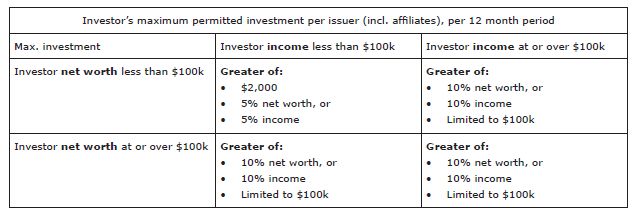

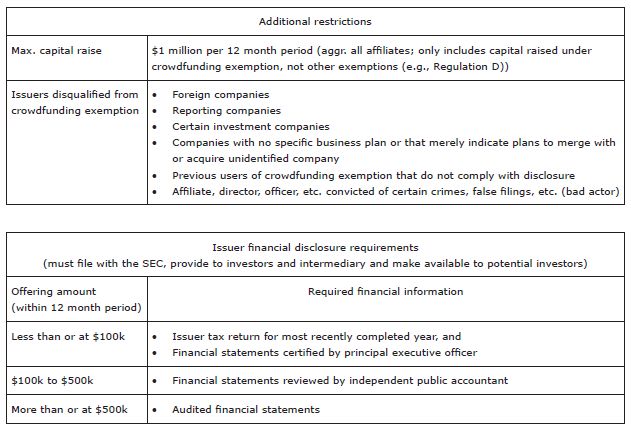

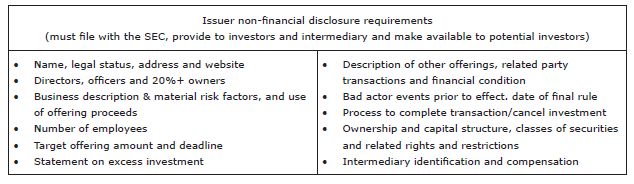

Broadly stated, the JOBS Act exempts certain activities related to crowdfunding from the registration requirements of the U.S. Securities Act of 1933 (Securities Act), and provides investment limitations on investors, as well as disclosure requirements for issuers and intermediaries engaged in crowdfunding transactions. The JOBS Act also exempts certain crowdfunding intermediaries (funding portals) from broker/dealer registration under the U.S. Securities Exchange Act of 1934 (Securities Exchange Act).

The JOBS Act brings crowdfunded securities under the definition of "covered securities" in Section 18 of the Securities Act, thus exempting them from certain state "blue sky" registration and qualification requirements. The JOBS Act further provides that no filing or fee may be required with respect to crowdfunded securities under state blue sky laws, except for those of the state in which the issuer's principal place of business is located, or where a majority of purchasers of such securities reside. Further, the funding portals' crowdfunding activities (as discussed below) are exempted from state blue sky laws, except for those of the state in which a funding portal's principal place of business is located. The exemption from blue sky laws generally only applies to registration and offering requirements, and does not limit states' enforcement powers. The proposed rules discuss this exemption briefly and do not substantially add to the statutory provisions.

Overview of Proposed Rules

For Issuers/Investors:

For Funding Portals:

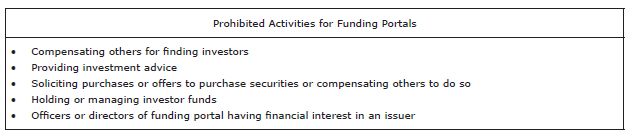

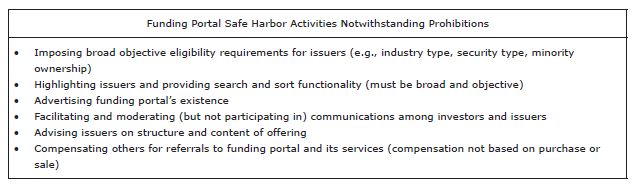

In addition to allowing registered broker/dealers to act as crowdfunding intermediaries under the JOBS Act, the proposed rules create a newly designated crowdfunding intermediary called a "funding portal," facilitating primary issuances of securities on behalf of issuers without the burden of registering as a broker/dealer under the Securities Exchange Act. While funding portals do not need to register as broker/dealers to be crowdfunding intermediaries, certain funding portals' activities are prohibited.

Because these broad prohibitions include certain activities funding portals are meant to engage in, the proposed rules include certain safe harbors.

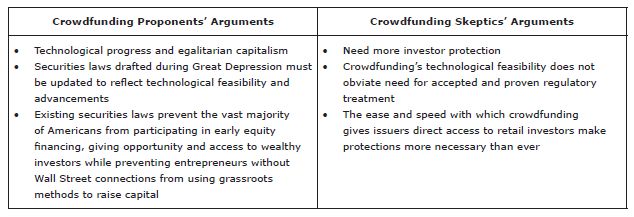

Progress vs. Protection

While Congress has signaled its interest in promoting crowdfunding for small businesses seeking to raise capital by passing the JOBS Act, the efficacy of the legislation and the balance between the regulatory objectives of promoting crowdfunding and protecting retail investors will be determined largely by the rollout of regulations now in proposed form.

Request for Comments

The SEC's requests for comments on the proposed crowdfunding rules are broad and comprehensive. Where the SEC has rulemaking discretion, such as prohibiting activities of funding portals, it requests comments as to whether additional activities should be prohibited or if any of the proposed prohibitions should be modified or removed. Where the SEC has more limited discretion, for example with issuer disclosure requirements (many of which are specified by the JOBS Act), the SEC asks whether the requirements are appropriate and whether additional requirements should be prescribed. Aside from broad questions of scope and appropriateness, the SEC's requests for comments focus on the technical aspects and risks generally associated with the infrastructure of the nascent crowdfunding industry. The SEC has asked the public to submit comments on the proposed rules on or before February 3, 2014. Given the scope of the proposed rules and the span of their impact, we expect extensive comments from interested parties.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.