Between volatile demand, increasing pressure from consumers for efficient service levels, and a growing competitive environment, the U.S. parcel market has undergone significant changes in recent years.

While the COVID-19 pandemic spurred explosive growth for parcel carriers in 2020 and 2021, volume has since moderated. In 2023, the market experienced 4.1% growth (compared to ~14% in 2020), with projections of 3% annual growth through 2029. Despite this, demand for fast, cost-efficient shipping remains strong. The dynamics driving the current shippers' market are discussed in our Parcel Spotlight from May 2024 (Parcel Delivery Spotlight, David Tait, Rick Maicki (ankura.com)).

The carrier landscape has long been dominated by UPS and FedEx, but recent years have seen emerging players vie for market share. The expansion of Amazon's own delivery capacity surpassed UPS and FedEx in market share for the first time in 2023 and has created excess capacity in UPS and FedEx's networks. Increased competition has also been intensified by the entrance of alternative shippers including OnTrac and Pandion, creating a challenging environment for large carriers, as well as financial challenges. UPS recently announced a year-over-year decline in operating income of 32.6%, falling well below analyst estimates for both top line and bottom line, and resulting in narrowed full-year outlooks.

These recent developments offer shippers an opportunity to leverage heightened competition to reduce supply chain costs without compromising consumer expectations. Retailers must define a clear parcel strategy to mitigate the impact of impending price hikes from major carriers.

Price Hikes for USPS Parcel Select

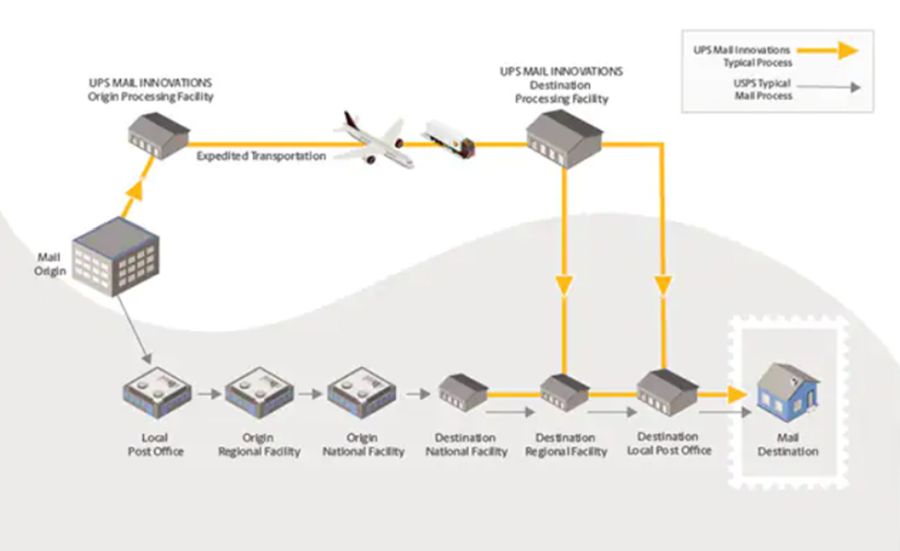

Many major carriers leverage the extensive last-mile delivery network of the United States Postal Services (USPS) to reduce ground shipping costs and avoid various delivery surcharges. Services like UPS SurePost and FedEx Ground Economy (formerly known as "SmartPost") consolidate ground packages and transport them to a USPS facility closer to the end customer for final delivery using USPS's Parcel Select service. As shown in the example below, UPS presorts packages and delivers them to a post office close to the destination, where the packages are then handed off to USPS for last-mile delivery.

Source: UPS

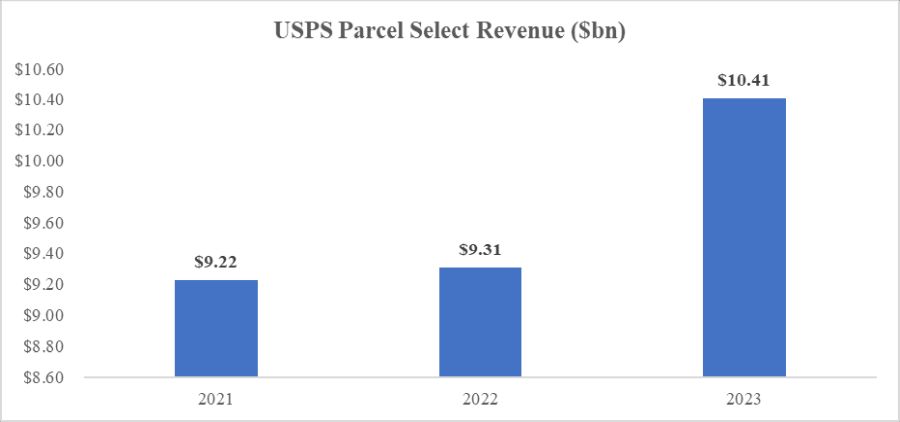

While this service presents an economical alternative, it does come with significant trade-offs, including extended and more variable delivery times, additional packaging and labeling requirements, and reduced tracking visibility. Nonetheless, it has been embraced by many shippers and usage has grown rapidly in recent years.

In 2021, USPS launched its "Delivering for America" 10-year plan with the overall objective of achieving financial stability (including increased revenue generation) and operational improvements. As part of this initiative, in May 2024, USPS filed a request for an overall 25% price increase on its Parcel Select service to the Postal Regulatory Commission. The PRC approved the prices which went into effect on July 14. While averaging 25% across all weights and zones, these increases are particularly punitive on small packages weighing under one pound, which have increased as much as 75%.

In addition to increasing revenue, the decision by USPS to increase prices is, in part, aimed at pushing volume further upstream in their network and utilizing capacity in regional and national facilities. They have stated that "it is not needed and not a good business strategy to have third parties perform that work and then bring packages to the Postal Service for last-mile delivery."USPS aims to take a larger role in the overall fulfillment journey by reducing the involvement of UPS, FedEx, Pitney-Bowes, and others, but the transition poses the risk of degrading service considering that USPS has been "reporting service performance results that are well below its own targets, despite having lowered service performance standards."1

The influence of these price increases on services like FedEx Ground Economy, UPS SurePost, and other hybrid delivery models is still unfolding, but significant impacts are expected. While major Parcel Select users typically operate on a Negotiated Service Agreement (NSA) providing significant discounts, these agreements, over time, will likely be affected by the increased rates. Anecdotal evidence suggests it is becoming more difficult for shipping companies to get a favorable NSA, as USPS focuses directly on their e-commerce customers. This move is expected to result in the loss of about 76 million packages for the Postal Service which will revert to single-carrier ground services like UPS and FedEx Ground.

While the price adjustment is meant to support USPS's consolidation of their overall delivery network and streamline operations, shippers must evaluate whether the increased costs of Parcel Select will justify switching to other, more reliable services.

Key Considerations in the Face of Price Increases

Given the price increase to USPS Parcel Select services, retail customers should consider several operational adjustments to mitigate the impact on their logistics and shipping operations, including the below.

Diversify Shipping Partners: Diversifying shipping partners can reduce dependency on USPS, UPS, FedEx, or DHL. Analyzing shipping data allows retailers to secure competitive rates from alternative providers, and optimize their carrier mix based on cost, delivery speed, and service reliability. Most efficient shippers will include some niche providers in their carrier roster to capitalize on specialized capabilities.

Evaluate the Trade-Off: Retailers must first evaluate the benefits of lower costs against the advantages of more reliable delivery times, better tracking, and reduced packaging and labeling requirements offered by Fedex, UPS, or alternatives like OnTrac's Residential E-commerce Delivery Service. If cost is the driving factor and service levels are less critical, USPS Ground Advantage may also present an alternative.

Diversify Services: In addition to diversifying shipping partners, retailers should consider diversifying the mix of services. Where the cost advantage is insignificant and service quality is critical, the greater reliability of FedEx Ground Economy/UPS SurePost may be preferable over hybrid services. These cost increases should make USPS Ground Advantage a viable service where a guaranteed delivery window and robust tracking are not a requirement. Some shippers are now using a combination of these services, with many choosing to use USPS Ground Advantage for less time-critical returns.

Negotiate Contracts: Developing a deep understanding of pricing complexities, including surcharges and minimum charges, enables fact-based negotiations. Retailers should consider rebidding contracts to capitalize on the competitive market landscape and potentially introduce new vendors for last-mile deliveries.

Embrace Technology: Enhanced data tools and AI analytics can optimize shipping decisions and improve overall efficiency. Implementing machine learning automation can replace manual data integration processes, driving increased operational efficiency and ultimately managing costs.

Adjust Fulfillment Strategies: Aligning fulfillment strategies with customer expectations involves reviewing and adjusting shipping nodes and package sizes. Retailers should ensure their fulfillment network and operations are optimized to fully leverage service options while maintaining competitive delivery speeds.

Brace for Change

On top of the drastic changes the U.S. parcel market has faced in recent years, USPS's price increase to their Parcel Select service poses another material disruption. As retail customers grapple with these changes, they will need to reassess their supply chain and fulfillment strategies, shipping pricing strategies, and budget allocations to accommodate higher costs while preserving competitive service levels.

How the Ankura Performance Improvement Team Can Help

The Ankura Performance Improvement Team has a proven track record of executing strategic plans to achieve sustainable performance improvement and targeted operating results aimed at maximizing Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA), cash flow, and ultimately shareholder value.

Our expertise extends to optimizing distribution and logistics. We work alongside clients to reduce costs and improve efficiency by streamlining inbound and outbound logistics. Our team's firsthand experience ensures cost-effective solutions for transportation modes, shipping rates, and on-time delivery.

Ankura leverages its extensive internal resources and market intelligence to assemble the perfect team for each client's unique challenges, guaranteeing optimal outcomes for complex problems.

Footnote

1. Postal Regulator Commission Docket CP2024-295, Order 7260, pp. 4,17

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.