Presented to: LSI Energy in Alaska Conference

Agenda

- 12-18 months into the oil price collapse

- What have we learned? - Will the "gap" in oil and gas prices return?

- Recent changes in LNG markets – temporary or permanent?

- Alaska LNG Project risks

- Insufficient demand, supply competition, or both? - Key indicators to watch going forward

Previous themes at this conference

- 2011: Shale gas creates massive uncertainty for pipeline project to Lower-48

- 2012: Shift in focus of Alaska P/L project to LNG exports due

to the rise of North American shale gas.

- The potential effect of shale on global LNG prices

- The rise of LNG supply competition - 2014: Collapse in oil prices and the closing of the oil/gas

price "gap"

- New uncertainties for Alaska LNG project - 2015: ??

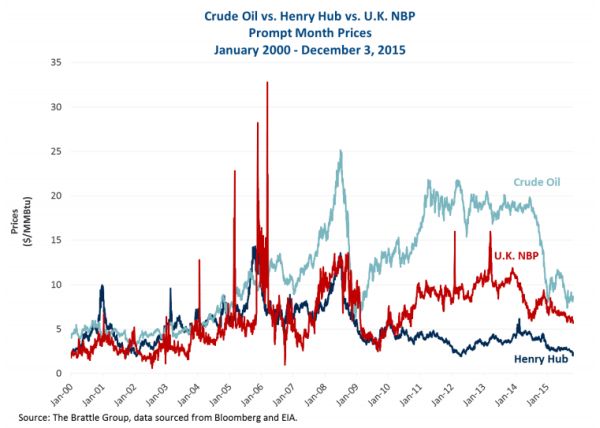

The crude oil price has collapsed and the oil/gas price "gap" has closed

To continue reading this presentation, please click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.