Over the last few years, the additive manufacturing industry has experienced strong growth, with revenue tripling from USD 6 billion in 2016 to USD 18 billion (EUR 16.17 billion) in 2022. A report recently released by the European Patent Office (EPO), entitled "Innovation Trends in Additive Manufacturing", demonstrates that this growth has been accompanied by extensive innovation, and identifies several interesting trends.

Overview

Additive manufacturing (AM), also known as 3D printing, is a manufacturing process in which parts are made by depositing, selectively joining, or selectively solidifying material, typically layer-by-layer. Our earlier insight "3D Printing: An Overview" gives an overview of some of the techniques used in AM.

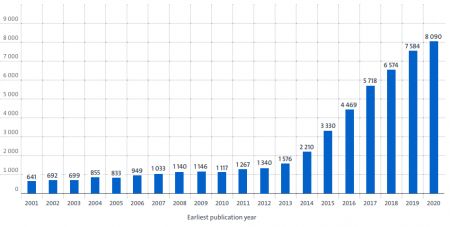

The main theme of the EPO's report is that the number of International Patent Families ("IPFs") and thus, by proxy, innovation volume, in the AM sector has grown rapidly over the past 10 years. As shown in Figure 1, more than 50,000 AM-related inventions were the subject of patent filings between 2001 and 2020. Between 2013 and 2020, the year-on-year growth in the number of IPFs was 26.3%. This is nearly eight times larger than the average growth for other technology fields during the same period (3.3%).

Figure 1 – Number of IPFs in all AM technologies, by earliest publication year. Source: European Patent Office, "Innovation Trends in Additive Manufacturing", Figure 4

Sector trends

It is now around 40 years since the arrival of the first commercial AM machines. For much of this period, the applications of AM have been relatively limited, and, in many sectors, use of AM has been restricted to prototyping and product development. This has been because of various limitations of AM techniques, including low throughput, expensive materials, and material properties (e.g. strength) of final products that fall short of those produced by traditional manufacturing methods.

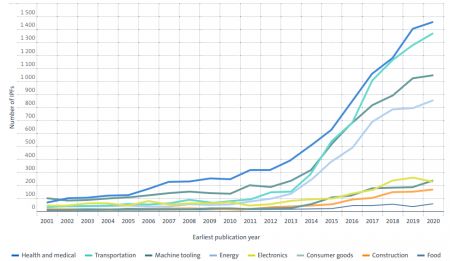

One sector that has overcome these limitations is the health and medical sector, in which AM techniques are commonly used in the production of final products such as medical devices, implants and prosthetics. This is reflected in the IPF data shown in Figure 2: of the IPFs that relate in some way to the application of AM, over 35% relate to the health and medical sector. A major factor in the adoption of AM in the health and medical sector is that AM allows products to be personalised to the individual requirements (e.g. anatomy) of patients, which is often difficult and expensive with conventional manufacturing processes.

Between 2013 and 2020, the number of IPFs in other sectors, such as the transportation, machine tooling and energy sectors, has also increased rapidly. Among the IPFs in these sectors, there are a significant number that relate to the use of AM in the production of final products. AM techniques may not widely replace conventional manufacturing techniques in the high-volume production of final products due to the limitations described above. However, it seems likely that AM techniques will be used increasingly in the manufacture of specific types of final product, such as replacement components, customisable parts, and parts with complex geometries for use in high-performance systems.

Figure 2 – Number of AM-related IPFs relating to applications, by earliest publication year. Source: European Patent Office, "Innovation Trends in Additive Manufacturing", Figure 9

Material trends

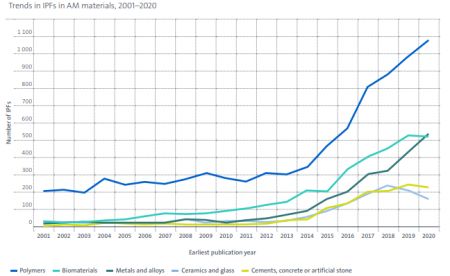

From the early days of AM, polymers have been most widely-used due to their compatibility with AM techniques. In 2020, IPFs relating to polymers accounted for over half of all IPFs that relate to materials, and the number of IPFs that relate to polymers continues to grow rapidly (see Figure 3).

Whilst polymers are clearly dominant, the number of IPFs relating to other materials, such as biomaterials and metals, has also been growing, with the rate of increase in the number of IPFs relating to metals and alloys outstripping even that of polymers. Innovation in metals and alloys means that AM techniques can now be performed with a wide range of such materials, including steels, titanium, nickel, cobalt, aluminium, copper and gold. This lays the foundations for the increased adoption of AM techniques in the transportation, machine tooling and energy sectors discussed above.

Figure 3 – Number of AM-related IPFs directed to materials, by earliest publication year. Source: European Patent Office, "Innovation Trends in Additive Manufacturing", Figure 8

Applicant trends

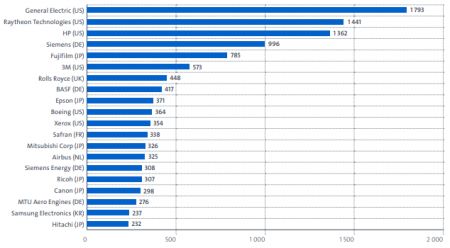

Unsurprisingly, the list of the top applicants (Figure 4) in the AM sector is dominated by large engineering companies, with household names such as General Electric, Raytheon Technologies, and HP coming out on top. Siemens, holding the fourth position, has the most IPFs of any European company, with a portfolio of nearly 1,000 IPFs. Representing the UK, Rolls Royce features at number 7, with a portfolio comprising nearly 500 IPFs.

Figure 4 – Top 20 applicants in all AM technologies. Source: European Patent Office, "Innovation Trends in Additive Manufacturing", Figure 25

However, patenting activity in the AM sector is not exclusively the domain of industry giants. The AM innovation ecosystem thrives on contributions from specialized AM companies and a vibrant start-up scene. Further, universities and public research organizations (PROs) have made significant contributions, filing approximately 12% of AM-related IPFs. This is nearly double the share of universities and PROs in other technologies during the same period (7%) and reflects that this is still an emerging area of technology.

Final thoughts

Given the extent of innovation in the AM sector, it seems highly likely that AM techniques will play an increasingly important role in the design and manufacture of products. However, the exact nature of this role remains unclear. Will AM become widely implemented outside of prototyping and product development? Which sectors will adopt AM for the production of final products? What type of final products will AM be used to produce? Irrespective of the answers to these questions, the rapidity with which the technology is developing makes the AM industry an exciting one to follow.

J A Kemp LLP acts for clients in the USA, Europe and globally, advising on UK and European patent practice and representing them before the European Patent Office, UKIPO and Unified Patent Court. We have in-depth expertise in a wide range of technologies, including Biotech and Life Sciences, Pharmaceuticals, Software and IT, Chemistry, Electronics and Engineering and many others. See our website to find out more.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.