Scientific innovation is the key to creating new lifesaving therapies and better patient outcomes. And healthcare innovation requires capital.

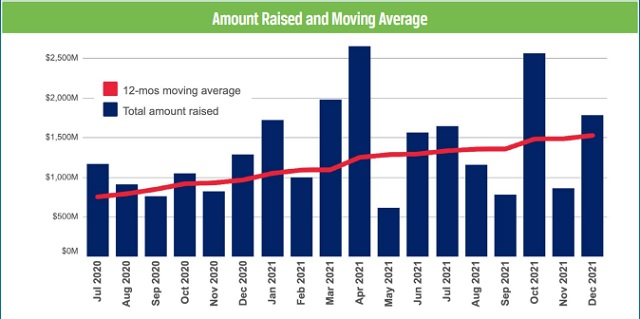

In Cooley's Q4 2021 Venture Financing Report, the firm reported that it handled 82 disclosable financings of life sciences companies, representing more than $5.2 billion of invested capital. Deal sizes spiked, with an average deal size of more than $63 million in the quarter. Meanwhile, in a signal of investor caution, the percentage of life sciences transactions structured in tranches increased to more than 17% of deals, doubling from the prior quarter.

First-time founders and serial entrepreneurs alike need to cultivate and nurture relationships with existing and potential investors. Cooley partner Josh Seidenfeld weighs in with five tips to stay connected with investors.

1. Network early - and often

Stay a step ahead of your existing financial road map. If you anticipate a Series A raise in 18 months, start laying the groundwork now. Attend industry events (virtual or in-person) to forge new relationships. Research investors and funds who are actively investing in your sector, and seek out opportunities to meet the appropriate partner(s) from that fund. It takes time to create meaningful relationships - and you will be in a stronger position when you need to raise if you have existing relationships with prospective investors.

2. Leverage your existing network

Your board and advisers are in your corner. Seek out warm referrals to investors whenever possible. Your professional advisers, such as law firms, accounting firms, and insurance and/or real estate brokers, can be a great resource. Existing investors also will often champion introductions to additional potential investors.

3. Keep your current investors informed

Send regular updates to show your investors that you are meeting your milestones and following your road map, and include qualitative and quantitative information. If you anticipate a problem, it is best to be upfront. Most experienced, early-stage investors will expect bumps in the road and potential pivots. Be candid about the challenges - and listen to your existing investors' concerns. By keeping your investors informed, you build trust and keep the door open for future investment rounds.

4. Create a world-class team

High-quality leadership matters. Some investors are more thesis-driven, whereas others are focused on the specific opportunity. In a recent Cooley Healthtech Talks webcast, Ambar Bhattacharyya, managing director of Maverick Ventures, shared his belief that the founders are the most important aspect of an investment decision: "The primary quality we look for in founders is grit - [founders] come in all shapes and sizes, all backgrounds, all ages. We look for grit - that is the #1 factor we look for when going through the arduous journey of being an entrepreneur." Billy Deitch, partner at Oak HC/FT, agrees that first and foremost, it is about the team. "Expertise and quality of experience at the top matters, as does the ability to recruit more leaders," Deitch says. "The CEO needs to be a pied piper that others will follow."

5. Be prepared to address social impact

Socially responsible investing is on the rise, and investors will want to understand financial returns, as well as the positive social impacts, of your company. Environmental, social and governance (ESG) factors are frequently part of investors' assessment criteria. Flare Capital partner Dan Gebremedhin, MD, shares: "When backing first-time founders ... I'm looking for people who are in it for the right reasons, and are in it for the long run. They really want to build a lasting company; they care a lot about their customers' perspective and are trying to improve patients' lives at the end of the day." It's vital to communicate your company's impact to your existing investors.

Overall, select an investment partner whose long-term goals and objectives are the best match for your company. Do your homework and due diligence upfront to create the strongest foundation as you scale.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.