Introduction

The Federal Budget has placed a strong emphasis on increasing support for housing development to address the current housing crisis by introducing over $6.2bn of new and additional spending on social and affordable housing, new housing infrastructure, and rent assistance, amongst others.

From a tax perspective, however, the Federal Budget was very light on providing stimulus to increase investment in this area. Whilst we expect the announced measures will impact unlocking additional housing, we encourage the Government to engage in further consultation with industry regarding the previously announced Build to Rent (BTR) tax incentives. The initial Exposure Draft legislation fell short in many key areas, which must be addressed if the measures are to achieve the expected construction of 150,000 additional apartments in the coming decade (per the Property Council of Australia's modeling).

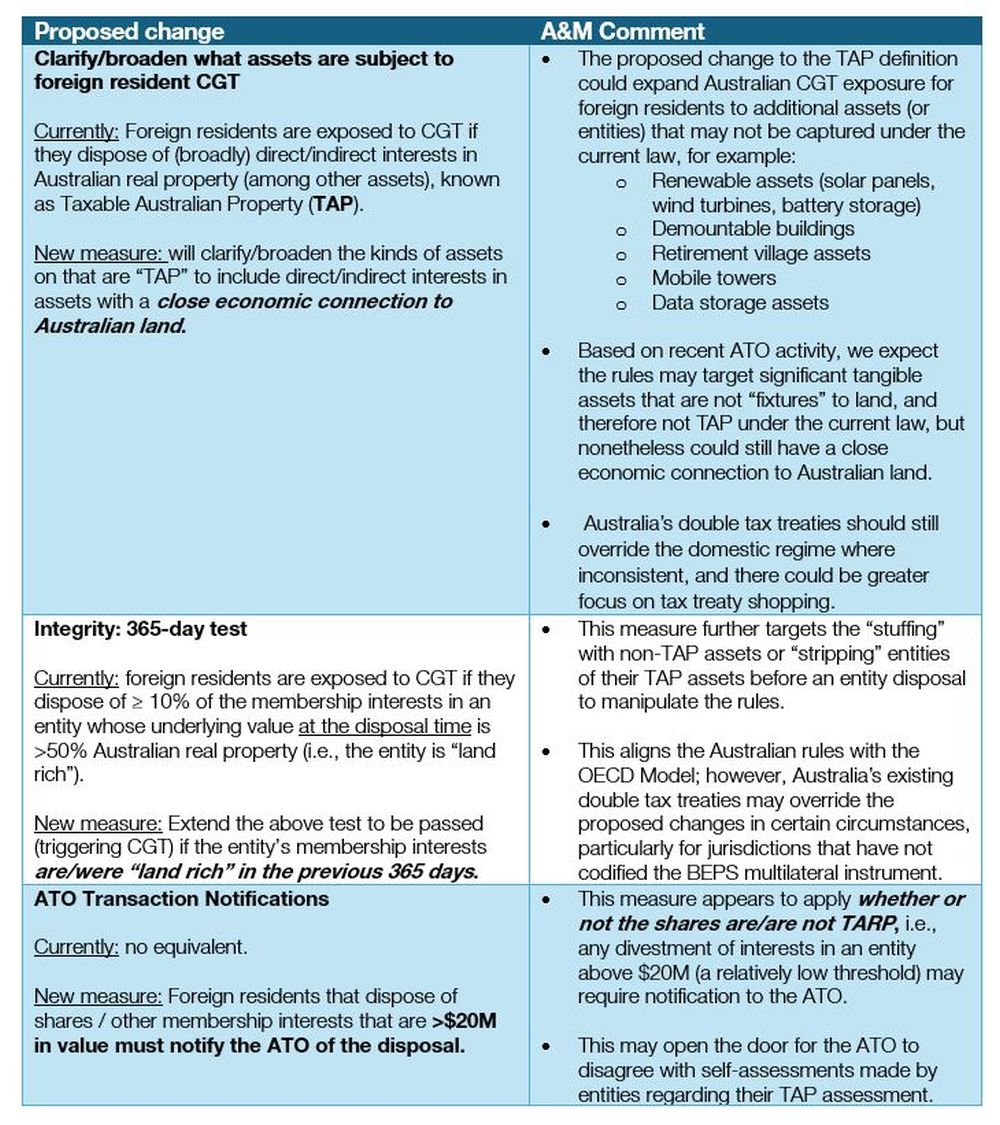

Strengthening the foreign resident capital gains tax (CGT) regime

In the most significant corporate tax change, the Federal Budget announced new changes to the foreign resident CGT regime, which are intended to expand and clarify these rules. Treasury forecasts an increase in taxation on foreign resident investors of $200m annually from implementation ($600m in total).

The Federal Budget announcement noted that consultation will be undertaken, which will permit affected businesses to have some say in the complexities that will likely arise when implementing these changes. A&M will contribute to these discussions.

The following three changes are expected to apply from 1 July 2025:

Other relevant Federal Budget measures

FIRB

The Budget reaffirms previously announced and welcomed changes to Australia's foreign investment framework, including:

- Refunding 75% of fees for foreign investment applications that do not proceed because the applicant was unsuccessful in a competitive bid;

- Allowing foreign investors to acquire existing BTR properties (subject to the property continuing to be operated as a BTR development) and

- Reducing FIRB fees for BTR properties (subject to the property continuing to be operated as a BTR development).

In our view, the impact of the BTR changes will be dependent on the final form of the BTR tax incentives.

PBSA

More detail has been provided on the role universities will play in addressing the housing shortage by affirming that regulatory requirements will be placed on universities to deliver new purpose-built student accommodation (PBSA) in order to increase their international student enrolments above their initial allocation. New PBSA must be available to both local and international students. Universities will need to partner with external PBSA developers and operators to meet these requirements. We recommend that providers engage early with universities to ensure they are involved in the consultation process.

Thin Capitalisation

Disappointingly, the Federal Budget confirmed that the recent amendments to the thin capitalisation regime exempted only Australian plantation forestry entities from the earnings-based test. Industry groups have called for Australian real property entities to also be carved out from the new thin capitalisation rules given the challenges these rules present to stimulating investment into Australian housing by foreign resident investors.

Originally published 19 May 2024

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.