On June 21, 2024, the U.S. Department of the Treasury's (Treasury) Office of Investment Security released proposed language for the Outbound Investment Security Program (hereafter, the Proposed Rule). When made effective, the Proposed Rule will—under threat of monetary penalties, transaction nullification or divestment, or even jail time (for willful offenses)—prohibit U.S. venture capital firms, private equity investors, lenders of convertible debt or of debt secured by equity interests, and others (collectively, investors) from entering into certain equity investments, convertible lending agreements, foreclosures on equity interests, and certain other transactions (collectively, investments) that could directly or indirectly bolster China's domestic semiconductor-manufacturing, artificial intelligence (AI) systems development, and quantum capabilities. While those prohibitions will target "acute" threats to U.S. national security, investments involving certain less sensitive semiconductor-manufacturing and AI systems development capabilities that "may contribute" to a threat to U.S. national security will require post-closing reporting to Treasury within 30 days. Industry has until August 4, 2024, to submit comments on the Proposed Rule.

The U.S. government touts the Proposed Rule as a pillar of its overall strategy to slow China's advancement in areas the U.S. deems critical to national security. The Proposed Rule is supposed to complement the U.S.'s increasing deployment of trade regulatory regimes for this purpose, such as (1) export controls on semiconductors, semiconductor manufacturing, and super-/quantum computing to China (which we wrote about here and was most recently updated here); (2) planned regulation of U.S. persons' provision of both "managed" and "unmanaged" infrastructure as a service to foreign persons; and (3) congressional bills such as H.R. 8315 to impose controls on the export of AI models to China.

The Proposed Rule is broadly consistent with the August 9, 2023 Advance Notice of Proposed Rulemaking (the 2023 ANPRM). However, with the Proposed Outbound Rules' text now available, additional details have emerged.

I. JURISDICTION: WHO WILL BE REQUIRED TO COMPLY WITH THE PROPOSED RULE?

There are two types of parties over which the Proposed Rule plans to impose jurisdiction:

- "U.S. persons" entering into "covered transactions"; and

- "Controlled foreign entities" (CFEs) of "U.S. persons" entering into "covered transactions."

Note, however, that the Proposed Rule would seek to directly regulate only the behavior of U.S. persons when their CFE engages in a "covered transaction" by requiring the U.S. person to take "reasonable steps," as described further below.

A. Who Are "U.S. Persons"?

The "U.S. person" definition is a familiar one that includes entities organized under the laws of the U.S. or a U.S. jurisdiction wherever located, their foreign branches, persons in the U.S., and any individuals who are U.S. citizens or lawful permanent residents, wherever located. The word "subsidiary" is intentionally left out—Treasury instead intends to regulate a wider swath of entities owned by U.S. persons, which it calls "controlled foreign entities." Like other international-trade regimes, non-U.S. parent companies of U.S. entities will not be considered U.S. persons because of that relationship.

B. What Is a "Controlled Foreign Entity"?

CFEs under the Proposed Rule will include both:

- entities that are subsidiaries of a U.S. person, directly or indirectly, under a traditional conception of the "parent-subsidiary relationship"; and

- entities that aren't directly or indirectly a subsidiary of a U.S. person parent, but that are nonetheless ultimately controlled by a U.S. person.

Specifically, the Proposed Rule's "parent" definition generally reflects prevailing notions of what persons (entities or individuals) are parents. It includes persons who hold, directly or indirectly, greater than 50 percent of outstanding voting interest in or voting power of the board of another entity, as well as the general partner, managing member, or equivalent. The only new addition to this group, at least from an international-trade regulatory perspective, is the addition of the "investment adviser" (as defined in the Investment Advisers Act of 1940) to a pooled investment fund entity as a "parent" of that investment fund entity.

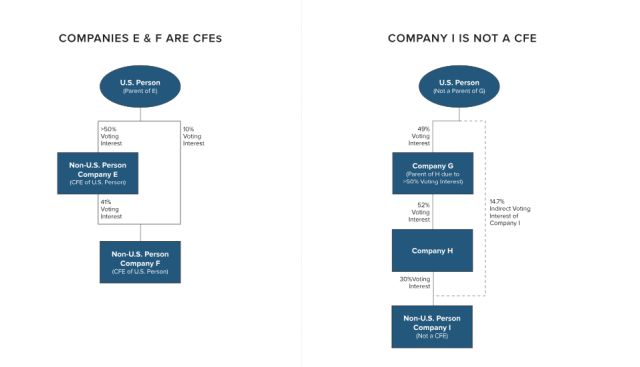

By defining a new term, "controlled foreign entity," Treasury will capture entities where there is no single chain of ownership or control that links, even indirectly, the CFE to the "parent," but that nonetheless are controlled by a U.S. person when multiple chains of ownership or control are considered. For example, consider Examples 3 and 4 in the Proposed Rule:

|

COMPANIES E AND F ARE CFES |

COMPANY I IS NOT A CFE |

|---|---|

|

|

II. JURISDICTION: WHICH TRANSACTIONS ARE "COVERED TRANSACTIONS"?

The Proposed Rule will have jurisdiction over a "U.S. person's" direct or indirect:

- acquisition of an equity interest or contingent equity interest in a person, with "knowledge" that the person is a "covered foreign person" (CFP), including where the interest is acquired through a lender's foreclosure on collateral;

- provision of a loan or other debt that is convertible to equity to a person, with "knowledge" the person is a CFP;

- conversion of a contingent equity interest in, or debt to, a person into an equity interest, with "knowledge" that the person is a CFP (note that a single investment could be a "covered transaction" more than once because of the later conversion of the convertible investment in an equity interest);

- provision of a loan or other debt that gives the U.S. person certain control rights over or relating to a person, with "knowledge" that the person is a CFP, such as the right to appoint board members or make management decisions;

- acquisition, lease, or development of operations, land, property, or other assets (e.g., greenfield or brownfield investments) in a "country of concern" (CC) that the U.S. person "knows" will, or "intends" to result in, the establishment of a CFP or the engagement of a "person of a country of concern" (PCC) in a "covered activity";

- entrance into a joint venture (JV), wherever located, with a PCC where the U.S. person "knows" or "intends" that the JV will engage in a "covered activity"; and

- acquisition of a limited partnership interest in a non-U.S. person private fund, fund of funds, or other pooled investment fund, with "knowledge" that the fund will likely invest in a PCC, and where the fund in fact then invests in a PCC, in which case the original acquisition is the "covered transaction."

A. What Is a "Country of Concern"?

Right now, there is only one named CC—the People's Republic of China, including the special administrative regions of Hong Kong and Macau ("China"). The President did not give Treasury authority in Executive Order 14105 of August 9, 2023 ("Addressing United States Investments in Certain National Security Technologies and Products in Countries of Concern") (the Outbound Order) to designate additional CCs.

B. What Is a "Person of a Country of Concern"?

A PCC is:

- any individual who is a citizen or permanent resident of a CC and who is not a citizen or permanent resident of the U.S.;

- any entity incorporated in, organized under the laws of, or having its principal place of business or headquarters in a CC;

- the foreign government of a CC, including any political subdivision, political party, agency, or instrumentality thereof;

- any person acting on behalf of the foreign government of a CC;

- any entity owned 50 percent or greater or controlled by the foreign government of a CC; and

- any entity owned 50 percent or greater directly or indirectly, or controlled directly or indirectly, by any of the above categories of individuals and entities.

Note that PCCs could otherwise be "U.S. persons," including entities incorporated or organized in the U.S. With this expansive definition of a PCC, Treasury hopes to prevent even otherwise domestic transactions that could accrue to the benefit of the Chinese semiconductor-manufacturing, AI, or quantum industries.

C. What Is a "Covered Foreign Person"?

CFPs are:

- PCCs that engage in a "covered activity" (PCC-CAs);

- persons that (a) directly or indirectly hold any amount of voting interest, equity interest, or control just one voting or observer board seat in a PCC-CA or (b) have the power to direct or cause the direction of the management or policies of a PCC-CA (including through a contractual arrangement relating to a variable interest entity), where such persons falling under (a) or (b) derive more than 50 percent of their revenue or net income or incur more than 50 percent of their capital expenditures or operating expenses through one or more PCC-CAs, as measured by the annual financial statement from the most recent year; and

- PCCs involved in a JV with a U.S. person if the JV is engaged in a "covered activity."

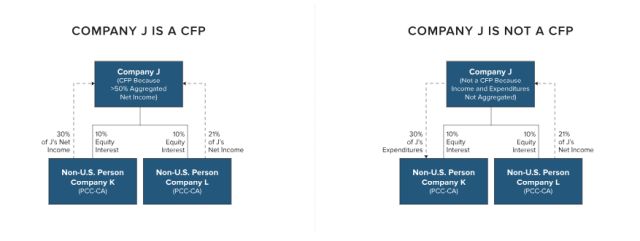

To illustrate the middle bullet point above, take Examples 5 and 6 of the Proposed Rule:

|

COMPANY J IS A CFP |

COMPANY J IS NOT A CFP |

|---|---|

|

|

|

Note that in the chart on the left, neither Company K nor Company L would traditionally be considered a subsidiary of Company J, but yet both are CFEs of Company J. Further, Company J is a CFP, but may also be a U.S. person. |

In the chart on the right, a very similar situation unfolds, but because the Proposed Rule will not aggregate different financial measures, Company J's 30% of total capital expenditures allocated to Company K and the 21% of total net income it receives from Company L are not aggregated. Company J, whether or not a foreign person, is nonetheless not a CFP under the Proposed Rule. |

D. What Is a "Covered Activity"?

A covered activity is any activity that is prohibited or notifiable in the context of the Proposed Rule. We list these covered activities below under "Prohibited Transactions" and "Notifiable Transactions."

E. What Is "Knowledge"?

The "knowledge" definition in the Proposed Rule aligns with the definition found in the Export Administration Regulations (EAR), which includes not only actual knowledge of a fact or circumstance but also "reason to know" or awareness of a high probability that such a fact or circumstance is present or is substantially certain to occur. As such, if Treasury examines documents under the Proposed Rule once enacted, Treasury will feel empowered to hold a U.S. person accountable if the relevant facts or circumstances were either at hand (though not positively known) or even not at hand but obtainable by "reasonable and appropriate due diligence" or otherwise publicly available.

While the "knowledge" standard outlined in the Proposed Rule is sensible in the transaction-by-transaction world of export controls for which it was written, it will likely be very difficult for U.S. persons to ever know they've completed "reasonable and appropriate due diligence" and obtained every relevant publicly available fact in the fast-moving world of corporate dealmaking.

F. What If the Investor in a Fund Isn't Sure Whether the Fund Will Invest in a CFP Engaged in a "Covered Activity"?

The "completion date" with respect to investments in funds will track to the date the investment in the CFP is made, which could happen significantly after the investor's capital is transferred to the fund. In such scenarios, the relevant "knowledge" is the investor's "knowledge" at the time of the investor's investment in the fund. Investors will need to track their investments that might constitute "notifiable transactions" because the Proposed Rule does not contain any requirement that the "investment adviser" file the notification on the investor's behalf or otherwise inform the investor of the notification requirement.

G. What Exceptions Apply?

"Covered transactions" will not include:

- certain investments in publicly traded securities under the Securities Exchange Act of 1934;

- investments in securities issued by an SEC-registered "investment company" or business development company under the Investment Company Act of 1940;

- certain truly passive limited partner investments not exceeding a yet-to-be-determined threshold and not transferring any intangible benefits;

- transactions where at completion of the transaction, the investment target will not be a CFP and no PCC investors will remain;

- certain types of intracompany transactions between a U.S. person and its CFE to support ongoing operations;

- transactions occurring after the effective date pursuant to a binding, uncalled, capital commitment entered into before the Outbound Order;

- acquisition of a voting interest in a CFP by a syndicate of banks in which a U.S. person does not have control or otherwise lead the syndicate; and

- transactions meeting certain requirements and otherwise subject to the jurisdiction of another country's outbound-investment regime determined to "adequately address" national security concerns by the Treasury Secretary.

III. PROHIBITIONS AND AFFIRMATIVE LEGAL REQUIREMENTS APPLICABLE TO U.S. PERSONS

Covered transactions under the Proposed Rule will consist of both "prohibited transactions" and "notifiable transactions." Unlike CFIUS, where the Committee reviews transactions, the Proposed Rule will operate more like a sanctions regime that prohibits certain transactions, but will also allow some transactions involving "covered activities" with a required 30-day post-closing notification to Treasury.

A. Prohibited Transactions

"Prohibited transactions" are a subset of "covered transactions" where the U.S. person invests in a CFP or JV that engages in one of the below activities with respect to the adjacent "covered national security technologies or products":

Prohibited Transactions

|

INDUSTRY SECTOR |

ACTIVITIES |

COVERED NATIONAL SECURITY TECHNOLOGIES AND PRODUCTS |

|---|---|---|

|

Semiconductors and Microelectronics |

Develop, Produce |

Any electronic design automation software for the design of integrated circuits or advanced packaging. "Advanced packaging" means "to package integrated circuits in a manner that supports the two-and-one-half-dimensional (2.5D) or three-dimensional (3D) assembly of integrated circuits, such as by directly attaching one or more die or wafer using through-silicon vias, die or wafer bonding, heterogeneous integration, or other advanced methods and materials." |

|

Semiconductors and Microelectronics |

Develop, Produce |

(1) Front-end semiconductor fabrication equipment designed for performing the volume fabrication of integrated circuits, including equipment used in the production stages from a blank wafer or substrate to a completed wafer or substrate (i.e., the integrated circuits are processed but they are still on the wafer or substrate); (2) Equipment for performing volume advanced packaging; or (3) Commodity, material, sof tware, or technology designed exclusively for use in or with extreme ultraviolet lithography fabrication equipment. |

|

Semiconductors and Microelectronics |

Design |

Any integrated circuit that meets or exceeds the performance parameters in Export Control Classification Number 3A090.a in supplement No. 1 to 15 C.F.R. part 774, or integrated circuits designed for operation at or below 4.5 Kelvin. |

|

Semiconductors and Microelectronics |

Fabricate |

(1) Logic-integrated circuits using a nonplanar transistor architecture or with a production technology node of 16/14 nanometers or less, including fully depleted silicon-on-insulator (FDSOI) integrated circuits; (2) NOT-AND (NAND) memory integrated circuits with 128 layers or more; (3) Dynamic random-access memory (DRAM) integrated circuits using a technology node of 18 nanometer half-pitch or less; (4) Integrated circuits manufactured from a gallium-based compound semiconductor; (5) Integrated circuits using graphene transistors or carbon nanotubes; or (6) Integrated circuits designed for operation at or below 4.5 Kelvin. |

|

Semiconductors and Microelectronics |

Package |

Any integrated circuit using advanced packaging techniques. |

|

Semiconductors and Microelectronics |

Develop, Install, Sell, or Produce |

Any supercomputer enabled by advanced integrated circuits that can provide a theoretical compute capacity of 100 or more double-precision (64-bit) petaflops or 200 or more single-precision (32-bit) petaflops of processing power within a 41,600 cubic foot or smaller envelope. |

|

Quantum Information Technologies |

Develop |

A quantum computer. |

|

Quantum Information Technologies |

Produce |

Any of the critical components required to produce a quantum computer such as a dilution refrigerator or two-stage pulse tube cryocooler. |

|

Quantum Information Technologies |

Develop, Produce |

Any quantum-sensing platform designed for, or which the relevant CFP intends to be used for, any military, government intelligence, or mass-surveillance end use. |

|

Quantum Information Technologies |

Develop, Produce |

Any quantum network or quantum communication system designed for, or which the relevant CFP intends to be used for: (1) Networking to scale up the capabilities of quantum computers, such as for the purposes of breaking or compromising encryption; (2) Secure communications, such as quantum key distribution; or (3) Any other application that has any military, government intelligence, or mass-surveillance end use. |

|

Artificial Intelligence |

Develop |

Any AI system that is designed to be exclusively used for, or which the relevant CFP intends to be used for, any: (1) Military end use (e.g., for weapons targeting, target identification, combat simulation, military vehicle or weapon control, military decision making, weapons design, or combat system logistics and maintenance); or (2) Government intelligence or mass-surveillance end use (e.g., through mining text, audio, or video; image recognition; location tracking; or surreptitious listening devices). "AI system" means "(a) A machine-based system that can, for a given set of human-defined objectives, make predictions, recommendations, or decisions influencing real or virtual environments—i.e., a system that uses data inputs to: (1) Perceive real and virtual environments; (2) Abstract such perceptions into models through automated or algorithmic statistical analysis; and (3) Use model inference to make a classification, prediction, recommendation, or decision. (b) Any data system, software, hardware, application, tool, or utility that operates in whole or in part using a system described in (a)." Note: Adds definition of "AI system" that aligns with the definition released following the Outbound Order in Executive Order 14110 of October 30, 2023 ("Safe, Secure, and Trustworthy Artificial Intelligence"). |

|

Artificial Intelligence |

Develop |

Any AI system that is trained using a quantity of computing power greater than (the Proposed Rule lists alternative options): (1) 1024computational operations (e.g., integer or floating-point operations); or (1) 1025computational operations (e.g., integer or floating-point operations); or (1) 1026computational operations (e.g., integer or floating-point operations); or (2) 1023computational operations (e.g., integer or floating-point operations) using primarily biological sequence data; (2) 1024computational operations (e.g., integer or floating-point operations) using primarily biological sequence data. |

Nearly every "prohibited transaction" description was modified in some way following the 2023 ANPRM. Additionally, the terms "develop," "fabricate," "package," and "produce" are now defined. "Develop" and "produce" closely align to the EAR definitions of those terms, but "fabricate" and "package" are defined anew for the semiconductors context.

"Prohibited transactions" also include any "covered transaction" where one of the below-listed sanctioned persons is the relevant CFP or JV for purposes of the Proposed Rule and is engaged in any "covered activity," whether prohibited or notifiable.

- designated on the BIS Entity List;

- designated on the BIS Military End-User List;

- designated on the OFAC Specially Designated Nationals and Blocked Persons List;

- designated on the OFAC Non-SDN Chinese Military-Industrial Complex Companies List;

- designated as a "foreign terrorist organization" by the U.S. Department of State; and/or

- meeting the definition of a "military-intelligence end user" at EAR section 744.22(f)(2).

The BIS Entity List in particular is a significant escalation of the "prohibited transactions" set because most transactions—other than exports, reexports, and transfers of hardware, software, and technology "subject to the EAR"—are otherwise not subject to party-specific restrictions, including financial transactions and investments. It is further unclear whether entities "included" on the Entity List include any entity with a current or recent association with one of the newly designated physical addresses in Hong Kong. See 89 Fed. Reg. 51644.

B. "All Reasonable Steps" Requirement

U.S. persons will be required to take "all reasonable steps to prohibit and prevent" transactions by their CFEs that would be prohibited if engaged in directly by the U.S. person as described above. Treasury offers no definitive safe-harbor mechanism and simply provides a non-exhaustive list of factors it will consider when examining whether a U.S. person complied with this requirement:

- the execution of agreements with respect to compliance with the Proposed Rule between the U.S. person and its CFE;

- the existence and exercise of governance or shareholder rights by the U.S. person with respect to the CFE, where applicable;

- the existence and implementation of periodic training and internal reporting requirements by the U.S. person and its CFE with respect to compliance with the Proposed Rule;

- the implementation of appropriate and documented internal controls, including internal policies, procedures, or guidelines that are periodically reviewed internally, by the U.S. person and its CFE; and

- implementation of a documented testing and/or auditing process of internal policies, procedures, or guidelines.

C. Prohibition on Knowingly Directing an Otherwise Prohibited Transaction

U.S. persons will be prohibited from knowingly directing a transaction by a non-U.S. person that would otherwise be a "prohibited transaction" if undertaken directly by the U.S. person. This prohibition may affect many individual U.S. person executives and managers in entities outside the U.S. who have authority individually or as part of a group to direct, order, decide upon, or approve a transaction. The Proposed Rule notes that such persons can "recuse" themselves from the transaction, but the scope of the required recusal is not yet clear, and commentary in the introduction to the Proposed Rule indicates Treasury is considering a permanent recusal from overseeing the investment following the completion date.

D. Transactions Requiring Notification to Treasury Within 30 Days of Completion Date

"Notifiable transactions" are those "covered transactions" where the relevant CFP or JV engages in one of the below activities with respect to the adjacent "covered national security technologies or products." Under such circumstances, the U.S. person must notify Treasury, including in instances where the transaction was undertaken by the U.S. person's CFE. Note that the Proposed Rule will require notification by a U.S. person of its own (or its CFE's) investment in a CFP engaged in semiconductor design, fabrication, or packaging where the investment is not otherwise prohibited above.

Notifiable Transactions

|

INDUSTRY SECTOR |

ACTIVITIES |

COVERED NATIONAL SECURITY TECHNOLOGIES AND PRODUCTS |

|---|---|---|

|

Semiconductors and Microelectronics |

Design |

Any integrated circuit outside the scope of the integrated circuits that are in scope for "prohibited transactions" and described at the proposed 31 C.F.R. § 850.224(c). |

|

Semiconductors and Microelectronics |

Fabricate |

Any integrated circuit outside the scope of the integrated circuits that are in scope for "prohibited transactions" and described at the proposed 31 C.F.R. § 850.224(d). |

|

Semiconductors and Microelectronics |

Package |

Any integrated circuit outside the scope of the integrated circuits that are in scope for "prohibited transactions" and described at the proposed 31 C.F.R. § 850.224(e). |

|

Artificial Intelligence |

Develop |

Any AI system that is not described in § 850.224(j) or (k) (prohibited transaction list) and that is: (1) Designed to be used for any government intelligence or mass-surveillance end use (e.g., through mining text, audio, or video; image recognition; location tracking; or surreptitious listening devices) or military end use (e.g., for weapons targeting, target identification, combat simulation, military vehicle or weapons control, military decision making, weapons design, or combat system logistics and maintenance); (2) Intended by the covered foreign person to be used for cybersecurity applications, digital forensics tools, and penetration-testing tools, or the control of robotic systems (the Proposed Rule lists alternative options); (3) Trained using a quantity of computing power greater than 1023computational operations (e.g., integer or floating-point operations); (3) Trained using a quantity of computing power greater than 1024computational operations (e.g., integer or floating-point operations); (3) Trained using a quantity of computing power greater than 1025computational operations (e.g., integer or floating-point operations). |

E. Required Notification of Post-Transaction Actual Knowledge Due Within 30 Days of Acquiring

Under the Proposed Rule, U.S. persons who have undergone a "covered transaction" will be under an obligation to notify Treasury within 30 days if the U.S. person obtains actual knowledge that the transaction would have been prohibited or notifiable but for the lack of "knowledge."

IV. VIOLATIONS

The Outbound Order authorizing the Proposed Rule relies on statutory authority under the International Emergency Economic Powers Act, and as such, any civil violation of the Proposed Rule is subject to maximum monetary penalties of approximately US$368,000 per transaction (or twice the amount of the transaction, whichever is greater) or nullification or divestment of the transaction. Any willful violation—including attempts, conspiracies, and aiding and abetting—is subject to maximum penalties of US$1 million per violation, 20 years in prison, or both.

Substantive violations include:

- taking any action prohibited by the Proposed Rule;

- failures to fulfill the requirements of the Proposed Rule (i.e., notifications of transactions or post-closing knowledge);

- misrepresentation and concealment of facts; and

- evasions, attempts, causing violations, and conspiracies.

The Proposed Rule also contains a voluntary self-disclosure (VSD) mechanism for instances in which a person believes they may have engaged in a potential violation of the Proposed Rule. Like VSD mechanisms at other agencies, the Proposed Rule lays out the information required for the VSD to receive treatment as such, but it does not describe the factors it will weigh or a framework for deciding on penalties in an enforcement arising from a VSD.

V. REQUEST FOR COMMENTS

Treasury requested comments on 25 topics, due by August 4, 2024. This comment period is likely the last meaningful opportunity for industry to shape the Proposed Rule before it is scheduled, later this year or next, to become effective. Investors with interest in the semiconductor-manufacturing, AI systems development, and/or quantum information technologies sectors, particularly if there is a nexus to China, even indirectly, should act quickly to digest the Proposed Rule and whether it could affect investment plans. Winston can assist with drafting comments. Please reach out to the authors of this article or your Winston relationship partner for assistance.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.