On December 22, 2023, the Internal Revenue Service

("IRS") and the Treasury Department released hotly

anticipated proposed regulations on the implementation of the

Section 45V credit for the production of clean hydrogen.

Section 45V was enacted as part of the Inflation Reduction Act in

2022. Generally, Section 45V allows a federal tax credit for the

production of qualified clean hydrogen at a qualified clean

hydrogen production facility. The credit is determined based on the

kilograms of qualified clean hydrogen produced, multiplied by an

amount that depends on the lifecycle greenhouse gas emissions rate

resulting from such production. The credit ranges from 60 cents to

$3.00 per kilogram, adjusted for inflation. Taxpayers begin to

qualify for the credit where the lifecycle greenhouse gas emissions

rate per kilogram of hydrogen produced is less than or equal to

four kilograms of C02e, with the maximum rate available where such

emissions rate per kilogram of hydrogen produced is less than 0.45

kilograms of CO2e.

The proposed regulations were accompanied by a series of other releases from the executive branch.

- Text of Proposed Regulations

- Related Treasury Department Press Release

- EPA Letter to Treasury on the Definition of Lifecycle Greenhouse Gas Emissions

- DOE Whitepaper on Assessing Lifecycle Greenhouse Gas Emissions Associated with Electricity Use for the Section 45V Clean Hydrogen Production Tax Credit

The proposed regulations were issued on the heels of the circulation of a leaked draft earlier in December 2023, as reported by Bloomberg.1 The contents of the leaked version were controversial to some, as they included what some consider to be strict requirements relating to the so-called three pillars requirement for purposes of determining emissions relating to the electricity used to power facilities that could be eligible for the credit. The proposed regulations issued on December 22, 2023, are consistent with the reporting around the leaked version and could require taxpayers to acquire Energy Attribute Certificates relating to the generation of clean electricity that meet the so-called "three pillars" to qualify for the credit and/or to maximize the amount of the credit.

Described a bit differently depending on the source, the three pillars for clean electricity used to power a hydrogen generating facility are as follows:

- Additionality – clean electricity used to power the hydrogen production must be from a new generation facility or facilities;

- Deliverability – clean electricity must be sourced from the same geographic region as the hydrogen production facility; and

- Matching – the clean electricity must be generated during the same time period as the hydrogen production facility uses electricity in the production process.2

These three pillars are key to taxpayers claiming this credit, as the proposed regulations confirm that emissions from the generation of the electricity used to power a hydrogen production facility are considered for determining the lifecycle greenhouse gas emissions of the hydrogen production. As we describe in this report, the lifecycle greenhouse gas emissions of hydrogen production have a direct, material effect on the value of the credit to the hydrogen producer.

Though the three pillars are getting the most initial attention, there are many interesting and nuanced tax technical aspects of the proposed regulations that we cover in this report, specifically proposed rules on the Section 45V credit with the Section 45Q carbon sequestration credit as well as the contents and timing of the required third-party verification reports.

Written or electronic comments on the proposed regulation must be received by February 26, 2024. A public hearing is scheduled to be held on March 25, 2024, in Washington, DC.

Section 45V – Credit for Production of Clean Hydrogen

Section 45V contains rules relating to the clean hydrogen production credit ("CHPC"). The CHPC is an amount equal to:

Kilograms of qualified clean hydrogen * the applicable amount3

The applicable amount is the applicable percentage of $0.60, subject to inflation adjustments.4

The applicable amount is increased to $3.00 for two categories of qualified clean hydrogen production facilities:

- Facilities that began construction prior to January 29, 2023, and meet the prevailing wage requirements for any alterations or repairs on or after January 29, 2023, and

- Facilities that meet the prevailing wage requirements for both the construction of such facility and any alterations or repairs of such facility and meet the apprenticeship requirements with respect to the construction of such facility.5

The applicable percentage is determined as follows:6

Lifecycle greenhouse gas emissions means:

the aggregate quantity of greenhouse gas emissions (including direct emissions and significant indirect emissions such as significant emissions from land use changes), as determined by the Administrator, related to the full fuel lifecycle, including all stages of fuel and feedstock production and distribution, from feedstock generation or extraction through the distribution and delivery and use of the finished fuel to the ultimate consumer, where the mass values for all greenhouse gases are adjusted to account for their relative global warming potential.7

Lifecycle greenhouse gas emissions only include emissions through the point of production (well-to-gate), as determined under the most recent GREET (Greenhouse gases, Regulated Emissions and Energy use in Transportation) model.8

The CHPC is available for the 10-year period beginning on the date a qualified clean hydrogen production facility is originally placed in service.9 Construction must begin before January 1, 2033, for a facility to be a qualified clean hydrogen production facility.10

Qualified clean hydrogen must be produced (i) in the United States or a possession thereof, (ii) in the ordinary course of a trade or business of the taxpayer, (iii) for sale or use, and the production and sale or use of such hydrogen must be verified by an unrelated party.11

No CHPC is available for any qualified clean hydrogen produced at a facility which includes carbon capture equipment for which a credit is allowed to any taxpayer under Section 45Q for the taxable year or any prior taxable year.12

Facilities placed in service prior to 2023 that did not originally produce qualified clean hydrogen but are subsequently modified to produce qualified clean hydrogen are deemed to have been originally placed in service on the date the property required to complete the necessary modification is placed in service.13

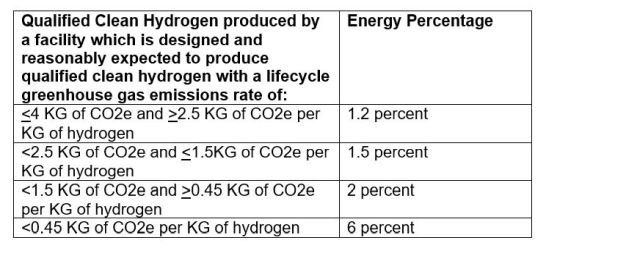

Taxpayers may elect to treat clean hydrogen production facilities as energy property to claim a Section 48 investment tax credit in lieu of the Section 45V production credit.14 Rules similar to the applicable percentage regime discussed above apply for purposes of determining the energy percentage for such facilities based on the design and reasonable expectations of the facility's lifecycle greenhouse gas emissions.15

The energy percentage is determined as follows:16

The actual lifecycle greenhouse gas emissions of the facility must be verified by an unrelated third party.17

Proposed Treas. Reg § 1.45V-1 – Credit for Production of Clean Hydrogen

This section sets forth an overview of the proposed regulations and also includes several defined terms for purposes of the proposed regulations.

Facility is defined for purposes of the definition of qualified clean hydrogen production facility. A facility for these purposes is a single production line that is used to produce qualified clean hydrogen. A single production line includes all components of property that function interdependently to produce qualified clean hydrogen. Components of property function interdependently to produce qualified clean hydrogen if the placing in service of each component is dependent upon the placing in service of each of the other components to produce qualified clean hydrogen.18

Of note, the term facility does not include:

- Equipment that is used to condition or transport hydrogen beyond the point of production, or

- Electricity production equipment used to power the hydrogen production process, including any carbon capture equipment associated with the electricity production process.19

However, components with a purpose in addition to the production of qualified hydrogen may be part of a facility if such components function interdependently with other components to produce qualified clean hydrogen.20

The proposed regulations provide an example distinguishing (i) carbon capture equipment used in the production of the electricity that powers the hydrogen production process that is not part of the facility from (ii) carbon capture equipment that is used in the hydrogen production process itself that is part of the facility.21

A&M Observation – This definition of facility is critically important in the context of determining whether the same facility that produces qualified clean hydrogen also includes carbon capture equipment that earned a Section 45Q credit. If a Section 45Q credit is allowed to any taxpayer, in any prior year, for carbon capture equipment that is part of a qualified clean hydrogen production facility, such facility is disqualified from being eligible for the CHPC. In stark contrast, carbon capture equipment for which a Section 45Q credit is allowed may be part of a facility that produces the electricity used by a facility that produces qualified clean hydrogen without limiting the availability of the CHPC as to such qualified clean hydrogen production facility.

The proposed regulations include some further color on the definition of lifecycle greenhouse gas emissions:

- The most recent GREET model means the latest version of 45VH2-GREET developed by Argonne National Laboratory that is publicly available.22 If a new version of 45VH2-GREET becomes publicly available during a taxable year, then a taxpayer may choose between the new version and the prior version for such taxable year.23

- Emissions through the point of production (well-to-gate) includes emissions associated with feedstock growth, gathering, extraction, processing and delivery to a hydrogen production facility.24 It also includes the emissions associated with the hydrogen production process, inclusive of the electricity used by the hydrogen production facility and any capture and sequestration of carbon dioxide generated by the hydrogen production facility.25

Finally, the proposed regulations address the timing of a taxpayer's claim of the CHPC where verification and/or sale or use occur in a taxable year after the taxable year of production.26

A&M Observation – It appears this rule requires a taxpayer to claim the CHPC in the year of production but does not allow a taxpayer to make such claim until verification and sale or use occur. This implies that a taxpayer may be required to amend returns for the year of production if the verification and/or sale or use do not occur in time for the taxpayer to include the claim on its originally-filed returns.

A&M Observation – Taxpayers who need to amend to claim the CHPC would be disqualified from receiving any amounts relating to a "direct pay" election under Section 6417 as such election must be made on a timely originally-filed return (including extensions).27 Such taxpayers would also be precluded from transferring the CHPC to an unrelated third party for cash under Section 6418 as the deadline for such a transfer is the transferor taxpayer's extended return filing due date.28 Even where taxpayers expect the verification to take place in time to claim the credit on an originally-filed return, this timing rule is likely to create friction in credit transfer situations as transferee taxpayers may not be willing to execute a transfer transaction prior to the verification being complete, or at the very least prior to receiving assurance that the verification will be completed timely.

Proposed Treas. Reg. § 1.45V-2 – Special Rules

This next section covers a grab bag of three special rules for taxpayers claiming the CHPC:

- Coordination with the Section 45Q carbon capture credit;

- An anti-abuse rule; and

- A list of recordkeeping requirements.

Coordination With the Section 45Q Carbon Capture Credit

This section confirms the statutory rule that no CHPC is allowed for any qualified clean hydrogen produced at a qualified clean hydrogen facility that includes carbon capture equipment for which a Section 45Q credit is allowed for the taxable year or has been allowed for any prior taxable year.29

This section does go on to provide an exception to the general CHPC limitation for facilities where a taxpayer has been allowed a Section 45Q credit in situations where the "80/20 Rule" under the Section 45Q regulations is satisfied with respect to a retrofit of the carbon capture equipment included at the qualified clean hydrogen production facility. Under this exception, the satisfaction of the 80/20 Rule as to the carbon capture equipment itself results in such equipment being treated as other than carbon capture equipment for which a Section 45Q credit was allowed for any prior taxable year.30

A&M Observation – As we discuss below, it is important to hold this application of the 80/20 Rule to the carbon capture equipment itself separately from instances where the 80/20 Rule is applied to an entire facility for purposes of starting or restarting the 10-year CHPC period.

As a result of a successful retrofit under the 80/20 Rule of carbon capture equipment that is treated as part of a qualified clean hydrogen production facility, the qualified clean hydrogen production facility becomes eligible for the CHPC, so long as the Section 45Q credit is not allowed to any taxpayer with respect to the retrofitted carbon capture equipment.

A&M Observation – There does not appear to be a mechanism by which a taxpayer can officially elect out of the Section 45Q credit to ensure eligibility for the CHPC after a retrofit of the carbon capture equipment that satisfies the 80/20 Rule. As such, it appears that the Section 45Q credit must not be "allowed" to any taxpayer even in situations where Section 45Q credits are "allowable" to a taxpayer; i.e., situations where a taxpayer owns a qualified clean hydrogen production facility containing carbon capture equipment that is eligible for the Section 45Q credit.

This analysis may turn on the distinction between a tax benefit that is allowable versus a tax benefit that is allowed. The IRS has clarified the difference in the depreciation context, stating that "[d]epreciation allowed is depreciation you actually deducted (from which you received a tax benefit). Depreciation allowable is depreciation you are entitled to deduct."31 It follows that the absence of a claim to an available Section 45Q credit on a taxpayer's return may be sufficient to assert that no Section 45Q credit has been "allowed." Given the importance of the requirement that a taxpayer not be "allowed" a Section 45Q credit for a facility to be eligible for the CHPC for the same facility, a clarification or confirmation as to this point would be welcomed in future guidance; for example, through the creation of a mechanism by which a taxpayer may affirmatively disclaim any right to a Section 45Q credit.

A&M Observation – Our discussion in this report generally assumes the value of the CHPC credit will always outstrip that of the Section 45Q credit for facilities where both are available. Of course, taxpayers in this situation will need to run confirmatory models to rule out a situation where the Section 45Q credit is more valuable than the CHPC.

To view the full article, click here.

Footnotes

1. See https://www.bloomberg.com/news/articles/2023-12-05/hydrogen-industry-raises-alarm-over-leaked-us-tax-credit-rules, retrieved on January 7, 2024.

2. The proposed regulations would allow annual matching through 2027, with an hourly matching requirement beginning in 2028. Proposed Treas. Reg. § 1.45V-4(d)(3)(ii).

3. Section 45V(a).

4. Section 45V(b)(1) and (b)(3).

5. Section 45V(e). Section 45V(e)(3) describes the prevailing wage requirements, and Section 45V(e)(4) cross-references the description in Section 45(b)(8) for the apprenticeship requirements.

6. Section 45V(b)(2).

7. Section 45(c)(1)(A), cross-referencing 42 USC 7545(o)(1)(H) as in effect on August 16, 2022.

8. Section 45V(c)(1)(B). The GREET model refers to the Greenhouse gases, Regulated Emissions, and Energy use in Transportation model developed by Argonne National Laboratory, or a successor model (as determined by the Secretary). The Department of Energy hosts the GREET model at this link.

9. Section 45V(a)(1).

10. Section 45V(c)(3)(C).

11. Section 45V(c)(2)(B).

12. Section 45V(d)(2). The use of the term "any taxpayer" means that a Section 45Q(f)(3)(B) election to shift the Section 45Q credit to a taxpayer who does not capture the carbon could still lead to disqualification for the CHPC.

13. Section 45V(d)(4).

14. Section 48(a)(15).

15. Section 48(a)(15)(A)(ii).

16. Id.

17. Section 48(a)(15)(C)(iii).

18. Proposed Treas. Reg. § 1.45V-1(a)(7)(i).

19. Proposed Treas. Reg. § 1.45V-1(a)(7)(ii).

20. Proposed Treas. Reg. § 1.45V-1(a)(7(iii).

21. Proposed Treas. Reg. § 1.45V-1(a)(7)(iv).

22. Proposed Treas. Reg. § 1.45V-1(a)(8)(ii).

23. Id.

24. Proposed Treas. Reg. § 1.45V-1(a)(8)(iii).

25. Id.

26. Proposed Treas. Reg. § 1.45V-1(c).

27. Section 6417(d)(3)(A)(i)(I). Direct pay under Section 6417 for the CHPC is available to all taxpayers, and not just applicable entities (e.g., tax-exempts and governments), for the first five years of hydrogen production by a qualified clean hydrogen production facility. Section 6417(d)(1)(B); (d)(3)(D)(i)(III)(aa). There does not appear to be an explicit rule as to when amounts available for direct pay must be claimed in Years 2-5 in cases where a valid five-year election was made timely, as technically there is no "election" requirement for Years 2-5. Absent a clear rule to the contrary, taxpayers would be well advised to include any Year 2-5 direct pay claims on a timely filed return (including extensions).

28. Section 6418(e)(1).

29. Proposed Treas. Reg. § 1.45V-2(a); see also Section 45V(d)(2).

30. Proposed Treas. Reg. § 1.45V-2(a); cross-referencing the 80/20 Rule found in Treas. Reg. § 1.45Q-2(g)(5). The 80/20 Rule generally provides that a credit-eligible facility may be treated as originally placed in service following a retrofit if no more than 20 percent of the value of a facility's value post-retrofit is attributable to used components of property (with the value of the facility equal to the cost of the new components of property plus the value of the used components of property). The 80/20 Rule is relevant in many contexts; one of its most common application pre-IRA was generally to determine if a wind facility had been "repowered" to allow for a new 10-year Section 45 production tax credit period. See Rev. Rul. 94-31, 1994-1 C.B. 16.

31. IRS 2022 Publication 946, Chapter 1, Page 12.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.