LEVEL-SETTING

- The banking industry finds itself in the early stages of a transformation. Existing balance sheets have been shaped by more than a decade of low interest rates that fueled asset appreciation, muted volatility, and aided credit performance. A glut of deposit inflows due to covid-driven stimulus payments further influenced balance sheet composition. These trends supported growth, but also led to decisions that are now difficult to reverse.

- Some challenges are well understood. Deposit concentrations, uninsured deposit levels, and mark-to-market losses on securities portfolios that grew rapidly during 2020-2022 have received widespread publicity, as has the proposed heightening of risk-based capital standards.

- Other challenges are less obvious—for example, the challenge for some smaller institutions to grow capital given geographic and product-line limitations and outsized CRE concentrations.

- Other forces reshaping the industry include competitive

pressure from non-bank lenders and deposit alternatives, and the

imperative to integrate technology throughout business processes.

Thus far in 2025, outside help from pro-growth policies and lower

interest rates have fallen short of expectations.

- Post-election expectations for accelerating growth, lower rates, and a fresh approach to bank regulation, supervision, and consolidation were tempered as the first quarter progressed. A few qualifiers to the optimistic outlook have emerged.

- On the economic front, entrenched inflation levels reined in rate-cut and curve steepening expectations. Tariffs further complicate the growth-inflation-rates equation. Comments from the new administration suggested a willingness to accept a market correction in the process of addressing the federal deficit level and funding.

- On the regulatory and supervision front, a few inflight rule proposals were scuttled, merger guidelines dialed back, and new agency appointments advanced. Basel III Endgame (B3E) appears to be heading toward a capital-neutral re-proposal. While directionally helpful, developments to date have been incremental rather than advancing a holistic framework that operates beyond election cycles.

- The net result is an operating environment that is proving more

challenging than anticipated. Policy volatility clouds business

decisions, and sentiment data suggests capital investment will slow

further from 2024. More fundamentally, policymaking by executive

order forms a poor foundation for multi-year business

decisions.

- Labor market conditions are weakening across a number of indicators, shaping the outlook for bank consumer loan growth and credit performance in 2025.

- Survey data, which is often subject to sentiment-outcome gaps, has been confirmed by hard data, including declines in job openings and the quit rate.

- Millions of student loan borrowers face declines in credit scores as the covid-era relief measures roll off and delinquencies incurred as early as October 2024 are phased into credit reports through May 2025.

- Tariffs may further challenge the consumer outlook. Tariffs involve an immediate cost – higher prices – in exchange for uncertain longer-term payoffs.

- Many institutions leaned into credit card, auto, and home

equity lending to support loan growth over the past two years.

Credit performance in these sectors is weakening with higher

interest Executive Summary rates and a slowing labor market.

NET INCOME

- Interest expense moved lower in Q4 in step with rates.

- Provision held flat.

- Non-interest income maintained YoY gains.

- Pre –tax net operating income edged marginally lower QoQ.

BALANCE SHEET

- The bulk of the $110 billion Q4 drop in assets came from a single GSIBs reducing trading assets.

- Net loans moved higher by 83 bps during the quarter to end up 2.1% YoY.

- Total deposits held steady and core share improved to 81.9%.

TOP LINE

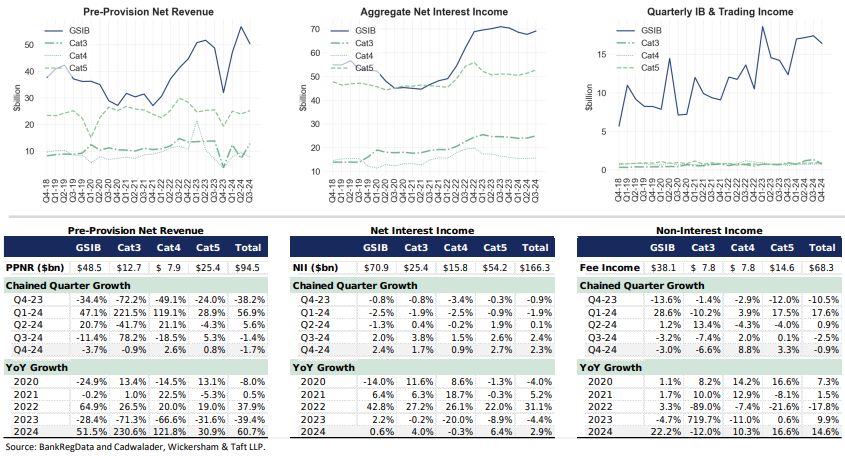

- PPNR decelerated on a chained-quarter basis into Q4.

- NII improved but lagged optimistic assumptions for yield curve re-steepening.

- Non-interest improved on IB, trading, and fee income growth.

LOANS

- Loan growth has underperformed relative to a buoyant stock market, unemployment, and GDP.

- Higher rates weighed on demand in 2024 while lending standards tended tighter.

To view the full article click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.