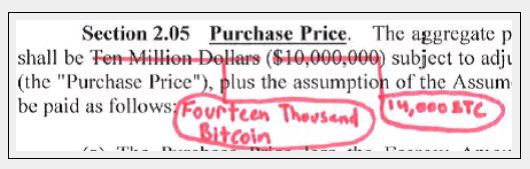

The list of goods and services you can buy with Bitcoin is increasing all the time. But can you buy a company with Bitcoin?

Let's assume you want to, regardless of whether Bitcoin might succeed or fail; or whether you government is encouraging or discouraging its use; or whether its price will continue to plunge. The short answer is: Yes.

In fact, the first Bitcoin deals have already been announced, including Bitcoin gambling site SaoshiDice's sale in July 2013 or the sale of ZeroBlack LLC in December 2013.

Using Bitcoin can make sense in deals like these, where dollar amounts are relatively low and the parties deal in Bitcoin every day (and get free marketing from doing the deal in Bitcoin). In these instances, Bitcoin can have its advantages (for one, payment is faster and more flexible than waiting on a wire confirmation).

BUT SHOULD YOU?

Most of the transactions we deal with are more complex than cash transactions, which are relatively simple.

Many deals we do require some sort delay between when the deal is signed (and the price is generally agreed to), and when the deal is final and the money is handed over. This delay can happen for any number of reasons. For example, the consent of a third party may be required (either from a governmental body such as the Federal Trade Commission or from private parties such as payment processors). Given the volatility of Bitcoin, that delay could be problematic. Buyers and sellers may not want the risk involved with that kind of volatility.

Such a delay can be avoidable, but parties (especially buyers) often want a different delay: an escrow. Escrowed funds, set aside to protect the buyer from undisclosed problems with the business, can be tied up for a year or longer. Last year, the price of Bitcoin was one tenth of what it is today. The risk of the value of the escrow fluxuating wildly may be too great. But even if it's not, will your bank even escrow Bitcoin?

There are a host of other issues to be considered as well: earn-outs for management teams, tax implications, the nature of indemnification payments, industry specific regulations (especially in industries that require transactions to be fair market value), etc. The list goes on.

SOLUTIONS

There are solutions for the problems above. The issue of fluxuating purchase price is nothing new, we see it in stock-for-stock deals (where the value changes every minute) all the time. Earnouts can be pegged to pre-negotiated US Dollar amounts of Bitcoin.

At this point in time, it seems that doing a deal in Bitcoin potentially poses more risks and negotiating challenges than it rewards. Personally, negotiating a deal in Bitcoin sounds fun, and I would love to get the opportunity (though professionally, I'd likely be inclined to advise against it).

UPDATE (Feb. 2, 2014, 6:50 AM CT)

Hat tip to Chris Phillips (@PaymentsDealLaw) for this report from Payment Magnates, which is a report from MtGox, a Chinese Bitcoin Exchange. Per MtGox:

This kind of news, if true (or at least widely regarded to be true) and/or unfixable could be devastating to the cryptocurrency. Stay tuned.

For further information visit Waller's Banking Law Blog

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.