Medicare Advantage (MA) enrollment exceeds 33 million members, represents $450B in payments from the Federal government, and is expected to double over the next 10 years. Yet, changes to the MA program have reduced overall profitability and challenged payers to adapt. Risk adjustment methodology, Stars metrics, and overall reimbursement rates have all changed. In this new environment, providers are choosing not to renew MA contracts with payers, and some payers are electing to drop participation in MA altogether. Effective management of medical cost, risk adjustment, Stars, and administrative costs are no longer "nice to have" to operate a profitable plan. This is particularly true for many smaller plans where fixed administrative costs combined with a MLR floor have already made profitability elusive. One lever alone is likely insufficient to drive profitability improvement. Many plans will need to rethink their operating model to survive in the new environment.

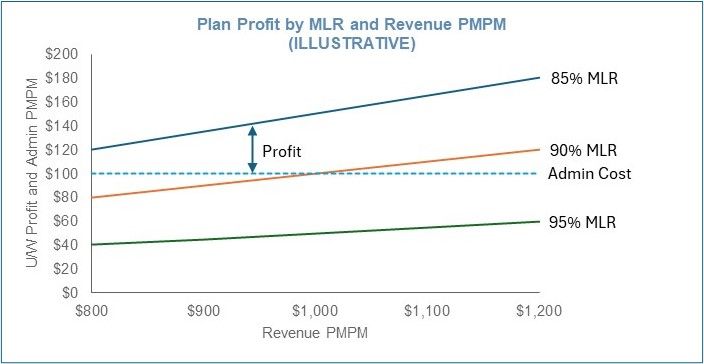

Graph: Plans will need to increase revenue PMPM while driving

down MLR without increasing administrative cost

There are five primary levers to address:

- Payment integrity – medical cost: Inaccurate and inappropriate payments to providers often represent 1 – 3 % of claim spend. Addressing the root causes of these payments which can be caused by system logic, provider data errors, mis-applied benefits and medical policy, etc., can support sustainable change well beyond what a recovery vendor will deliver.

- Care management – medical cost: Un-targeted programs and loose medical policy no longer work. Investments in care management activity need to deliver positive ROI. Plans will need to be deliberate in which members and clinical procedures they target and engage and make sure to get desired outcomes. Outreach and activity that are not delivering value need to be redirected. Importantly plans should understand what members they have missed that are driving medical costs and reduce those misses. Improvements in care management can drive near-term improvement to the bottom line.

- Risk adjustment – revenue PMPM: While v. 28 has adjusted the risk adjustment methodology removing codes and changing weightings, it is no less important to capture accurate HCC coding and the associated reimbursement for the insured population. Best practices require strong data analytics often including Natural Language Processing to identify suspected diagnoses from clinical records, retrospective review, physician attestations, promotion of annual wellness exams, and likely HCC coding capabilities.

- Stars – revenue PMPM: While direct financial incentives are most pronounced getting to a 4-star plan, increases to a 5-star plan improve marketability. In any case, plans need to manage key metrics proactively throughout the year to impact the outcome. Regardless of most recent changes, which are likely to change again, an analytical platform that tracks key inputs across member experience, health equity, and HEDIS can be foundational to managing Star Rating performance.

- Administrative cost: Many plans, especially those with limited scale, struggle with the MLR cap of 85% of premium and keeping administrative costs below 15% while still delivering on the capabilities outlined in 1 – 4 above. Much of the administrative cost of a health plan is essentially fixed (IT, Marketing, Claims, Network, etc.) While there are significant economies of scale, these functions need to be right-sized. Costs associated with the four preceding drivers need to demonstrate a clear ROI and need to be appropriately allocated between medical and administrative cost for purposes of calculating the MLR cap. While administrative cost is often the most difficult to address, it must be considered in concert with the other levers.

Where to start

Assess current performance

First, plans need to understand performance at a granular level. What are the drivers of medical cost? Which members? Which disease states? Which providers? Does my risk adjustment accurately reflect the member population? How is my prior authorization and care management performing? What operating leverage do we have in our administrative functions? Where do Special Needs Plans factor in? For provider owned plans, it is also essential to understand financial performance across both the health plan and the health system for MA members.

Address in-year savings

Payment integrity efforts can often find meaningful dollars including over-payment recoveries that can drive immediate bottom-line improvement. Similarly, care management efficacy improvement can reduce clinically inappropriate utilization. Both of these efforts typically yield near-term financial results.

Fix risk adjustment and Stars

While Stars and risk adjustment payments won't hit for some time, these activities are no less important for a high performing plan. For risk adjustment, plans need to apply analytics and specific tactics to capture appropriate HCC codes. Examples include identifying members with chronic conditions and ensuring coding is in place, annual house calls for specifically targeted members to understand risk profile, vendors for retrospective chart review, and methodical tracking and projection of the expected Risk Adjustment Factor. For Stars, depending on the current level, activity may or may not need to change. In any case adjustments are required for the new measurements.

Balance administrative cost structure

Core administration functions (enrollment, eligibility, claims, and member services) and network management need to be efficient. While often fixed, there may be opportunities to explore outsourcing or partnerships to drive savings. New technologies including generative AI can also drive automation and increase efficiency. Costs for marketing and distribution can be somewhat more discretionary and need to be managed for a clear return on investment. Expenses associated with medical management, care management, risk adjustment, and Star similarly need to be managed with a clear return balanced with the results they can drive in medical cost savings. Cost benchmarks can provide some guidelines but should not dictate an operating model.

Rethink the care management model

Efficient care management requires active collaboration with providers. Whether through delegated risk, better coordinated member engagement, or modernizing prior authorization the overall system will need to address the most effective way to engage members in delivering better outcomes. Certainly, opportunities exist to increase the ROI of specific payer delivered programs, and the next frontier of care management is likely a joint payer provider model with aligned incentives and shared resources.

There is no "silver bullet" to fixing profitability in a Medicare Advantage plan. Often, management will need to address multiple levers in concert while constantly considering member and provider experience. Even for a high performing plan, continuous improvement across the core levers of profitability can ensure a sustainable competitive positioning in the market.

Originally published September 3, 2024

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.