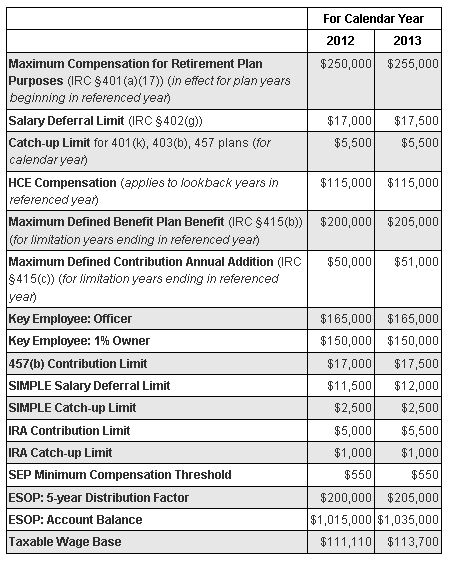

The US Internal Revenue Service (IRS) has just issued the cost of living adjustments for various retirement plan limitations that will take effect either on January 1, 2013 or for the 2013 plan year.

These 2013 Plan limitations are important to both plan sponsors, plan participants and individuals with respect to tax planning and plan administration for 2013. There are changes to some but not all of the limits. This is due to the Cost of Living Adjustment (COLA) rounding rules. Although income tax rates for 2013 are unclear at this time, if tax rates do increase for individuals, the value of retirement plans and their tax deductible contributions will increase as well. The 2013, and for comparison, the 2012 limits are as follows:

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

We operate a free-to-view policy, asking only that you register in order to read all of our content. Please login or register to view the rest of this article.