Green and conscious consumer demand is rising, but there is growing scepticism about the accuracy and completeness of sustainability claims.1

Awareness of terms such as greenwashing, greenwishing, and greenhushing is increasing, along with criticism of claims about carbon neutrality and the integrity of carbon credits. To gain credibility with consumers, regulators, and investors, companies are urged to make genuine and verifiable improvements in their sustainability practices. Overstating progress or making unrealistic forecasts that may not be achieved economically can be risky in today's environment.

UNDERSTANDING KEY SUSTAINABILITY TERMS

Greenwashing: Making misleading or false claims about a company's climate actions including setting clear long-term goals without concrete plans to achieve them.

Greenwishing: When a company expresses a desire or undertakes an initiative to be climate-friendly but fails to demonstrate a credible impact.

Greenhushing: The refusal to voluntarily report on Environmental, Social, and Governance (ESG) metrics.

Regulatory focus is increasingly on Scope 3 emissions — indirect emissions from a company's value chain. As a result, companies face the challenge of decarbonizing their value chains cost-effectively while considering social and other factors.2

ADAPTING SUPPLY CHAINS FOR A LOW-CARBON FUTURE

AN OVERVIEW OF CURRENT SUPPLY CHAIN DYNAMICS Today's supply chains are shaped by historical decisions and assumptions aimed at minimizing total costs and ensuring resilience. Key factors include:

- Proximity to raw materials

- Key suppliers

- Energy and other infrastructure

- Transportation options

- Warehousing and distribution

- Mergers and Acquisitions

- Legacy assets

- Incentives, taxes and tariffs

In a low-carbon economy, supply chain strategies must now also focus on reducing Greenhouse Gas (GHG) emissions alongside traditional considerations of costs, risks, and time. It is becoming increasingly difficult to be part of a supply chain that is not taking climate action, even without regulatory pressure. Key drivers for this shift include:

Regulation3:

Governments and regulatory bodies are driving ESG initiatives with economic conditions and consequences for failing to achieve decarbonization. Key examples include the European Union (EU) Corporate Sustainability Reporting Directive (CSRD); and the proposed US Securities and Exchange Commission (SEC) rules covering disclosure of GHG emissions, both of which cover major markets. Potential carbon border taxes strive to achieve trade-based parity for in-market providers based on GHG emissions and are intended to prevent leakage of emissions to other jurisdictions. Practically, these taxes offer an incentive for trading partners to reduce emissions in their extended supply chain.

Finance flows:

- Global, regional, and national banks are committing to

decarbonization by:

- Considering their share of financed emissions among their clients.

- Engaging in programmes to educate and finance climate action.

- Redesigning products based on performance measures, including incentives and price adjustments.

- Finance and insurance organizations are increasingly incorporating climate-risks (regulatory, physical, and transition), climate action and decarbonization plans in their pricing models.

- Activist investors are also critically evaluating and holding CEOs and boards accountable for the costs and risks of climate action. They balance today's business performance against future prospects seeking appropriate uses of capital.

- Sources of net-zero funding have diversified, with increased investments from philanthropic organizations, governments, and the private sector.

- Private equity investors are increasingly measuring ESG credentials, particularly relating to GHG emissions and ethical working practices, during buy-side due diligence. This helps manage reputational risk and ensures that the cost of correcting underperformance is factored into the deal.

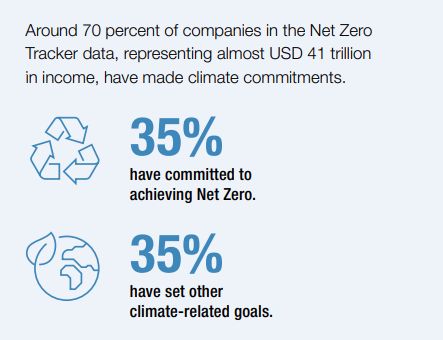

Corporate responsibility:

Companies have made voluntary commitments, independent of regulation, that align with consumer preferences or a sense of corporate responsibility. These commitments range from being 'climate positive' to 'carbon negative' across various emissions scopes and timeframes.

Competitive pressures:

Business-to-business organizations are working to achieve meaningful decarbonization goals, even without consumer interest. They should understand the impacts created by their supply chains and the companies to which they are a supplier or end-user. Important considerations include the links between supply chain and food systems, the demand for raw material extraction, value addition and consumption, and the need for no- and low-carbon transport and logistics.

Accelerating towards a low-carbon economy requires rethinking the supply chain from a high-level perspective to capitalize on strategic levers of change and challenge assumptions. Strategic sourcing will play a key role in driving the production of decarbonized electricity, fuel, and other energy sources. This will directly impact a company's Scope 1 and 2 emissions (direct and indirect emissions from purchased energy respectively).

Other operational aspects will also need strategic consideration. The costs, risks, and benefits of Power Purchasing Agreements (PPAs), virtual PPAs, renewable energy certificates and similar instruments require careful consideration and communication to be credible or to meet the certification requirements for emerging low carbon products, such as hydrogen and its derivatives.

To view the full article click here.

Footnotes

1. Your Customers Prefer Sustainable Products - businessnewsdaily.com

2. Using a Circular Economy to Slash Supply Chain Emissions | Cutter Consortium

3. A note on scope: This article focuses on greenhouse gas emissions and reductions. The requirements of global sustainability-related regulation are considerably broader. Topical issues ranging from biodiversity to PFAS ("forever chemicals") to labour relations and the impacts of effective governce practices are also important but outside scope.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.