On September 20, 2007, FERC issued an Order on Offer of Settlement and Complaints regarding allegations of tariff violations and interference with the independence of PJM Interconnection, L.L.C.’s Market Monitor, Dr. Joseph E. Bowring. The Commission found that PJM had not violated its tariff, but that modifications of the reporting requirements must be made to ensure a good working relationship between PJM and its market monitor. FERC Chairman Kelliher explained in a statement that "we found there to be significant tension between PJM management and the market monitor that could compromise the monitor’s ability to perform his tariff-related duties."

Dr. Bowring alleged that PJM management perceived him as "first an employee of PJM with all the duties of an employee," a view that conflicted with the autonomy essential to his position as the market monitor. While FERC noted the Dr. Bowring was able to maintain independence and fulfill his responsibilities, Chairman Kelliher also stated that there was "an unusual degree of supervision over the Market Monitor," making it difficult for him to perform the responsibilities of his position.

To ease these tensions and restore confidence in market regulation, FERC made a preliminary finding that the market monitor should not report to both the PJM Board of Managers and PJM Management. Instead, the market monitor will report only to the Board or to an independent committee of the Board. Although FERC found that no violation had occurred, FERC explained the importance of in order to ensure no future tariff violations would occur and sought to support the market monitor by requiring PJM to provide adequate resources, including staff, access to required information and cooperation.

FERC imposed a strict settlement timetable for the parties and encouraged settlement over continued litigation. FERC explained that the shortened timetable and emphasis on the working relationship between PJM management and the market monitor is necessary to maintain confidence in energy market regulations governing efficient and competitive operations. The end result will strengthen and clarify FERC’s May 2005 Policy Statement on Market Monitoring Units.

FERC is concurrently addressing the question of market monitor independence by way of the June 21, 2007 Competitive Markets Advanced Notice of Proposed Rulemaking; a Final Rule is not expected for several months. Therefore, FERC is pushing towards a timely settlement of the current PJM matter.

FERC And CFTC Cooperation In Natural Gas Market Enforcement Action Fading

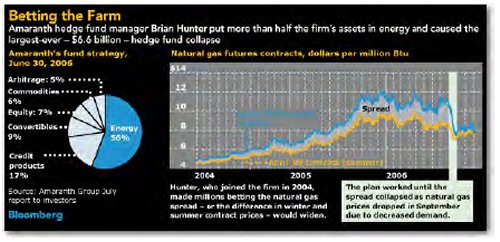

In July 2007, both FERC and the Commodity Futures Trading Commission ("CFTC") brought enforcement actions against Amaranth Advisors LLC ("Amaranth"), a Connecticut-based hedge fund, for alleged manipulation of natural gas markets. Amaranth is accused of lowering gas futures prices on the New York Mercantile Exchange via limited surges of substantial selling, which the agencies contend benefited gas derivative positions held by Amaranth in the Intercontinental Exchange and other natural gas derivative exchanges.

While the CFTC brought its action in the United States District Court for the Southern District of New York, because FERC is acting under its administrative authority, FERC’s enforcement action is not before a court. Instead on July 26, 2007, FERC issued a show-cause order, describing the allegations against Amaranth and seeking $291 million in fines and profit disgorgement. Amaranth responded alleging that FERC is without jurisdiction in the case because Amaranth never made any transactions involving physical natural gas.

The case is particularly significant as it represents the first time FERC has used the new enforcement authority granted by the Energy Policy Act of 2005, to regulate transactions made in connection with physical gas sales. In the July 26 Order, FERC explained that the "in connection with" element of its new authority "applies where there is a "nexus" between the manipulative conduct and the jurisdictional transaction."

CFTC and FERC had been cooperating to develop a case against the Amaranth hedge fund, but recently, the CFTC has alleged FERC is without jurisdiction in this matter, because it involves gas markets, which are primarily regulated by the CFTC. CFTC regulates futures markets, where FERC regulates physical gas sales.

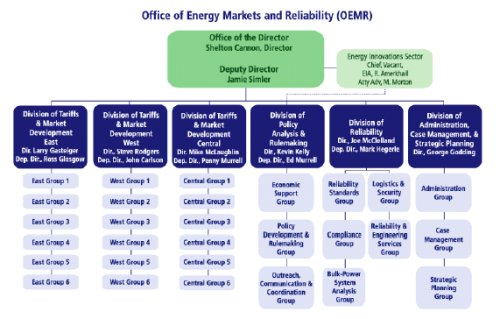

FERC Announces Creation Of New Office Of Electric Reliability And Energy Innovations Sector

FERC announced the creation of the new Office of Electric Reliability on September 20, 2007. This new office, formerly the Division of Reliability within the Office of Energy Markets and Reliability, will be headed by the same director of the former division, Joseph H. McClelland. With the establishment of the Office of Electric Reliability, the Office of Energy Markets and Reliability will now be known as the Office of Energy Market Regulation ("OEMR").

The creation of the Office of Electric Reliability reflects the increased significance of mandatory and enforceable reliability standards, which FERC continues to develop and implement. The new office will be committed "to protecting and improving the reliability and security of the nation’s bulk power system," according to Director McClelland. OEMR will continue to focus on traditional economic regulation and develop market rules and regulations for the power and gas markets.

FERC also announced on September 20, 2007, the creation of the new Energy Innovations Sector. This unit will operate within OEMR and will promote and manage issues relating to demand response, renewable energy, global warming and advanced technologies within energy markets. The creation of this unit will help FERC to fulfill its responsibilities under the Energy Policy Act of 2005. The new unit will serve as a panel of experts to coordinate with FERC Staff and provide technical support and policy recommendations regarding these issues.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.