- within Insolvency/Bankruptcy/Re-Structuring and Law Department Performance topic(s)

This edition of the Automotive Industry Spotlight will focus on how the results of the 2024 U.S. presidential election may impact the mid- and long-term strategies of automakers.

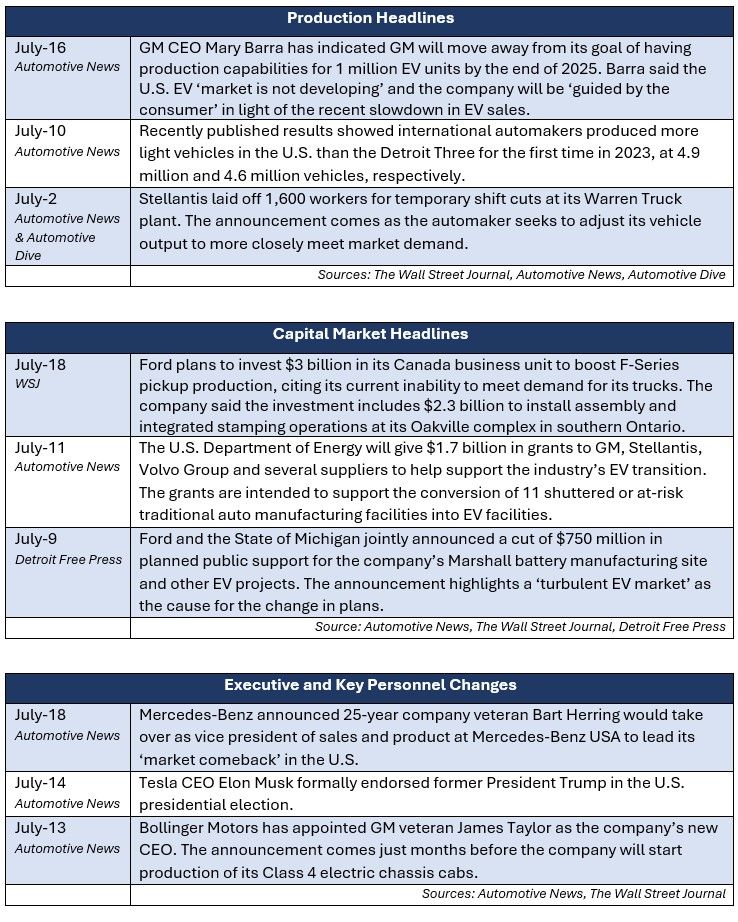

In industry news, General Motors (GM) abandoned its 2025 electric vehicle (EV) production target, citing the significant slowdown in consumer demand. The Department of Energy announced $1.7 billion in federal grants for several automakers to repurpose dormant and at-risk manufacturing sites for EV and EV-adjacent development. Ford and the state of Michigan announced a $750 million incentive cut for Ford's planned battery plant in Marshall.

In regulatory news, the National Highway Traffic Safety Administration (NHTSA) has opened a probe into Stellantis related to Ram and Jeep models experiencing power failure. BMW announced a significant recall on almost 300,000 vehicles related to issues with cargo storage. The Department of Commerce announced pending rule proposals on vehicle software sourced from China and other countries, citing data security and sharing concerns.

Industry Focus — The Presidential Election and the Future of EV Policy

The rapidly changing shape of the 2024 presidential election has thrown the predictability of long-term policy, particularly as it relates to EVs, into question. Automakers and suppliers are closely monitoring candidate platforms and potential implications for the future.

While a Democrat ticket featuring Kamala Harris has not explicitly focused on automotive and industrial policy, particularly on EV-related requirements, industry experts have largely agreed it would resemble a continuation of Biden-era policies, and potentially even see an acceleration of certain requirements. On the other hand, a Trump presidency would likely lead to a clawback of Environmental Protection Agency (EPA) rules that inherently require substantial increases in EV sales and longer-term uncertainty for automotive policies. GM, Stellantis and Ford are in particularly vulnerable positions as a result of the policy-driven uncertainty, with long-term investments in EV development hanging in the balance.

Continuity Would Likely Prevail... to Varying Degrees

With Kamala Harris as the presumptive nominee for the Democratic Party, the current expectation would be a continuation of Biden-Area automotive policies. While continuity would benefit automakers that have set plans for longer-term strategies based on policy rolled out by the Biden administration, industry experts believe there's room for a Harris-led ticket to accelerate EV transition requirements and tighten emission standards even further.

Policy changes will likely be heavily influenced by any candidate's pick for a running mate. Among the popular choices this year are governors of swing states with heavy concentrations of manufacturing — particularly Josh Shapiro, D-PA, and Gretchen Whitmer, D-MI,. Shapiro would represent a particularly bullish step forward for EVs. Since he was elected in 2022, his tenure as governor has seen significant investment in an EV-focused future for Pennsylvania. Most recently, he committed $20 million to the development of a state-wide EV charging network 1.

Michigan stands to be affected more than most states by the 2024 presidential election, with billions of dollars of public and private sector investment on the line. Although Whitmer has said she is not interested in serving on the Democratic ticket, she has largely supported Biden-era EV investment policies, but she was notably slower than other Democratic party leaders to officially endorse Harris as the party's prospective nominee.

One key endorsement Harris still lacks is that of Shawn Fain and the International Union, United Automobile, Aerospace and Agricultural Implement Workers of America (UAW). Fain recently stated that the UAW would hold off on its official endorsement of any Democratic candidate until they could have 'fruitful discussions' with the potential candidates regarding their labor-focused policy positions. Fain has also indicated that the UAW will not endorse Donald Trump 2. Meanwhile, Republican running mate Sen. J.D. Vance of Ohio, has been outspoken in his support of labor.

A Likely Change in Requirements, But Not Strategies

In his nomination acceptance speech at the Republican National Convention, the Republican nominee vowed 'to end the electric vehicle mandate day one.' While the shift in policy would be dramatic, industry experts generally believe it would not lead to significant strategy shifts for automakers in their long-term shift toward EVs. Given the size of investments made in an EV-focused futured, automakers would most likely remain committed to their development plans 3.

Trump also indicated at a recent rally in Grand Rapids, Michigan that he is 'totally for electric cars,' leading to further comments that he believes anyone who wants an EV should be able to have one, but that the government should not shape the car market 4. With the potential removal of the EV shift would come increasingly tough rules on direct and indirect imports of EVs through tariffs 'double or triple' in value from current Biden administration levels of 100 percent on EVs from China. The tariffs would expand to include EVs manufactured in Mexico at still-to-be-built plants for Chinese automakers — particularly BYD. Trump also indicated that he would 'welcome' Chinese automakers to build EVs in the United States 5.

The dramatic shift in policy with another Trump administration would likely have minimal immediate effects on automakers and their capital planning but would throw longer-term projects into question. Given EPA regulations are set for vehicle model years a minimum of 18 months in advance, it is likely the first model year that could be impacted by policy shifts would be 2028. S&P Global Mobility estimates that a Trump victory would mean a shift in EV market share in the United States from a planned 50 percent by 2030 to a target of 37 percent by the same year —still significant growth from approximately 7 percent in 2023 6.

Given the investment into an EV-focused future from both private and public sector sources, it is likely that Trump would not receive the support of the entire Republican party in shifting priorities wholly away from EVs. Several Republican lawmakers have seen their states benefit from job growth and investment related to national infrastructure projects in support of EVs and would likely vote for a continuation of these policies to the benefit of their own constituents.

What About the Consumer?

A recent automotive consumer study by Cox Automotive highlighted significant consumer uncertainty with the automotive market as it relates to the presidential election. The study was completed prior to President Biden's announcement that he would not be seeking reelection.

The survey found that shoppers believe that the election's impact on inflation, interest rates and the broader economy will impact vehicle prices one way or the other, leading many to adopt a 'wait and see' approach toward purchasing vehicles. Nearly 41 percent of respondents in the study believe that vehicle prices will go up after this year's election, whereas approximately 33 percent of the respondents believe vehicle prices would not be impacted.

Notably, the survey concluded that 54 percent of respondents disagreed with the statement 'The government should mandate consumers to purchase electric vehicles,' with more than 60 percent of respondents also indicating that election results will not impact which powertrain they will consider in a future vehicle purchase 7.

Sources:

1 Pennsylvania News – Gov. Shapiro Announces $20 Million for Electric Vehicle Infrastructure https://www.abc27.com/pennsylvania/gov-shapiro-announces-20-million-for-electric-vehicle-infrastructure/

2 New York Times – U.A.W. Holds off on Endorsing Harris https://www.nytimes.com/2024/07/23/us/politics/uaw-harris-endorsement.html

3 Blomberg – Trump Vows Action to End Electric Vehicle Mandate on Day One https://www.bloomberg.com/news/articles/2024-07-19/trump-vows-action-to-end-electric-vehicle-mandate-on-day-one

4 New York Times – Between Attacks on Electric Cars, Trump Says They're 'Incredible' https://www.nytimes.com/2024/07/23/climate/trump-electric-vehicles-musk.html

5 Fortune – Trump Invites Chinese Automakers to Build Cars in the U.S. https://fortune.com/asia/2024/07/19/trump-invites-chinese-carmakers-evs-us-mexico-tariffs-200/

6 S&P Global Mobility – 2024 US Presidential Election and the Auto Industry https://www.spglobal.com/mobility/en/research-analysis/2024-us-presidential-election-and-the-auto-industry.html

7 Cox Automotive Research: With a National Election Approaching, the U.S. Auto Industry Enters a Season of Uncertainty https://www.coxautoinc.com/market-insights/cox-automotive-research-with-a-national-election-approaching-the-u-s-auto-industry-enters-a-season-of-uncertainty/

Additional July insights are included below.

Industry Update

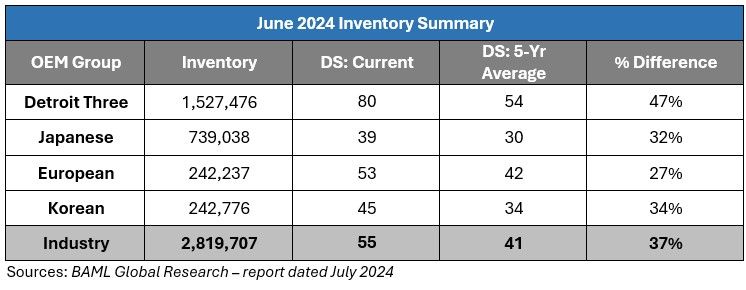

June inventory levels ended at 2.82 million units, a 92,000-unit increase from May. Days' supply closed at 55, approximately 37 percent above the five-year average. Inventory at Japanese original equipment manufacturers (OEMs) had the largest decrease, with a 20,000-unit decrease in inventory, partially offset by a 59,000 unit increase across the Detroit Big Three.

Regulatory Landscape

NHTSA opens probe into Stellantis: Model year 2022 Jeep Wagoneer and Dodge Ram vehicles are under new investigation from the NHTSA in relation to complaints that the vehicles can lose power, shift into park and apply the emergency brake. The investigation covers more than 150,000 vehicles containing the company's 5.7-liter Hemi e-Torque mild hybrid system that enables the vehicle to power itself 1.

BMW Recall: BMW said on July 17 that it is recalling almost 300,000 crossovers due to problems with the rear cargo rails detaching in the event of a crash. The recall affects vehicles from model years 2018 to 2023, and the company expects to send recall letters to consumers by August 30 2.

U.S. to issue proposed rules limiting Chinese vehicle software in August: The U.S. Commerce Department plans to issue proposed rules on connected vehicles next month and expects to impose limits on software made in China and other countries deemed adversaries. The new rules would seek to limit data extraction by foreign governments related to consumers and U.S. infrastructure capabilities 3.

Regulatory News source

1 Automotive News https://www.autonews.com/regulation-safety/nhtsa-investigates-stellantis-engine

31 July 2024

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.