Regulatory scrutiny of mergers involving US defense contractors has been limited, but that is likely to change soon.

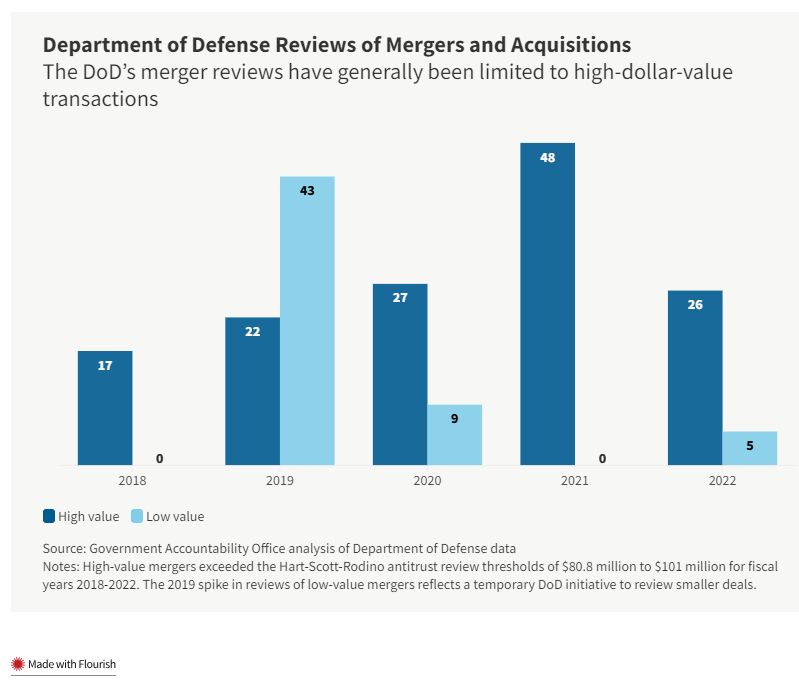

The Department of Defense assessed an average of about 40 defense-related mergers and acquisitions each year from 2018 to 2022, a small portion of the roughly 400 defense mergers estimated to occur annually, according to a report from the Government Accountability Office (GAO).

The DoD's insight into mergers is limited in part because the agency generally focuses on high-dollar-value mergers that pose antitrust concerns. The DoD's assessment of smaller suppliers is lacking, meaning that the DoD is not fulfilling its responsibility to review a "broad range of defense-related M&A," the GAO report said.

Lawmakers in Congress amplified concerns expressed in the GAO report, claiming that the DoD prioritizes high-dollar transactions with competition risks, instead of reviewing transactions that are most likely to affect national security, innovation, and supply chains.

With pressure escalating on the DoD to act, defense contractors should expect more regulatory scrutiny of mergers in their space. For more, see: Scrutiny of U.S. Defense Contractor-Related M&A Activities Will Soon Intensify

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.