Stock Market Commentary

The rally in U.S. stocks came to an abrupt halt as uncertainty around tariffs, fiscal policy, and future economic growth put investors on edge. Technology and consumer discretionary stocks, two of the best-performing sectors last year, were particularly hard hit. The tech-heavy Nasdaq Composite Index and the broader S&P 500 Index both fell into correction territory, declining over 10% from their peak and ultimately ending the quarter down 10% and 4.3%, respectively.

Despite the dour headlines, not all markets were negative. International stocks, aided by a weakening U.S. dollar, posted robust gains. The MSCI EAFE Index, which tracks the performance of companies in developed markets including Japan and Europe, ended up 7%, the largest quarterly outperformance versus U.S. stocks since 2002. The MSCI Emerging Markets Index, which includes countries such as China and India, also rose, up 3%. Even in the United States, 7 out of 11 sectors were positive, led by energy and healthcare.

While economic uncertainty and market volatility may remain elevated in the near term, we continue to emphasize the importance of diversification and periodic rebalancing. U.S. stocks, particularly large technology companies, have been market leaders in recent years, but investable opportunities do exist outside that segment of the market.

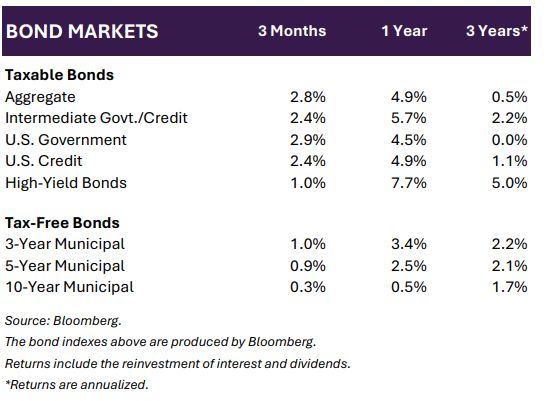

Bond Market Commentary

In the first quarter of 2025, the fixed income market performed well as a risk diversifier, with the Bloomberg US Aggregate Bond Index rising 2.8% year-to-date. However, like equities, bond markets experienced notable volatility due to the threat of significant tariffs. These tariffs raised investor concerns about higher inflation and slower economic growth, prompting a shift to favor short-duration assets and a more defensive tactic in the fixed income market.

As a result, corporate bond spreads widened in the first three months of 2025. Highyield bond spreads spiked 78 basis points (bps) from their January low, before tightening slightly, while investment-grade spreads followed a similar pattern, rising modestly by 15 bps since February.

The U.S. Federal Reserve acknowledged the rising risks to economic stability and responded by maintaining the federal funds rate at 4.25% to 4.5% and adopting a cautious approach. Other central banks, however, adopted more aggressive policies for 2025. Citing uncertainty over the impact of U.S. trade policies, the European Central Bank, Swiss National Bank, and Bank of Canada each cut their target rates by 25 bps in March.

Economic Commentary

In the first quarter of 2025, the U.S. economy found itself at a crossroads, balancing modest growth against the rising pressures of inflation and shifting global trade dynamics as various tariffs went into effect, with the president estimating $600 billion in tariff revenue per year, or 1.8% of current gross domestic product. Inflation remained a pressing concern as the core Personal Consumption Expenditures (PCE) price index, a key inflation indicator, rose 2.8% year-over-year, slightly above expectations.

In January and March, the Federal Reserve opted to hold interest rates steady, saying it is in no hurry to lower them in the current climate of uncertainty. The U.S. unemployment rate also held fast at 4.2%, combating expectations of higher unemployment in light of government job cuts linked to policy changes from the Department of Government Efficiency.

Consumer sentiment dropped notably, with the University of Michigan's consumer sentiment index reporting a 12% plummet from February to March across all demographics, marking its third consecutive month of decline. Expectations of less-stable personal finances, tariffs and their potential economic impact, higher unemployment, and persistent inflation all contributed to the decrease. Although uncertainty played a role in the erosion of consumer sentiment and other soft data, the hard data show a more stable picture as we head into the second quarter.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.